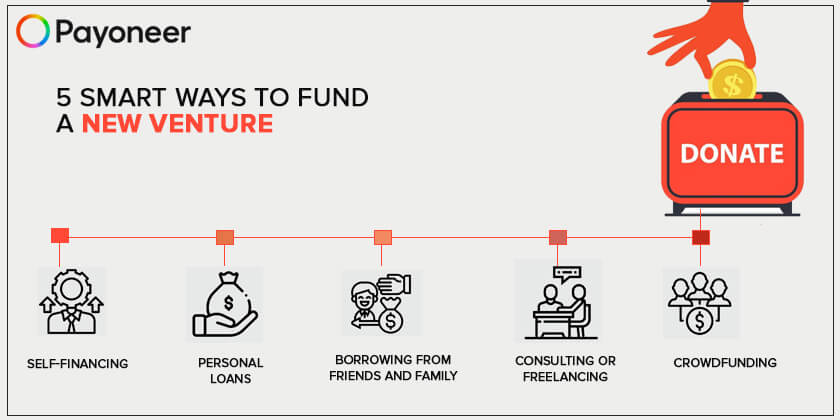

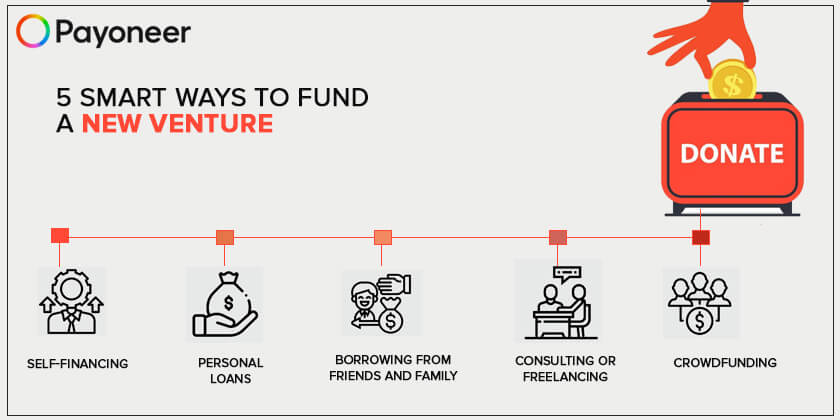

5 Smart Ways to Fund a New Venture (or side gig)

Editor’s note: This is a guest post from Jennifer McDermott, Consumer Advocate at finder.com

If you’re thinking of heading down the path of a new venture, congratulations! This is no doubt a very exciting time but also a stressful one. You probably have an exhaustive laundry list of things to do, but at the top of this will be how to fund your new venture.

This could easily turn out to be the trickiest part of starting a new business or side gig, so it pays to be smart about it. There are a number of options you can choose from, but you’ll generally use a combination of them, especially as your venture begins to take off.

Each of these have their advantages and disadvantages, spreading from the conventional to the out-of-the-box. Here are five popular ways to fund a business:

1. Self-financing

It can be daunting pouring your hard-earned savings into a new venture, however the majority of successful start ups were self-funded. Taking time to amass savings before launching will also help you get your start-up into the best shape possible. Plus, with your own capital invested, you will have complete control over operations as opposed to angel investors or venture capitalists who might want a say in how things are run.

One great example of a self-funded success story is of a little company called Facebook. Today the world’s biggest social media platform started from humble beginnings in Harvard student Mark Zuckerberg’s dorm room. While it eventually received its first investment in June 2004 (from PayPal co-founder Peter Thiel), Facebook ran for years on a student’s shoestring budget.

2. Personal loans

Personal loans are a great option if you’re just starting out, especially since a business loan isn’t may not be an option until you have built up a good business credit score. Difficult for those just starting out. However, some lenders offer loans that you can use as you see fit (for your start-up for example) and are unsecured, meaning you don’t need to put up anything as collateral.

The downside is that most lenders won’t loan you above $40,000, so you’re restricted by that. But on the upside, in most cases it allows you to gain funding in less than a week. Check out your options and compare which loan will work best for you. Always remember to have a solid plan in place for paying it back and incorporate it into your business plan.

3. Borrowing from friends and family

Going to the Bank of Friends and Family is a very common way that ventures adopt to get their first round of funding. After all, you already have a close relationship with these people and you don’t have to go searching far and wide for them. Australian duo Mike Cannon-Brookes and Scott Farquhar started software company Atlassian out with a $10,000 credit card and money raised from close friends and family.

But there are disadvantages. Sometimes, business and personal life shouldn’t be mixed. You should make sure you have firm rules in place and not to cross them. They also won’t be as well-connected as venture firms or angel investors, so can’t offer the range of other benefits you might receive with these investors.

4. Consulting or freelancing

This is a much more secure option for those not wanting to give up income as their business is still fledgling, yet of course it doesn’t come without it’s own pitfalls. Consulting, or even freelancing, is a good way to continue to accumulate income. Yet this is different to financing it entirely yourself. You can start your business as a consulting firm, gain clients and cash flow, then slowly transform the business into a product company.

By ‘product company’, I’m not referring to a company that sells only physical products. By freelancing or consulting, you’re doing custom work for each client. Selling a product, however, is one thing that you’re selling to many. This is the difference between running a business and founding a startup: the ability to scale.

While this is a safe option, what with a steady stream of capital while you slowly transfer over, it’s low-margin and you should work actively to move beyond this and not stagnate as a consulting company alone.

5. Crowdfunding

Crowdfunding platforms like Kickstarter or Indiegogo use the power of the Internet to find people willing to back your idea, generally with quite small amounts. This route has seen startups launch a successful campaign and gain enough capital to start, then go on to secure even more from venture capital. It’s definitely a good way to get noticed as well, acting as advertising at the same time. BauBax, a jacket with built-in travel accessories like a neck-pillow and eye mask, raised over $9 million with almost 45,000 people backing it. This shows the huge success some ideas can have, but there are also many campaigns every day that don’t achieve their goal.

Go forth and be successful!

I haven’t touched much on venture capital firms or angel investors, but there are lots of resources out there if you decide to take these routes. They also tend to be options available to people with lots of capital to throw around from the beginning, rather than one starting out on a first venture.

The most important thing is to weigh up your priorities. Think how much interest a loan could cost you, the length of time you’re given to use the funds you do get, and even how much company control you might have to hand over to certain investors. Remember, being smart and careful from the outset could save you in the long-run.

Jennifer McDermott is the Consumer Advocate at personal finance comparison website finder.com. She has more than 12 years’ experience under her belt, where she’s analyzed consumer trends in the travel, lifestyle, and finance industries. Jennifer loves to uncover interesting findings and issues to help people find their way to better deals.