Paying contractors and remote employees in the Philippines

The Philippines is one of the world’s most popular destinations when it comes to outsourcing, serving as a fountain of highly-skilled, hard-working remote employees, freelancers, and contractors. Thanks to differences in the cost of living, companies can save as much as 50% of their overhead costs while still paying a generous salary with appealing benefits.

Websites like OnlineJobs.ph exclusively serve businesses looking to employ people in the Philippines, helping connect you with Filipino freelancers and employees. Most Filipinos speak English well, and because the country is 7-8 hours ahead of Western Europe and 13 hours ahead of the east coast of the US, it’s an excellent way to make sure that your customers have good service and support around the clock.

But to succeed in working with people in the Philippines, you need your cross-border business payments to be well organized and run smoothly. If funds don’t clear quickly, you risk causing cash flow problems for your employees and contractors, and could even end up with a reputation for being late or slow about payments. You want to be able to track the progress of your payments, all while keeping fees and money lost in currency conversions to a minimum.

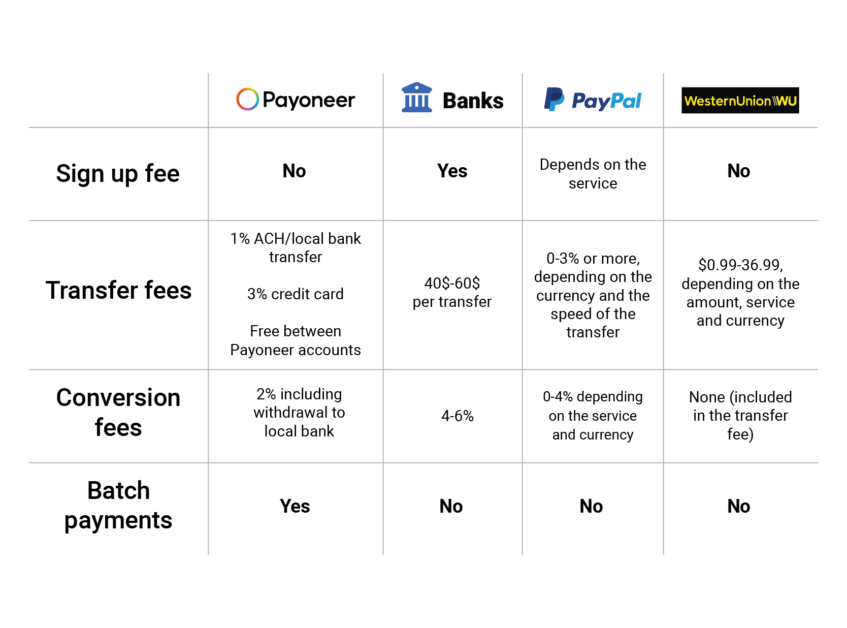

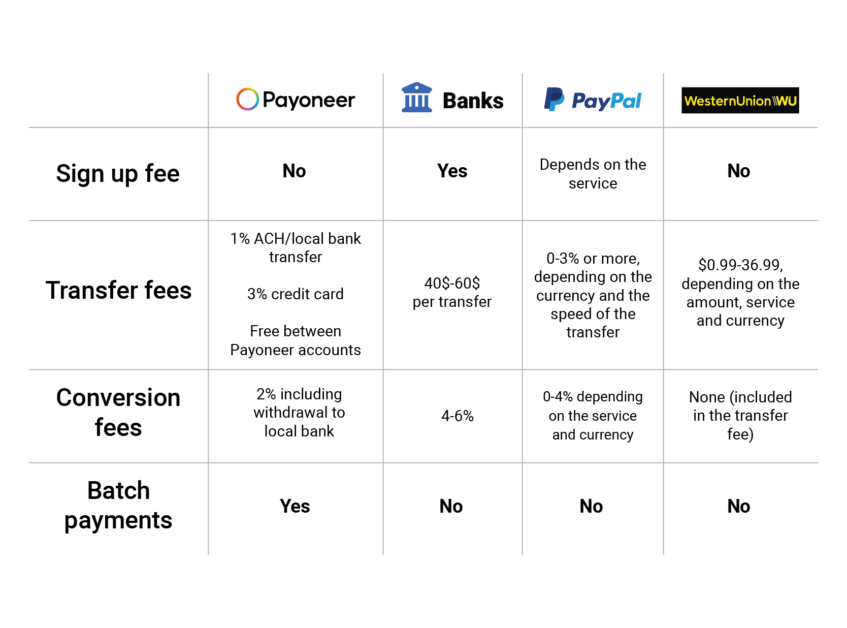

Here are some of the ways that businesses pay their employees and contractors in the Philippines.

Overall description

Preferred payment options for contractors and employees in the Philippines

Bank transfers

In 2015, the government of the Philippines launched the National Retail Payment System (NRPS) which created two automated clearing houses for bank to bank transfers between any business accounts in the country, called PESONet and InstaPay. During COVID-19 these payment methods became much more popular for business payments, because they are secure and reliable.

However, they don’t support international payments at the moment, so you won’t be able to use either InstaPay or PESONet unless you already have a local business account in the Philippines.

You can send money to remote employees and contractors in the Philippines through an international SWIFT bank transfer, just like you can to most countries in the world. However, SWIFT transfers are notorious for being hard to track, so if the payment gets lost along the way, it could be weeks before you find out what happened — if you ever do. SWIFT transfers can also come with hefty fees — the final amount depends on the bank you use, but they can cost as much as $85 from the US, plus you’ll probably have to pay commission for the currency exchange if you want to change USD into Philippine Peso (PHP).

Money transfer services

When bank transfers come with such high fees, it’s not surprising that people look for an alternative. That’s why money transfer services like Western Union, which has been around for decades, and its newer digital rival PayPal, are so popular.

Western Union supports international business payments in 54 currencies, with secure payments from your bank account, credit or debit card, or a cash payment in a supporting store. The fees are transparent and explained in advance, but depending on the payment method it could cost you as much as $97 for a $3,000 transfer, and funds can take up to 4 business days to clear into the recipient’s bank account. Western Union also caps payments at USD19,000, which might be awkward for larger companies.

PayPal is easy to use for international payments, and funds arrive within as little as a few minutes, although it takes an average of 3-5 working days for them to clear into your bank account. However, PayPal fees can run very high, with a transfer fee of 5% and a conversion fee of 4% for the Philippines, plus there’s no maximum fee limit on debit or credit card transfers. You’ll also have to pay a 2.9% funding fee, and another fee depending on which country you’re sending from.

Payoneer: A better way to pay partners in the Philippines

Payoneer makes it easy and cost effective to pay your remote workers or contractors in the Philippines from over 190 countries worldwide. You can make payments directly from the balance in your Payoneer account, or connect your credit card or US or Canadian bank account for funds to be debited automatically.

Once you’ve authorized the payment, recipients can withdraw funds to their local bank account in the Philippines at low fees. Payoneer connects with G-Cash too, a digital wallet that’s extremely popular in the Philippines. With Payoneer, your contractors in the Philippines can easily receive and access funds on G-cash.

It’s simple to use Payoneer to pay accounts in the Philippines. It only takes a few clicks to complete the payment order, and you can either initiate a payment or respond to a payment request. Payoneer also offers a batch payment function so you can pay multiple employees, freelancers, agencies, or suppliers with a single transaction order.

The benefits of using Payoneer to pay your partners and workers in the Philippines

Payoneer is the best solution for outsourcing agencies in the Philippines, which is itself the world’s outsourcing hub. With Payoneer, you can improve your relationship with contractors and freelancers and boost your reputation as an employer, by giving your payees the flexibility to decide how to use their funds.

When you send money through Payoneer, recipients can use Payoneer to pay their own contractors or employees for free, withdraw money in USD, PHP, or one of 150+ currencies at competitive rates, or use their Payoneer card to pay for expenses without fees.

Payoneer is great for you, too, helping you save money on cross-border business payments to payees in the Philippines. It’s free to make a payment in most currencies and costs just 1% of the payment amount if you’re sending it in USD, compared with 3-5% fees with PayPal and other alternative payment solutions. Payoneer changes just 2% total for conversion fees for contractors, but at a local bank it would cost you 4-6%.

Payoneer also makes life easier for businesses with lots of cross-border payments. The batch payments feature lets you authorize numerous payments with a single click, and you can link either your local credit card, or, your bank account if you’re in the US or Canada, so the money is taken directly from your account or card and you won’t have to worry that there might not be enough funds in your Payoneer account.

Finally, Payoneer payments are totally transparent. Both you and your contractors or remote employees can track the payment every step of the way, so there are no unpleasant surprises.

A better way to send payments to the Philippines

Payoneer makes it easy and low-cost to send secure, trackable payments to contractors, freelancers, remote workers, partners, or suppliers in the Philippines. Fast transfers help keep your recipients happy, and simple processes save you time and effort on bookkeeping and administration, so you can focus on growing your business.

[1] According to eligibility and current Payoneer offering