How to Expand Your eCommerce Business to the U.S.

Editor’s Note: This is a guest post written by Scott Letourneau, CEO & Founder of Nevada Corporate Planners & Sales Tax System.

As a global eCommerce seller, you already know the largest eCommerce market is in the U.S., but if you’re considering making this critical expansion for your business, there are some vital factors to consider.

If it’s possible to expand and make changes later, of course, some of those changes may create unexpected consequences, and knowing the full picture upfront will be helpful.

We’ve found that successful eCommerce sellers who expand globally have several factors in common. One is the ability to plan effectively, which involves thinking three moves ahead.

In this post we’ll be addressing some of the steps you can take to ‘think ahead’ and ensure your expansion plans are carried out successfully.

Is a Foreign or U.S. Entity Structure the Best?

This is the first step and question you should be asking, and its one that should not be taken lightly. You may sell into the U.S. from a foreign entity, but you may want to consider forming a U.S. entity, especially if you’re looking to sell on multiple marketplaces.

Some eCommerce sellers expand into the U.S. using a foreign entity, and that’s an option. Typically, this is a new seller wanting to do business in the U.S. with a foreign entity, but looking to keep their costs down.

This approach is also useful if you’ll test your sales and profitability in smaller markets, such as Canada, to determine if you want to stay in that market. As the largest market globally, the U.S. doesn’t require a test, just your commitment.

Where Should You Structure Your Business Legal Entity?

Do you operate with an entity in your country to sell into the U.S., or do you form a separate U.S. legal entity? In regards to your business structure, there are advantages and disadvantages to each approach.

Expanding to the U.S. with a Foreign Entity

The main advantage of expanding to the U.S. with a foreign entity is that it keeps your costs down by simplifying your banking and accounting because everything is under one company. You’ll still keep your accounting for each marketplace place separate, but, overall, you’ll be operating one company.

If you’re expanding to the U.S. with a foreign entity the costs are slightly less compared to forming a separate U.S. company. As far as your U.S. tax responsibilities are concerned, these will be the same, depending on your engagement as a U.S. trade or business.

Foreign Seller Entity Disadvantage

The disadvantage of operating with a foreign entity is that all your liability is in one entity. You’ve heard the saying before, “Don’t put all your eggs in one basket.”

Any liability from your U.S. business will impact all your business revenue that is operating out of one entity, that is a considerable risk to take.

Expanding with a U.S. Entity

You’ll separate your liability from your existing foreign e-commerce business with your new U.S. e-commerce business. Imagine being involved in a crippling lawsuit in your home country.

Would you rather lose 100% of your business or only 50%, because the other half was in a U.S. entity, outside of the jurisdiction of your own country?

Granted, the U.S. is the most lawsuit crazy country globally, and product liability guidelines are being reviewed in many markets, including the E.U. You can indeed sell your eCommerce brand through a foreign entity or U.S. entity virtually the same, yes.

When someone buys your U.S. brand, they take over your account, inventory, and intellectual property; they’re not buying the stock or membership in your entity.

Even with this transaction, your attorney would much rather have you purchase from a U.S. entity, versus a foreign entity, due to all the laws under one country. It’s also easier to obtain U.S. product liability insurance with a U.S. company.

Finally, U.S. consumers would instead purchase from a U.S. entity, which will help your conversions and overall sales.

Which State is Best?

Choosing the best state for a U.S. entity is complicated. The big three are Delaware, Nevada, and Wyoming. Each has advantages and disadvantages, but most foreign sellers ask the wrong questions when launching a potential multimillion-dollar U.S. business.

Wyoming and Delaware have advantages in privacy and low filings fees. After all, “big companies” incorporate there. While it’s true that state fees should be considered, they must be in perspective to your overall business.

If you could invest $300 more to gain an extra layer of protection for your U.S. operation that protects that business back in your home country, would you make that investment? Once you understand the U.S. legal system, the process of a lawsuit against a company (even if the “owners” are private) will make you realize you may be able to hide, but your company can’t.

Services to Help You Expand to the U.S.

Whether you expand as a foreign entity into the U.S. or form a new U.S. entity, you’ll need the following services either linked to your foreign entity or a new U.S. entity to sell on multiple marketplaces:

- An EIN from the IRS

- S. Virtual Address Service

- Sales Tax Registrations

- Tax Support to File the Appropriate Federal and State Returns

1. Obtaining an EIN

As a foreign seller, you can call the IRS over the phone and obtain your EIN. You may have to call back countless times if the IRS is backed up.

The biggest challenge is making a mistake on the SS4 application. If you do, you cannot call back and fix it or submit an “amended” SS4. If you find yourself in this situation, you’ll need to work with a CPA to handle the IRS issue, which gets expensive.

2. U.S. Virtual Address Service

From a UPS Store to a U.S. virtual address service, there are many options for a service that will scan and forward mail for you. As an eCommerce seller, you know you’ll not have much mail because 95% of all invoices, bills, and payments are online. The critical U.S. exceptions are the IRS and state tax agencies.

Both taxing authorities are old school and mail out all-important tax notices to your address on file. Missing a critical IRS notice or state taxing authority notice may cost you multiple times more than your investment to expand to the U.S., so this is very important.

It’s more important to find a provider that scans this critical mail AND knows how to handle important mail. Does your provider have any experience with the IRS or state tax issues?

3. U.S. Taxes

There are two levels of tax: federal and state. To better understand any applicable U.S. income tax laws, there are different U.S. tax system levels to understand.

You’ll want to understand how your U.S. earned income is taxed. To do that, you’ll have to determine your company’s involvement in the U.S. Your degree of involvement will determine your U.S. federal tax responsibilities.

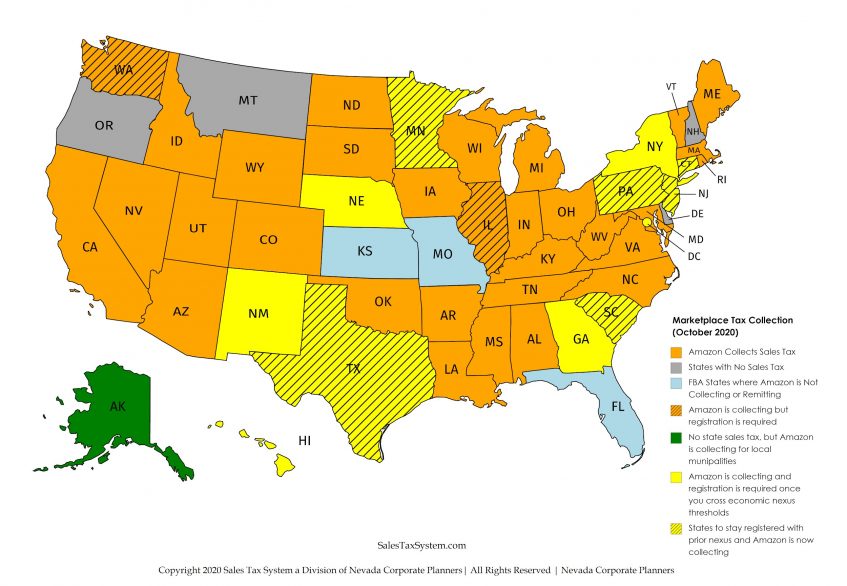

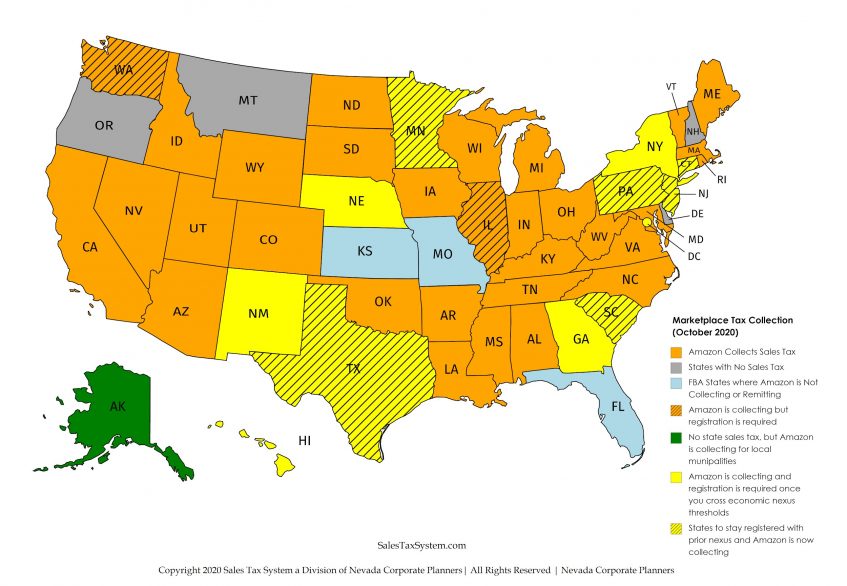

Sales tax is at the state, not at the federal level. Therefore, sales tax isn’t covered by federal tax treaties. Since it’s not covered, you must understand the different types of nexus (physical, economic, and marketplace) will determine which states you need to register for sales tax and file returns.

Below is a current chart for Amazon FBA sellers only as to which states they should register for U.S. sales tax and file sales tax returns. The big misconception amongst Amazon FBA sellers regarding sales tax is that Amazon is collecting in 44 states, so there’s no need to register for sales tax in any of them, which is NOT true.

Bottom Line

Expanding to the U.S. requires careful consideration before creating an Amazon.com Seller Central account or applying to sell on Walmart or additional marketplaces. Our team can help you with all the requirements listed above to have a successful U.S. expansion.

Need support with your U.S. expansion? Our team will send more insights to help you make the best decision for your U.S. expansion.