Brexit and the Gig Economy: 7 Ways Freelancers Will be Affected

As you already may know, Brexit is approaching quickly. During the transition period leading up to January 1, 2021, the UK is negotiating its future trade relationship with the EU. If by that date, there is still no settled arrangement, the UK can request an extension or be subject to a ‘no-deal’ exit – the prospect of which is daunting.

Brexit is particularly important for UK-based freelancers and self-owned businesses that will now have to navigate unfamiliar financial waters.

The impact of Brexit on the UK’s 2 million freelancers cannot be fully known at this point, but anticipating potential changes and preparing accordingly will make the switch less difficult. Current estimates place the contribution of freelancers to the British economy at around £300 billion a year. This makes the UK one of the world’s largest freelance economies.

So, what does Brexit mean for UK freelancers and how can you prepare? We’ve prepared an overview to help you better understand what may lie ahead.

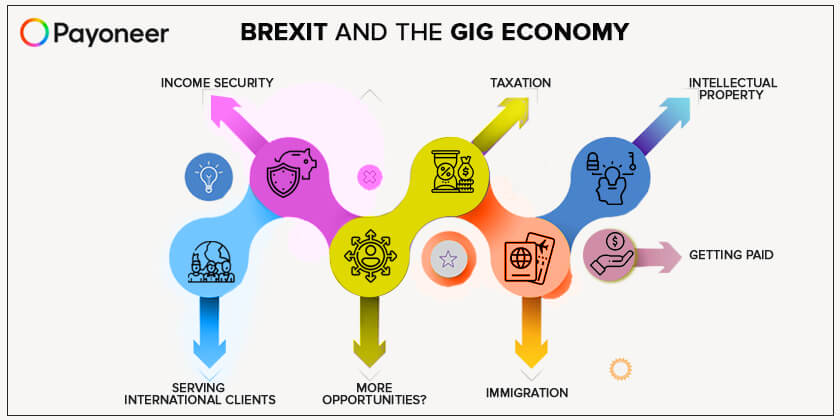

7 Ways Freelancers Will Be Affected by Brexit

1. Income Security

Income security is a major concern for many UK-based freelancers. It is difficult to know what Brexit will bring, especially without a solid deal mitigating trade with the EU, and this can be pretty scary for an independent freelancer in the gig economy. Preparing for a dip in income now can help cushion you in case of economic falls or clients.

2. Serving International Clients

International clients who use UK-based freelancers under the EU Single Market have benefited from low administrative burdens and a frictionless economy. It is possible that if paying UK freelancers after Brexit becomes complicated or difficult, international companies will move to hiring local or EU-covered freelancers. Furthermore, business accreditation is currently common across the EU, including the UK. After Brexit, it may be necessary for UK businesses, including freelancers, to get separate accreditation in order to work with international clients.

3. More Opportunities?

Brexit could be a boon to freelancers. With greater uncertainty, more UK companies could minimize the expense of taking on full-time employees by relying more on freelancers. Especially during this transition period when businesses are unsure of how the fallout will affect their business with external contractors or projected growth, it may seem like a safe bet to hire local freelance contractors until the dust settles.

For many foreign nationals working and residing in the UK, uncertainty about Brexit and their residency status could cause a wave of people leaving for their home countries or for countries still within the EU. While this isn’t exactly good news for the UK economy, it could mean more opportunities for local freelancers with no plans on moving out of the UK.

4. Taxation

If you are a freelancer paying VAT in the UK, things will likely stay the same. While domestic VAT rules will remain stable, VAT procedures for import or export may change – including for freelance services. For example, the UK is currently part of the shared EU VAT domain, meaning that if you are registered for VAT in the UK, you are simultaneously registered in all member states. After the Brexit transition, the VAT rules for freelancers providing services outside of the UK may change.

5. Immigration and Freedom of Movement

One of the big benefits of the EU is frictionless movement and the ease of immigration. If the UK decides to limit immigration or change regulation, the EU is likely to limit migration out of the UK as well. This may make it harder for freelancers to relocate to other EU countries. These changes may impact non-UK residents working in the UK and UK citizens living and working in other EU countries. While providing proof of employment is fairly straightforward for full time employees, self-employed non-citizen residents – including freelancers – may have a more difficult time providing documentation.

While tourist travel across borders will likely remain easy, entry requirements for workers entering the EU from the UK will change. In a no-deal situation, you may need an up to date passport to travel so be sure to stay up to date before booking business travel.

6. Intellectual Property

Currently, the EU shares a harmonized policy for intellectual property registration. While a Brexit deal will likely consider accommodating IP applications, a no-deal Brexit may affect the ease of registering a patent or trademark. Freelancers should be aware that in this case, they may be required to submit additional documents to protect their rights. This will include providing proof of a physical UK address.

7. Getting Paid

One of the four main tenets of the EU is the ability to move capital freely. Post Brexit, this is likely to change. If you are a freelancer who relies on a UK bank account for business transactions, including getting paid by clients, leaving the single market could affect how you accept payment from countries outside of the UK.

What will the European Freelance Workforce be Like After the Deal?

There’s no real way to know how Brexit will impact the EU freelance economy, however changes in taxation, payment regulation, import and export tariffs, customs, and freedom of movement for employees may encourage some EU companies to seek out talent outside of the UK. In a volatile no-deal situation, unpredictability could mean that freelancers stand to lose sizable EU clients.

Despite this uncertainty, new opportunities may also be on the horizon for well-prepared freelancers in the aftermath of Brexit.

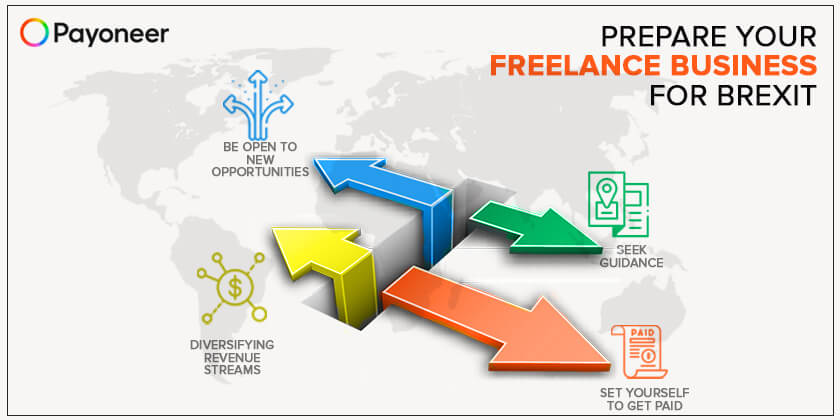

Steps you can Take to Prepare Your Freelance Business for Brexit

1. Be Open to New Opportunities

The agility built into freelancing is a big benefit in the face of Brexit uncertainty. If you can identify a need and pivot to fulfill it, this can be a big opportunity for growth. Prospecting for new clients both within the UK and abroad, even if only for short term gigs during the transition period, could help propel your freelance business.

2. Diversifying Revenue Streams

Not putting all of your eggs in one basket will make sure that if one aspect of your business dips, others will make up for the loss. Think about what other skills or niches you might have in your toolbox and begin capitalizing on them now.

3. Seek Guidance

It may be worth seeking professional accounting services during the Brexit transition to make sure you understand new regulations and remain compliant. While doing your own business can save money, accounting errors and confusion can cost a bundle in penalties.

4. Set Yourself to get Paid

One of the bigger challenges facing UK freelancers is the ability to receive payments from international clients. Issuing payments may also become a challenge. Using a cost-effective payments platform like Payoneer, ensures that no matter what regulatory changes arise from Brexit, you will be able continue doing business and remain compliant.

Conclusion

It’s hard to know what will happen to the freelance economy after the Brexit transition period. Until things normalize, setting up your business to thrive tomorrow means being proactive today. Get yourself setup with a payments platform to send and receive payments without needing to worry about changing regulations.

Payoneer’s secure payment solution operates across 200 countries with full regulatory compliance in multiple regions, including the EU.

Are you a freelancer and need a smart and easy way to get paid?