The growth of eCommerce during the COVID-19 pandemic

As each month passes, it becomes increasingly clear that the COVID-19 pandemic will have a permanent impact on almost all aspects of our social and economic structures. The way we work, learn and consume has most certainly changed forever.

Of course, while some of these changes were in the making for the past few years, a rapidly expanding pool of data indicates we have taken a leap forward into the future. No more so than in the arena of e-commerce.

COVID-19’s impact on cross-border e-commerce has been unmistakable. What was previously a gentle slope of growth has now taken a sharp and steep incline. What’s more, as hundreds of millions around the world moved into full or partial lockdowns, the changes in online consumer type and shopping behavior began to be cemented into a new reality. It’s been one giant leap for the consumer, one massive growth spurt for e-commerce.

In this report, we look at how online sellers in various regions were impacted by the pandemic and to what extent they were able to overcome the challenges faced by their businesses. Leveraging Payoneer’s global customer base, the report’s data is based on a sample of more than 200,000 merchants selling on international marketplaces during Q2 and Q3 2020, compared to the same period in 2019. Additional insight is provided through global seller and partner testimonials.

As seen from global revenues, it’s clear that not only has worldwide e-commerce advanced considerably in just a few months, but a new baseline and growth trajectory for the industry is now set – and shows no sign of retreat.

Key takeaways

| Year-over-year (YoY), global e-commerce revenues grew by over 80% in both Q2 and Q3 2020. | |

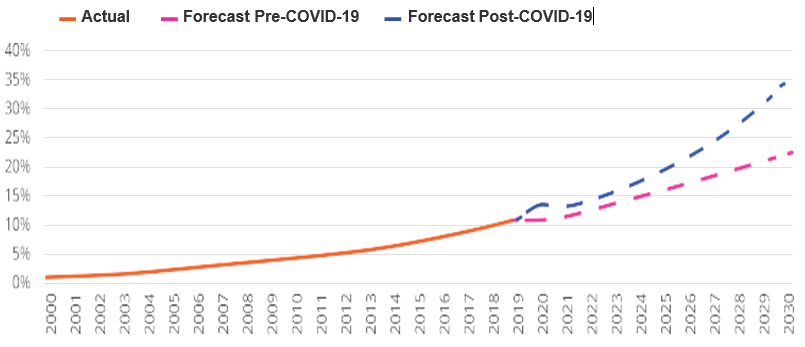

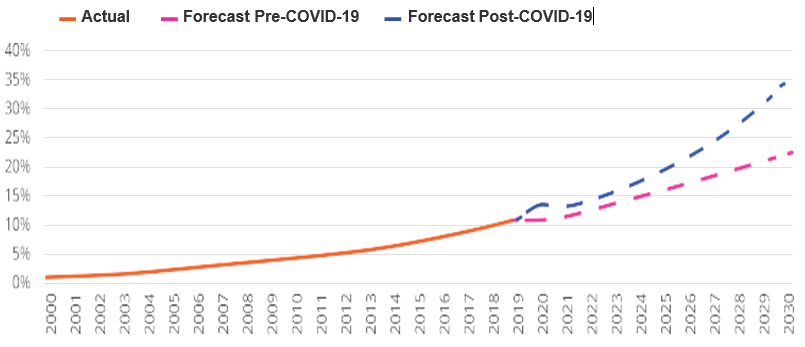

| Due to the COVID-19 pandemic, US e-commerce penetration forecasts through 2030 have massively increased from 21% of all retail to 34%. | |

| 76% of sellers are thinking of expanding into new markets to further grow their businesses. | |

| YoY sales volumes for US-based cross-border merchants grew by 155% in Q3 2020. | |

| Korean sellers saw sales volumes skyrocket 129% in Q3 2020, a seven-fold rise on the yearly increase seen in the same quarter last year. | |

| The rebound seen amongst Chinese logistics providers translated into significant growth worldwide, including for Chinese sellers. Revenues increased by 65% in both Q2 and Q3 2020. | |

| The resumption of supply chains helped UK sellers’ sales volumes take off by 59% and 64% in Q2 and Q3 2020 compared to the same quarters last year. | |

| Vietnamese sales volumes shot up by 90% and 45%, respectively, in Q2 and Q3 2020, after Amazon lifted its temporary FBA restrictions. |

Unprecedented e-commerce growth shows no signs of slowing

For cross-border sellers, these are unprecedented times. So much so that while before the pandemic, US e-commerce was expected to penetrate almost 22% of all retail sales by 2030, as seen in the chart below, expectations have now taken a giant leap upwards and are now expected to grab 34% of all retail sales. Not only is this sharply increased new trajectory impressive, it also provides great inspiration and motivation for online merchants to take advantage of rapidly changing consumer behavior.

US e-commerce penetration: Pre-COVID-19 vs Post-COVID-19 estimates

Source: Global X ETFs, US Census Bureau, Adobe

Note: Forecasted figures starting in 2020 based on Bass Model and annualized e-commerce sales figures from confirmed first half of 2020 ($368.8 billion first half 2020 – Adobe

Are you an eCommerce seller looking for easy, quick, and secure ways to sell globally?

Payoneer has the answers.

Open an account today

Indeed, e-commerce growth trends can be seen in both global and regional markets. For example:

| Globally, visits to e-commerce marketplaces increased 37%, from 16 billion in January 2020 to 22 billion in June of the same year. | |

| In the UK, the pandemic has caused an increase in 2020 e-commerce sales forecasts from £73.6bn to £78.9bn. | |

| More than a third of consumers in Europe and North America plan on shopping online weekly. | |

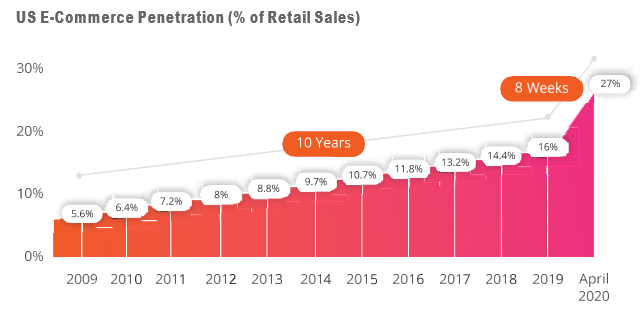

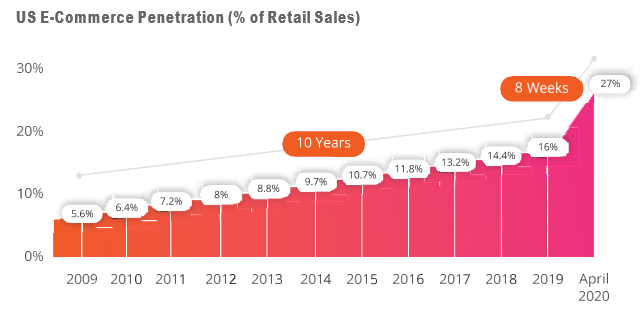

| After growing about 1% a year from 2009-2019, e-commerce penetration in the US, as seen in the chart below, shot up by 11% in just the first four months of 2020 alone. This is the equivalent of a decade of growth within just a few months. |

US retail sales forecast ($bn)

Source: Bank of America. US Department of Commerce Shawspring Research

As online retail picks up pace, more and more high street chains are closing. While this problem has haunted brick and mortar retailers for many years, the pandemic has accelerated the process, pushing them over the brink.

According to a survey of US and UK consumers, 50% of respondents now conduct at least 75% of their shopping online, while 25% make almost all of their purchases on the web. What’s more, even as brick and mortar stores have reopened, almost half of consumers

surveyed plan on conducting more of their holiday season shopping online this year, while 35% plan on shopping online more than they did prior to the pandemic.

Furthermore, the trend towards e-commerce transcends age groups, even those who have traditionally preferred shopping at physical stores. This is especially true among Baby Boomers, who have greatly increased shopping online throughout the pandemic. While this was to be expected, especially given that they are disproportionately impacted by the virus and are more likely to stay confined, it appears that the convenience of shopping from home has caught on. 47% said they plan on increasing their online purchases even after the pandemic subsides.

Global traffic to e-commerce marketplaces increased 37%, from 16 billion to 22 billion, in the first six months of 2020.

The COVID-19 effect: Increased sales revenues throughout the world

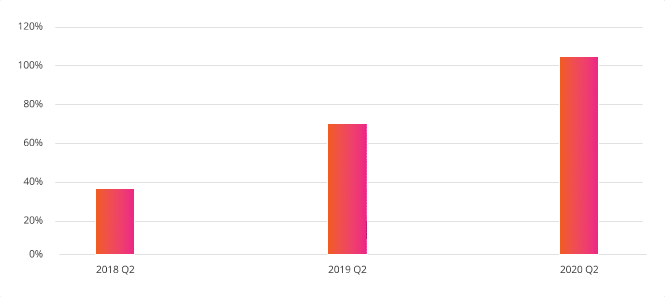

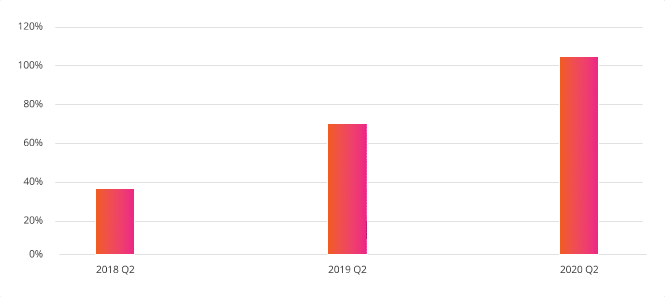

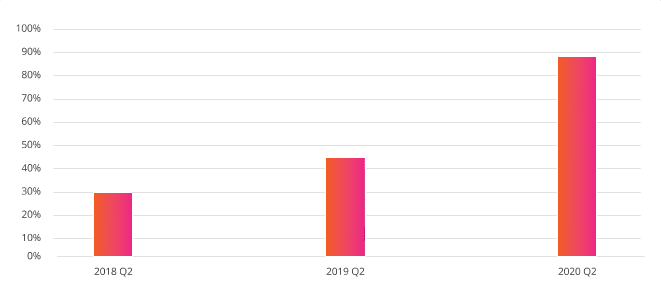

In Q2 2020, year-over-year (YoY) global sales volumes increased by 81%, nearly three times as much as the YoY growth seen

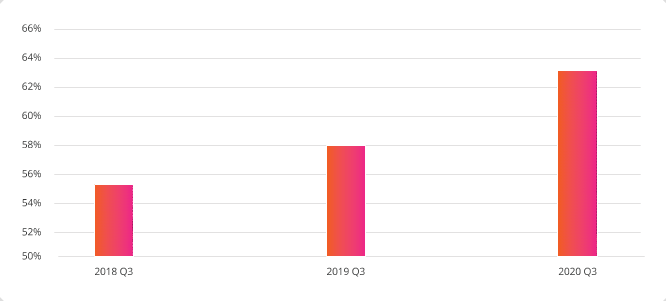

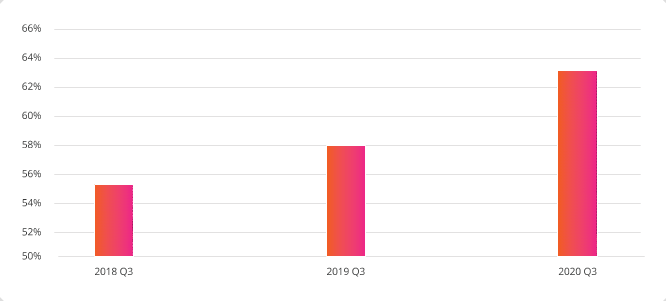

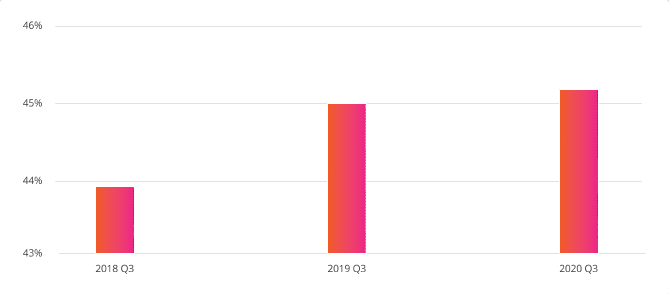

in Q2 2019. The third quarter of 2020 also saw an 81% YoY increase, compared to 36% in Q3 2019.

These increases point to the accelerated adoption of online shopping by consumers over brick and mortar stores that was brought on by the pandemic. That this took place amidst poor economic news, including a record drop in global consumer confidence and reports that US consumers largely spent their government stimulus checks on essentials, (e.g., utility bills and rent), only reinforces this notion.

Looking at individual countries, we see how sellers throughout the world have been able to navigate the “new normal” in cross-border e-commerce since the onset of the pandemic.

As detailed in Payoneer’s Q1 2020 Global Seller Index, supply chain disruptions, Amazon FBA restrictions and lockdowns were just some of the events that forced sellers to get creative when it came to weathering the COVID-19 storm in its initial months.

As seen by our Q2 and Q3 data, cross-border merchants proved their ability to overcome these challenges and helped propel global e-commerce to new heights.

An analysis of several leading e-commerce markets helps to illustrate how.

Q2 year-over-year (YoY) global sales volumes increased by 81%, nearly three times as much as the YoY growth in Q2 2019. Q3 2020 also saw an 81% YoY increase, compared to just 36% in Q3 2019.

Are you an eCommerce seller looking for easy, quick, and secure ways to sell globally?

Payoneer has the answers.

Open an account today

Top 10 countries: year-over-year revenue growth

1. China |

2. United States |

3. Hong Kong (SAR) |

4. South Korea |

5. United Kingdom |

6. Ukraine |

7. Vietnam |

8. Israel |

9. India |

10. Japan |

||

China

Back in Q1 2020, we noted how the onset of the COVID-19 pandemic resulted in the temporary closure of Chinese manufacturing plants, shipping companies and other components of the supply-chain. This forced logistics providers to innovate and adapt in order to ensure cross-border merchants could continue operating, including using commercial charter flights to reduce the impact of insufficient transport capacity.

Their efforts clearly paid off. According to one Chinese seller, “this year, we started selling on a lot of new marketplaces, some of which have brought us a boom in sales volume. In fact, our total sales volume increased by 200% from 2019! Additionally, marketplace expansion has helped us increase inventory while optimizing our supply chains.”

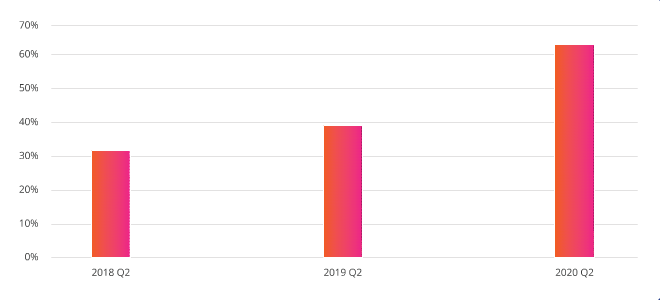

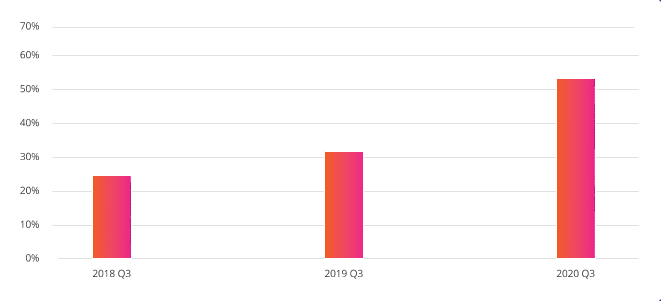

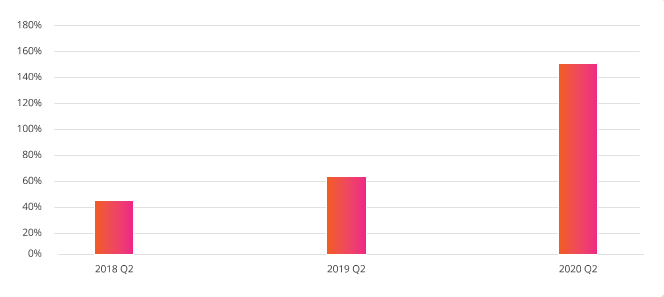

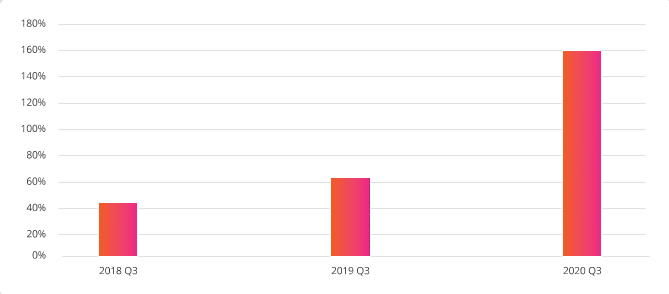

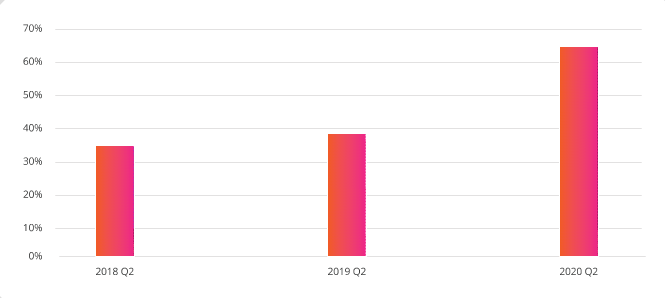

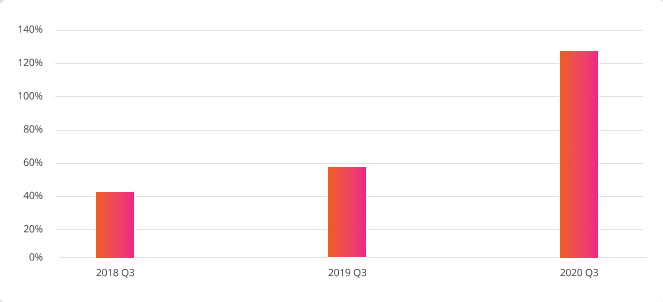

As a whole, Chinese sellers reported a 65% YoY increase in sales volume in both Q2 and Q3 2020. To compare, Q2 and Q3 2019 saw an increase of just 22% and 31%, respectively from Q2 and Q3 2018.

China YoY % sales volumes increase: Q2 2018-Q2 2020

China YoY % sales volumes increase: Q3 2018-Q2 2020

United States

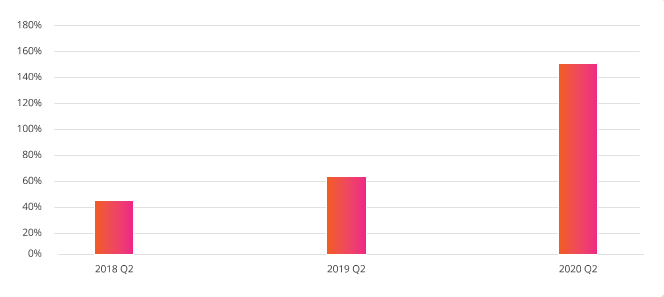

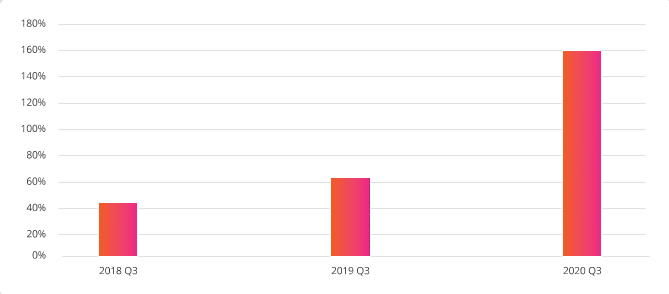

At the beginning of the year, supply-chain disruptions left US sellers struggling to keep up with an increase in demand for goods purchased online. As the year progressed and logistics providers resumed normal operations to ensure consistent product flows, sales grew dramatically. In Q2 and Q3 2020, YoY sales volumes for US sellers shot up 153% and 155%, more than three times the yearly increase seen in Q2 and Q3 2019, relative to 2018.

“What we’ve seen from US sellers over the last six months has been astounding, especially given the logistics issues at the beginning of the year. The triple digit growth in sales volumes attests to the resilience of the US seller community, as well as the increased consumer shift towards e-commerce witnessed over the last few years.”

Iain McNicoll VP Regional,

Americas, Payoneer

US YoY % sales volumes increase: Q2 2018-Q2 2020

US YoY % sales volumes increase: Q3 2018-Q2 2020

Are you an eCommerce seller looking for easy, quick, and secure ways to sell globally?

Payoneer has the answers.

Open an account today

United Kingdom

Similar to US sellers, supply-chain disruptions during the first few months of the pandemic resulted in UK cross-border merchants having a difficult time keeping up with demand for their products. Once their logistics operations were restored, however, sales volumes spiked, increasing 59% and 64% in Q2 and Q3 2020 compared to last year.

“At the beginning of the year, we were affected by product supply chains breaking down for raw materials, which caused some stock issues that we had to quickly navigate. We invested into our own warehousing throughout Europe to allow us to offer faster same day delivery times. Customers have realized the convenience and safety of online shopping and so far, we have not seen a slowdown in online orders. If anything, orders are still increasing, and we endeavor to keep on providing the very best service we can at a time when consumer expectations and demands are now very different.”

Craig Roberts Owner,

Cooper and Gracie Ltd

UK YoY % sales volumes increase: Q2 2018-Q2 2020

UK YoY % sales volumes increase: Q3 2018-Q2 2020

South Korea

While South Korean sellers were forced to deal with several hardships in Q1 2020, they successfully adapted to the COVID-19 reality to expand their businesses.

In the words of one major Korean seller, “once we assumed that the situation wasn’t going back to normal in the short-term, we decided to modify our global strategy to expand to more marketplaces in order to increase sales. We think it was a great and well-timed decision.”

Decisions like this resulted in a 65% increase in YoY sales volumes in Q2 and a phenomenal 129% increase in Q3, seven times the increase seen in Q3 2019 relative to Q3 2018.

South Korea YoY % sales volumes increase: Q2 2018-Q2 2020

South Korea YoY % sales volumes increase: Q3 2018-Q2 2020

Vietnam

In Q1 2020, the well-established Vietnamese dropshipping industry suffered from a decrease in demand brought on by the COVID-19 pandemic, as well as temporary FBA restrictions that limited what could be stored in Amazon warehouses.

As the year progressed, however, sales volumes spiked. Q2 2020 saw a 90% increase from Q2 2019. This was double what was seen in Q2 2019 compared to Q2 2018. Additionally, Q3 2020 say 45% YoY growth.

Vietnam YoY % sales volumes increase: Q2 2018-Q2 2020

Vietnam YoY % sales volumes increase: Q3 2018-Q2 2020

Are you an eCommerce seller looking for easy, quick, and secure ways to sell globally?

Payoneer has the answers.

Open an account today

Seizing new opportunities amidst industry growth

Amidst the growth in global e-commerce, cross-border sellers are seizing the opportunity to expand into different geographies and marketplaces to reach new customers and grow their businesses.

According to one Korean seller, “We had been preparing to expand our business to new marketplaces outside of Amazon for a while. COVID-19 helped move us ahead quicker than expected. After being introduced to Shopee, we started selling on Shopee Indonesia and Shopee Korea. Our sales were significantly boosted in Q2 and we plan on expanding to other Shopee markets as soon as possible.”

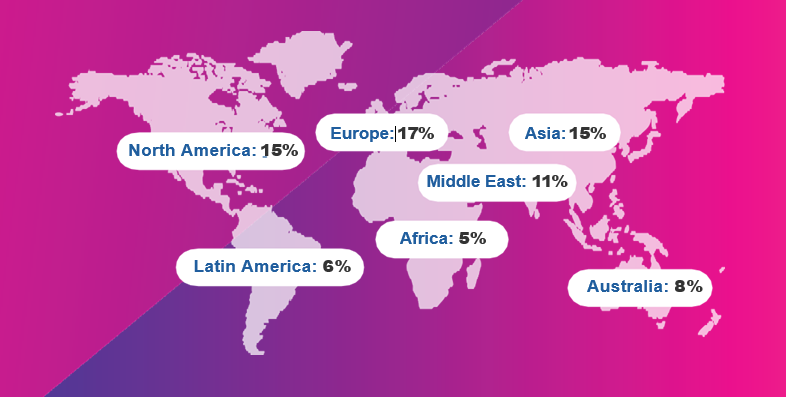

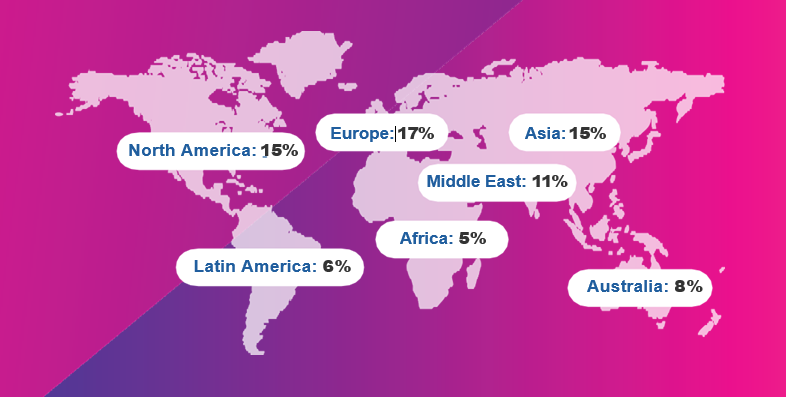

A Payoneer survey of global sellers further reinforced this idea, showing that 76% would like to expand into one or more of the following markets:

Marketplace merchants have traditionally been great innovators, identifying new opportunities and seizing them at the right time. It’s precisely this combination of qualities brought together by marketplaces and third-party merchants that will make 2020 a truly transformational year for e-commerce and its long-term growth trajectory. –Jonny Steel, VP Marketing, Payoneer

And these sellers may well be on to something, for industry growth hasn’t been uniform globally. Certain countries have taken to online shopping more than others.

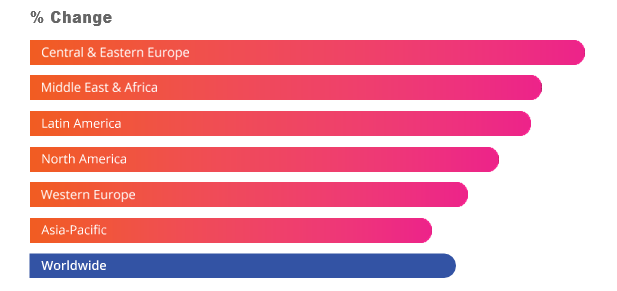

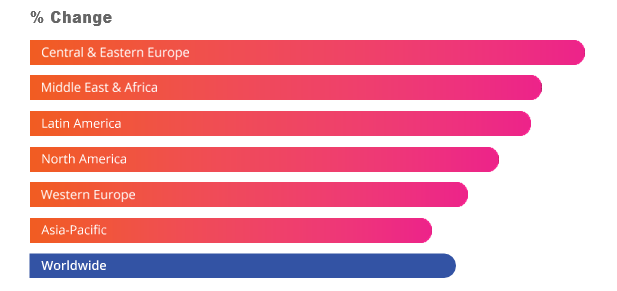

While North America and Asia, and China in particular, still lead the pack with regards to sales in 2020, other regions have seen dramatic increases throughout the year, making them prime locations for expansion. These include Central and Eastern Europe, where sales increased by 21% in the first five months of 2020, the Middle East and Africa, where sales were up by close to 20%, and Latin America which saw growth of more than 19%.

Retail E-Commerce Sales Growth Worldwide, By Region, 2020

Source: eMarketer, May 2020

Note: Includes products or services ordered using the internet via any device, regardless of the method of payment or fulfillment; excludes travel and event tickets, payments such as bill pay, taxes or money transfers, food services and drinking place sales, gambling and other vice goods sales.

Conclusion

The COVID-19 pandemic is having a profound impact on all facets of life, including how we work, how we interact with our friends and family and how we shop. As a result, there is no denying that consumer habits are changing in e-commerce’s favor.

With such a significant boost in revenues, it is also clear that the flight of global e-commerce sales is on a new path and poised to reach new heights.

Looking ahead to the rest of the year, including the holiday season, we fully expect a record Q4 in terms of global sales volumes. For sellers, now is the time to grow your business to take advantage of this sea change in global e-commerce. Here at Payoneer, we’ll be with you every step of the way, ensuring you’re able to process all your business’s payments throughout your expansion and beyond.

There’s no turning back – the e-commerce boom is here to stay. Even after lockdowns were relaxed, the consistent sales growth indicates that we are witnessing a shift towards online shopping that is unlikely to revert. Global merchants are benefiting from infrastructure investments made by e-commerce marketplaces, ensuring that consumers enjoy high quality of service regardless of merchant location or order volume. – Woo Lee, VP Regional, East Asia & Australia, Payoneer

Go with the leader

Payoneer is the world’s leading cross-border payment platform, empowering global e-commerce by connecting businesses, professionals, countries and currencies.

What sets Payoneer apart?

| Accept and make payments in multiple currencies via a simple and cost-effective solution. | |

| Easily access earnings in your local currency at low rates. Additional discounts available for high-volume sellers. | |

| Connect with consumers on the world’s top online marketplaces while getting paid in one place from all your global sales. | |

| Enjoy dedicated, local support around the globe in multiple languages at any time. | |

| Pay VAT directly from your Payoneer account. | |

| Access working capital to expand your business. | |

| Pay your service providers directly from your account, regardless of whether they have a Payoneer account. |