How global businesses use the Payoneer card to accelerate their growth

Discover the smart way to streamline your businesses expenses, exploit your growth opportunities, and maintain ultimate financial control with the all-new Payoneer card.

Register today and you’ll enjoy the same great benefits that have enabled countless businesses to achieve their cross-border ambitions.

With global purchasing wherever Mastercard® is accepted, fee-free transactions*, and high spending limits, the Payoneer card is the easy way to pay for anything straight from your Payoneer balance.

How can I use my Payoneer card?

Whatever your business and whatever your ambitions, the Payoneer card has the capacity to help you get there faster.

- Controlled spending for marketing agencies

If you’re a busy marketing agency, managing and tracking spends across different channels and for different clients can quickly become complex. If you can’t keep accurate control of your outlays, you could even accidently put your business at financial risk.

A Payoneer card eliminates that uncertainty. You can boost your efficiency and control by ordering up to 200 cards linked to your primary card, then use each one for a specific client or channel. With each card, you can use your online dashboard to set precise daily or monthly spending limits and assign personalized nicknames, so you know you’ll never overspend again. It’s the perfect tool for lean expense management.

- Organized investments for marketplace sellers and drop-shippers

When your peak season approaches and demand increases dramatically, you need to know you’ve got the necessary stock to fulfil any upsurge in orders. With a maximum daily limit of 200,000 USD, the Payoneer card gives you the scope and flexibility to order inventory in bulk – so you’ll never miss an opportunity to grow.

For those overseeing several different outlets, you can also manage individual stores quickly and easily with different Payoneer cards.

- Easy expenses for B2B businesses

Ambitious tech and finance companies use the Payoneer card in locations around the world to effectively manage their day-to-day business expenses. Because the Payoneer card can be used anywhere Mastercard® is accepted, paying for office supplies, software or business trips becomes a breeze. You could even use it for paying your contractors.

4 great reasons to start using the Payoneer card today

Whatever your circumstances, the Payoneer card offers a range of benefits designed to make it easier to control your spending.

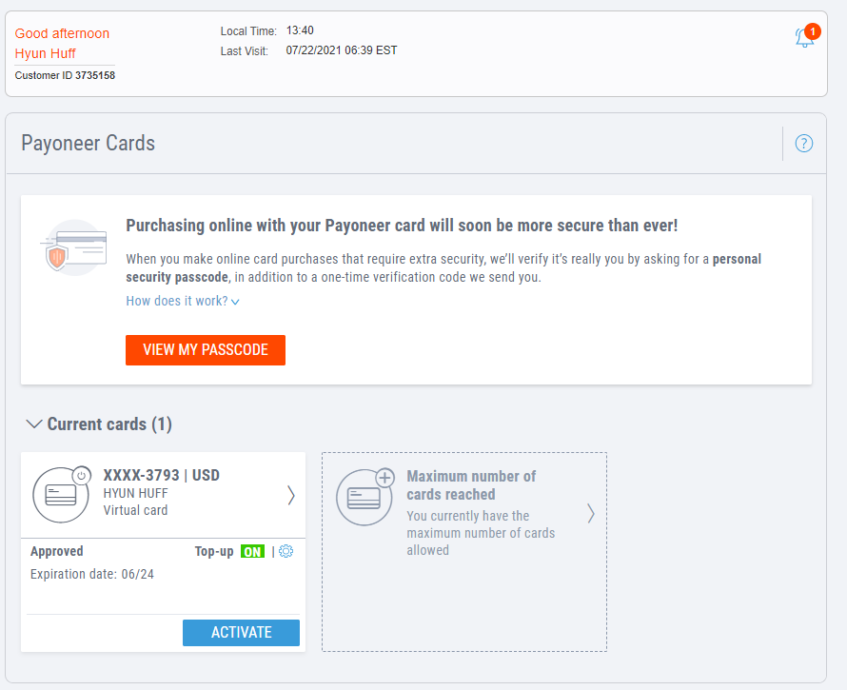

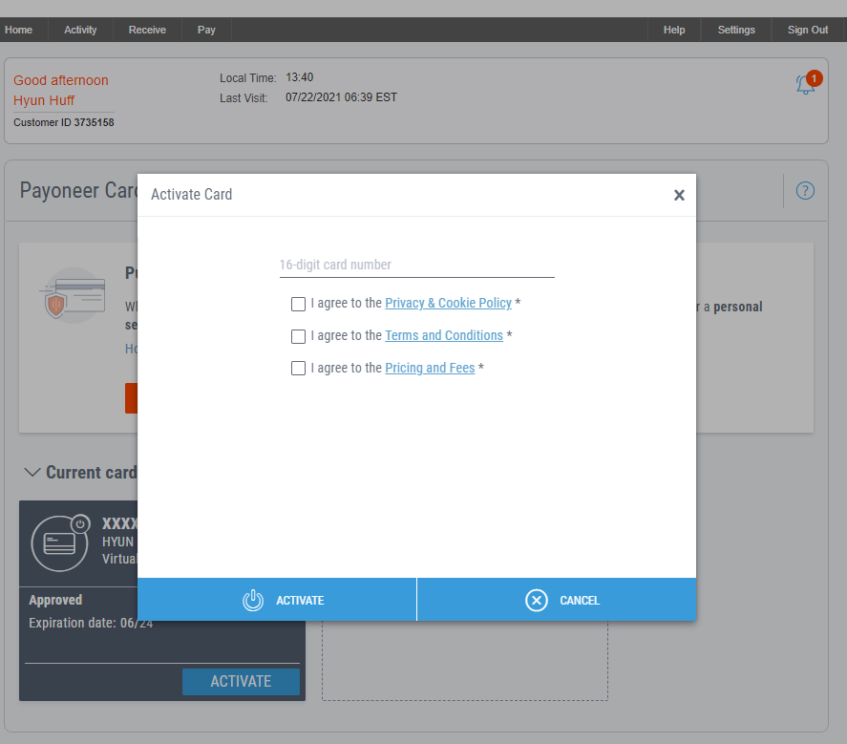

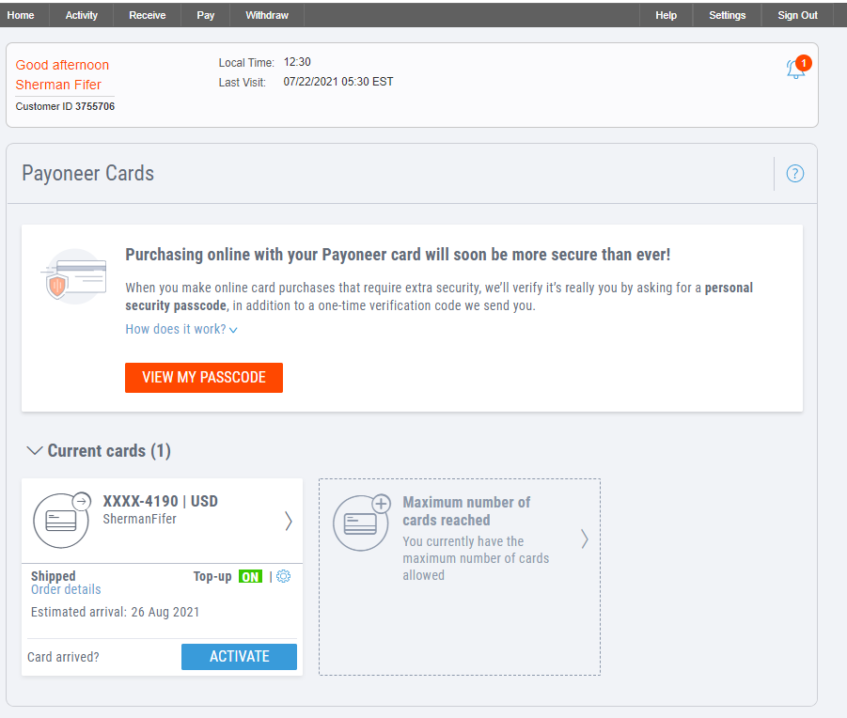

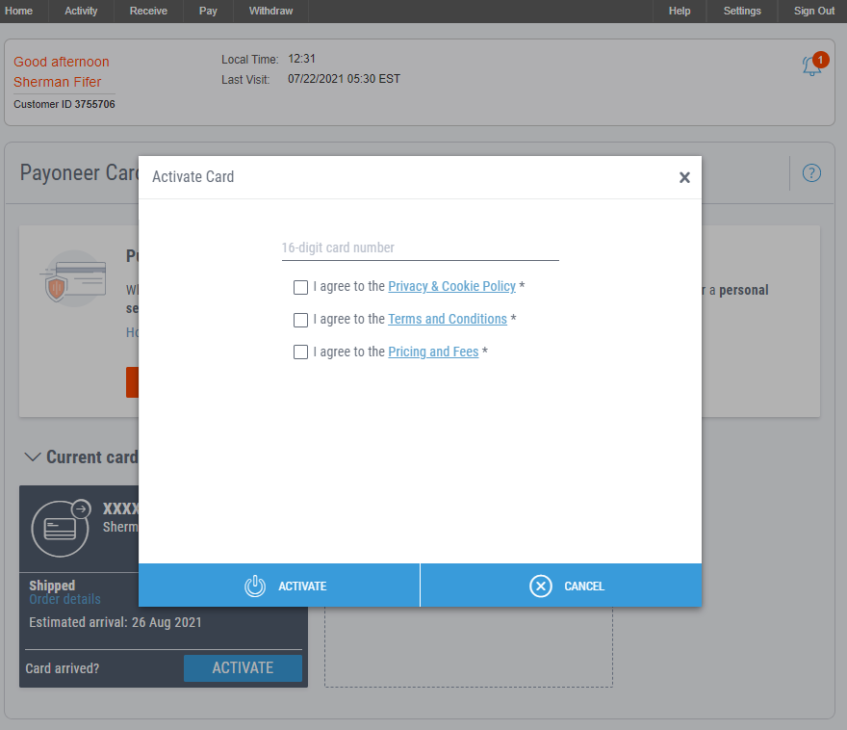

- Enjoy safer and faster virtual card activations. Getting started is super easy. Just set a four-digit PIN, agree to the T&Cs, and go through the multi-factor authentication process. The whole process will take just two minutes – and then you can start paying your global expenses with ease. It couldn’t be smoother!

- Pay your global business expenses effortlessly. No more headaches around paying for ads, bills, and contractors. With the Payoneer card, you can pay for services, expenses and more in any major currency, any time.

- Grow your business and realize your ambitions. Wherever your dreams take you, we’ve got your back. Spend up to 200,000 USD a day, every day, without ever hitting the brakes. And access multiple free** company cards to help you manage your business.

- Maximize your savings. With the Payoneer card, you’ll save on bank withdrawal fees and conversion fees with fee-free purchases*. You can also make every purchase count by earning cashback*** on all your Payoneer card transactions.

It’s easy to get started

Ready to take advantage of all the benefits of the Payoneer card?

Order yours today and unlock the freedom and control to achieve your ambitions.

Still got questions about the Payoneer card? Check out our detailed FAQs.

* Payoneer will not apply a per-transaction fee for purchases made in USD using the Payoneer Corporate Purchasing Mastercard® issued by First Century Bank, N.A, across the globe; and for purchasing in EUR, USD, GBP and CAD made using the Business Premium Debit Mastercard® of the same currency within the EEA region.

*** This Cashback offer is available in limited countries only and is subject to the terms and conditions of the Global Cashback Reward Card Plan.