Payoneer’s wire transfer tutorial for freelancers and business owners

Ways to wire money for business owners – the complete guide to sending and receiving money internationally

Welcome to our definitive guide on sending and receiving money internationally – a must-read for every business owner making their mark globally.

As business owners, we at Payoneer understand the importance of efficient and secure financial transactions. And, in a world that’s more integrated and connected than ever, you are most likely to need to send or receive funds from overseas.

In international business, wire transfers have become a cornerstone of providing a reliable, safe, and timely solution for your global payments. Yes, they might carry a cost, but the peace of mind that comes with knowing your money is in safe hands is invaluable.

This guide aims to empower you with the knowledge you need to handle these transactions like a pro. We’ll break down the process of wire transfers, shedding light on the benefits and considerations. We believe that understanding is the first step towards mastering, and we want you to be a master of your financial destiny.

We’ll also share some practical tips and tricks to help you minimize costs and ensure maximum security. After all, we are in this together – your financial success is our mission.

At Payoneer, we know international transactions are about more than money. They’re about building relationships, maintaining trust, and ensuring efficiency. As we dive into the world of wire transfers, we’re here to help you achieve all that and more. Ready to embark on this journey with us? Let’s get started!

What is a wire transfer and what are the ways to wire money internationally and domestically?

Wire transfers are a key part of the online financial world, helping you move money securely from one bank account to another. These transfers can happen within the U.S. (domestic) or between a U.S. account and another country (international) account.

You’ve probably heard about wire transfers when you need to electronically send money to someone else.

Just a heads up, most money sent by U.S. customers to overseas accounts is known as remittance transfers as per the rules. When done through certain providers, these transfers give you some extra security.

As the name suggests, domestic wire transfers let you move money from one U.S. bank or credit union account to another. It’s a popular choice because it’s quick and easy.

If you ever run into trouble with your wire transfer, don’t worry. Just get in touch with your service provider straight away and let them know what’s up.

Here at Payoneer, we’re all about making things smooth and easy for you, and we’re always here to help with any step of your wire transfer process.

Wire transfer internationally – effective solutions for business owners

Transfers between different banks a.k.a. Inter-bank transfers: This type of transaction involves sending funds from a bank in one country to a different bank in a different country. It’s a common way of handling international bank transfers. The sending and receiving banks must adhere to their respective country’s financial regulations, reporting the movement of funds to their local financial authorities.

Let’s illustrate this with an example. Say a small business owner in New York must pay a London supplier. The owner would initiate a transfer from their bank in the U.S., and the funds would then be sent to the supplier’s bank in the U.K. Perhaps from Bank of America in New York to HSBC in London.

Transfers within the same bank a.k.a. Intra-bank transfers: In this situation, the funds are moved between different branches of the same bank in different countries. These transfers typically occur through the SWIFT network, a global messaging network that financial institutions use to securely send and receive information, such as money transfer instructions.

Consider the following example: A freelance graphic designer in California who works for a German company wants to send her earnings from her U.S. Citibank account to her Citibank account in Berlin. In this case, Citibank would use the SWIFT network to communicate the transfer instructions, ensuring the funds are moved securely and efficiently from one account to the other.

In both scenarios, the process is designed to be secure and transparent, adhering to international banking standards and regulations to ensure your money reaches its destination safely.

I'm ready for easy and low-cost payments

Domestic wire transfer options

Transfers between different banks: When you need to send money from your bank to a different bank within the same country, you’re making what’s known as an interbank transfer. This is a common method for handling domestic transfers, and every bank has its process and timeline for these transactions.

For example, if you’re a business owner in Miami and need to pay a supplier in Seattle, you might transfer from your bank, say Bank of America, to the supplier’s bank, which could be Wells Fargo. Both banks would follow U.S. financial regulations and report any necessary details to the proper authorities.

Transfers within the same bank: When you move money between accounts at the same bank, you make an intrabank transfer. This process is generally quicker than an interbank transfer since it involves no other financial institutions.

For instance, if you have a business account and a personal account at Chase and want to move funds from your business account to your personal account, you’d be making an intrabank transfer. The transfer would occur within Chase’s internal system, which usually allows the funds to be available quickly.

These transactions are designed to be secure, efficient, and per domestic banking regulations. So, whether you’re making an interbank or intrabank transfer, you can be confident that your money is being moved safely.

I'm ready for easy and low-cost payments

Pros & cons of international wire transfers

As with any financial service, international wire transfers come with their own set of advantages and drawbacks. On the one hand, they provide a fast, reliable, and secure method to send money across borders, often proving crucial for businesses and individuals alike.

However, on the other hand, they involve certain complexities, such as fees, exchange rates, and regulatory issues.

In the following sections, we’ll delve deeper into the pros and cons of international wire transfers, arming you with the knowledge to make informed decisions when dealing with international transactions.

Pros of wire transfers

- Speed: International wire transfers are typically faster than other methods of sending money abroad. Depending on the bank and the countries involved, transfers can often be completed within one to two business days.

- Security: Wire transfers are one of the most secure ways to send money. Banks and other financial institutions use advanced encryption and security measures to protect your funds and personal information during the transfer process.

- Global Reach: Wire transfers can be sent to almost any country around the world, making them ideal for international business transactions, sending money to family overseas, or paying for goods and services abroad.

- Large Transfers: There are usually no limits on the amount you can send via an international wire transfer, making it a good option for large business transactions or significant personal transfers. Of course, certain countries have exchange rate controls & regulations to limit the size of international wire transfers.

- Direct Transfer: The money moves directly from the sender’s account to the recipient’s account, without intermediaries. This directness can simplify the transaction process and make it easier to track the funds.

Cons of wire transfers

- Fees: International wire transfers can come with substantial costs. Both the sender’s and recipient’s banks might charge for their services, and intermediary banks may also take a cut.

- Exchange Rates: Banks often use their exchange rates for converting money in international wire transfers. These rates might not be as favorable as those available elsewhere, which can affect the total amount received.

- Irreversible: Once a wire transfer has been initiated, it can’t typically be reversed. This makes it essential to double-check all details before sending the transfer.

- Time-Consuming Setup: An international wire transfer setup can be complex and time-consuming, requiring various details about the recipient’s bank and account.

- Potential Delays: Wire transfers can sometimes face delays despite generally being quick. Bank holidays, time zones, and verification processes can slow the transfer process.

The best ways to wire money internationally

Navigating the landscape of international money transfers can seem daunting for business owners and freelancers alike. Yet, there are banks, online platforms, and even smartphone apps, each promising to streamline this process.

But how do you figure out the right choice for your unique needs? What’s the quickest, the simplest, or the most reliable? Don’t forget those pesky fees and fluctuating exchange rates, which can quickly eat into your bottom line.

Fear not – we’re here to help. We’ve been through this maze before and are ready to guide you. Whether you’re a business owner paying an overseas supplier, a freelancer receiving payment from an international client, or just exploring the best ways to manage your global transactions, we’re here to ensure you’re well-equipped.

In the following sections, we’ll explore the top international methods for wiring money. We’ll dissect their pros and cons, evaluate their costs, and assess their usability. We’ll also share some practical tips to ensure you get the best value for your money.

So, get comfortable and prepare to embark on this journey into international money transfers with us. By the end, you’ll better understand which ways to wire money best aligns with your professional needs.

Your local bank.

Starting your journey into international money transfers, the first stop is often your bank. After all, you trust them with your money, so why not trust them with your transfers? Recall that banks offer a range of transfer options, from intra-bank transfers (moving money between accounts within the same bank) to inter-bank transfers (sending money to an account at a different bank), both domestically and internationally.

While wiring money through your bank can be straightforward and secure, knowing the potential costs is essential. Banks often charge fees for these services, which can vary significantly depending on the bank and the transfer specifics.

Let’s consider a few examples from some of the leading U.S. banks:

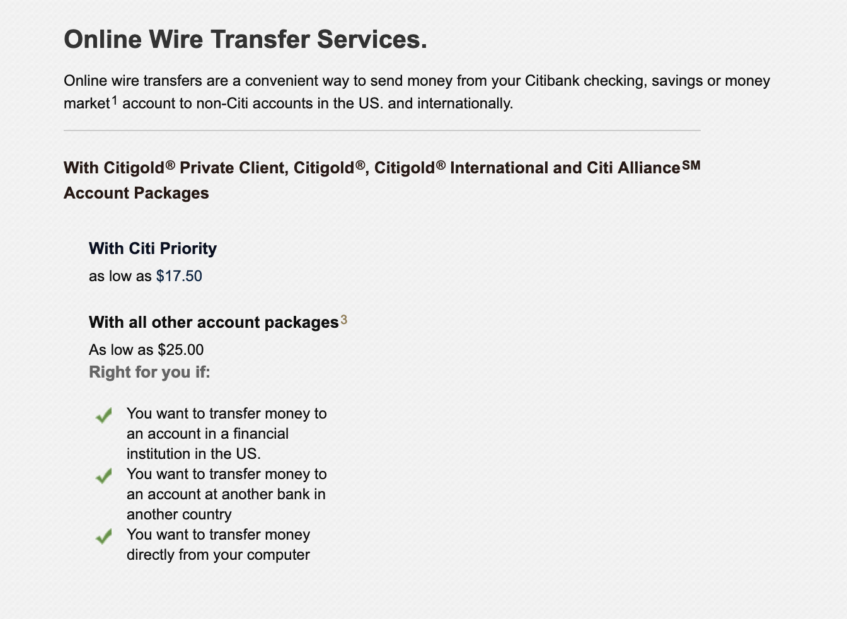

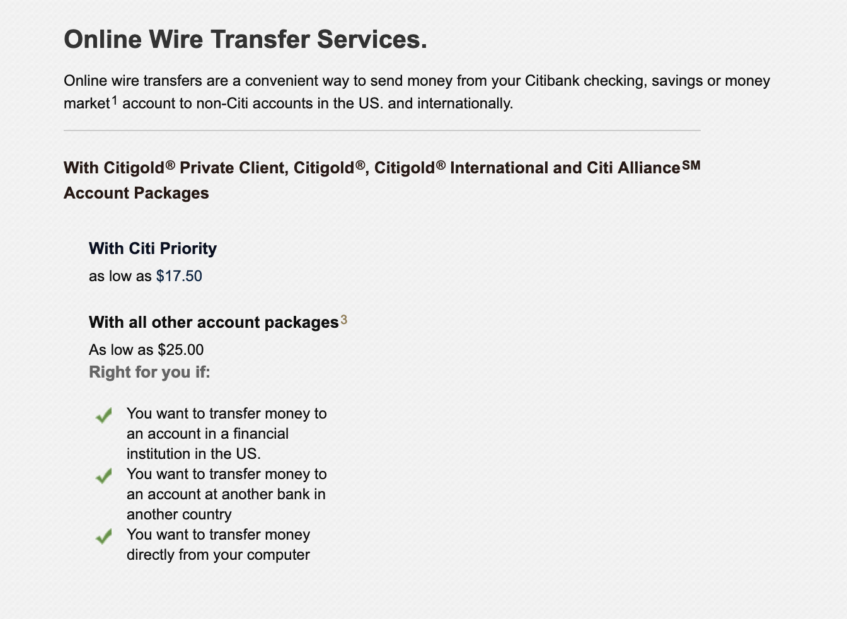

Citibank

Citibank offers international wire transfers to most countries in the world. However, these transfers come with a fee. The costs can vary depending on whether you’re sending or receiving money, the amount being transferred, and the destination country. Pay close attention to foreign exchange fees – they’re always favorable to the bank and not the customer.

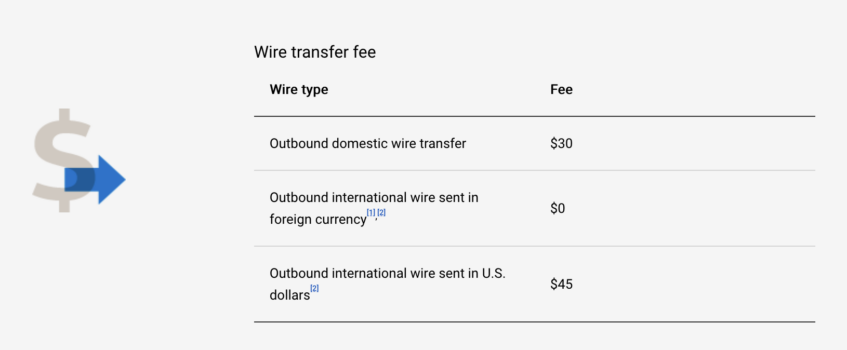

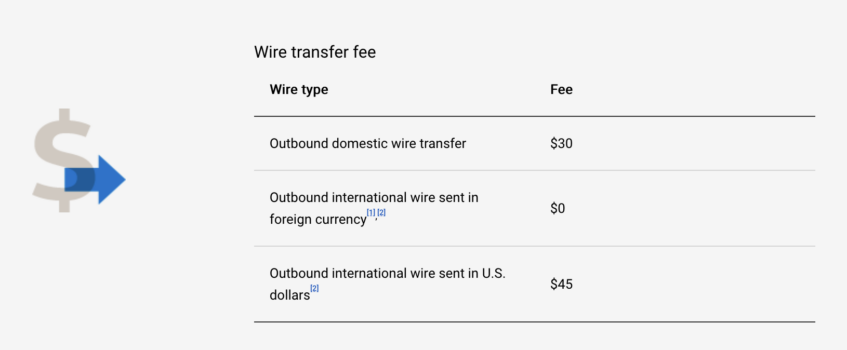

Bank of America

Bank of America also provides international wire transfer services. Bank of America (BoA) charges high fees for these services, which can vary based on several factors, including the currency used and the destination country. Be sure to read the fine print whenever you initiate an international wire transfer.

Wells Fargo

Wells Fargo is another major bank offering international wire transfer services. Their fees vary based on the transfer specifics, including the currency and destination. Again, take the time to consult their fee schedule.

Chase

Chase Bank also offers international wire transfers with associated fees. These fees can vary based on the currency, transfer amount, and the destination country. Chase offers low rates for amounts under $5000, but fees climb substantially for larger amounts.

While banks are a secure and reliable way to send money internationally, their fees can quickly add up, particularly for frequent or large transfers. The most unfavorable fees are the forex rates they offer to customers. It’s often not worth the cost, delay and inconvenience of sending money via bank transfers. As such, business owners and freelancers must consider these costs when choosing a method for international money transfers.

I'm ready for easy and low-cost payments

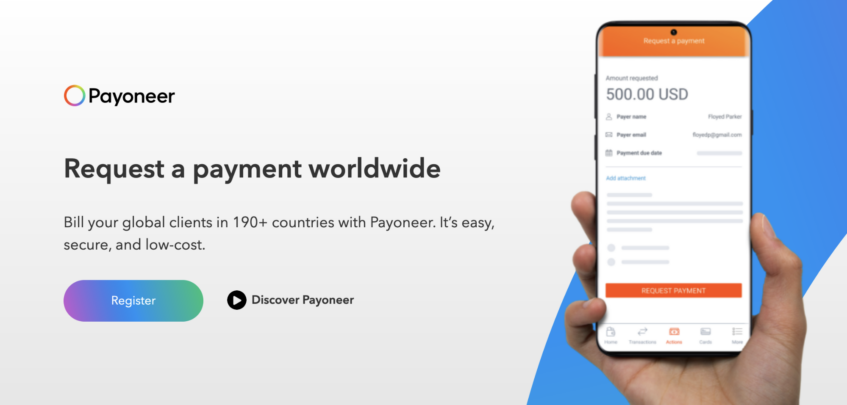

Payoneer wire transfer services for businesses

At Payoneer, we understand the unique challenges that businesses, sellers, and freelancers face in today’s global market. That’s why we’ve designed a cross-border and flexible payments solution that’s as seamless and straightforward as your local banking transactions. No matter where you are in the world, our platform allows you to send and receive payments with ease, efficiency, and affordability.

We’re passionate about breaking down barriers and making global commerce feel like a local transaction. Our service isn’t just about moving money—it’s about empowering you to do more of what you love and expanding your business or freelancing opportunities without borders.

With us, you can forget about complicated procedures and high costs often associated with international transactions. Instead, you’ll experience a service that’s fast, simple, and cost-effective. We’re here to make your global payments as effortless as possible, leaving you more time to focus on what truly matters—growing your business or freelance career.

Receive international payments with Payoneer wire transfers

We’ve crafted solutions that empower business owners to receive payments from abroad with ease. Here’s how we do it:

- Payment requests: With our intuitive platform, you can send your clients a bill directly from your Payoneer account. It’s an all-in-one invoicing and payment solution. Your clients can pay you online swiftly using their preferred payment method, be it a local bank transfer, credit card, or ACH bank debit. It’s a smooth transaction experience that takes mere minutes. Simply request a payment and you’re golden.

- Local receiving accounts: Imagine having a local bank account in key markets like the US, UK, EU, Japan, Canada, Australia, and Mexico. That’s what our receiving accounts provide. It’s a gateway for you to receive payments as if you’re operating locally in these countries. Your clients simply transfer funds to these accounts as though they’re making a domestic transfer, making international transactions feel closer to home.

- Marketplaces & networks: Our platform is integrated with global companies and popular online marketplaces & networks like Upwork, Airbnb, and Amazon. Alongside thousands of Payoneer partners, these platforms can directly transfer your earnings to your Payoneer account. All you need to do is select Payoneer as your preferred payment provider, and you’ll be able to receive funds from a vast network of companies. You can then withdraw the funds to your local bank account or at ATMs globally.

I'm ready for easy and low-cost payments

Send international payments with Payoneer wire transfers

In the international business arena, managing cross-border payments can be quite the challenge. But with us, there are many ways to wire money abroad. We’re here to transform how you handle international payments, making it as effortless as possible. Let’s explore how Payoneer’s capabilities can work to your advantage.

- Make a payment: With Payoneer, sending payments across borders is as simple as a few clicks. You can pay anyone directly from your Payoneer balance, whether they have a Payoneer account or not. And here’s the best part—if they’re a Payoneer user, the transfer is entirely free! For those who aren’t, a straightforward bank transfer does the trick. With Payoneer, your business reaches over 200 countries effortlessly!

- Payments to contractors: Whether you’re engaging contractors for one-time projects or have ongoing collaborations, we’ve got you covered. You can make individual payments or set up automatic, recurring transfers. With us, you gain the flexibility to choose a payment schedule that aligns with your business operations.

Payoneer wire transfer services make it possible to pay contractors in over 200 countries & territories. You can pay Payoneer customers free and you can make batch payments direct to the recipient’s bank account.

I'm ready for easy and low-cost payments

eWallet money transfers

An eWallet is a convenient service that allows you to store and use funds for online and in-store purchases. Popular eWallet providers include Moneybookers, PayPal, and Skrill. Many people use eWallets to withdraw money earned online, especially for international transactions.

Before connecting your eWallet with Payoneer, consider compatibility and seamless transfers to ensure a smooth experience. With Payoneer, you can leverage the benefits of an eWallet for secure and efficient transactions.

- Check if your eWallet accepts Payoneer’s bank account type for transfers.

- Connect your eWallet to your Payoneer Prepaid Mastercard® if you don’t have a local bank account.

- For new registered users without funds on their card, receive payments through marketplaces or request payments directly to your Payoneer account.

Struggling to access your funds from your eWallet? Discover how we can help you withdraw your eWallet funds hassle-free and securely. Say goodbye to the frustration of locked funds and explore the convenient withdrawal options available with our all-in-one solution.

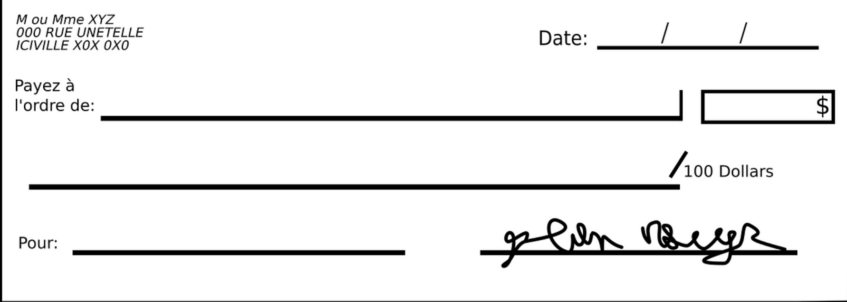

Personal Check

When transferring funds, personal checks offer a familiar and straightforward option. These traditional paper checks allow you to securely send money from one person to another, whether they are in the same country or abroad.

Using personal checks is easy. All you need is a checking account with a bank or credit union. To send money, fill out a check with the recipient’s name, the amount, and the date. Then, sign the check and hand it over to the recipient or mail it to their address.

Personal checks provide several advantages. First, they are widely accepted, making them convenient for various transactions, such as paying bills, reimbursing friends, or purchasing. Plus, they offer a clear paper trail, making tracking and documenting your payments easy.

However, it’s important to remember that personal checks can have drawbacks. They rely on the recipient physically depositing the check and waiting for it to clear, which can take time. Plus, if the check gets lost or stolen, there is a risk of unauthorized use of the funds.

I'm ready for easy and low-cost payments

That’s a wrap!

Congratulations! You’re now equipped with a comprehensive guide to Payoneer wire transfer services and the inner workings of international payments. But we’re not done just yet. We have an exciting proposition that could revolutionize your business and freelance endeavors.

We offer the ultimate solution for seamless money transfers. With our user-friendly platform, you can say goodbye to exorbitant fees and unfavorable exchange rates. We’re here to empower business owners and freelancers like you to save money and maximize your earnings.

By signing up with Payoneer, you’ll unlock a world of possibilities. Enjoy the convenience of sending and receiving payments globally just as quickly as you do locally. Say farewell to complicated processes and lengthy wait times. With us, you’ll experience swift, secure, and cost-effective transactions that will transform your business.

Don’t just take our word for it – explore the features and benefits of Payoneer for yourself. Join our community of savvy entrepreneurs and freelancers already reaping the rewards. Make the switch to efficient, affordable, and secure international money transfers. Your success awaits. Sign up today and unlock a world of financial possibilities!

Editor’s Note: The original post was updated on May 16, 2023 for accuracy and comprehensiveness.