Payoneer Tips on How to Become a Successful Amazon AE Seller

Earn in AED with Amazon AE: Access UAE’s thriving ecommerce market and freelance clients!

Source: Statista eCommerce – United Arab Emirates

Welcome to the world of eCommerce in the United Arab Emirates (UAE), where the online shopping industry is growing at an unprecedented rate. The B2C eCommerce market in the UAE is projected to reach $30.7 billion by 2023, and the industry’s anticipated growth is expected to be even more attractive in the medium to long term. As a result, by 2027, the UAE’s B2C eCommerce Gross Merchandise Value (GMV) is expected to be approximately $46.8 billion.

As a result of the pandemic-generated diversion to online shopping, reward & loyalty schemes provided by retailers, and rising social commerce momentum, the UAE’s eCommerce market is set to continue its strong growth. Firms are investing heavily in fulfillment centers to serve the rapidly growing eCommerce market in the country, making it integral for a successful eCommerce market.

The eCommerce market in the United Arab Emirates is growing steadily, and various categories are expected to experience substantial growth over the next couple of years. Foremost among these categories are personal care, apparel, beauty, and footwear. As a result, domestic and global players are keen to take advantage of the growth opportunities the UAE’s eCommerce market offers. As a result, infrastructure investment is projected to increase significantly in the coming years.

Did you know that the UAE’s eCommerce market is predicted to generate over $8 billion online sales by 2025? With Payoneer, you can easily set up an account for free and take advantage of this booming eCommerce market. And if you’re already active in the United Arab Emirates, Payoneer’s user-friendly platform makes managing payments a breeze. So, don’t miss out on the opportunity to grow your business in the UAE with confidence and ease.

Fast Stats about UAE eCommerce Growth:

- A CAGR of 11.12% is projected during 2023-2027.

- UAE’s B2C eCommerce market is expected to reach US$30.7 billion by 2023.

- Growth fueled by a pandemic-driven shift to online shopping and loyalty/reward schemes.

- Strong growth potential for categories like apparel, footwear, personal care, and beauty.

- Substantial investments in fulfillment centers, as well as the largest in the UAE by Noon.

- Food delivery firms grew strongly during the FIFA World Cup event in Q4 2022.

- Localization is important for global brands seeking to unlock growth in the UAE market.

Master the UAE’s Thriving eCommerce Market with Payoneer’s Hassle-Free AED Receiving Accounts

Are you tired of struggling to receive payments from regional marketplaces in the UAE because of the strict banking regulations and hefty fees? We understand the challenges, so we’re excited to introduce Payoneer’s AED-receiving accounts for AED Amazon account holders.

No more lengthy background checks or proving a solid credit history. Now you can receive your hard-earned funds from Amazon AE, Namshi.com, and other marketplaces in AED, just like you have a local bank account.

Say goodbye to the headache of traditional banking and hello to hassle-free payments with Payoneer.

Unlock the UAE market: The benefits of opening an AED receiving account with Payoneer

- Expand your business to the United Arab Emirates (UAE) market without needing a local bank account or legal entity.

- Receive funds earned on regional marketplaces, such as Amazon AE, Namshi.com, and others, in AED as if you had a local bank account.

- No need for a financial history in the UAE or lengthy credit checks, making the process faster and easier.

- Withdraw your funds to your local bank account and avoid high conversion fees.

- Use your funds for various business-related payments, including payments to suppliers and other business partners. Plus, payments to other Payoneer accounts are free.

- Signing up and using Payoneer’s AED-receiving account services is completely free.

- The UAE is a Booming eCommerce Market for Amazon AE SellersSource: Mordor Intelligence UAE

Source: Mordor Intelligence UAE

The United Arab Emirates (UAE) boasts a strong and growing eCommerce market that offers many opportunities for cross-border sellers.

With a population in the millions, the majority of whom are fluent in English and have high disposable income levels, the UAE presents a highly attractive marketplace for businesses looking to expand their reach.

In addition to the factors mentioned above, here are some more encouraging statistics that make the UAE eCommerce particularly attractive to freelancers, consultants, and entrepreneurs:

- The United Arab Emirates has a population of nearly 10 million, with 99% actively using the internet.

- UAE residents are reported to spend an average of 7.5 hours online every day.

- With a gross national income per capita of approximately $70,000, the UAE is known for its high purchasing power.

- The eCommerce industry is booming, with projected revenue expected to reach $8 billion by 2025.

- UAE is the 28th largest eCommerce market, with a predicted revenue of US$11,782.3 million by 2023, expected to grow at a CAGR of 8.6% to reach a projected market volume of US$16,373.4 million by 2027.

- The UAE eCommerce market is expected to grow at a CAGR of 8.6% from 2023 to 2027, resulting in a projected market volume of US$16,373.4 million by 2027.

- Fashion is the largest market, accounting for 38.7% of UAE eCommerce revenue, followed by Electronics & Media (19.9%), Toys, Hobby & DIY (15.4%), Food & Personal Care (13.6%), and Furniture & Appliances (12.4%).

- The UAE eCommerce market is projected to contribute to the worldwide growth rate of 17.0% in 2023, with an expected increase of 10.6% in the same year.

- Global eCommerce sales are expected to increase over the next years, similar to the growth in the UAE eCommerce market.

- Amazon AE is the biggest player in the UAE eCommerce market, generating revenue of US$477.6 million in 2022.

- The second and third-largest stores in the UAE eCommerce market are namshi.com and carrefouruae.com, with US$264.8 million and US$223.2 million in revenue, respectively.

- The top three stores in the UAE eCommerce market account for 35.2% of the top 100 online stores’ revenue in the country.

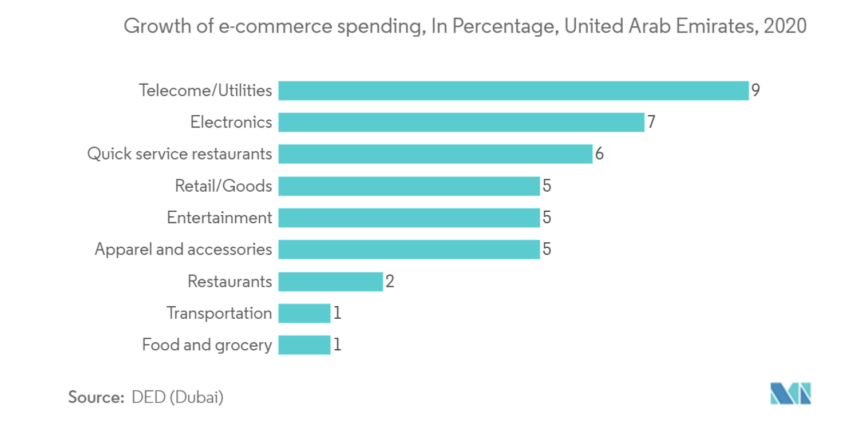

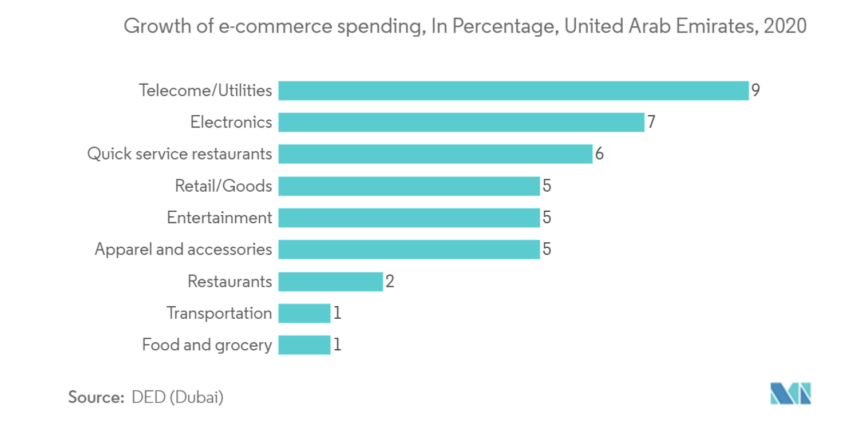

UAE ecommerce purchases – what are shoppers buying online?

The United Arab Emirates is leading the charge in eCommerce among Gulf Cooperation Council (GCC) states, with a 53% increase in 2020 amounting to a record $3.9 billion in sales, accounting for 10% of all retail sales. This is expected to reach $8 billion in sales by 2025 due to nearly 100% of the population having internet and mobile access.

While Amazon.com acquired Souq.com, the largest domestic online merchant, traditional retailers like Carrefour and Lulu Group have launched online shopping portals in the UAE to adapt to the growing eCommerce market. However, language and localization are crucial for success in this market, as Arabic language sites and cross-border eCommerce shopping are popular.

However, barriers to entry remain, including cash on delivery, security concerns, inadequate logistics, and a lack of unified address systems. Despite these hurdles, the UAE is on track for dramatic gains in eCommerce growth.

- UAE government supports eCommerce growth, encouraging foreign investment through initiatives such as Dubai CommerCity, a free economic zone for eCommerce

- High mobile phone and internet penetration rates in the UAE, with over 80% of the population owning a smartphone, allowing for easy access to eCommerce businesses through mobile apps and websites

- Growth in social commerce, especially popular among younger consumers who shop through social media platforms such as Instagram and Facebook

- Cross-border eCommerce is booming in the UAE, with many consumers purchasing products from overseas vendors, presenting opportunities for eCommerce businesses to offer reliable and affordable shipping while providing a seamless shopping experience for consumers.

In response to the COVID-19 pandemic, Emiratis have turned to online shopping in greater numbers. The following product categories are currently popular among UAE consumers:

- Fashion accounts for 27% of eCommerce revenues.

- Electronics and Media account for 18% of eCommerce revenues.

- Food and Personal Care account for 13% of eCommerce revenues.

- Furniture and Appliances account for 12% of eCommerce revenue.

- Toys, hobbies, and DIY equipment account for 29% of eCommerce revenues.

Emirati online shoppers tend to use global marketplaces like Namshi.com and Amazon AE.

Provide services for UAE-based clients with your own AED receiving account

Expanding your business to the United Arab Emirates (UAE) is a wise decision in the current global marketplace. With a thriving economy, a tech-savvy population, and a rapidly growing eCommerce market, the UAE offers ample opportunities for businesses of all kinds to grow and prosper.

While eCommerce merchants have already recognized the potential of the UAE market, other businesses, such as graphic designers, virtual assistants, and marketing services, can also benefit from providing services to UAE-based clients. Here’s why having a UAE receiving account from Payoneer can help you streamline your business and grow your customer base in the UAE:

Streamline payments with an AED receiving account:

- Accept payments directly from UAE-based clients with an AED receiving account from Payoneer.

- Receive payments via local bank transfers or credit card payments.

- Eliminate the need for slow and expensive international bank transfers.

- Convert currency at a low cost within your Payoneer account, ensuring you always have the necessary currency.

- Withdraw your earnings to your local bank account or pay your team or partners directly from your account.

Tap into the Growing UAE Market:

By the end of 2023, the eCommerce market in the United Arab Emirates is expected to generate around US$11,782.3 million in revenue, making it one of the top 30 largest eCommerce markets in the world.

- The Dubai Chamber of Commerce and Industry forecasts eCommerce to generate $8 billion in sales by 2025.

- The most popular eCommerce categories in the UAE include toys, hobbies, DIY equipment, fashion, electronics and media, food and personal care, and furniture and appliances.

- UAE-based clients often prefer to shop on global marketplaces like Namshi.com and Amazon AE, making it easier for businesses to reach a wider audience.

AED Amazon Sellers Can Succeed in the United Arab Emirates’ eCommerce Market with PayoneerSource: Pixabay No Attribution Required

Are you an Amazon AE seller looking to grow your business in the United Arab Emirates (UAE) booming eCommerce market? Then, look no further than Payoneer’s AED receiving account. With this account, you can receive payments in dirhams on major UAE marketplaces like Amazon AE and Namshi.com, among others.

But that’s not all. With Payoneer’s AED receiving account, you’ll enjoy fast and secure transfers with zero fees and the ability to withdraw funds in local currency straight to your local bank account. You can easily pay your suppliers and partners in different currencies with just a few clicks.

Payoneer also offers receiving accounts in other major currencies, including USD, EUR, GBP, CAD, JPY, AUD, and SGD, making it easy to expand your business and sell to customers worldwide. Plus, with Payoneer’s currency conversion service, you can avoid high fees from local banks.

In addition to the AED receiving account, Payoneer offers various value-added services to help eCommerce sellers succeed in the UAE market. These services include:

- Currency Conversion: Payoneer allows you to convert funds from one currency to another within your account at competitive rates. This means you can easily convert your AED earnings to other currencies and withdraw them to your local bank account.

- Payment Request: With Payoneer, you can request payments from your clients and customers with ease. Simply send a payment request to your client’s email address, and they can pay you with a few clicks.

- Global Payment Service: Payoneer’s Global Payment Service lets you receive payments from companies and marketplaces worldwide, including Amazon, Upwork, Fiverr, and more. With this service, you can receive payments in USD, EUR, GBP, JPY, AUD, and other currencies directly to your Payoneer account.

- Withdrawal Services: Payoneer offers a variety of withdrawal options, including local bank transfers, prepaid Mastercard, and ATMs, making it easy for you to access your funds quickly and easily.

- Customer Support: Payoneer provides round-the-clock customer support via phone, email, and chat to ensure that you receive prompt assistance whenever needed.

By utilizing Payoneer’s services, eCommerce sellers can streamline their payment processes, reduce fees and receive payments in multiple currencies, allowing them to focus on growing their business and tapping into the growing UAE market.

Source: Pixabay

Looking to tap into the growing eCommerce market in the United Arab Emirates?

Payoneer’s AED receiving account makes it easier to sell on marketplaces like Amazon AE and Namshi.com and receive payments in AED.

With no monthly fees and low conversion fees, you can easily withdraw your earnings to your local bank account in your preferred currency.

Setting up a Payoneer account is free, and there is a small fee for payments below $100. For more information on our fees, please review our fees page.

Ready to explore the United Arab Emirates’ flourishing eCommerce market? Get my AED receiving account

Not yet a Payoneer user? Open an account

* Setting up a Payoneer account is free though payments below $100 do incur fees. For more information on our fees, please review our fees page.