5 International Tax Compliance Pitfalls (and how to avoid them)

Editor’s Note: This is a guest post written by Stefan Mladenovic, CEO and Co-Founder at Taxually.

Anticipation, excitement, all those new customers and so many untapped markets just waiting to be explored!

Opening your business up to the world and taking your products or services across borders and into new territories is a thrilling step for any seller or entrepreneur.

However, there are a few things that might diminish the thrill ever so slightly and they’re to do with the complexities and intricacies of international VAT compliance.

It may not sound like the most gripping of subjects but there are multiple pitfalls and stumbling blocks you need to be aware of when making your venture across borders.

Here we’ll cover 5 of the most common international tax compliance pitfalls and how to avoid them as an online seller.

5 International Tax Compliance Pitfalls

When you’re looking at international expansion, you need to be armed with the right knowledge about your VAT liabilities. When it comes to VAT in different countries, you’ll need to know the following:

- VAT must be paid in local currency and at the local rate, which can differ from country to country. Currency fluctuations and exchange rate changes can make all the difference between profit or loss in individual countries.

- Many countries don’t even call VAT “VAT”. For example, in France it’s the rearranged acronym of TVA. The Spanish know it as IVA and the Germans refer to it as MWST.

- It takes time to get VAT registration arranged in different countries. In most countries it takes roughly 3-6 weeks, but in some it can take 10 or more weeks just for registration to be completed.

- With the advent of IOSS and OSS VAT compliance regulations it is a requirement that all businesses selling into European Union register for either of these programs dependent upon their registered place of business. At Taxually, we can manage this registration process and subsequent filings to the local tax authorities.

- There are different legislative requirements in each country for what constitutes a valid VAT invoice. What may be correct in Germany might not be sufficient in France or other countries for instance.

In addition, there are many more things to consider ensuring you’re compliant such as distance selling rules, local reporting deadlines, stock holding, and how you adjust your own margins per-country to name but a few.

The world of international VAT compliance can be complex and seemingly hard to navigate. But it doesn’t have to be if you have the right tools, support, and expertise to call on.

A Simple Solution to Cross-Border VAT Compliance

Those tools, support, and expertise you need are readily available from Taxually.

So, how can Taxually help?

In short, we take the pain and frustration out of cross-border VAT compliance, by providing you world-leading tech and expertise that enables you to focus on what really matters: selling.

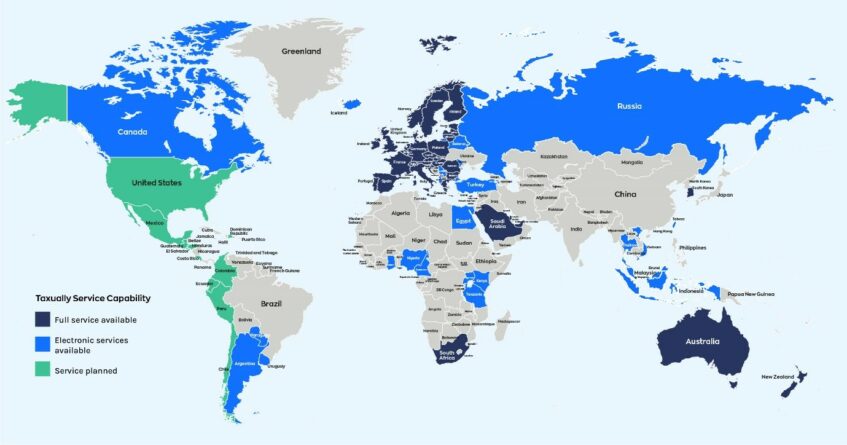

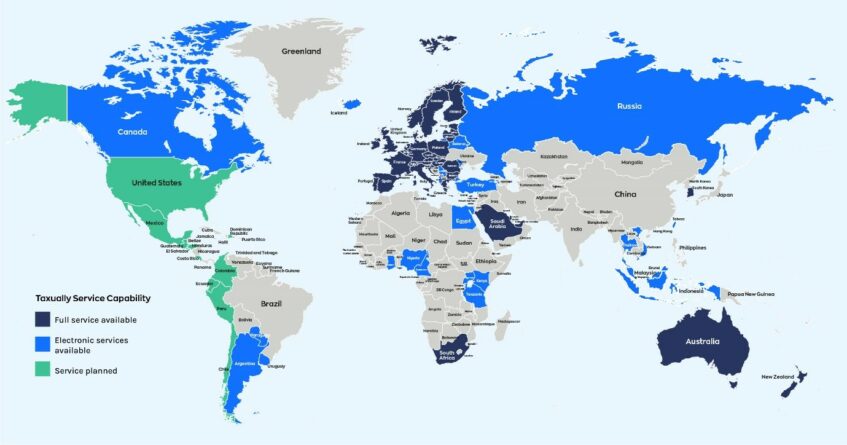

We’re already supporting thousands of eCommerce sellers, digital businesses, and marketplace merchants of all shapes and sizes – from SMEs through to Enterprise clients – all over the world and in all major markets as they expand their businesses and go global!

Wherever you’re based, we can handle any cross-border transaction for you. There isn’t a payment permutation or location combination that can’t be managed.

It’s what our clients have come to expect, and they now trust us to help them with all things VAT compliance for three main reasons:

- Our technology is borne out of tax expertise.

Our founders have over 35 years’ experience in the tax industry between them, meaning VAT and compliance is etched into our organizational DNA.

- We save you time, effort, and money whilst providing peace of mind.

Our customers save considerable time and effort with automated and instant VAT calculations.

- We handle EVERYTHING end-to-end

From the very start of the chain with country registration through to VAT calculation and return filing, we cover all the bases for our clients. We even cover fiscal representation which most of our competitors don’t.

Payoneer & Taxually Team Up to Help You with Your VAT Compliance Needs

We’ve joined forces with Payoneer to provide you with the same streamlined and efficient VAT registration and reporting services we already provide our clients around the world.

As an added bonus in celebration of this new partnership, you can get a 10% discount on your annual Taxually subscription.

All you need to do is make a payment through your Payoneer account and the discount will be automatically applied.

What are you waiting for? Get started today!