Alternative to opening a business bank account in Australia

Australia’s economy is thriving, with plenty of small and medium businesses (and large ones too) that make excellent clients for companies all over the world, plus it’s a popular base for digital nomad entrepreneurs or freelancers who work for businesses overseas. The chances are good that you could be working with suppliers, contractors, or clients in the land down under, so you’ll want a smooth, hassle-free way to manage cross-border business payments to Australia.

The simplest way to handle your business in Australia is through a local Australian bank account in Australian dollars (AUD). That way, nobody has to pay high currency conversion fees, you can keep your money in AUD to pay local expenses instead of leaking money on currency conversions, funds clear quickly, and it’ll be much easier to track your payments. But opening a local business bank account in AUD isn’t always that simple.

Get local AUD bank account details

How to open a business bank account in Australia

Australian banks permit you to open a business bank account even if you’re not a citizen or a resident. But you do have to get an Australian Business Number (ABN) or Australian Company Number (ACN) first, by registering your business with the Australian tax office and ASIC, the Australian business regulatory body.

Australia recognizes a number of different types of businesses, including a sole trader, partnership, a public or private company, and trusts. You might have to bring different documents depending on what type of business you’ve registered as.

Australia’s “Big Four” banks — the National Australian Bank (NAB), Commonwealth Bank (CommBank), ANZ Bank, and Westpac — all offer business bank accounts for non-Australians, including online business banking and foreign currency business accounts. There are also some big international banks, like CitiBank and HSBC, which offer business bank and foreign currency accounts. You’ll have to open a “regular” business account before you can add and link a foreign currency account.

If you have a locally-based representative of your business, like an Australian partner, you’ll find your application for an account goes much faster. You can still open an account without one, but you can expect it to take more time, and you’ll have a lot more financial checks.

Most Australian banks require you to come in person to complete the process of opening an account, although you can usually begin the application online so as to speed things up. You can nominate just one person to open the account, and that person can then authorize other signatories later on. That way, only one person has to supply personal identification documents and only one person needs to go in person to complete the process

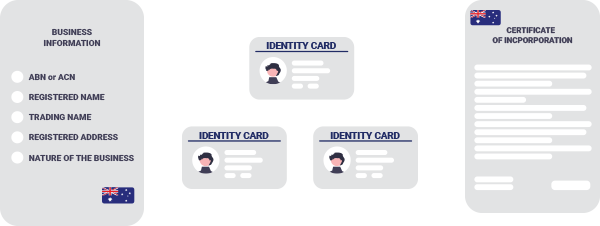

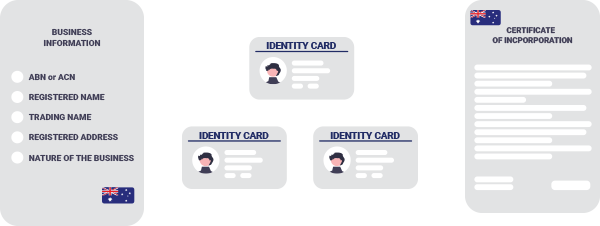

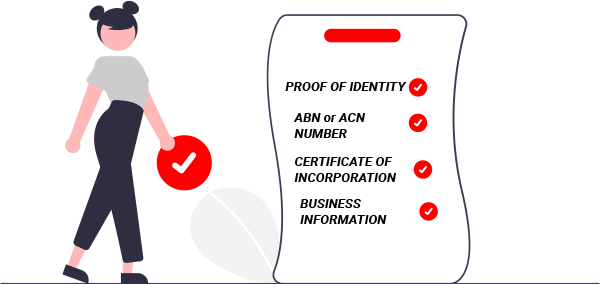

Here are some of the documents you can expect to bring to open a business bank account in Australia.

- Proof of identity and address for all the signatories, the directors of the company, and any shareholders with more than 25% of the shares.

- A certificate of incorporation or business registration

- Your ABN or ACN

- Your business’ official registered name, trading name, and registered address

- Information about the nature of your business and where your business takes place

If anyone who’s involved in the business is a US citizen, then they’ll also have to provide a tax identification number. If your business is in financial services, you might have to share more details and documents.

Australian banks typically offer a number of types of business accounts. You’ll probably want a business transaction account (checking account), which is meant for daily activities like deposits, withdrawals, and sending payments and charges. Banks also offer business savings accounts, which you can use to earn interest on your profits, and a business term deposit account with fixed account terms and interest rates.

Most Australian banks charge a flat monthly fee of around AU$20 for business transaction accounts, but some waive fees for the first 12 months. Some banks offer a pay-as-you-go structure, where you’ll pay a fee for each activity. It can be worth it if you don’t have a lot of transactions. You’ll also have to pay an extra fee for international payments, which can be anything from AU$10-AU$30 per transaction. Business savings accounts don’t usually come with fees.

Some banks, like CommBank and NAB, allow you to verify your details and documents online, but that only applies to some business accounts.

There are also some online-only banks that offer a business bank account in Australia. For example, Revolut has business accounts that support 27+ currencies, including AUD, with free international payments and transfers for a flat monthly fee. However, Revolut is only open to businesses registered in the US, EEA, and Switzerland. AirWallex also offers an online business account that supports 11 currencies, including AUD, but currency conversion rates aren’t always competitive, and there’s no mobile app. Custom support is available only through email, not chat or phone.

A simpler path to a local AUD account with Payoneer

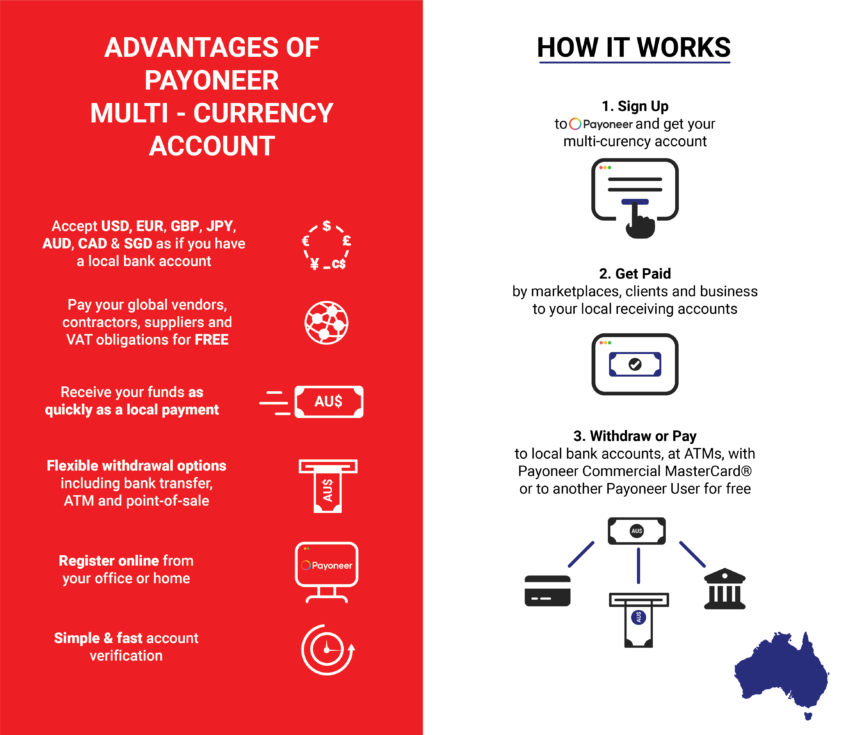

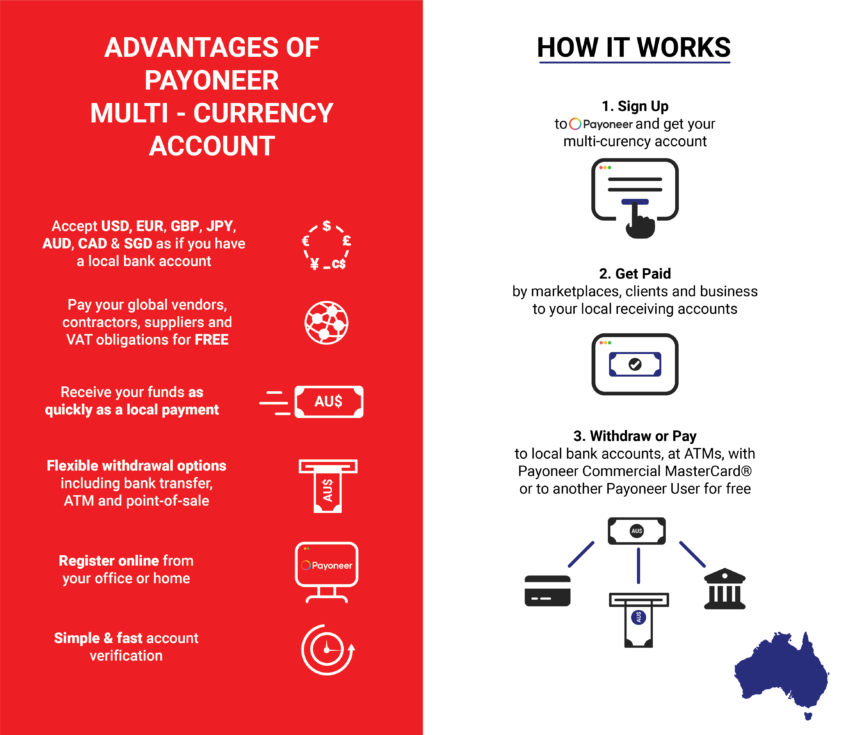

Payoneer helps you receive payments from customers and clients based in Australia, manage currencies, and pay contractors, suppliers, or remote employees in Australia. Instead of jumping through hoops to open a business account in a local Australia bank, you could use Payoneer instead.

Payoneer offers a local receiving account that works just like a local Australian bank account, so you can accept payments in AUD. Anyone you work with who has an Australian bank account can use the same domestic bank transfer network to make a convenient local bank transfer to your Payoneer AUD receiving account.

It’s easy to set up your AUD business account with Payoneer. Just register with Payoneer and choose which local receiving accounts you need[1] — in AUD, HKD, SGD, GBP, EUR, CAD, or USD. You’ll soon be able to view your account details and share them with clients on your invoices, through email, or over WhatsApp.

You can withdraw funds in over 150 different countries and currencies for a low, transparent fee, and international payments to AUD receiving accounts are free. If you prefer, you can hold them in your Payoneer account in AUD and use the funds to pay local taxes or global contractors either to their Australian bank accounts, or to their Payoneer account.

Experience the difference of having an AUD business bank account

With a local AUD business bank account, you’ll be able to build better relationships with clients, freelancers, suppliers, and contractors in Australia. Australians, like everybody else, feel more trust for their local payment systems and are nervous about the risk of fraud or of payments going astray in international money transfers, so they prefer to work with people who have a local bank account.

Additionally, you’ll save time by avoiding those complicated, time-consuming forms that you have to complete each time for bank transfers. Your money management will be easier when you don’t have to change currencies so often, and payments will process faster, be more transparent, and easier to track.

It’s simpler to handle invoices, receipts, tax returns, and other bookkeeping chores with an AUD account too. Most bookkeeping tools can only connect with a local business account, so if you want to automate income, expenses, and tax calculations and pay them automatically online, you’ll need a local AUD account.

Last but not least, having a local AUD account saves you money. You’ll enjoy lower foreign currency conversion fees or even fee-free payments, and stop losing money when exchange rates fluctuate. Instead of paying high fees to use a foreign debit or credit card, you’ll be able to just use your AUD card. Platforms like Amazon, eBay, and Upwork all pay out faster when you can link a local bank account, and you stop losing out on their currency conversion calculations.

A fuss-free path to a local AUD business account

Payoneer offers all the benefits of a local AUD business bank account, but without the time, fuss, and expense of satisfying traditional local, international, or online banks. Payoneer’s fast payment processing, ability to send and receive payments in AUD, and simple, low-cost foreign currency conversions help you simplify your interactions with employees, freelancers, suppliers, and clients in Australia, no matter where in the world you and your business are located.

[1] According to eligibility and current Payoneer offering