Credit Card Chargebacks: Everything Merchants Need to Know

What is a Credit card Chargeback?

A chargeback (also known as reversal) is a form of buyer’s protection provided by the credit card’s issuing bank, which allows customers to file a complaint regarding fraudulent transactions or a service dispute on their card statement. Once the buyer files a dispute, the issuing bank launches an investigation into the complaint. If the transaction is proven to be fraudulent or service was not rendered, the issuing bank refunds the original value to the buyer.

If you are the merchant in question and a buyer disputes a charge you’ve made, you’ll need to provide proof that the transaction was legitimate.

If you do not do so – Payoneer will accept the buyer’s chargeback and will debit your Payoneer balance for the transactional value, along with an additional fee. If the buyer’s chargeback was proven as untrue (based on the merchant’s rebuttal documents), the merchant’s account will not be charged.

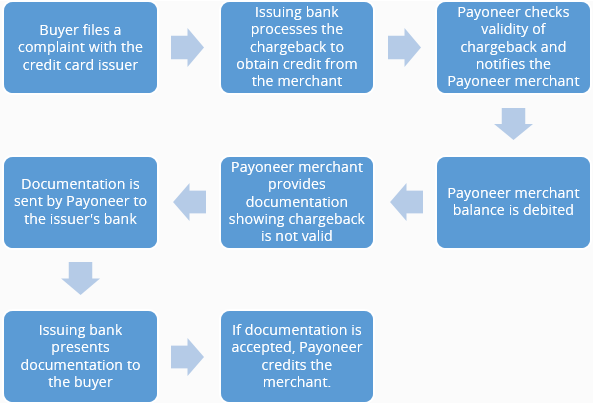

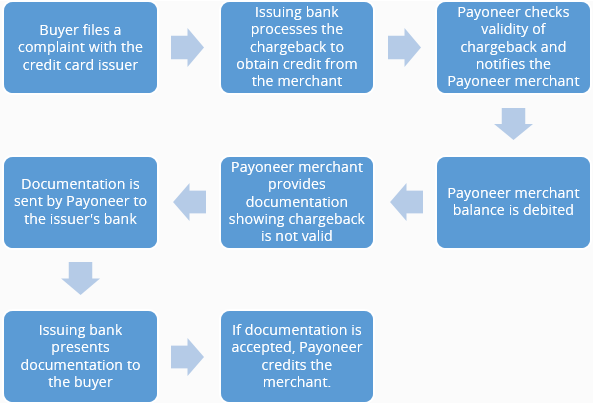

Chargeback Life Cycle

As a merchant accepting credit cards as a form of payment, it’s important to understand how a chargeback is processed and what’s expected from you as a merchant. As seen in the chart below, the chargeback process is complicated and involves many entities. A typical chargeback process lasts between 3 weeks and up to 6 months.

Reasons for Chargeback

Chargebacks are common practice and sometimes unavoidable. There are multiple reasons why a buyer would request a chargeback, but most fall under these three explanations:

Fraudulent transactions

This happens when the credit card is used without the authorization of the credit card holder. Merchant is fully responsible to remedy this chargeback reason. For example: the credit card is stolen and used to make purchases at the merchant’s online store.

Service dispute

Disputes can occur when buyers feel that a service was not rendered or an item was not as described. In these cases, buyers will often request a chargeback. Merchant is fully responsible to remedy this chargeback reason. Example: an item purchased in a merchant’s online store does not match the description.

Technical reasons

Technical problems can occur in the payment process, such as duplicate processing or untimely authorizations. Technical problems between Payoneer and the acquirers may rarely cause inconsistencies. Should they occur, Payoneer will take full accountability for any technical misconduct and will remedy the chargeback for the merchant.

What Does this Mean for Payoneer Merchants?

First of all, it’s important to understand that chargebacks are a natural part of business. Disputes can occur even with the best business practices. Understanding what your responsibilities are as a merchant will help you to protect yourself, your business, and make the process with Payoneer as smooth as possible.

Merchants need to ensure they’re offering prompt customer support to their clients, high quality products and services, and dispute-resolution options without escalating to a chargeback. If your buyer contacts you with a dispute, it is best to resolve the dispute directly with the buyer and not have the buyer contact his credit card issuer.

Providing the buyer with a refund is the best way to resolve a dispute quickly.

Take the necessary steps to detect fraud: Merchants should keep track of all payments to their Payoneer account and report any suspicious activity to Payoneer immediately. There are warning signs all merchants should be aware of, before accepting payment from buyers:

- Transactions or buyer details you do not recognize

- Multiple orders made within a short period of time, by the same buyer or multiple buyers

- Buyer name inconsistent with client name you’re familiar with

- Orders made using multiple credit cards

- Buyers contacting at strange hours, changing requests or demanding urgent service

While chargebacks may be an inevitable part of running a business, there are ways to minimize the chances of dealing with them:

- Be clear and honest with your buyers. Provide your buyers with your contact details and the hours during which they can contact you, so they know what they can expect from you. Present all details upfront and not after a payment is completed. This will make your buyers will feel comfortable contacting you directly rather than involving their credit card issuer if something goes wrong.

- Verify your buyers’ identity. Make sure you’re providing your services to a buyer you have communicated with at least once before accepting a payment. Make sure the person you’re communicating with is the one that is also paying you; varying identities is a red flag for fraud.

- Save all your emails, communication threads and invoices. If you’re communicating through a messaging platform such as Skype or WhatsApp, create screen shots of your conversation and save them periodically.

- Save proof of service documentation. These include: sales invoices, contracts, shipping confirmations or delivery slips. For service providers, proof that service was provided can include emails with attachments. If you provided a digital service, proof of buyer’s login history and downloads can be helpful.

- Make your refund policy and T&Cs visible and easy to find on your website. If a buyer is ordering a product from you online, make acceptance of the agreement mandatory for purchasing processes.

- Refund your customers. Many business owners choose the “customer is always right” approach to minimize damages and encourage repeat business; this may mean taking the responsibility for a dispute, whether or not you agree with the buyer.

- Keep your buyers well informed. Communicate order statuses, present progress updates or shipping tracking options so that your buyers know what to expect.

What is a Retrieval Request?

A retrieval request is initiated when a buyer does not recognize a charge on his credit card statement. A retrieval is usually a preliminary action before a chargeback (but not always). To answer a retrieval request, the merchant needs to provide a copy of the sales draft or any related documentation which can prove that the transaction happened within 10 days.

Retrieval requests are crucial timing-wise. If you fail to answer the retrieval within 10 days, the chargeback will be processed without your consent.

What Kind of Proof is Needed from the Merchant to Dispute a Chargeback?

To answer a retrieval or chargeback you need a signed document. As an online merchant, most orders confirmations are emailed or communicated through indirect online solutions. Emails are not always considered a signed sales document, even if they were sent from the buyer’s email address. A shipping slip won’t always help either– depending on why the buyer is filing a chargeback (if the buyer claims he did not authorize the charge, a shipping slip is not relevant).

Friendly Fraud and You

“Friendly fraud” is an industry term which refers to a fraudulent claim made by a buyer. This usually describes a purchase made by the buyer in which payment was sent and the products or services were received. The buyer disputes the payment with the credit card issuer, thus getting his money back and keeping the product/service provided. This known fraud pattern is the trickiest to prevent and very difficult to remedy. The fraud involves a dishonest person who wishes to keep the service or product without actually paying for it.

FAQs

WHAT SHOULD I DO IF I RECEIVE AN EMAIL FROM PAYONEER WITH A CHARGEBACK NOTIFICATION?

Payoneer will send notify you immediately with an email when a chargeback is filed against you. The email will display the payment ID, the chargeback reason, timeframe and necessary rebuttal documents to provide. Reply to the email as soon as you can with all supporting documents, or accept the chargeback claim. It is also advised that you contact your buyer directly about the chargeback. If both parties are willing to come to a mutual solution, your buyer can reverse the chargeback.

WHAT SHOULD I DO IF I RECEIVE A RETRIEVAL REQUEST?

Provide all supporting documents related to the transaction being questioned. Payoneer will review the documents and submit them to the credit card issuer for processing.

WHY IS THE CHARGEBACK AMOUNT DEBITED FROM MY PAYONEER BALANCE?

As a merchant, you are accountable for all payments processed to your Payoneer balance, including those that are later reported as chargeback. When a chargeback is processed against your merchant account, you are required to provide all information you have in order to reverse the chargeback. If your rebuttal documents are sufficient, and the credit card issuer accepts the rebuttal – a full credit will be issued to your Payoneer account.

I PROVIDED REBUTTAL DOCUMENTS TO A CHARGEBACK, HOW LONG UNTIL I RECEIVE CREDIT?

The chargeback process involves many parties – the card issuing bank, the buyer, the merchant and Payoneer. The time it takes to resolve a chargeback depends on the initial reason the chargeback was filed. It can take a month to 6 months until the account is credited, providing the rebuttal documents are accepted. Payoneer will notify you whenever there’s an update.

WILL CHARGEBACKS PREVENT ME FROM DOING BUSINESS?

Standard industry practices allow a merchant to operate even when chargebacks are filed against them on a monthly basis. However, there is a certain limit that banks and issuers allow; the limit differs from companies and merchant verticals but the general guideline allows merchants with a chargeback ratio (the ratio between number of transactions and number of chargeback transactions on a monthly basis) of below 1% to continue to operate. However, merchants that are not able to provide supporting documents or refuse to cooperate with Payoneer will most likely have their account closed.

A BUYER CONTACTED ME AND ASK FOR A REFUND. WHAT DO I DO?

Contact Payoneer. We will issue a refund for your customer and debit your Payoneer card accordingly. If there’s no sufficient balance on the account at the moment of the refund, a pending debt will be placed which will be debited the next time the account is funded.

Do you have more questions about chargebacks or buyer disputes?