[FREE REPORT] eCommerce in China: the present and future of online shopping

Though China might be in close competition to become the largest global economy, it is – without a doubt – dominating the eCommerce market by a huge margin. With millions of online shoppers both locally and around the world, Chinese retail websites like AliExpress and Wish sold a whopping $589.61 billion worth of goods in 2015 alone, according to the National Bureau of Statistics in China. Estimates of global eCommerce sales numbers are hotly debated, but are somewhere in the range of $1 trillion for 2016. In other words, China accounts for over 50% of eCommerce sales in the world.

And this isn’t surprising. The “Made in China” label is no longer associated with poor quality; China’s share of world manufacturing has increased from 3% in 1990 to nearly 25% in 2015. China completely dominates production in some markets, producing 70% of all mobile phones and 60% of shoes sold in the world today.

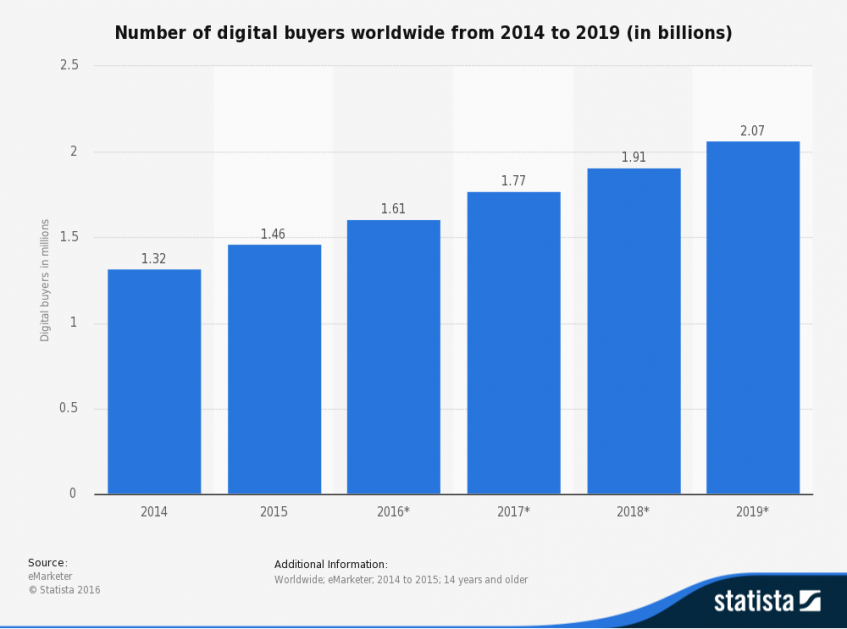

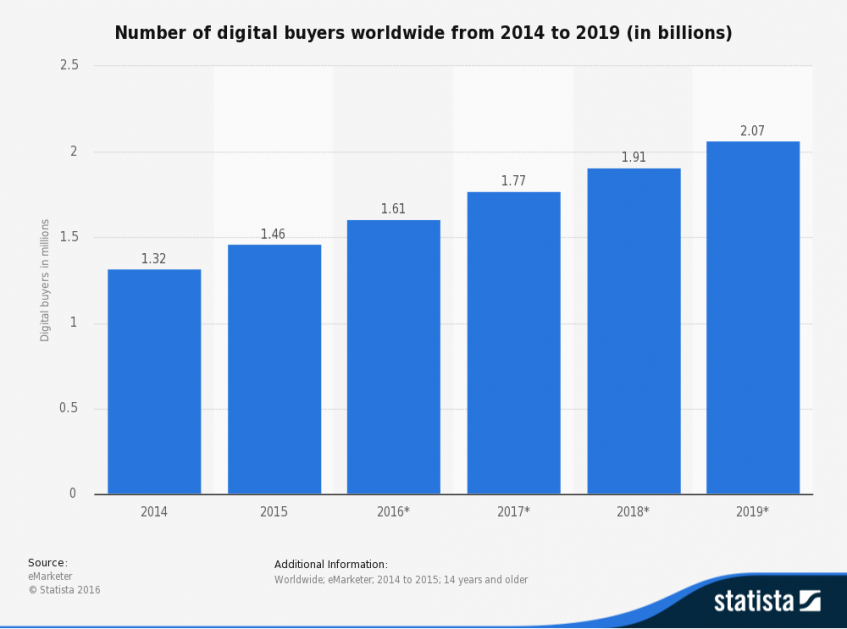

Nearly ¼ of the world’s population shop online in 2016

The face of online shopping has also changed drastically over the last few years, and still has a ways to go. In 2015 1.46 billion people on the planet shopped online, and this number is expected to grow to 2.07 billion by the end of 2019. As we shift towards mobile purchases and further away from brick-and-mortar channels, global enterprises like Walmart and Macy’s are forced to layoff thousands and shut down hundreds of storefronts. This is partially due to the evolution of showrooming – a term that techopedia defines as “when a shopper visits a store to check out a product but then purchases the product online from home.”

We have unquestionably grown to rely on eCommerce brands just as much as we used to rely on our favorite chains. A 2012 report from Forrester revealed that nearly one-third of online shoppers start a product search on Amazon, rather than using a search engine. That number has undoubtedly increased since then, as we turn to our trusty online shops to look for products before going to the mall. The range of products we purchase online has also expanded, with services like scheduled diaper and grocery deliveries further decreasing our need to leave the house to shop.

Opportunity for sellers big and small

With the rise of Chinese retail websites and direct-to-buyer platforms like Amazon Marketplace, Chinese merchants are now able to sell and ship cross-border directly to consumers, cutting out the middle man and virtually diminishing the East-to-West barrier. Amazon has even taken measures to lessen the costs of shipping for small items from China to the US, to help its sellers compete with AliExpress’ rock-bottom shipping prices. Western shoppers enjoy competitive prices on popular items and China has never felt closer.

Sales within Asia are huge as well. Marketplaces like Taobao and Tmall, for example, rank #3 and #4 respectively for web traffic within China (SimilarWeb) and sell almost solely to Chinese customers. Together they reported a total of $111 billion in sales in Q1 2016.

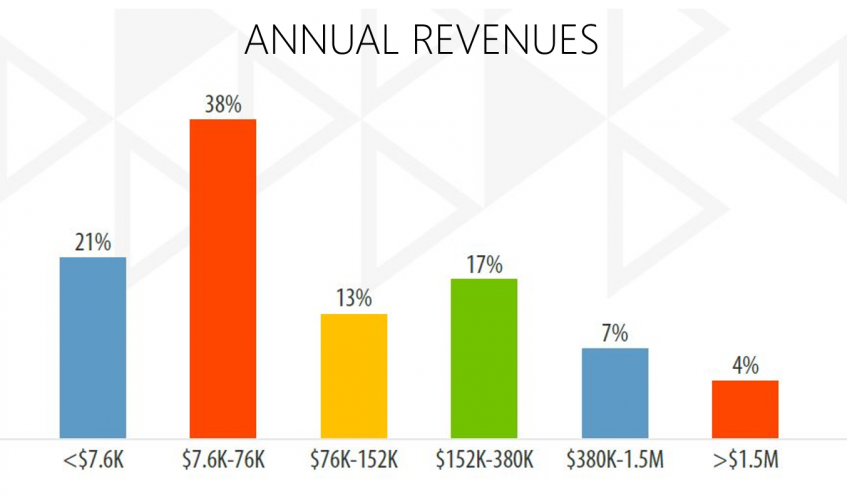

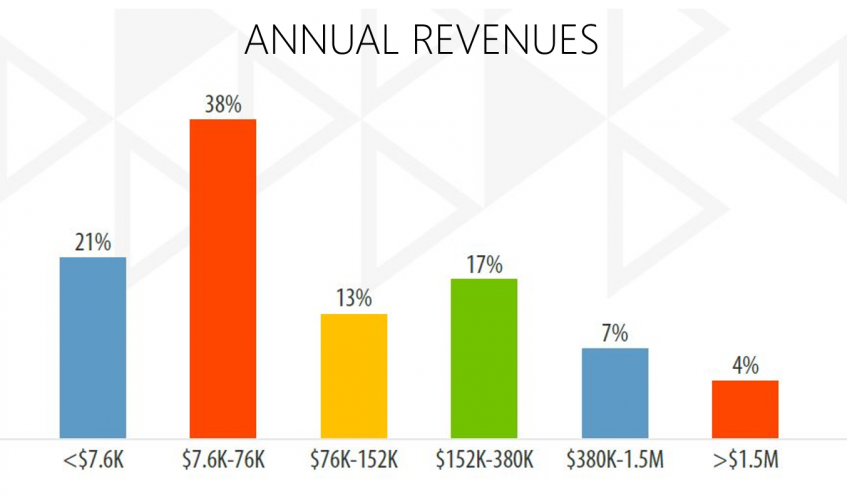

The market is not dominated by mega-millionaire titanic sellers, surprisingly enough. According to data collected by Payoneer from over 900 Chinese online merchants, 59% of sellers in China report annual revenues of $76K or below and only 4% report revenues in the millions. The available channels enable small-scale Chinese sellers to distribute their goods to a large number of global buyers, lowering barriers to entry and leveling the playing field for sellers of all sizes.

Download the full report here >>

Small-scale Chinese sellers dominate some of the biggest marketplaces, the report shows. AliExpress, Wish and eBay, for example, have a much higher percentage of small-scale merchants selling on their platforms. However, sellers – regardless of size – are interested in selling on Amazon more than any other marketplace, and it is ranked the #1 marketplace merchants want to join (if they haven’t already).

The market is wide open

Competition is high, sellers report, and it’s getting higher all the time. Nearly half of the respondents cited increasing numbers of Chinese sellers as the biggest challenge to selling online. But don’t let this be a deterrence; there are very low barriers to entry, and the market certainly isn’t reserved solely for merchants from China. Amazon sells over 1 billion products and has over 188 million viewers each month, not taking into account shopping holidays like Cyber Monday and its own branded Prime Day. There is always room for more.

Learn from the experts: Find out more about how to build your own cross-border eCommerce business from 900+ successful sellers. Download the full report here.