Getting paid via Bill.com? Make the most of your earnings by getting paid to your USD account with Payoneer!

If you’re working with American clients, or you’re a US payee sending payments to international contractors, suppliers, and agencies, you might already be familiar with Bill.com.

Bill.com is a cloud-based payment platform that helps thousands of Americans pay their invoices to contractors and suppliers around the world. Small business owners and contractors send in their invoices, and payees process the payment through Bill.com. With the help of Bill.com, Americans can send and record payments, coordinate bookkeeping and accounting, and stay on top of cash flow.

But when you’re the one receiving international payments, there are different obstacles to deal with. If you get paid in a foreign currency straight into your local bank account, you might have to immediately convert funds into your local currency, so you can’t hedge against currency fluctuations. If you’re getting paid in USD and the dollar is strong, like it is right now, that can cause you to lose money.

Plus you’ll have no choice but to accept your bank’s exchange rate, and banks usually charge unfavorable exchange rates and high conversion fees. When you need to pay others in a foreign currency, you’ll lose even more money converting funds back into the right currency. Fortunately, Payoneer provides a solution to this issue with a local receiving account in USD. This way, you can accept funds in USD from your clients through Bill.com, and make the most of international payments.

Here are some of the benefits of using Payoneer together with Bill.com.

The benefits of using Payoneer with Bill.com

By getting paid into a Payoneer local USD account, freelancers and contractors can:

- Receive payments in foreign currencies like USD from overseas clients, and hold funds in that currency until they are ready to use it or convert it to their local currency. This is very important today, when the dollar is strong and other currencies are falling.

- Save money on conversion fees when you convert your funds. Payoneer users can exchange money into 150+ currencies at favorable exchange rates and for a low fee of 2% when withdrawing funds and making local bank transfers.

- Enjoy lower transfer fees when you use your Payoneer funds to pay business expenses like suppliers, partners, or local tax obligations. Payoneer transfers cost just 1% for USD transfers and are free for all other currencies, plus Payoneer to Payoneer transfers are free in any currency.

- Avoid double conversion fees by holding income in USD (or other foreign currency) and using the balance to pay business expenses in that currency. This way, you won’t have to convert funds into local currency to withdraw to your bank account, and then convert it back into a foreign currency to pay expenses.

- Simplify global payment management. With Payoneer, small business owners can receive funds in multiple currencies into a single account, pay contractors and suppliers in their local currencies, and save time with batch and automated payments.

- Control how to use funds. Payoneer lets you decide whether to withdraw money to your bank account; buy online or instore with the Payoneer Commercial Mastercard®; pay partners, suppliers, and contractors into their Payoneer or local bank accounts; or hold money in your account in a number of currencies.

How to use Payoneer with Bill.com

Are you excited by the thought of using Payoneer to improve your cross-border payments? The good news is that it’s quick and easy to get started. If you don’t yet have a Payoneer account, you can register for one for free within just a few minutes.

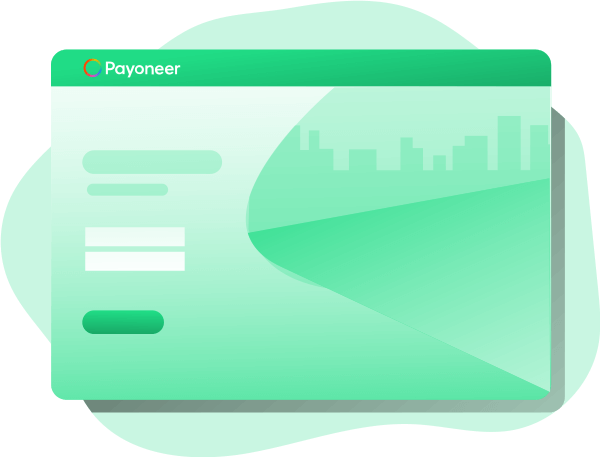

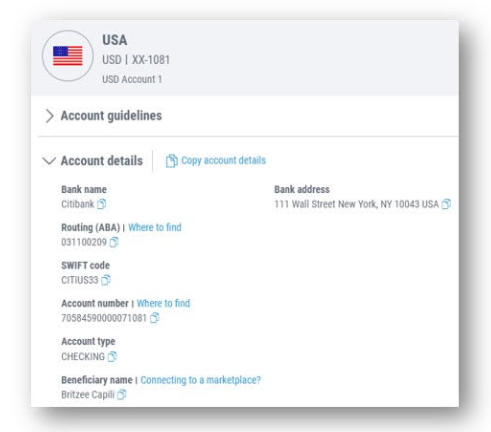

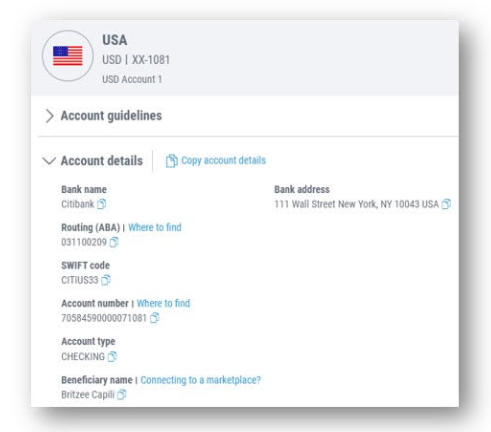

Once you’ve opened a Payoneer account, you can receive a USD local receiving account, with the same kind of bank account details that you’d get if you opened a regular local US bank account.

Now you can easily share your US bank account details with your clients via invoice, email, or WhatsApp. Simply log in to Payoneer, go to Get Paid > Receiving Accounts and USD, and copy your Payoneer USD account details. The page will look like this:

Your clients who pay you through Bill.com will need to add your USD account information under “Vendors.” They should open the Bill.com Navigation Menu, go to the Vendor Bank Info section, and then add:

- The name of the bank account holder (Beneficiary Name)

- Your routing number

- Your account number

- Re-enter account number

Once they click Save, they’ll see that your Payoneer account is now verified and they can send you payments. For more details, visit the Bill.com FAQ page.

Now your Bill.com payers can send funds through a local US transfer for zero fees into your Payoneer USD receiving account. All that’s left is to decide how to use your funds. It couldn’t be simpler!

Make more from your Bill.com account with Payoneer!

By using Payoneer to receive payments from clients through Bill.com, you’ll be able to save money on conversion and transfer fees, make the most of favorable exchange rates, stop losing money on unnecessary currency conversions, and enjoy more control over when and how you use your funds. Getting paid through Payoneer instead of a regular local bank account helps small business owners to maximize revenues and optimize global payments.