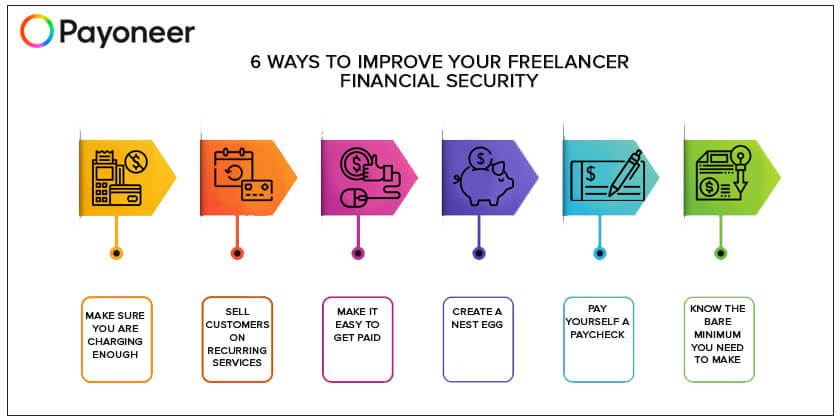

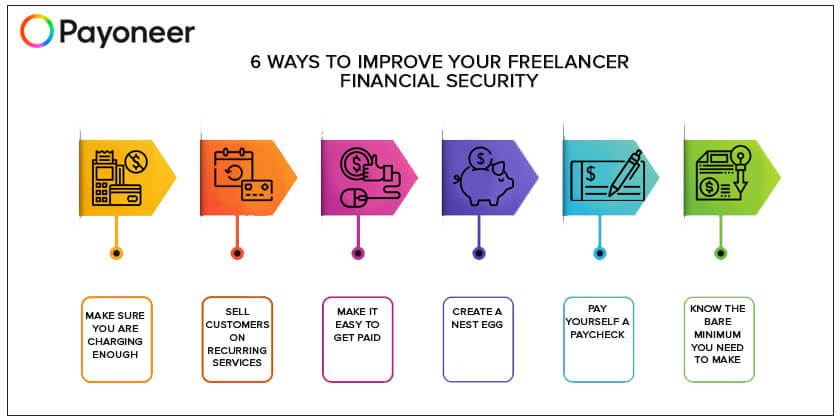

6 Ways to Improve Your Freelancer Financial Security in 2018

While there are ample reasons to become a freelancer, there is one major drawback that makes many would-be free agents hesitate before quitting their jobs: financial insecurity. Without the stability of a regular paycheck, freelancers can never guarantee that they will make a fixed amount of money.

Clients pay late (and sometimes not at all). The amount of work a freelancer does can vary wildly from one month to the next. All of that equates to big risks when it comes to being sure you will bring in enough revenue to pay your bills.

While nothing can remove the risk of financial instability, there are at least some ways to mitigate it.

1. Know the Bare Minimum You Need to Make

It can be a shocker to find out you do not have enough money at the end of the month to even buy groceries if you do not budget ahead. Before you even start your freelancing business, create a budget of all your personal expenses, as well as those you will incur to run your business. Ideally, you will make more than this, but this is your breakeven point or the minimum amount you must make each month.

2. Make Sure You Are Charging Enough

It is fairly common for new freelancers to charge less than they are worth when they first start out. If you are working 40+ hours a week and still not making ends meet, you are not charging enough. Go back to that budget to determine how much you need to make, then boost your hourly or per-project rate for new clients to make up the difference.

3. Sell Customers on Recurring Services

The issue for many freelancers is the one-off nature of their work. They design a website and then the client no longer needs them. They write one whitepaper and the client pays and moves on. There is a real opportunity here to show your customers that they will need you far beyond that initial project. Having clients on a retainer ensures steady income each month and helps you plan out your work schedule, knowing that your regular clients will need a certain number of hours a month from you.

4. Make It Easy to Get Paid

The more forms of payment you accept, the easier it will be for your clients to pay you. Using a global payment processing company that the marketplaces you work with use will streamline your payments and get funds deposited into your account faster.

5. Create a Nest Egg

It is inevitable that you will have slow months as a freelancer. If you manage to pad your savings account, a slow month will not destroy you. Aim to save about six months’ worth of profit so that you always have cash on hand to handle unexpected expenses or regular expenses should work be slow.

6. Pay Yourself a Paycheck

Though money works a little differently when you freelance than it does when you were an employee, you are still better off acting like an employee and paying yourself a regular paycheck. It may be smaller than what you could pay yourself, but keeping it small means you always know you can afford to write that check.

Paying yourself a paycheck also means you are socking away part of your tax payment with each check. Then, come tax season, you will owe less (or nothing at all) because you have paid into your tax debt throughout the year.

There is no magic wand to wave to ensure financial stability as a freelancer, but that is the price you pay for having the freedom to run your business your way.

Freelancers, take back your financial independence. Let Payoneer get you paid faster!