Alternative to opening a business bank account in Canada

Canada’s economy is thriving, making it an excellent place to do business with. Thanks to its proximity to the US, many Americans in particular have clients and customers over the border in Canada, or work with Canadian partners and other business connections.

Business is always better when your transactions and payments go smoothly, but cross-border payments can be expensive, time-consuming, and take a long time to clear. You want your customers, clients, and contractors to pay you in a way that’s low-cost, transparent, secure, and user-friendly, both for your own sake and for theirs.

A business bank account in a local Canadian bank can tick all these boxes, plus it makes it easy for you to hold funds in CAD and use them to pay local taxes or other obligations. But opening a local business bank account in Canada isn’t always that simple.

Get alternative to opening a business bank account in Canada

How to open a business bank account in Canada

Most Canadian banks allow you to open a business bank account even if you’re not a citizen, not a resident, and don’t plan to become one. But things can vary from one bank to another, so make sure to check the regulations before you start the application process.

Different banks also have different rules about whether or not you have to come in person to open an account. The ones that do accept applications without requiring your presence usually have more restrictions about what kind of transactions you can carry out and how much you can transfer. Either way, you can usually apply for an account online.

Whichever bank you apply to, you (the business owner) will need to show two valid forms of identification, at least one of which has to be a photo ID, and at least one of which must be government-issued, like a passport or drivers’ license.

The other documents you’ll have to bring depend on which type of company you own. If you’re a sole proprietor, you’ll have to bring your trade name registration and your master business license.

For a corporation, you’ll be asked for:

- Two valid forms of identification for each signatory

- Your company’s articles of incorporation or association, certificate of status, and certificate of existence

- Your corporate profile report

- Certificate of compliance

- Corporate annual government filing

- Notice of assessment for income tax

- Your business number and license

For a partnership or limited partnership, you’ll be asked for:

- A registered declaration of partnership

- Your trade name registration

- A copy of your partnership agreement

You can also expect a rigorous identity check, and to have to explain why you want a business bank account in Canada. Your business also needs to meet the regulations laid out in the Access to Basic Banking Services Act.

All of Canada’s 5 top banks — the Royal Bank of Canada (RBC); TD Bank; Scotiabank; Bank of Montreal (BMO); and the Canadian Imperial Bank of Commerce (CIBC) — offer business bank accounts for foreign-owned businesses, but the fees vary greatly depending on which type of account you want, how many transactions you’ll need each month, and your minimum monthly balance, so do your homework.

Fees can be anything from $5 per month for RBC’s basic Digital Choice account, to $125/month for the TD Unlimited Business Plan. There can be other fees to pay too, with some accounts charging a fee to receive a SWIFT payment.

Some Canadian banks have branches in the US and offer business bank accounts there. If your business is based in the US, you might be able to open a USD business account at your local branch, and then transfer it to Canada. But you’ll probably pay higher monthly fees and have to keep a higher minimum balance.

There are some online-only banks that offer business bank accounts in Canada. Tangerine is a popular Canadian online-only bank. Its business account has zero debit or deposit fees, no minimum balance, and no service charges, but it only offers a business savings account, not a business checking account.

Another option is Alterna, which doesn’t charge a monthly fee as long as you keep a minimum of $3000 in your account, and offers free electronic debit and credit transactions, but you’ll have to register your business in Canada to be eligible.

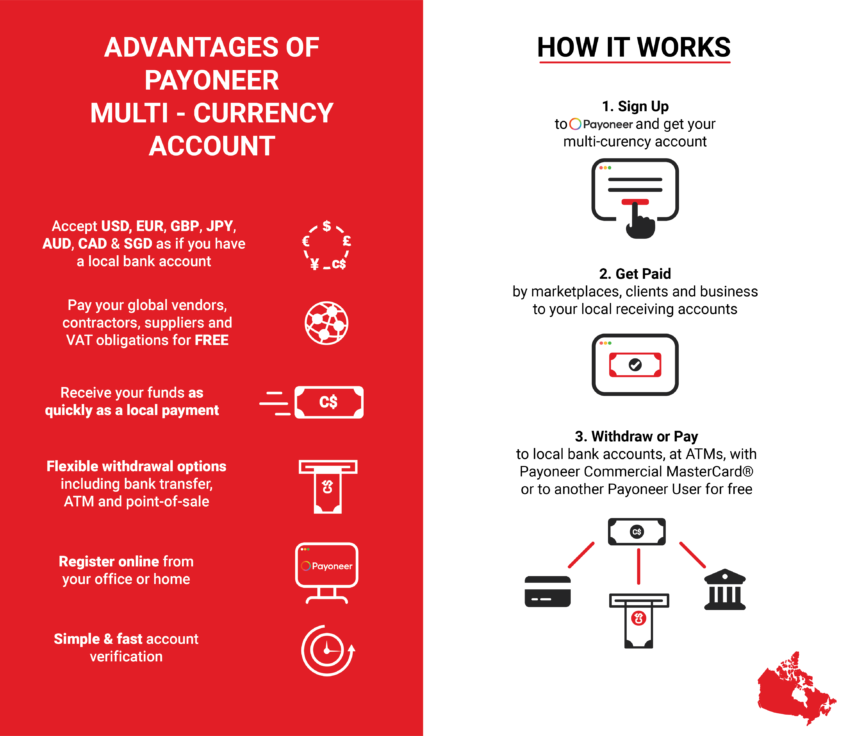

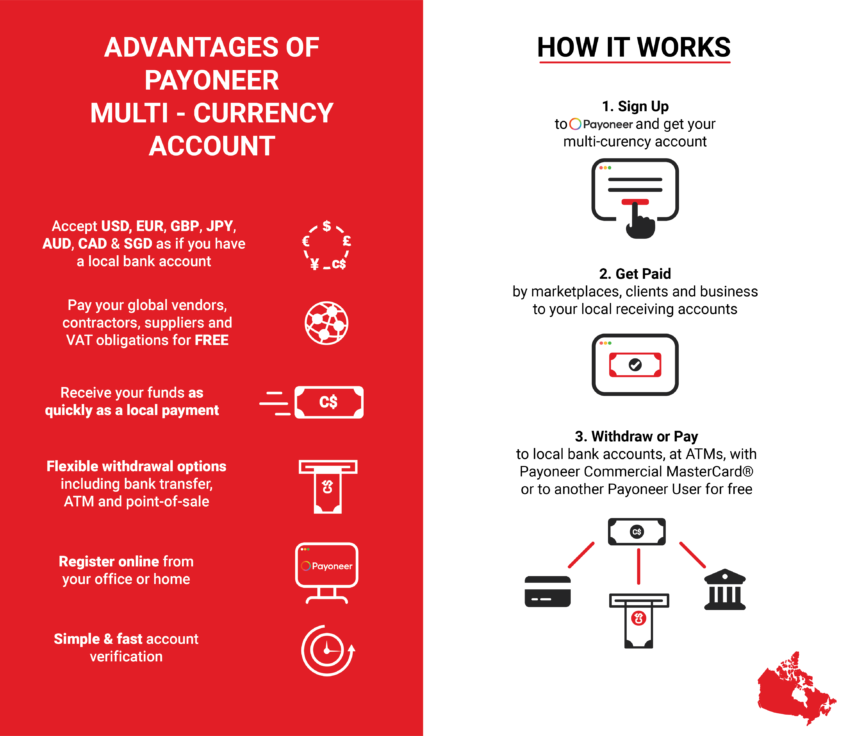

An easier alternative: Payoneer local CAD account

Payoneer helps you receive payments from customers and clients based in Canada, manage currencies, and pay contractors, suppliers, or remote employees in Canada. Instead of jumping through hoops to open a business account in a local Canadian bank, you could use Payoneer instead.

Payoneer offers a local receiving account that works just like a local Canada bank account, so you can accept payments in CAD. Anyone you work with who has a Canadian bank account can use the same domestic bank transfer network to make a convenient local bank transfer to your Payoneer CAD receiving account.

It’s easy to set up your CAD business account with Payoneer. Just register with Payoneer and choose which local receiving accounts you need[1] — in AUD, HKD, SGD, GBP, EUR, CAD, or USD. You’ll soon be able to view your account details and share them with clients on your invoices, through email, or over WhatsApp.

You can withdraw funds in over 150 different countries and currencies for a low, transparent fee, and international payments to CAD receiving accounts are free. If you prefer, you can hold them in your Payoneer account in CAD and use the funds to pay local taxes or global contractors either to their Canadian bank accounts, or to their Payoneer account.

Get local CAD bank account details

The benefits of a local CAD business bank account

A CAD account helps you build trust with your Canadian clients and attract more business. Not surprisingly, they prefer to work with businesses that have a local bank account, so they can use the payment processes that they already know and trust, and save money on foreign currency conversion and cross-border payment fees.

Having a CAD account also helps you save money. You’ll be able to hold onto funds in CAD and either use it to pay local costs, or wait and make a larger transfer when the money builds up, instead of leaking money on poor exchange rates. Funds clear faster in local transactions, too, which helps with your cash flow.

Platforms like Amazon, Upwork, and eBay usually have local payment services which link to a local business bank account. You’ll get paid faster and save money on currency conversions when you connect a local CAD account.

If you use business bookkeeping software like Intuit, QuickBooks, or Xero, you’ll find that they can only link with a local account. If you want to use these toolsto automate income and expense calculations, or to calculate and pay your local taxes, you’ll need a local CAD account.

An easier path to a Canadian business bank account

A Payoneer CAD account lets you tap into all the advantages of a local CAD business bank account, but without the hassle, fees, minimum balance requirements, and compliance regulations that you’ll have to deal with at a local traditional or online Canadian bank. With Payoneer, you can enjoy transparent payment tracking and low-cost, speedy payment processing when you make and receive payments in CAD, so you can forge better relationships with your customers, partners, and clients in Canada, no matter where you and your business are located.

[1] According to eligibility and current Payoneer offering