Is the dollar rate change in 2022 a risk factor for global businesses?

If you’re running a cross-border business with suppliers or customers who use US dollars, you have clients who pay you in USD, or you’ve simply tried to buy something priced in US dollars recently, you’ll have noticed that the USD is unusually strong at the moment, and has been for several months.

In this article, we’ll discuss the rise in dollar value, the factors causing the rise in the dollar, and the impact of a strong dollar on businesses and foreign currencies. Note that this should not be taken as financial advice. You should always research business and financial decisions thoroughly, and ask your financial advisor if relevant.

The surging US dollar

According to Bloomberg, the US dollar gained 14% between May 2021 and August 2022. Over a 10-month period till September 2022, the USD grew by 12%, but the JPY fell by 12%, the GBP by 9%, and the EUR by 3%. When compared against the dollar alone, GBP dropped by 21%, JPY by 20%, and EUR by 16%, making the dollar king of all the currencies.

Although financial trends can have complicated roots, the rise of the dollar is mainly due to the US raising interest rates early and frequently, together with the strong growth of the US economy. At the same time as the rise in value of the dollar, many major currencies like the UK pound, the Japanese yen, the Chinese yuan, and the Euro all experienced turbulence and/or weak growth which dragged down their value.

Nobody can ignore the impact of the strong dollar

As the leading international currency, whatever happens to the USD affects everyone who uses money, no matter where they are in the world. The strong dollar is causing serious trouble for emerging currencies in regions like Africa, and also affecting foreign exchange for currencies that are usually strong and stable like Euro, GBP, and JPY. Investment rates in USD are rising, and those in other currencies are dropping proportionally.

The strong dollar affects the decisions taken by cross-border sellers, freelancers and agencies with clients overseas, businesses outsourcing to international contractors, etc. American consumers buying imported goods; ecommerce small business owners in global markets; businesses that work with partners or suppliers in USD; anyone who deals in foreign trade in commodities like oil or wheat that are priced in USD; freelancers and international contractors who get paid in USD; and more are all feeling the strong dollar’s impact.

But the effects of exchange rates on businesses have pros and cons. American consumers and businesses can import goods for lower prices, and countries exporting raw materials priced in USD enjoy higher prices. But cross-border businesses that have to pay expenses in USD but get paid in local currencies are seeing expenses rise while real income stays the same.

The rise in the value of the dollar: a timeline

What are the factors sustaining the rise in dollar value?

Basically, the reason why the dollar is so strong is because it’s more attractive than any other currency in the world at the moment. This is due to four main factors:

- Rising interest rates in the US

- Strong economic growth in the US

- A flight to safety from other currencies

- The global dominance of the USD

1. Rising interest rates in the US

After the shocks of the pandemic and the supply chain crisis in the global economy, every country is concerned about the risks of inflation. The United States’ central bank, the Federal Reserve, was among the first central banks to raise interest rates in order to keep inflation under control.

When interest rates are high, investors in the US dollar and in assets linked to the USD are more likely to see good returns on their investment, making the USD more appealing. At the moment, yields from investments in US Treasury bonds are higher than those from almost any other G7 country, and there are signs that the Fed will continue to raise rates. Each interest rate hike strengthens the dollar more.

2. Strong economic growth in the US

The value of a currency reflects how people feel about the chances of growth in that country. In the post-covid world, the US has seen a stronger recovery than any other currency, thanks to strong fiscal and monetary stimulus.

Currently, GDP growth in the US is 15.6% higher than it was in Q3 2019. By comparison, GDP growth in the Eurozone is just 8.3% above its level in Q3 2019, and in Japan it’s 3.6% below. This kind of growth encourages more people to move their money to USD, again making the dollar stronger.

3. A flight to safety from other currencies

In times of turmoil, people look for safe investments, and the US treasury market is one of the largest, most liquid, and best-protected markets in the world. That gives investors — including large corporations, financial institutions, and governments — the confidence that they’ll be able to access their money whenever they need it.

Usually, other established currencies like GBP, EUR, or JPY would also be seen as safe havens. But a combination of events, including the Ukraine war pushing energy prices in Europe, and China’s zero-covid policies which are holding back growth across Asia, have made them less attractive.

Meanwhile, investors are leaving emerging markets in droves and fleeing to safe haven in US-denominated assets. It’s set up a negative cycle where outflows from emerging market currencies drag down the value of those currencies, which scares investors into selling emerging market currencies bonds and buying dollar assets even faster, which pushes the value of those currencies down more and strengthens the dollar.

4. The global dominance of the USD

Most major commodities, including oil and wheat, are priced in USD. Companies in many emerging markets use USD for trade instead of their local currency, because it’s stable and widely accepted. Approximately 40% of all global financial transactions are settled in USD.

The US is the biggest economy in the world, so US corporations, small business owners, online sellers, and service providers are constantly driving international and domestic transactions. Whenever businesses in the US export products or services, it stimulates demand for dollars because customers have to sell their local currency and buy USD to make the payment.

As a result, businesses, governments, and individuals around the world hold USD reserves to manage currencies for trade purposes. Importers keep hold of dollars so they can quickly make purchases in USD. Exporters hold funds in USD for future transactions. Even when a strong dollar has a bad effect on currency conversions, businesses based in those currencies still have to use the US dollar.

The failure of the Bitcoin alternative

Another of the many factors helping the rise in dollar value is that Bitcoin failed to live up to its promise. Bitcoin and other cryptocurrencies were marketed as the ultimate shield against inflation. Many people bought “stablecoins” because they were told that decentralized cryptocurrencies were safer than any fiat currency.

But this year, when the post-pandemic world had to deal with anxieties about economic growth, Bitcoin and other cryptos fell dramatically. At a time when inflation is high and consumer prices are skyrocketing in most markets, crypto prices have crashed. Many investors watched crypto crumble and decided that their money is safer in USD than in Bitcoin.

Which countries are affected by the rise in the dollar?

It’s hard to find any country which is affected by the dollar’s strength. The chief economic commentator at the Financial Times, Martin Wolf, points out that the impact of the US dollar market is much bigger than the relative size of the US economy. “Whenever financial flows change direction from or to the US, everybody is affected,” he writes.

The stronger dollar is weakening established currencies and bringing down emerging markets. In countries that depend on imports, the stronger dollar pushes inflation because goods are more expensive. Developing countries with debt in dollars are finding it harder to make payments because of the impact of the exchange rate. On the positive side, though, commodity-rich countries that rely heavily on exports benefit from the stronger dollar impact.

The strong dollar is also causing headaches for every other central bank. They need to raise their own interest rates to keep pace with the US dollar, shore up their own currency, and lower the risk of inflation. But if they raise rates too much or too fast, they’ll risk slowing growth, which hurts their economy even more.

Countries with debt in dollars

Many emerging countries can’t borrow capital in their own currency because lenders aren’t willing to take the risk of getting repaid in a currency that could be unusable. Instead, they borrow and promise to repay in US dollars, regardless of the foreign exchange rate.

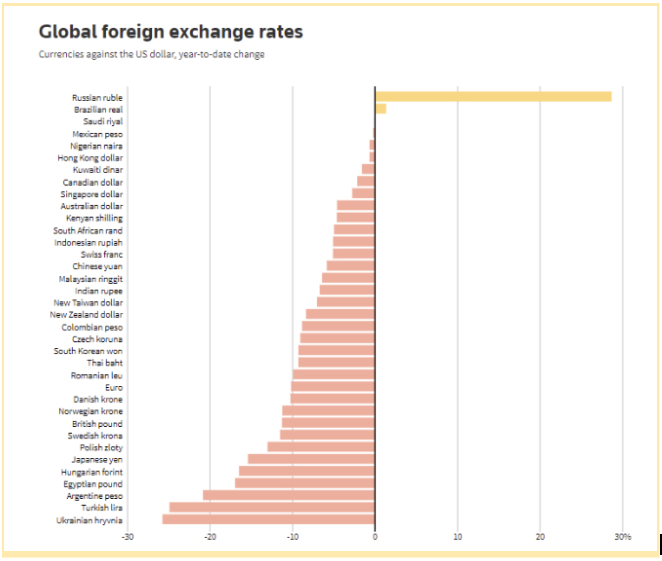

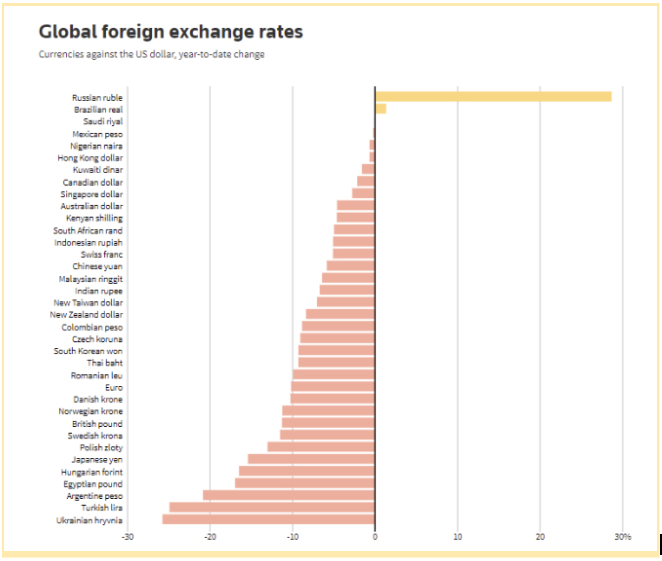

A strong dollar means a poor exchange rate for foreign currencies, so it’s more expensive to make the same payments. Those countries can’t easily refinance their debt or get more credit, because lenders are nervous that they won’t be able to make repayments. The table below shows that exchange rates for dozens of currencies have fallen against the US dollar over the past year.

In the last few months, Pakistan came close to defaulting on its loan; Sri Lanka’s president was pushed out of power when a shortage of dollars brought an economic crisis; and Egypt had to ask the IMF for help as foreign investment and its store of dollars dried up. According to the IMF, 60% of low-income countries are in government debt distress or at high risk of it, three times the number in that category just 10 years ago.

Some financial experts are worried that this uncertainty in emerging markets could spill over and trigger widespread economic chaos and other unforeseen effects.

Countries that import raw or vital materials

In today’s global village, more and more countries import a significant percentage of their basic commodities, like oil, wheat, or soybeans, or vital items like medications or fertilizer. But most of these items are priced in USD, so the stronger dollar made them much more expensive.

Now places like Turkey and Egypt have to spend more of their local currency to buy the same amount of commodities. They are losing money in foreign trade, and running out of reserves of foreign currencies.

Countries with high inflation

The rise in the dollar means that imports are more expensive for basic commodities and for luxuries, which weakens the buying power of the local currency. People demand wage increases to keep pace with rising consumer prices, while stable assets like property see their value skyrocket, which fuels more inflation.

Nigeria saw an extreme version of this when food prices soared and drove inflation to nearly 20% after the local currency, the naira, failed. But it’s not just developing economies that are suffering. The stronger dollar drives inflation even in many richer countries like Germany and the UK.

Countries that are net exporters

The rise in value of the dollar is good news for some countries. Economies that are net exporters of commodities like oil and base materials are benefiting from the strong dollar effect on exports.

The rise in the dollar value means that they can sell their products for higher prices. Dollars are flowing into their treasuries and helping to compensate for poor exchange rates and the need to repay dollar debts, while strong foreign trade helps boost local growth. A number of countries in Latin America are in this position.

The impact of the surging dollar on local businesses

Inevitably, the state of the domestic currency affects large and small business in the US, and everyone living in the US economy. Here are some of the ways that the strong dollar is affecting US-based businesses.

Lowering domestic inflation

Good news: the rise in the U.S. dollar means that imported goods cost less, which helps keep down domestic inflation rates and means that Americans can buy more with the dollar in their pocket. That encourages consumer spending on goods and services, which trickles down to greater business spending as well.

Enabling imports

When the U.S. dollar is strong, exchange rates flow in America’s favor and empower US-based importers. Any small business that’s importing energy, raw materials, or finished goods from overseas markets like China can buy more for the same price — as long as the items aren’t priced in dollars. As NPR reporter David Gura put it, for US importers “the world is on sale.”

Encouraging foreign travel

Great exchange rates for the US dollar is good news for American tourists too. Whether you’re paying for a hotel room in Cancun, lunch in Paris, or a shopping spree in London, you’ll find that everything is cheaper by comparison thanks to the strong dollar.

For the first time in about 20 years, the dollar and the Euro reached parity, which means that one dollar is worth approximately one Euro. This means better deals for US travelers in the 19 European countries that use the Euro, and a small consolation for European tourists in the US.

The impact of a strong dollar on businesses around the world

Fluctuations in the currency and the dominance of the U.S. dollar affects businesses around the world, not only governments. Here are some of the impacts of a strong dollar on cross-border businesses.

Raising the price for imports

Approximately half of all international trade is invoiced in dollars, so businesses could have to pay more for foreign trade even if they aren’t dealing with American partners. Imports of raw materials that are priced in dollars are more expensive now, making it harder for small business owners and manufacturers to balance their books.

Cross-border small business owners like ecommerce sellers could struggle with inflation impact. If they can’t afford to buy imports they need to run their business, they won’t be able to keep the same inventory levels and won’t be able to sell as much, even if demand remains stable or goes up.

Discouraging exports

When the dollar is strong, like now, it makes US-made goods more expensive for customers in other global markets, and that makes them less likely to buy. US businesses are finding it harder to sell products overseas.

International companies are also struggling to manage their local list prices. They want local prices to mirror prices in the US, but they also need to allow for foreign exchange rates into USD. If local prices are too high, customers will stop buying.

Dampening corporate profits

CEOs of multinational corporations that are headquartered in the US say that the strong dollar is hurting their profits. Companies like Apple sell products in local currencies and then convert the profits into dollars, but a strong dollar means that they lose out on exchange rates.

Michael Klein, professor of International Economic Affairs at Tufts University, explains that “Repatriated profits from abroad, in euros or pounds or yen, are going to be worth less in dollars, because a dollar is stronger.”

Working with overseas clients

For freelancers and contractors working with international clients, the strong dollar could be good news or bad news. If your clients pay in USD, your international business transactions are on the right side of the strong dollar. You can use your Payoneer account to keep your funds in dollars to pay suppliers or partners in USD without losing out on exchange rates, or you can pay local expenses and shop in your local currency and get more for your money.

But if you get paid in local currency, but you need to pay others in USD, the rise in the dollar will make things harder for you. You’ll have to earn more local currency to get the same amount of USD, so your expenses will go up but your income will stay steady.

To Hedge or Not To Hedge

One way to balance out the impact of the strong dollar is to carry out foreign currency hedging. It’s only relevant for businesses that are exposed to foreign currencies. If your company does business in other currencies, your CFO is probably already thinking about hedging.

There are plenty of tools like futures contracts, economic reports, interest rate predictions, and more to help you make a decision about hedging. But it’s not an easy decision. The strong dollar is making the global economy a lot more volatile, which makes hedging even harder. On top of that, some experts say that if you didn’t already hedge against a strong dollar, it’s too late now.

Adapt your business to the strong dollar

The strong dollar doesn’t have to be bad news for your small business, no matter where you’re located, as long as you keep on top of trends and make smart business decisions.

Stay updated about dollar trends

The more you know about fluctuations in exchange rates and changes to foreign currencies, the better you’ll be able to make good business decisions. Read summaries of economic trends and the impact of the strong dollar to remain up to date.

Convert your currency to USD with Payoneer

When one currency is stronger than all the others, you need to be even more careful about foreign exchange rates. When you use Payoneer to convert your local currency to USD, you’ll know that you’re getting a competitive exchange rate so that you don’t lose out on the conversion. Payoneer’s low fees also save you from leaking money when you do foreign currency conversions to USD.

The benefits of using a Payoneer account

Payoneer helps businesses take advantage of the strong dollar and find ways to compensate for uneven exchange rates. When you have a Payoneer account, you’ll be able to open a US bank account in USD. This way, you can receive payments and hold funds in US dollars, and then pay other expenses or make purchases without having to do a currency conversion.

Payoneer offers free Payoneer to Payoneer transactions, multiple payment methods including credit card, ACH bank debit, and local bank transfers, and easy, low-cost local bank withdrawal. With a Payoneer account, you can make the best of every currency exchange situation and won’t have to fear a strong US dollar.

*Please note, this article should not be considered as financial advice