Tips to Save on Fees When Working with International Currencies

Payoneer connects companies with professionals all around the world, offering international solutions for sending and receiving money. While the many services we offer are geared towards making your payments simple and efficient, working internationally and with foreign currencies is always tricky. Here are a few tips that can help you save some extra cash!

Best practices when using your Payoneer card

- Purchases: The main thing you need to keep in mind when using your Payoneer card is that your account is held in either USD or EUR, regardless of what country you live in. That means that if you are not spending in USD or EUR, each time you use your Payoneer card, funds are converted to your local currency.

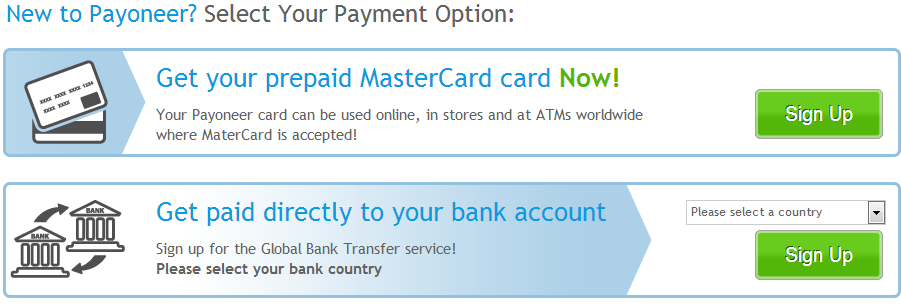

The Payoneer card is a prepaid Mastercard® and as such, currency conversions are made using Mastercard’s official exchange rates. If you’re making large transactions or withdrawals and want to get an estimate of what the current exchange rates are at the time of your transaction, Mastercard® offers an excellent online tool for that.

- Foreign Currency Transactions: If you’re anything like me when it comes to spending money, you will always check your transaction history and compare it to purchase amounts. I know I can be extremely OCD when it comes to the details of my bank and credit/debit card history, so it’s important you realize that the Payoneer card, just like any other Mastercard, is subject to currency conversion charges. While Payoneer itself does not charge you for point-of-sale purchases, Mastercard® and our issuing bank may charge up to 3% on foreign currency or “cross border” transactions (transactions made outside the country of our issuing bank). When making purchases, balancing your books or tracking your transactions, it’s important you keep this in mind.

Cash Withdrawals via ATM: Unlike point-of-sale purchases, cash withdrawals made at ATMs outside the US often use the bank’s conversion rates. While Mastercard® has competitive conversion rates that are amongst the best available, many international banks will not offer the same conversion rates. If your local bank has poor conversion rates, you may be better off withdrawing in USD and converting the funds at another location. Check here for a list of compatible ATMs near you.

Receiving funds from Payoneer Partners

You can connect immediately with over 2500 companies who choose Payoneer as a way to pay their users. Payoneer users worldwide can receive payments from marketplaces/ companies around the world (Upwork, Fiverr, ClickBank, 99Designs, PeoplePerHour, and more!!) directly to their bank account. So, no matter where you are in the world, you can access our partners to scale your business and immediately receive payment to your local bank account.