Mastering international B2B payments: A practical handbook for digital business owners

A handy guide to international B2B payments for entrepreneurs and digital business owners

The growth of digital business has opened up new opportunities for entrepreneurs all over the world.

And, with the rise of cross-border digital payment solutions, businesses can now easily sell their products and services to customers globally.

The benefits of B2B payments are numerous. First, they offer a faster, more secure, cost-effective way for businesses to make and receive payments.

Unlike traditional payment methods such as checks or wire transfers, digital payments can be made in real time, with funds transferred instantly between accounts. This provides greater control over cash flow and reduces the risk of errors and fraud.

Despite these benefits, SMB owners can still face challenges when dealing with cross-border payments.

Fluctuating exchange rates and high fees can quickly add up, making international payments a real challenge. Legal and regulatory hurdles can further complicate the process. If you’re not careful, these challenges can railroad your business plans.

We invite you to read the below guide to understand the world of international business payments a little better so that you can confidently expand your business globally and take advantage of new opportunities in the digital age.

The importance of B2B digital payments for growth-oriented SMBs

As more businesses expand internationally, the need for appropriate cross-border payment solutions becomes increasingly important.

For small and medium-sized businesses (SMBs) seeking to grow their businesses globally, digital payments are a logical first step.

This comprehensive guide will cover everything you need to know about international B2B payments.

Different types of international B2B payments

Before making an international payment, it’s essential to understand the different payment options available. Some of the most common types of international payments include:

- Wire transfers: A wire transfer is a direct transfer of funds from one bank account to another. It’s a quick and secure way to make international payments, but it can be expensive and time-consuming.

- Credit card payments: Credit cards are widely accepted worldwide and offer a convenient payment option for international transactions. However, they can come with high fees and foreign transaction charges. Payoneer Commercial Mastercard® options are also available.

- ACH bank debit: Automated Clearing House (ACH) bank debits are a cost-effective way to make international payments. They’re electronic funds transfers between bank accounts, typically faster and cheaper than wire transfers.

- Online Payment Platforms: Online payment platforms such as PayPal, Stripe, and Payoneer allow businesses to send and receive payments from clients anywhere in the world. These platforms offer multiple payment options, including credit cards, bank transfers, and ACH bank debit.

- Cryptocurrency: Cryptocurrencies such as Ripple (XRP), Bitcoin (BTC), Litecoin (LTC), and Ethereum (ETH) can be used to send and receive payments across borders. Cryptocurrencies are decentralized on the blockchain and operate independently of traditional financial institutions.

- Letters of Credit: A letter of credit is a financial document issued by a bank that guarantees payment to a seller if certain conditions are met. Letters of credit are often used in international trade to assure both the buyer and seller.

- Checks: While less common than other forms of international payments, checks can still be used to make payments across borders. However, processing times can be longer, and fees may be higher than other payment methods. In addition, check fraud is a serious concern, so it’s best to avoid checks unless they are bank guaranteed & fully verified.

What about fees and exchange rates for B2B digital payments?

When making international B2B payments, consider the fees and exchange rates involved.

Unfortunately, many banks and payment providers charge crazy-high fees and unfavorable exchange rates, which can significantly impact your bottom line.

To avoid these fees, consider using a payment platform like ours.

We offer competitive exchange rates and low fees, making our platform an ideal solution for SMBs looking to grow their businesses globally.

When sending and receiving international payments, there are a few best practices to keep in mind:

- Always double-check the payment details: Ensure you have the correct account information for the recipient to avoid delays and additional fees.

- Consider the timing: International payments can take several days to clear depending on the payment method. Plan accordingly to ensure that the payment arrives on time.

- Monitor exchange rates: Exchange rates can fluctuate rapidly, so it’s important to keep an eye on them to ensure you’re getting the best possible rate.

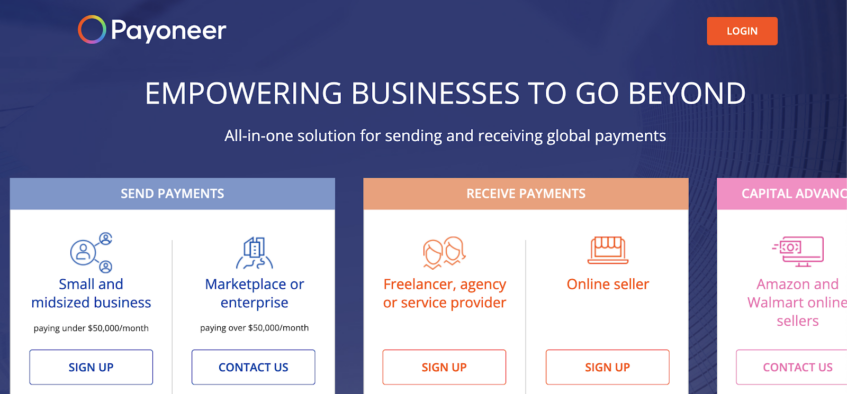

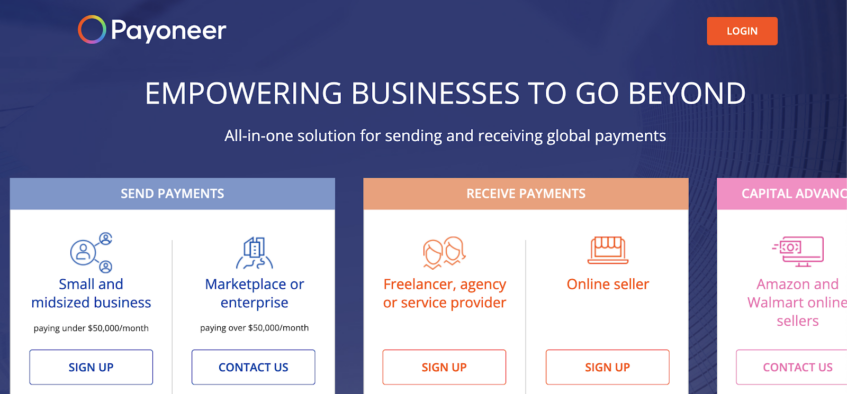

How Payoneer can help you with B2B digital transactions

We offer a range of SMB financial management features to help entrepreneurs and digital business owners streamline international payment processes.

These include:

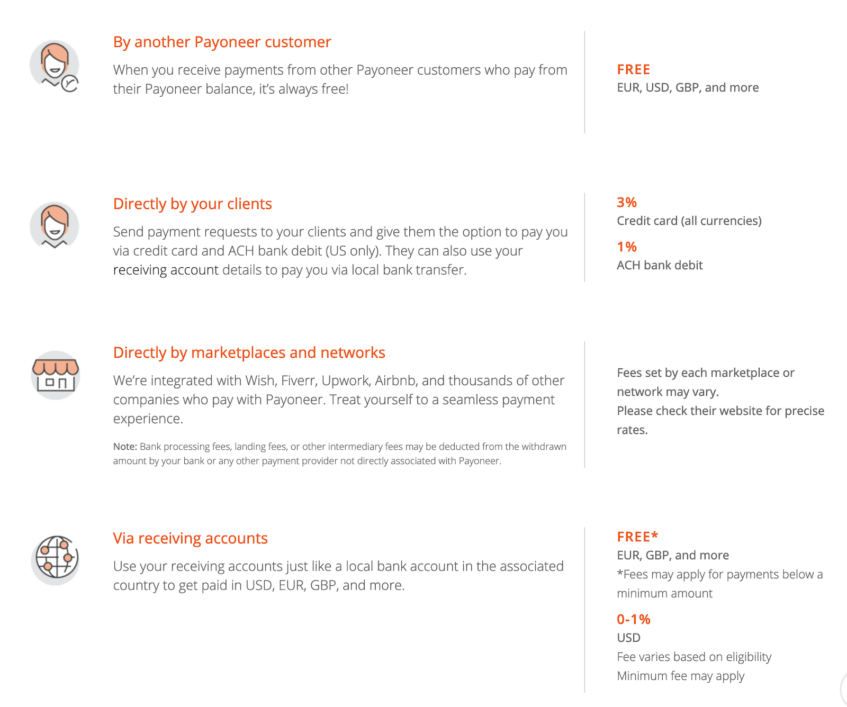

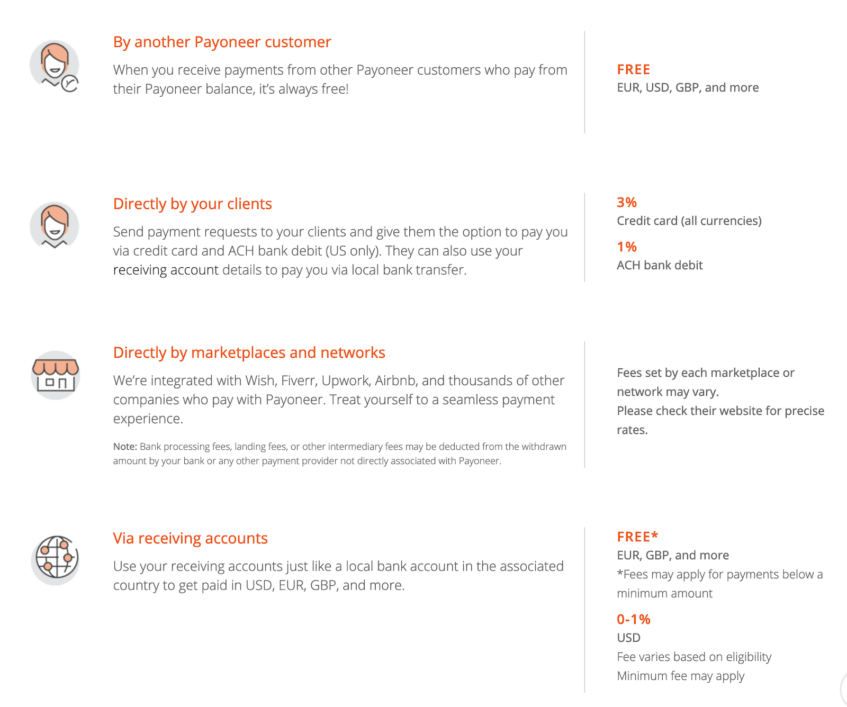

- Multiple payment options

- Low fees & no hidden costs

- Competitive exchange rates

- Advanced fraud protection and security measures

- A user-friendly dashboard for managing payments

- Easy integration with popular ecommerce platforms

International B2B digital payments can be complex, but with the right payment platform and knowledge, SMBs can successfully grow their businesses globally.

We provide a comprehensive solution for entrepreneurs and digital business owners, making international payments much easier, more secure, and affordable.

Sign up for an account today and explore our platform’s engaging features.

As small and medium-sized businesses (SMBs) expand globally, they face a growing need for appropriate cross-border B2B payments solutions.

But, unfortunately, a lack of reliable cross-border payment capabilities is holding many businesses back.

To compete on a global scale, SMBs need to be able to manage multiple currencies, stay on top of accounting, and ensure compliance with local and global regulations. However, building these tools in-house can be challenging for most SMBs.

Some of the main challenges facing SMBs in their quest for better digital payments:

- Delays in processing payments: Delays in payment processing can affect cash flow, limit access to working capital, and make it difficult to forecast future revenue.

- Organizing and managing global payments: Organizing and managing global payments requires ongoing resources that SMBs may not have or could put to better use elsewhere in the organization.

- User experience: User experience is critical to the success of any payment system. Clients and customers may seek alternatives if the payment system is not user-friendly.

- Regulatory compliance: As financial and business regulations continue to evolve, digital payment solutions must comply with all of them and keep up with any changes.

To address these challenges, SMBs need a user-friendly digital platform to manage transaction monitoring and payment processing globally. Our platform offers a range of features that can help SMBs streamline their international payment processes.

These features include competitive exchange rates, low fees, multiple payment options, easy integration with popular e-commerce platforms, advanced fraud protection and security measures, and a user-friendly dashboard for managing payments.

Our platform allows SMBs to better manage their international payment needs and focus on growing their businesses globally.

What SMBs should look for in an international B2B payments partner

Small business owners should also consider the following factors when choosing a B2B digital payments solution:

- Credibility and reputation of the provider in the industry, including customer reviews and awards received.

- Transparency and clarity in the pricing structure, with no hidden costs or surprise fees.

- Functionality that allows for customization and flexibility in payment processing, such as setting up recurring payments or automating certain tasks.

- Variety of options for payment methods and currencies, ensuring that customers worldwide can make payments in their preferred method and currency.

- Regulatory compliance with local and global laws and regulations, including measures to protect against fraud and ensure data privacy.

- Robust customer support, with knowledgeable representatives available to promptly answer questions and resolve issues.

- Integration with other software and platforms commonly used by small businesses, such as accounting software or e-commerce platforms.

Choosing the right digital B2B payments solution can make all the difference in a small business’s ability to expand globally and manage international payments efficiently. By considering these factors and selecting a provider that meets their needs, SMB owners can streamline their payment processes and focus on growing their businesses.

A b2b digital payments platform can help SMBs grow using a third-party payment provider is a simple approach to digital cross-border payments, but choosing the right platform is important.

For more information and guidance on how digital payments can help SMBs grow and how to select a digital payments provider, read the full International B2B Payments Guide for Entrepreneurs and Digital Businesses. Get the full guide