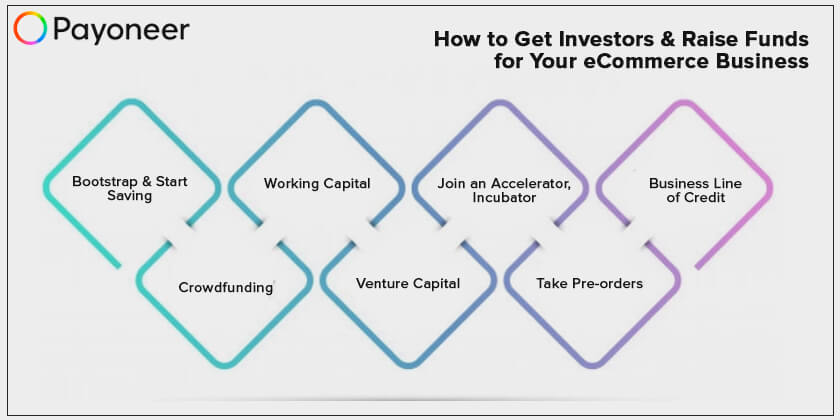

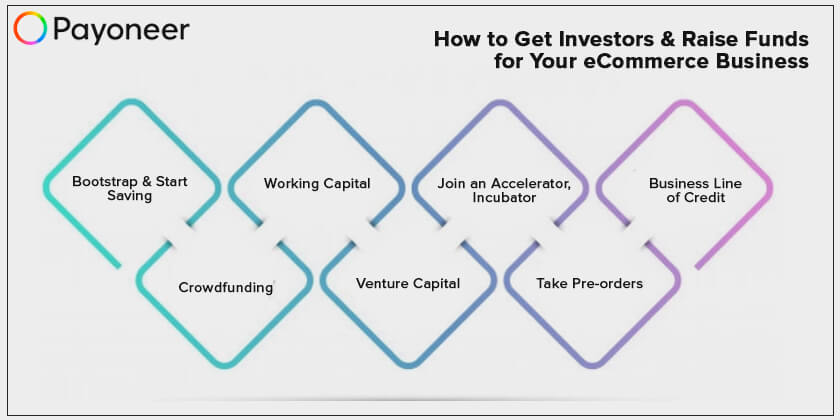

How to Get Investors & Raise Funds for Your eCommerce Business

Editor’s Note: This is a guest post written by Devansh Trivedi, Content Writer at Orderhive.

Starting a new venture is always a challenge as there’s whole lot to cater to, from order management to shipping to marketing and payments. However, if there’s one thing that is most likely to keep any new entrepreneur up at night, it’s figuring out a revenue model along with the ins and outs of how the cash would come in.

For example, eCommerce businesses have a pretty simplistic revenue model. They either manufacture the product themselves or onboard other manufacturers and sell it on their platforms. However, setting up an eCommerce business is a totally different ball game as the biggest challenge is gathering the amount needed to start up, before even making your very first sale.

This is a challenge many uninformed entrepreneurs face around the world, many of whom often end up with enormous amounts of debt from the loan sharks. However, it doesn’t have to be like that. Here we’ll look at some of the best avenues where any entrepreneur can raise funds for their new or already running eCommerce business.

Bootstrap & Start Saving

Sometimes, the best way to raise money is by simply saving it. A penny saved is after all a penny earned! Many founders prefer to go the old-fashioned way and save the funds that their business needs. This way, you can be certain that you would have full functional autonomy and will be free of any debt that comes with investments.

Join an Accelerator, Incubator or Mentoring Program

Like most things in life, there isn’t always a single blueprint for success in running startups. However, a little guidance from the experts can go a long way. Boot camps and incubators are both great places where digital entrepreneurs can spend some time honing their business acumen with the help of leading industry experts and fellow successful entrepreneurs.

These boot camps are rich with all the tools and resources that beginner entrepreneurs require and can also connect them to investors who are looking to invest in up and coming startups.

Crowdfunding

If you have an idea that solves the problems of a sizable population, going to the masses is one of the ways to raise money for it. Crowdfunding is a process where businesses ask people to invest in their company by raising funds in exchange for some of the equity and thanks to today’s plethora of online platforms like Kickstarter and GoFundMe, it’s easier than ever.

Any business can open its own crowdfunding page on these platforms and add all the details. Once the page is live, anyone, anywhere can invest in their business by visiting the page and buying a stake of the company.

Venture Capital

Another popular means of generating funds for your eCommerce business is by pitching your idea to venture capitalists. Venture capitalists are HNIs or companies that are looking to invest in an idea they find promising. They look for qualities like scalability and profitability, and if your business has the potential to meet their expectations, they can almost single handedly meet all your capital requirements. They buy a stake in your venture in return or lend you the amount and ask you to repay it with interest at the end of the term.

VCs have especially started investing in eCommerce since the global business community is quite upbeat about the unlocked potential of eCommerce around the world. This just may be a great opportunity to make a compelling proposition for your idea.

Business Line of Credit

A line of credit is an arrangement with either a financial institution or a seller, wherein you can avail their services or buy the goods at present and then pay for them at a later date. Since time immemorial, this practice has been the bedrock of flourishing trade relationships across the world.

A lot of eCommerce businesses, when just starting out, often don’t have the necessary resources to procure large amounts of products. So, they enter into a contract with the seller which allows them to buy the raw materials from them without having to make any upfront payment. Once they buy the goods, manufacture the finished product, and make a sale, they can pay for the raw materials.

Such an arrangement is known as a line of credit or a trade credit. Trade credits are given for a period of 30 to 90 days, however, they may also be given for a longer period of time, depending on the creditworthiness of the parties involved.

Take Pre-orders

Pre-orders are a great way to raise funds before even beginning to manufacture the products. If you’ve already made a name for yourself in the industry and are planning to launch a product but don’t have the necessary resources, you can cash in on your brand image in the market and open pre-orders for your product. You can always make things more exciting by offering special discounts or offers on pre-orders. Almost all the major brands opt for this route because it guarantees a certain amount of sales before they even roll out the product.

Working Capital

Working Capital Loans are short term loans that can help you secure the resources you need to start your business. These loans are provided by the banks and other lending institutions to businesses who either bank with them or are able to establish a fair amount of creditworthiness through their financial records. A working capital loan can help you take care of your day to day operational costs like wages, procurement and transportation of raw materials, payment of any outstanding bills, etc. Once your business starts to flourish, you can pay it back to the bank with interest within the stipulated time.

Conclusion

Finding the right channel to fund your business can be a tough nut to crack initially. However, once you understand the pros and cons of all the options available, it becomes much easier to zero in on the right choice for your company.