Pay your contractors and remote employees in Pakistan

Pakistan is the world’s 8th fastest growing freelance economy and one of the leading global hubs for freelance software engineers. It’s not surprising that it’s becoming one of the most popular places for outsourcing, especially for tech and call center positions.

Most Pakistanis speak English well, and the country is 4-5 hours ahead of Western Europe, 10 hours ahead of the east coast of the US, and 13 hours ahead of Silicon Valley, making it a great option if you need to provide round the clock tech support for your customers.

But if you want good business relationships with contractors and remote workers in Pakistan, you need your cross-border business payments to be on time, transparent, and easy to access.

Your employees and freelancers rely on your payments. If they often turn up late, you could cause cash flow issues for your recipients, and might even end up with a poor reputation as an employer.

On your side of things, you want to lose as little as possible in transfer fees and foreign currency conversions, and be able to track payments so they don’t get lost.

Here are some of the ways that businesses prefer to pay their employees and contractors in Pakistan.

Overall description

Preferred payment options for contractors and employees in Pakistan

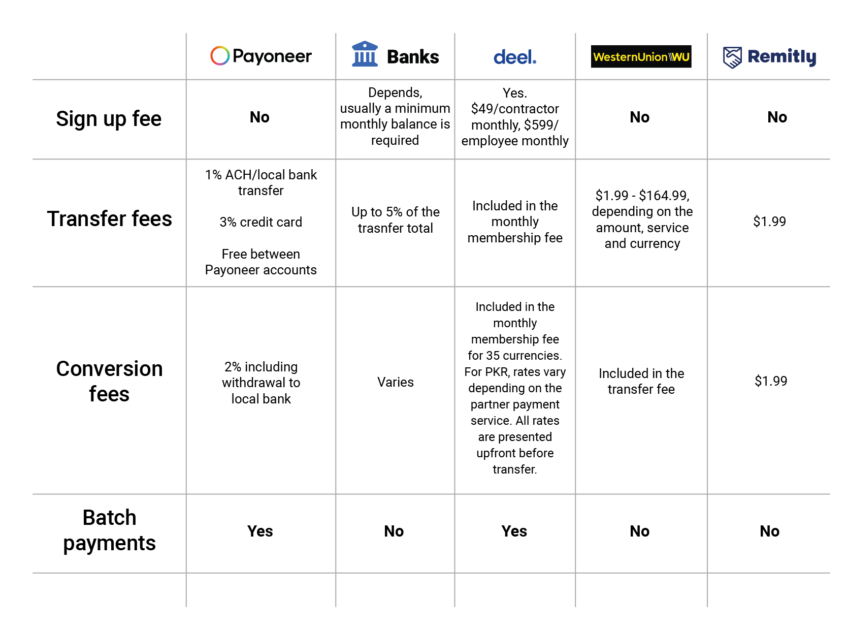

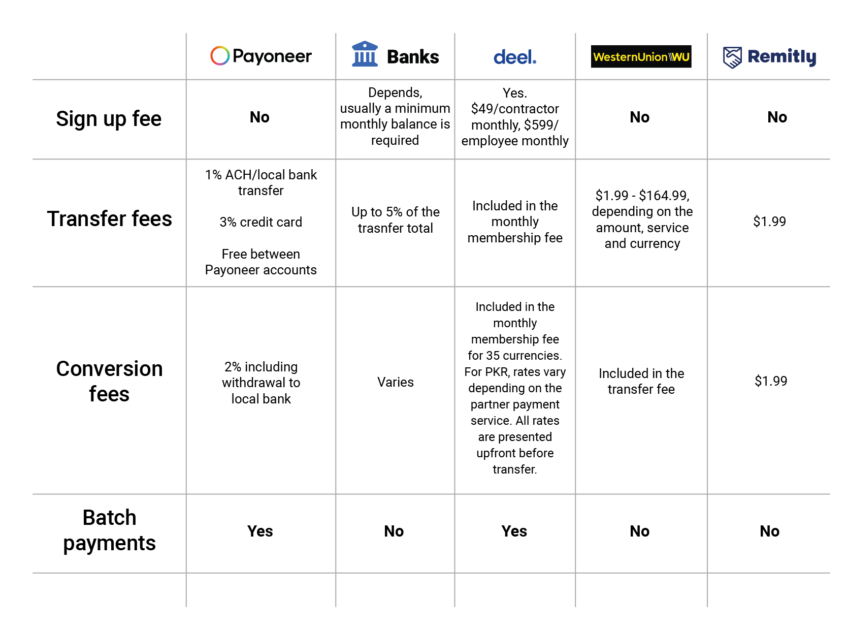

Bank transfers

In Pakistan, bank transfers and wire transfers are the most trusted and popular way to manage business payments. People either complete transfers online, or go into the branch to make the payment. Bank transfers are used to send money between accounts held at the same bank, and wire transfers like SWIFT are for inter-bank payments.

Sending money through a bank also makes it easier for your workers to get a Proceed Realization Certificate (PRC). They need the PRC to authenticate the remittance, so they can prove overseas income for tax purposes. When you use a bank for cross-border payments, the bank automatically issues a PRC.

But these transfers run expensive and can take a long time to clear. Wire transfers like SWIFT take anywhere from 1-5 days to clear within Pakistan, and longer if you’re sending the payment from outside the country.

If you’re sending money through SWIFT from the US to a contractor in Pakistan, for example, it could cost you up to 5% of the total transfer amount, or as much as $65 per transfer, plus the contractor will have to pay $15-30 just to receive it. You’ll probably also have to pay the bank commission to change your home currency into PKR before you make the transfer.

A local bank transfer is faster and lower cost, but only if you have an account with the same bank used by each of your freelancers or employees. On top of that, opening a bank account in Pakistan can be challenging and time consuming, and you usually have to visit in person to complete the process.

Money transfer services

It’s not surprising that people look for an alternative to expensive, time-consuming bank and wire transfers. PayPal doesn’t operate in Pakistan, but there are other options like Western Union and Remitly. One drawback with money transfer services is that they don’t usually provide a PRC remittance, so your contractors will have to sort that out for themselves.

Remitly is popular for small cross-border business payments, because funds clear quickly — within minutes if you choose the Express Payment option, or in 3-5 days for the Economy option — and fees are transparent and low. To send money from the US to Pakistan, for example, costs a fixed $1.99 transfer fee, and there’s no conversion fee. But there’s a $10,000 cap on payments, so larger businesses might find that difficult.

Western Union is another small business option. It offers secure international business payments from your credit or debit card, bank account, or a cash payment in a supporting store. Fees are transparent and you can check them before you commit, but they vary depending on the method you use to make the payment, the way that the recipient wants to receive it (i.e. to their bank account or as cash pickup), and how much you’re sending.

Depending on what you choose, you could end up paying close to $100 on a $3,000 transfer, plus payments are capped at $5,000. Funds take up to 4 business days to clear into the recipient’s bank account.

Integrated payroll services

If you’re managing a large number of freelancers and contractors, integrated payroll services can make life easier. They help you comply with local employment regulations, automate invoicing and receipts, and often connect with your bank account or credit card to automate payments. But they usually operate on a subscription basis, and because they tackle more than just payments, fees can be high.

Deel helps businesses manage compensation, benefits, contractor invoicing, tax obligations, and more. Most payment methods are fee-free, and there’s no extra charge for currency conversion, but you do have to pay a monthly subscription fee of $49/contractor or $599/remote employee.

Deel supports a number of currencies, including USD, EUR, GBP, AUD, and also cryptocurrencies, but not PKR, so your recipients will have to carry out a local currency conversion before they can withdraw funds locally.

Payoneer: A better way to pay partners in Pakistan

With Payoneer, it’s simple and inexpensive to send payments from over 190 countries worldwide to your freelancers, contractors, and remote employees in Pakistan. You can choose whether to use your Payoneer account balance, or to connect your US bank account, or your credit card from anywhere in the world, so that payments are debited automatically.

Funds clear quickly once you’ve authorized the payment — in fact, the transfer is instant when you make a payment from one Payoneer account to another! Payoneer also offers a PRC remittance to help your recipient manage taxes more easily.

With Payoneer, your employees and contractors in Pakistan can withdraw funds to their local bank account without paying exorbitant fees, keep the funds in their Payoneer account to pay their own expenses online, or use their Payoneer card to save on foreign exchange fees when they travel or need to pay business obligations in a foreign currency. Payoneer also integrates with JazzCash, a leading Pakistani digital wallet, so freelancers and remote workers in Pakistan can easily receive and send funds through JazzCash.

Payoneer is easy to use for payments to Pakistan, and we offer account management for customers with large accounts. You can either respond to a request for payment or initiate payment yourself, all in just a few clicks. Payoneer also has batch payment capability, so you can pay more than one contractor, agency, supplier, or employee with a single payment order.

The benefits of using Payoneer to pay your partners and workers in Pakistan

Using Payoneer to pay your employees or contractors in Pakistan is a great way to cut unnecessary costs. It’s free to send payments in most currencies, and you’ll only pay 1% in fees if you send the payment in USD, compared with fees of 3%-12% through money transfer services like Western Union or Remitly. Payoneer charges just 2% total for conversion fees for contactors, but you’d pay 4-6% at your local bank.

Plus you’ll make your life easier, too. You won’t have to worry about whether you have enough funds in your account when you link your American bank account, or your credit or debit card in the rest of the world. The batch payment capability means that you can authorize multiple payments with a single click, saving time for other business tasks.

Payoneer can help you boost your reputation as an employer in one of the world’s most popular centers for freelance software engineers, because your employees and contractors will enjoy better cash flow, more flexibility about how to use their funds, and won’t have any difficulties getting a PRC or IT remittance.

Your payees can use Payoneer to withdraw money in PKR, USD, or any of another 150+ currencies at competitive rates, or keep the funds in their Payoneer account and use it to pay their own suppliers, contractors, or employees. Alternatively, they can load the money onto their Payoneer card to pay their own expenses online without a fee, or use it when they travel to save on foreign exchange fees.

Last but not least, Payoneer gives both you and your recipients peace of mind about your payments, because you can track the progress of your funds every step of the way.

A better way to send payments to Pakistan

Payoneer lets you send secure, transparent payments to your remote workers, contractors, suppliers, partners, or freelancers in Pakistan. The user-friendly system saves you time and hassle, and speedy transfers keep your payees happy, so you can spend more time scaling your business.