Impact of the dollar rate change on global businesses in 2022

A combination of high interest rates in the US, the country’s relatively rapid economic recovery, and a rush from emerging currency bonds to the “safe haven” of USD-linked assets are all helping push the dollar higher than it’s been for 30 years. This might be good for American tourists on shopping sprees in Europe, but it’s having major — and negative — effects on international trade, global businesses, and the domestic economies of many countries.

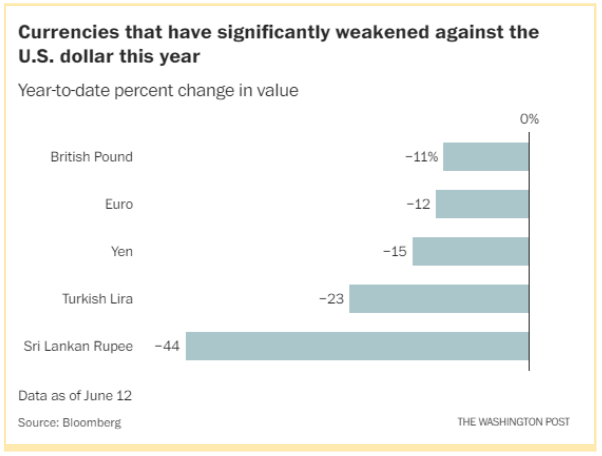

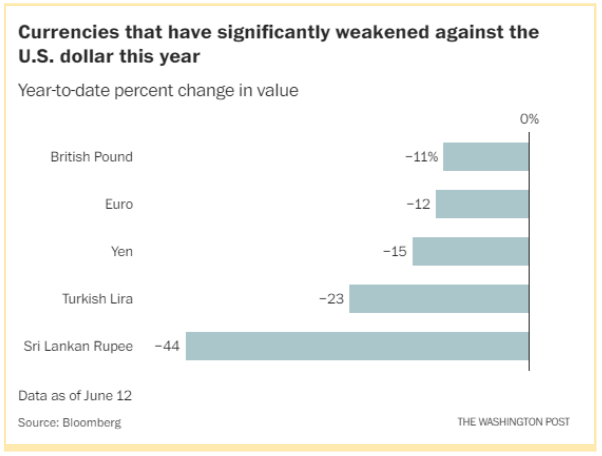

Established currencies that are usually strong have fallen massively against the dollar in the dollar exchange. The Financial Times calls the dollar “the king of the castle,” pointing out that between January and September 2022, GBP fell by 21% against USD, JPY fell by 20%, and EUR by 16%. These are all currencies that are used frequently in international payments, and that businesses expect to be strong.

International businesses are feeling the impact of dollar rate change. It pushes up the price of commodities and goods that are traditionally priced in USD, and makes it tough for companies and governments to repay dollar-based debt. Meanwhile, the strong dollar is also fuelling inflation in other countries, which discourages consumer spending and slows down growth.

Global businesses are nervous that they won’t be able to afford the raw materials or goods they need, and/or that customers outside of the US will stop buying their products, because one effect of the dollar rate variation is to make USD items more expensive outside of the US. There are some steps that they can take to mitigate those worries, but this should not be taken as financial advice or a replacement for talking to a financial/business advisor.

This economic landscape isn’t likely to change any time soon. Kathy Jones, Managing Director and Chief Fixed Income Strategist for the Schwab Center for Financial Research, says that the reasons for the dollar rise “look likely to remain intact into 2023. Moreover, there are few attractive alternatives to the U.S. dollar for global investors.”

Financial experts point out that the strong dollar is going to keep affecting international businesses. Martin Wolf, chief economics commentator at the Financial Times, notes that “The roles of US capital markets and the dollar are far bigger than the relative size of its economy suggests. Its capital markets are those of the world and its currency is the world’s safe haven. Thus, whenever financial flows change direction from or to the US, everybody is affected.” Global businesses have no choice but to keep up with the effects of the dollar rate variation.

Read on to learn more about the cause of the strong dollar and impact of the dollar rate raise for businesses, currencies, and citizens of different countries.

What Effect Does the Dollar Rise Have on Global Currencies?

Exchange rate fluctuations are nothing new. Every international currency trades against each other, so if one of them gets stronger, the others get weaker by comparison. But it’s not usual for there to be just one currency that’s way ahead of all the others. Today’s strong dollar is out of balance with other foreign currency rates.

Adam Posen, president of the Peterson Institute for International Economics, points out that “The dollar, euro, yen and yuan moved in relatively small ranges for a very long time. This is the first time in decades where everybody’s down against the dollar.” Today, the USD is the highest it’s been for 20 years, while the GBP and JPY haven’t been this low since the 1980s, and the EUR hit its lowest since 2002.

What Pushes Up Foreign Currency Rates?

There’s no single reason why the US dollar is worth so much right now. A number of factors came together to push up the USD.

1. Economic performance in global finance markets

The strength of a foreign currency depends on how people feel about that country’s economic performance. COVID-19 cut the economy all around the world, but the US has recovered more quickly than any other country.

In the US, GDP growth rose to 15.6% above rates in Q3 2019, but in the Eurozone it grew by only 8.3% and in Japan, it dropped by 3.6%. Even if the US economy was stronger in the past, right now it’s doing better than the competition. “The US dollar tends to climb in value when America’s economy is very strong, or, somewhat counterintuitively, when it’s weak and the world is facing a recession,” explains Julia Horowitz, CNN’s business writer.

2. The price of commodities

The war in Ukraine drove up the cost of many basic commodities, particularly energy and foodstuffs like wheat and cooking oil. But this rise in prices hit markets in Europe and Africa far harder than the US.

Rising prices cause citizens in those markets to cut back on their spending, which weakens growth. Poor growth prospects cause people to lose faith in those currencies and stop investing in their assets, which drags down the currency even more.

3. Climbing interest rates

Investment funds, governments, and individual investors want good returns, so they look to invest in places where interest rates are high and set to keep rising. America’s central bank, the Federal Reserve (Fed) was the first central bank to raise interest rates post-COVID, and it kept on raising them. This year, the Fed raised rates five times by a total of 2.25 percentage points to 3.25%, while the European Central Bank (ECB) raised them just once by 0.75 points to 0.75%, and the Bank of Japan kept its rates steady at -0.10%.

That means that assets in USD are more attractive to investors. “On a treasury bill today, you’ll get something like three and a half or 4% in the U.S.,” explains Jonathan Wright, economics professor at Johns Hopkins University. “And if you had a comparable bill in Europe, it’d be much lower, maybe 1%. So that causes capital flow into the dollar, and drives the dollar up,” he adds.

4. Dominance of global trade

Another factor helping the strong dollar is that the USD is currently winning all the trade wars. Many major commodities like oil, wheat, and soybeans are priced in USD, and the US dollar makes up close to 60% of central bank reserves around the world, more than any other currency.

Companies and countries have to buy USD to keep up with international trade, even when currency conversion rates are unfair to people buying dollars. This helps the dollar stay strong even when it means that prices are unbalanced.

5. Inflation rates

High inflation is both an impact of the dollar rate change, and one of its causes. When inflation is high, it dilutes the value of the currency and makes the currency weaker, and vice versa.

When the dollar is strong, imports to the US cost relatively less, but imports to other parts of the world cost relatively more. This helps keep inflation down in the US, but pushes it up elsewhere, sending the dollar soaring higher and pushing other currencies further down.

The Impact of the Dollar Rate Change on International Business in 2022

The USD is an important currency for global finance, so it’s not surprising that it affects businesses all around the world and of all sizes and industries. A good half of all international trade takes place in dollars, so every business has to deal with the influence of dollar rate changes.

Like every global finance trend, the strong dollar has both positive and negative effects.

Importers to the US

Cross-border businesses importing raw materials or finished goods to the US will do well, because their USD has more buying power. “Importing raw metals and energy from abroad, that’s going to be positive for you — as long as it’s not priced in dollars,”says Jordan Rochester, senior foreign exchange strategist at Nomura Securities.

Importers outside the US

But ecommerce sellers or industrial organizations that have to buy goods priced in dollars might not be able to maintain stock or production levels. If they can’t import the goods they need, they may not be able to afford to make sales even if demand rises.

International corporations

US-based companies that export to international markets are struggling too. The strong dollar means their goods are more expensive for overseas customers. This affects small ecommerce SMBs and large international corporations like Boeing and Apple. Michael Klein, professor of International Economic Affairs at Tufts University, says “this is a very tough environment for most U.S. exporters”

US-based international organizations also face a juggling act when it comes to pricing. They want their goods to cost roughly the same in each currency, but when the USD is way higher than every other currency, that makes it tough. “As the dollar has strengthened, adjusting local currency list prices so that you try to keep the U.S. dollar P&L whole has been a careful balancing act. How much can you adjust prices but not stifle demand?” asks Tom Sweet, CFO of Dell Technologies.

SMBs with international clients

The strong dollar is good news for business owners, freelancers, and contractors who live in a country where the dollar is strong, but have international clients who pay in USD. The effect of the dollar rate variation is that their real earnings from remittances go up. The same applies to anyone who earns revenue in USD but pays expenses like suppliers in their local currency.

The opposite is true for people who receive business payments in local currency but have to pay suppliers or expenses in USD. They see their real earnings drop, and they have to work harder to earn the equivalent amount in USD.

The Influence of Dollar Rate Changes on Investors

Investors are also concerned about the effect of dollar rate variations. When times look shaky — like after a global pandemic or during a war — people look for safe investments. The strong USD makes dollar-based assets stable and attractive. Investors are rushing to sell local currency investments and buy in USD, which makes emerging economies bonds fall even faster.

But it’s not so simple. Morgan Stanley analysts warn that the strong dollar weakens profits for global companies that sell overseas and convert to dollars. That will affect the performance of their stocks and shares, even though they are USD assets. They recommend a balance of international and US assets for investors, but investors are still favoring the dollar at the moment.

Can International Corporations Reduce the Impact of Exchange Rate Fluctuations?

Exchange rates never stay still, so companies have to think about how to deal with those exchange rate fluctuations. There’s no way to entirely avoid the way that exchange rates affect businesses, but there are some things business owners can do to lower the impact.

Businesses that import raw materials or finished goods, export products, or pay remote employees or freelancers in other currencies particularly need to think ahead about current and future ways that exchange rates influence international business. Here are some steps they can take to reduce the damage of changes in foreign currency rates.

1. Plan ahead

Many big corporations use currency hedging to protect themselves against global currencies strengthening or weakening. But hedging only works if they do it well in advance. Wright points out that companies that hedged foreign currency a couple of years ago will have some breathing space from the strong dollar. But for those that didn’t think ahead “it’s kind of too late.”

2. Be flexible about marketing initiatives

Look for new marketing opportunities when the currency fluctuates. For example, if exchange rates push up prices for the local market, investigate cross-border markets where currency conversion rates could be more favorable and it might be easier to make sales, or vice versa.

3. Create a currency plan

Companies that create a currency plan are able to be smart about currency conversions. A currency expert can help organizations look for ways to protect themselves from exchange rate fluctuations, like using a Money Transfer Service to lock in favorable currency conversion rates ahead of time.

One option is to hold multiple currency accounts which allow the business to receive and keep funds in other currencies, instead of immediately converting income into local currency and converting it back again when they need to pay expenses or suppliers in foreign currency. This way, business owners can save their money in dollars and avoid exchange rates.

4. Search for substitute vendors

Changes in international currency exchange rates can affect the prices charged by suppliers and vendors. If exchange rates have changed a lot, it can be a good idea to look for domestic suppliers instead of importing goods from overseas. Companies might find that some suppliers charge in USD but others accept local currency, which can make a difference to expenses when the dollar is strong.

The Benefits of the Rising Dollar

While the impact of the dollar rate change can be tough for some, there are others who benefit from a strong dollar. As mentioned above, the rising dollar helps keep inflation down in the US and in other countries that use the US dollar.

People often ask how many countries use the US dollar? Although it’s accepted across much of the world, the USD is only legal tender in 8 countries, Ecuador and El Salvador in Latin America; Zimbabwe in Africa; the Pacific nations of the Marshall Islands, Micronesia, Palau, and East Timor; and the US itself. All of these countries can benefit from lower inflation and cheaper imports helping to boost economic growth.

Countries where the US dollar is strong and that depend on tourism are also seeing benefits. When the dollar is strong, American tourists can buy more with their travel money, from designer handbags in Milan to boutique hotel rooms in Barcelona. These countries hope that the strong dollar helps them attract more visitors.

Portugal, which is in the Eurozone, has a low cost of living which makes it a popular destination for digital nomads. Now that the EUR has achieved parity with the USD, meaning that 1 Euro is about the same as 1 dollar, Portugal hopes that more people come for extended workations.

How the Dollar Raise Affects Different Countries

The effects of the dollar rate variation go way beyond places looking for US tourists and countries that use the US dollar. USD exchange rate fluctuations impact everyone.

The dollar raise has a different impact for different countries, depending on whether they are net importers or exporters, their inflation rates, and the size of their dollar debt. Here’s a deep dive into how the strong US dollar is affecting the economy in key global finance regions.

The Impact of the Strong Dollar on U.S. Market Conditions

A strong dollar is a double-edged sword for the US economy. On the positive side, high dollar exchange rates help keep inflation low, encourage consumer spending, and boost growth. “The strong dollar is helping curb inflationary pressures,” said Rhea Thomas, senior economist with Wilmington Trust, and JP Morgan’s head economist and head of research predict that the strong dollar could cut a full percentage point off inflation.

But it’s not all good news. A strong dollar makes it harder for US businesses to sell to overseas customers. As exports drop, the US trade deficit rises, which means the country spends more on imports than it earns on exports. The US trade balance is already averaging a deficit of almost $1 trillion annually, which is a problem when US debt is more than 100% of its GDP. The strong dollar encourages more Americans to buy comparatively-cheap foreign assets, which only accelerates the trade deficit.

At the same time, large organizations that are headquartered in the US make sales in local currencies around the world, but convert their revenue to USD for financial reports. Currency conversion rates cause their profits to drop. Microsoft reported that the strong dollar would lower expected earnings by about $250 million this year, and Salesforce says it will lose over $800 million due to exchange rates. Multinational companies based in the US rely on overseas operations for approximately 30% of their total earnings, so the strong dollar could seriously handicap their income.

The Influence of Dollar Rate Changes on Latin America

Many emerging economies, including those in Latin America, are already struggling, thanks to the pandemic. The strong dollar could push them over the edge, especially as investors rush to sell bonds in emerging currencies and buy USD instead, which drains emerging markets of foreign reserves.

Growth in Latin America is very varied. Some countries have unstable currencies and/or economies on the verge of crisis, like Chile or Venezuela. They are reliant on imports for basic commodities which are mostly priced in USD. As the dollar rises, prices go up, and these countries find it even harder to pay for goods like food staples and fuel.

A number of countries in Latin America, including Argentina and El Salvador, also have large dollar debts and might find it difficult to keep up with repayments in USD when the dollar is high. In some countries like Venezuela, the collapse of the economy means that USD is trusted far more than the local currency, but when USD exchange rates rise, it’s harder for ordinary Venezuelans to secure US dollars, and the government is also running out of USD reserves.

However, there are also LatAm countries that are benefiting from the influence of dollar rate changes. Countries like Brazil and Mexico don’t have high USD debt burdens, and they are net exporters of valuable USD-priced commodities like base minerals. The rising dollar means they can sell their exports for higher prices, which brings in more revenue and refills their dollar reserves.

The Impact of Dollar Rate Change on Asia

Like in Latin America, Asia presents a mixed picture. The ecommerce growth of Southeast Asia saw the rise of many cross-border ecommerce small businesses in India, China, Thailand, the Philippines, and across south-east Asia. Savvy SMB owners can buy goods in local currency from local suppliers and sell them in USD to American customers. This boosts their profits and in turn helps with local economic growth.

But many of the same countries are highly dependent on imports like oil, base minerals, and food. “For commodity importers such as China and India, it’s particularly impactful to have a higher dollar price for commodities they need to pull in,” said Alan Robinson, VP at RBC Wealth Management.

Finally, several Asian countries have to honor debt repayments in USD. The dollar raise means they need more local currency to make the same USD debt repayments. Sri Lanka, Pakistan, and Egypt already had to ask for help from the IMF.

The Consequences of the Strong Dollar for Net Oil Exporters

Although the strong dollar should mean that oil exporters who price in USD can benefit from higher prices, the opposite is happening. The rise in dollar rates, together with slow global growth and fears of a recession, is bringing down oil prices. In September, oil prices plunged to an 8-month low at the same time as the US dollar hit a record high. This is bad news for major oil exporters like the Gulf states, Saudi Arabia, and Russia.

Russia is concerned because oil revenues are its main source of income, due to Western sanctions over its war in Ukraine. However, the Organization of Petroleum Exporting Countries (OPEC) isn’t yet worried. OPEC is keeping prices low and supply high in the hopes of capturing a larger market share.

How Exchange Rate Fluctuations Affect the Eurozone

The strong dollar is great news for Eurozone countries that depend heavily on tourism. It’s been 20 years since there was parity between the US dollar and the Euro, so lots of Americans are planning a trip to Europe to make the most of their purchasing power — and Eurozone countries are happy to welcome them.

But many EU governments are worried about the impact of the dollar rate change on inflation. A strong dollar means a weaker Euro, which makes inflation worse because it pushes up the cost of imported goods. The strong dollar is also slowing down economic growth, at the same time that high energy bills due to the war in Ukraine is also applying the brakes.

Central banks in Europe and the UK are now trying to raise their own interest rates to slow down inflation and attract investors back to their assets. But higher interest rates could discourage consumer spending, slow down growth, and increase their own debt burden all at the same time. If they raise the rates too fast, they could even cause a recession. David Gura, NPR journalist, observed that “the U.S. is effectively spreading inflation to other countries that are already dealing with higher prices.”

What Does The Future Hold For The Dollar?

Financial experts agree that the US dollar is likely to continue strong for a significant time. The Fed has indicated that it’s going to keep raising interest rates for the rest of the year and into 2023. Even when interest rate hikes stop, there’s no sign that the Fed plans to cut rates anytime soon.

Although many central banks are rushing through their own interest rate rises, they can’t move fast enough to catch up with the US, which means that US dollar assets will carry on appealing to investors. Exchange rates have reached a certain momentum which is going to continue for a while. “We look for dollar strength to remain largely intact in the near-to-intermediate term,” wrote Scott Wren, senior global market strategist at the Wells Fargo Investment Institute.

Prices for fuel and basic commodities are also expected to remain high for the foreseeable future, and that’s another factor helping keep the US dollar high.

In the past when the dollar was unusually strong, central banks got together and agreed on an intervention to help restore balance to the foreign exchange market. But that’s unlikely to happen this time. “The politics of the dollar have really changed since the 1980s and 1990s when there was active intervention,” said economist Steven Kamin, former director of the Fed’s division of international finance. “Central banks recognize what’s really moving currencies are these substantial economic forces.”

Exchange Rate Fluctuations Don’t Have to be a Nightmare

The dollar raise affects just about everyone — consumers, governments, international business owners, freelancers, suppliers, and more. It’s important to keep up with the news about dollar rate fluctuations by reading publications like Reuters, Bloomberg, and CNN business, and to find ways to reduce the influence of dollar rate changes.

Save money with Payoneer

Cross-border business owners can also use Payoneer for business payments. Payoneer provides competitive currency conversion rates and low fees to help business owners save money when they pay overseas recipients.

How Payoneer helps businesses to beat the dollar raise

Business owners that use Payoneer to manage currencies can reduce the effects of the strong dollar, and even take advantage of it. For example, Payoneer offers a US receiving account that lets users receive payments and hold funds in USD. Account holders can use their USD income to pay other expenses or make purchases, without losing money by converting money to local currency and then back to USD.

Companies with a Payoneer account also benefit from free transfers to other Payoneer users, low cost and fee-free payments through credit card, ACH bank debit, and local bank transfers, and flexible ways to access their funds. Payoneer helps international businesses to mitigate the effects of a strong dollar and make the best of currency exchange rate fluctuations.