1042s vs. 1099s forms: who needs to file these IRS tax documents?

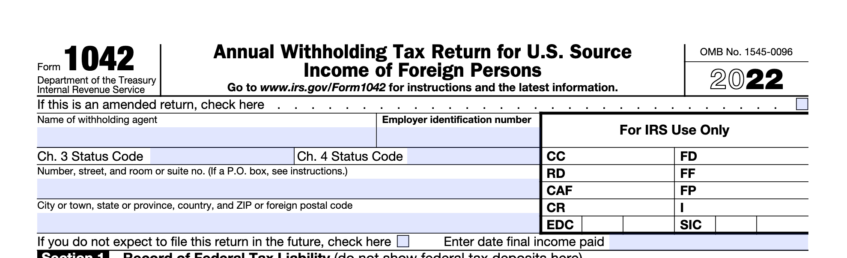

Source: IRS.gov Form 1042

When it comes to U.S. financial reporting, two forms that are commonly used include the 1042s vs. 1099 tax forms. To help you better understand when and why you might need to use these forms, we spoke with Ran Admoni, Payoneer’s tax products manager.

The 1042 form reports tax withheld on certain income paid to foreign persons, such as nonresident aliens, [foreign] partnerships, corporations, estates, and trusts. On the other hand, the 1099 form is used to report payments made to non-employee individuals or entities. This includes payments for rent, prizes & awards, medical & health care payments, and other income payments.

Both forms have specific requirements and deadlines for when they should be submitted to the IRS. Filing these forms accurately and on time is crucial to avoid penalties and fines. Dealing with multiple payees and their respective tax forms can be overwhelming, but there are solutions to simplify the process.

At Payoneer, we provide various tools and services to help you manage tax reporting, such as automated tax form generation and submission. By utilizing these tools, you can streamline the process of managing and submitting forms for multiple payees, saving you valuable time and effort.

1099 vs 1042 IRS tax forms:

As an eSeller or Entrepreneur, it’s important to understand that navigating the world of taxes can be daunting, especially regarding reporting income earned from non-US sources. This is where we come into the picture, providing eSellers and Entrepreneurs with detailed insights into the tax material they need to know to stay compliant with IRS regulations.

One of the most important aspects of tax compliance for non-US income is determining whether you’re filing Form 1042s vs 1099. However, with the complicated requirements for each form, it’s easy to get lost.

Fortunately, our tax experts are available around the clock to help you understand these forms’ ins and outs and provide support with filing.

Whether it’s understanding the specific payments that need to be reported on each form or how to file and submit them properly, our tax preparers have the knowledge and experience to guide you through the process. They can also help you stay updated with any changes to IRS regulations that may affect your tax reporting.

With our tax services, you can save time and effort by automating the tax form generation and submission process. Their comprehensive and powerful solution collects data accurately and efficiently from your payees, provides withholding tax calculations, and prepares final documents for submission to the IRS. This makes managing and submitting forms for multiple payees significantly easier, allowing you to focus on growing your business.

In short, our tax experts and services provide you with all the tools you need to stay compliant with IRS regulations and simplify the tax reporting process. With their help, you can stay ahead of your tax obligations and focus on what you do best – growing your business. Let’s begin with an introduction to Form 1042.

Important things to remember about Form 1042:

To adhere to the guidelines of the IRS, any intermediary or withholding agent that receives, controls, disposes of, or pays a withholdable payment or an amount subject to withholding must file an annual return for the prior calendar year using Form 1042, unless there are exceptions to filing.

Additionally, any partnership or nominee that distributes effectively connected income (ECI) under section 1446 or any entity that is required to report a distribution on Form 1042-S subject to withholding under section 1445 must file Form 1042 for the previous calendar year.

At Payoneer, we provide various tools and services to help you manage tax reporting, such as automated tax form generation and submission. By utilizing these tools, you can streamline the process of managing and submitting forms for multiple payees, saving you valuable time and effort.

You must file Form 1042 if any of the following apply:

You need to file Form 1042 in certain situations, such as when paying foreign persons who are subject to withholding, when you’re a qualified intermediary, or when you’re reporting tax withheld by your withholding agent. Additionally, you need to file if you’re paying certain types of income to covered expatriates or foreign private foundations or if you’re required to file Form 1042-S for Chapter 3 or 4 purposes. Even if you file Form 1042-S electronically, you still need to file Form 1042.

Click Here to download the most up-to-date version of IRS Tax Form 1042 directly from IRS.gov.

What is a 1099 tax form & who needs to file one?

Source: 1099-MISC IRS.gov

1099 is an essential tax form used to report payments made to non-employee individuals or entities by a business or an individual. The form is filled out by the payer and sent to both the recipient and the IRS to document payments made throughout the year. A wide range of payments can be reported on a 1099 Form, including rental income, tax refunds from the state (or locality), and earnings from freelance or independent contractor work.

Typically, 1099s are received by the recipients by January 31 of each year to report the payments made during the previous year. For instance, if you received $600+ in non-employee compensation, royalty payments or rent, or state/local refund, you can expect to receive a corresponding 1099 form.

On the other hand, if you’re a business owner who paid a non-employee individual or entity $600+ during the calendar year for business-related work, you must send a 1099-NEC. However, it’s important to note that the payer may still choose to file the 1099 tax form for payments below $600.

Navigating the 1099 form process can be complicated, but with our comprehensive tax services, you can easily manage tax reporting, including automated tax form generation and submission. Moreover, our tax experts are available around the clock to assist with any questions or concerns related to 1099 vs 1042 forms, making the tax season hassle-free for eSellers and entrepreneurs.

How does the IRS define a 1099-MISC tax form?

Form 1099-MISC is a tax form businesses use to report payments to non-employee individuals or entities. You must file Form 1099-MISC for each person you paid during the year for the following reasons:

At least $10 in royalties or broker payments instead of dividends or tax-exempt interest.

At least $600 in:

Additionally, use Form 1099-MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

Filing Form 1099-MISC is crucial to ensure compliance with IRS regulations and accurate tax reporting.

Therefore, you must send copies of the completed form to the payee and the tax authorities by the annual deadline, which is generally January 31 or February 15 if reporting payments in boxes 8 or 10. Noncompliance with these regulations may result in penalties and fines.

Click Here to download the most up-to-date version of 1099-MISC from IRS.gov.

Overall, 1099 forms are essential for both payers and recipients to ensure compliance with IRS regulations and accurate tax reporting.

1099 vs 1042 – The main differences between these IRS tax forms

The 1042 Tax Form:

The 1099 Tax Form:

1042 is used for tax withheld on certain income paid to foreign persons and has specific requirements for reporting payments while 1099 is used for reporting payments made to non-employee individuals or entities and has various types of forms to document different types of payments.

Both forms can be filed electronically and have different deadlines for when they must be provided to the recipient and filed with the IRS.

At Payoneer, we provide various tools and services to help you manage tax reporting, such as automated tax form generation and submission. By utilizing these tools, you can streamline the process of managing and submitting forms for multiple payees, saving you valuable time and effort.

Our tax services make it much easier to file forms: 1042s vs 1099s

Now that you understand the differences between 1042s vs. 1099 forms, you can confidently file your taxes. It’s crucial to comply with tax regulations to avoid penalties. While both forms are used to report income and payments, they serve different purposes and apply to different incomes and payees.

It’s important to determine which form is required – 1099 vs. 1042 – based on the specific situation and to ensure that all necessary forms are filed accurately and on time. However, with our automated and complete solution for tax services, you can ease the burden of completing these forms.

Whether you’re uncertain whether you need to file 1042s vs 1099, Payoneer’s tax services solution can certainly help.

He has worked in various capacities, including training manager, leading the KYC team, and managing the business side of Payoneer’s tax services.

Currently, he manages our tax service products under the Enterprise Product Group.

With our team of experts, we can help you collect accurate data from your payees,

calculate withholding taxes, and prepare and submit the necessary documents to the IRS in a timely and efficient manner.