The State of eCommerce: Five Takeaways from Our Global Seller Index

The biannual Payoneer Global Seller Index is an opportunity to review the current state of eCommerce as it relates to the worldwide seller community. For our Q3 2019 report, we analyzed and distilled data from more than 100,000 cross-border merchants, allowing us to better understand where the most successful sellers are located, and which seller community is growing the fastest.

Q3 saw several notable developments on the global stage, with some countries asserting their dominance in the eCommerce sphere while others showed increased strength in a fiercely competitive industry. Here, we’ll be breaking down five takeaways from this quarter’s report, providing you with an overview of the main players in global eCommerce.

See our full Q3 Seller Index

1. South Korea Diversifies its Industries and Turns into an eCommerce Hub

While South Korea has always had a sizeable cross-border seller presence, especially in the cosmetics and beauty products industries, recent steps among merchants to diversify their product lines have propelled the country to a global eCommerce leader. In Q3, Korea had the third highest sales worldwide, only behind China and the United States, despite having one of the lowest populations among leading seller countries.

2. Ukrainian Seller Revenues Skyrocket

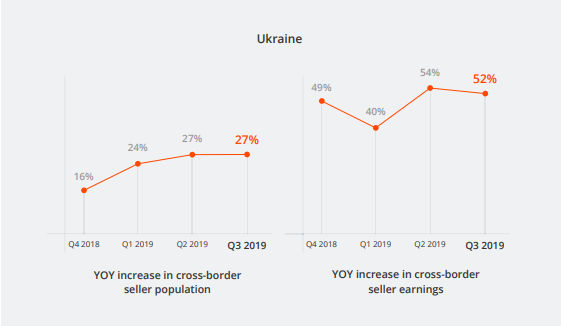

Historically, Ukraine has been viewed as a hotspot for freelancers and service providers, and with good reason. In our Q2 Global Gig-Economy Index, we noted that advanced technical training led to a 30% year over year increase in the number of Ukrainian outsourcing professionals.

Now, Ukraine can add cross-border eCommerce to their list of roles in the digital economy. In Q3, the country saw a 27% yearly increase in their global seller population and a 52% growth in seller earnings, the second highest increase globally.

3. Vietnamese Merchants Expanding Beyond Print-On-Demand

Similar to South Korean sellers, Vietnamese merchants have recently begun diversifying the eCommerce industries in which they operate, helping them greatly expand their role in the digital economy. Vietnam generated the sixth highest total seller volume this quarter, which Miguel Warren, Payoneer’s Regional VP for South East Asia attributes to “local merchants who have expanded their businesses beyond print-on-demand and dropshipping to more global marketplaces, including Amazon”.

4. Chinese Sellers Connecting with New Marketplaces

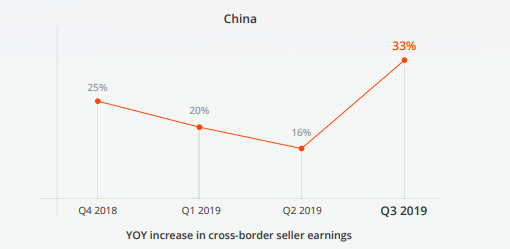

China’s status as the undisputed king of eCommerce is well known, a point that was reinforced in Q3 by the country’s total sales volume, which was far and away the highest worldwide. What was interesting this quarter, however, was that while China’s year over year seller earnings were up by 33%, their seller population didn’t increase at nearly the same rate.

For James Huang, Payoneer’s VP & Country Manager for Greater China, “the increase in seller output over the last year has come amid a wave of emerging markets connecting with the best sellers”. This has given veteran sellers the ability to reach new customers and expand their business’s reach.

5. Holiday Sales Expected to Shatter Records

The holiday season, which encompasses everything from Black Friday to Cyber Monday to Christmas and New Year’s, is by far the biggest shopping period of the year. This year, we are predicting a hefty 35% increase in sales from last year, which if true, would represent another record-breaking year. For Jonny Steel, VP Marketing at Payoneer, this reflects marketplace innovations and “merchants all around the world empowered to bring original products at great prices to a global customer base”.

Learn More!

Interested in discovering more about the current trends in global eCommerce? Download our full Q3 Global Seller Index!