Payments & Online Commerce During the Coronavirus

There’s no sugarcoating the facts. The coronavirus has infected over 5 million people worldwide and the effect on global commerce and payments has been undeniable.

Even with several countries enacting economic stimulus, the OECD cut its global growth projection to 2.4% for 2020 compared to 2.9% in 2019. In the long-term, this crisis may force a customer surge into E-commerce and cashless payments equating to income for the entire payments value chain. However, it’s likely that any major international recession will harm the short-term growth of the payments sector.

Here’s a look into several key developments for the world of payments and online commerce.

COVID-19 is Accelerating a Shift in Customer Habits

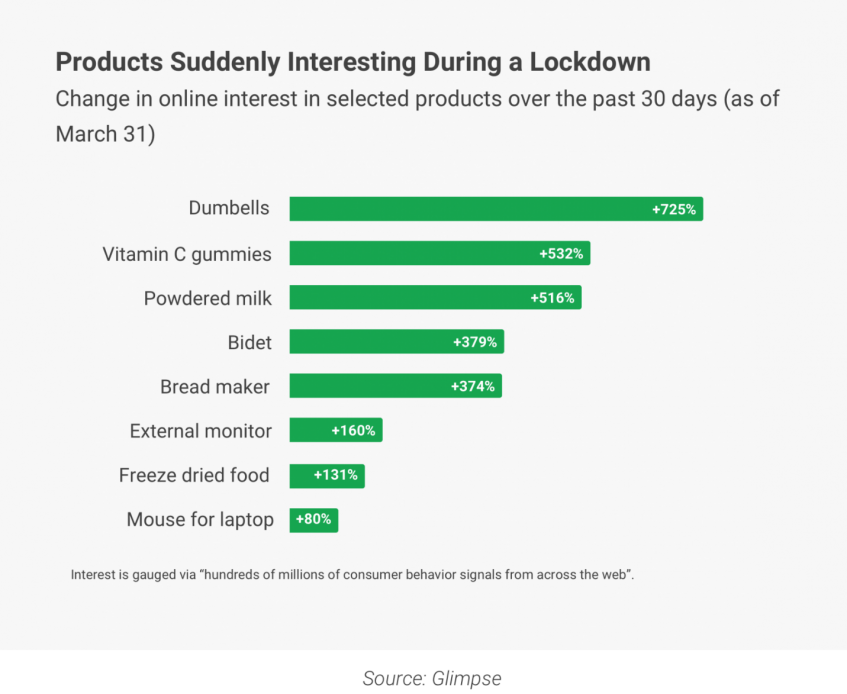

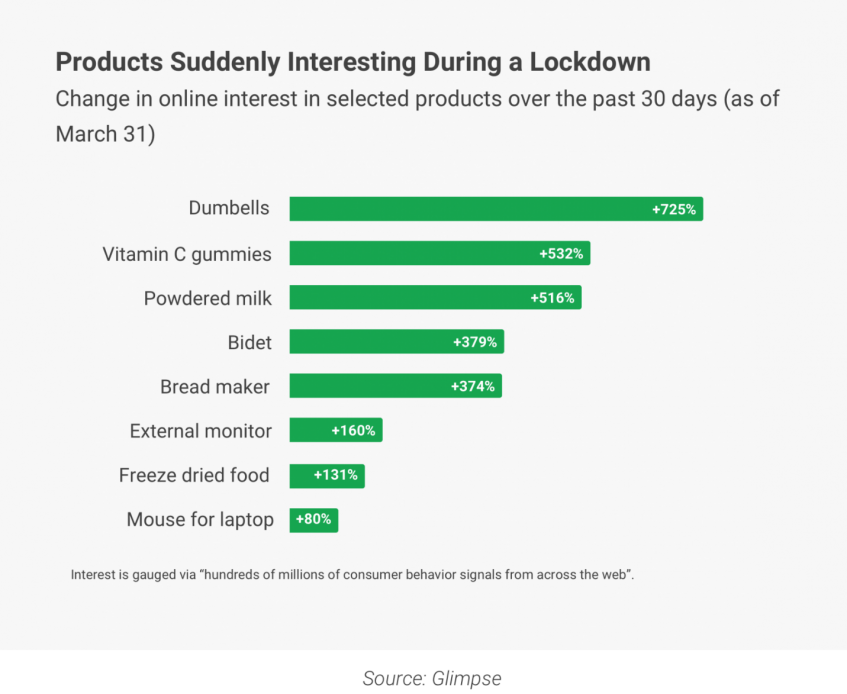

As many brick and mortar shops have pushed their commerce online. Their customers, young and old, are also purchasing online in larger numbers. Beyond this, COVID-19 has impacted consumer habits regarding frequency of purchase, payment method, total transaction value, as well as quantity and type of item purchased. In-quarantine consumer spending now leans towards lower value purchases such as food, drink and entertainment.

Even with such a strong influx of first-time online shoppers, it’s important to recognize the limits in rapidly meeting such a high demand.“ E-commerce companies are already straining under the increased demand, with online grocery specialist Ocado in the UK introducing a virtual queue and quotas on types of items to manage traffic to its site and prevent stockpiling”, states GlobalData Analysis.

The Risk Profile is Already Changing in Online Payments

With more transactions online come more opportunistic fraudsters using phishing attacks and ransomware. These can lead to payments going to fake accounts or valuable customer or company information being misused. E-commerce giants are reacting with their own security measures. Amazon recently removed more than one million listed products in connection to false claims related to the Coronavirus. In response to a reported 18 million Coronavirus related scam emails a day, Google claims to be using machine learning tools to protect its Gmail users.

Consumers are Moving Away from PoS Payments

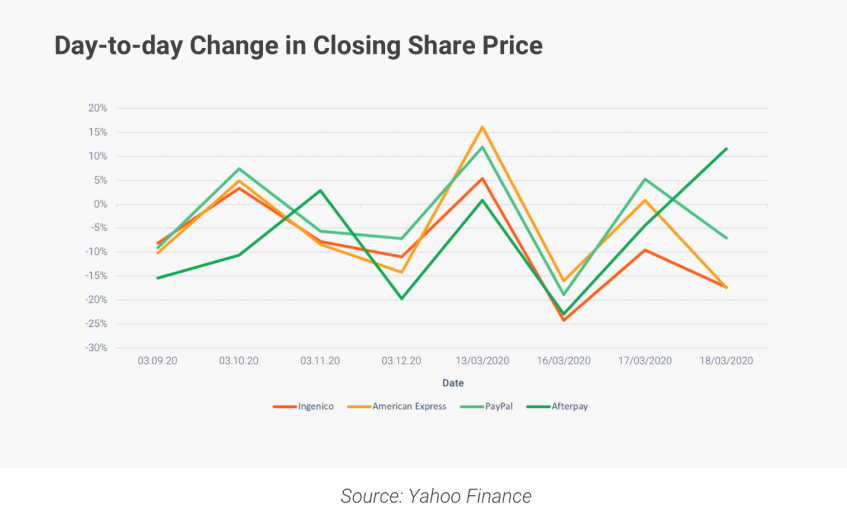

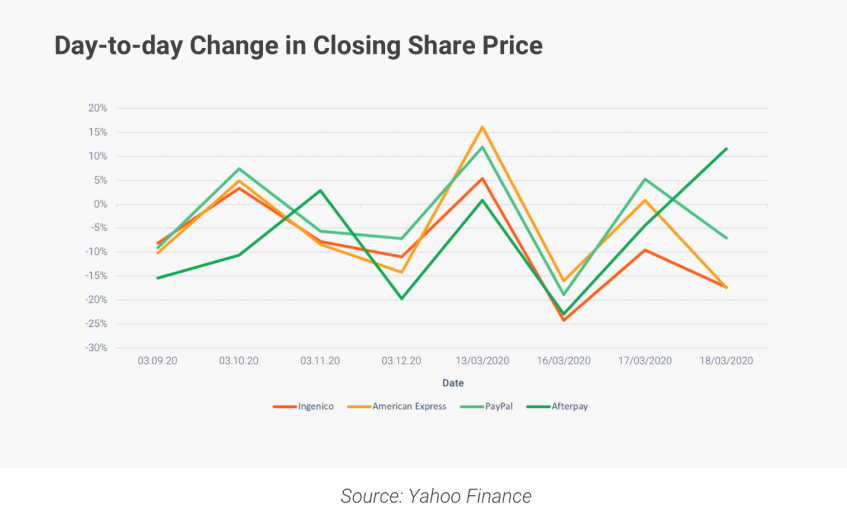

Many Point of Sale payment providers have felt a COVID-19 induced slowdown of in-store payments. According to Yahoo Finance these companies have recently lost over 20% of their share price. For example, Ingenico dropped its share price by 49.9% in late March.

We can expect to see new customers continuing to shop online after trying out e-commerce during quarantine. This phenomenon occurred in Chinese E-commerce following the SARS outbreak in the 2000’s. Customers enjoying their newfound online convenience can be expected to contribute to further E-commerce growth after the global economy gets back on its feet. This boost in the cashless economy will likely favor card schemes and big payment processors in the long run.

Online Businesses can Use Payments to Cope with an Uncertain Future

Today, online merchants are wondering how to remain successful in the face of uncertain political and economic circumstances. As customers change their priorities, merchants need to strategize for the days ahead. To execute plans and facilitate business continuity, merchants need a payment setup that provides the fluidity and adaptiveness required by a world in crisis.

To learn how you can utilize your payment setup to meet the challenge presented by the times, read our blog “Coping With the Payment Challenges of COVID-19”.

For an in-depth look into this topic you can download our white paper, “The Coronavirus, Payments & Online Commerce”.