5 Best International Payment Gateway

The Best International Payment Gateway Solutions

In the competitive world of eCommerce, having a reliable and secure international payment gateway is essential.

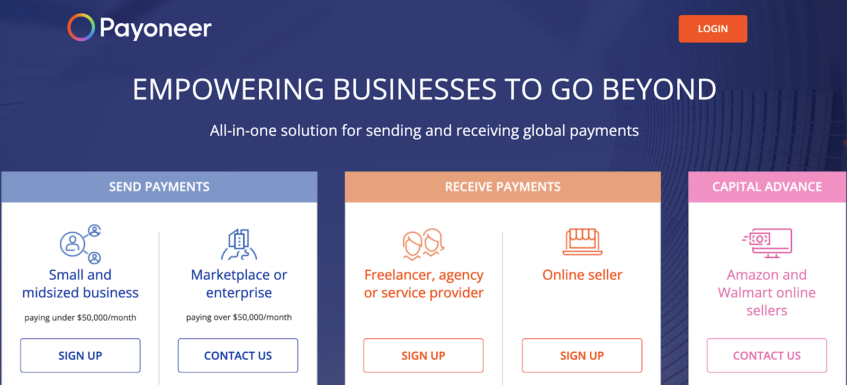

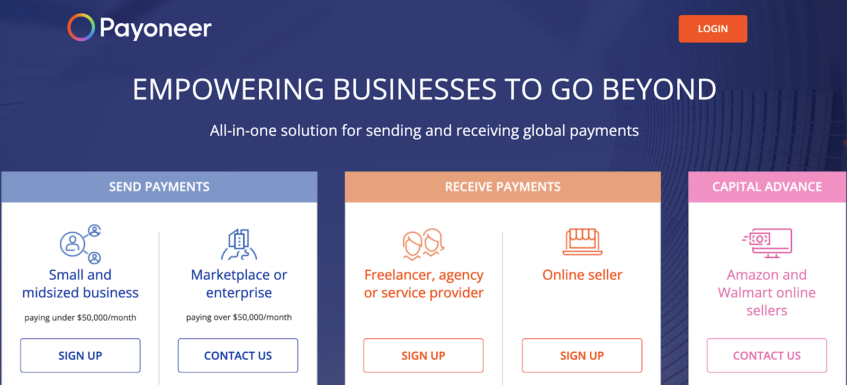

Payoneer is a premier solution for international payment processing, providing businesses with a range of benefits to help them expand their reach and offer their customers a seamless checkout experience. Not only can you use Payoneer to process payments, but you can also receive payouts through the platform.

One of the key features of Payoneer is its ability to receive payouts in multiple currencies, making it an ideal choice for businesses that operate globally.

With Payoneer, you can easily convert currencies and receive payouts from clients, marketplaces, and platforms from all over the world. This flexibility can help you reach new customers and expand your business while ensuring that you can easily access your funds and use them to grow your business.

In addition to its ability to receive payouts, Payoneer also offers competitive pricing, a user-friendly interface, proactive security measures, and integration with popular eCommerce platforms.

All of these features make Payoneer an ideal choice for businesses looking to streamline their payment processing and take their eCommerce business to the next level.

Choose Payoneer as your payment gateway and payout solution, and rest assured that your transactions will be fast, secure, and seamless.

Now we will introduce Payoneer’s list of the Top 7 Best International Payment Gateway solutions for eCommerce.

Best International Payment Gateway: Stripe

- Stripe’s software & APIs are used by millions of businesses for payment processing, payout management, and online business management.

- Stripe powers payments for eCommerce retailers and person-to-person retailers, software platforms, subscription businesses, marketplaces, and more.

- Stripe offers a range of tools to optimize payment processes, including fraud prevention, invoicing, virtual and physical card issuance, friction-reducing checkout options, financing, and spend management.

- Stripe provides unified payment functionality, allowing businesses to save engineering time and build what they need on a single platform.

- Stripe offers client and server libraries in multiple programming languages, including React, PHP, .NET, and iOS.

- Stripe allows businesses to customize and deploy payment interfaces directly from the Stripe Dashboard using no-code options.

- Stripe integrates with popular systems like Adobe, Salesforce, and NetSuite and allows businesses to sync Stripe data to their warehouse.

- Businesses can build custom backend integrations or interfaces within Stripe and list them on the Stripe App Marketplace.

Stripe is a leading international payment gateway solution utilized by millions of businesses of all sizes to process payments, manage payouts,

and handle online business operations.

In fact, Stripe’s online solutions deliver payment processing for some of the biggest names in the business world, from startups to Fortune 500s.

Stripe offers a wide range of products to suit the needs of businesses of all types, including online and in-person retailers, subscription businesses, marketplaces, software platforms, and more.

In addition to its wide range of products, Stripe is known for its technology-first approach to payments and finance.

With direct integrations with card networks and banks, Stripe operates at every level of the financial stack to optimize payment processes and improve conversion rates.

The platform is constantly improving and releasing new features, with an average of 16 production API deployments per day.

Stripe also boasts 99.99%+ uptime and is certified to the highest compliance standards, providing businesses with reliable and secure payment processing.

With its intelligent optimizations and powerful machine learning models, Stripe helps businesses increase revenue and streamline their payment processes, making it an ideal choice for international eCommerce businesses.

Best International Payment Gateway: Shopify

- Shopify is a complete commerce platform that lets businesses create, manage, and grow their online stores.

- Businesses can easily create and customize their online store and sell across multiple channels, including social media and online marketplaces.

- Shopify offers a suite of tools to manage products, inventory, payments, and shipping, allowing businesses to streamline their operations and focus on growing their business.

- Shopify is a cloud-based platform, accessible from anywhere and on any device, giving businesses the flexibility to manage their store from anywhere in the world.

- With multicurrency and multi-language capabilities, Shopify makes it easy for businesses to sell their products internationally and expand their reach.

- Shopify provides a range of payment options to customers, including Shopify Payments, making it easy for customers to complete their purchases.

- Shopify’s built-in fraud analysis tools and SSL encryption provide a secure and safe checkout experience for customers.

- Shopify provides businesses with access to a dedicated support team and the Shopify Expert Marketplace, where businesses can find qualified experts to help them with any aspect of their online store.

Shopify is a comprehensive eCommerce solution that allows businesses to manage and grow their online stores with ease.

With its cloud-based platform, Shopify provides businesses with the flexibility to access and manage their store from anywhere and with any device. This is especially beneficial for international eCommerce sellers who need to manage their business operations while on the go.

Besides accessibility, Shopify provides businesses with a range of features that make it an excellent choice as the best international payment gateway.

Shopify supports international sales with its multicurrency and multi-language capabilities, making it easy for businesses to sell their products to customers around the world. Shopify’s built-in fraud analysis tools and SSL encryption provide a secure checkout experience for customers, giving them peace of mind when making a purchase.

With Shopify Payments, businesses can accept a range of payment options, including credit cards and popular payment methods,

making it easy for customers to complete their purchases.

Overall, Shopify offers businesses a comprehensive eCommerce solution that streamlines payment processing and provides the tools to manage and grow businesses globally.

Best International Payment Gateway: PayPal

- PayPal is a reliable payment gateway that allows businesses to accept payments online, in-store, or on the go with a variety of tools and payment options.

- It provides an online checkout system, installment payment options, invoicing, and a POS system to cater to all business types and sizes.

- PayPal offers multiple payment methods to customers, such as PayPal, Pay Later, Venmo, and credit/debit cards, and supports integration with eCommerce, accounting, marketing, and operations tools to help businesses make sales and manage their operations.

- PayPal is designed with AI-generated fraud prevention resources & SSL (Secure Socket Layer) encryption to provide a secure checkout experience and Seller Protection on all eligible purchases.

- It supports global sales with multicurrency and multi-language capabilities, instant transfer options, and payment links.

- PayPal has no hidden fees or monthly commitments, making it an affordable payment gateway solution for small-to-medium businesses.

- With over 400 million customers worldwide and over 20 years of experience, PayPal is a trusted payment gateway that customers can rely on.

PayPal is an ideal international payment gateway solution for eCommerce sellers looking to accept payments from customers around the world.

Whether you’re running an online store or selling in-person, PayPal offers secure, reliable, and user-friendly payment tools that can help you expand your Payoneer eCommerce business. With PayPal, you can leverage a diverse range of payment options, including PayPal Payments, Venmo, Pay Later, credit and debit cards, and more.

PayPal seamlessly integrates with other eCommerce, accounting, marketing, and operations tools, enabling you to run your business more efficiently while generating higher sales. You can also accept payments without a website or physical store using PayPal invoicing or personalized payment links on social media.

Additionally, PayPal Zettle provides a complete POS system with a cash register, card reader, and mobile banking terminal that can be easily integrated with your preferred accounting and eCommerce apps for a frictionless payment experience.

Best International Payment Gateway: Adyen

- Adyen is a leading payment gateway designed to help businesses achieve their ambitions more quickly and effectively.

- The company boasts over 3000 employees representing 115+ nationalities and has 27 offices around the globe.

- Adyen is a platform that is engineered for ambition, offering end-to-end payment capabilities, data enhancements, and financial products to leading businesses across the world.

- Adyen has an impressive track record of success, marked by significant milestones like obtaining acquiring licenses in several countries and launching Adyen Issuing and Giving.

- The company follows a unique formula that emphasizes the importance of benefitting all merchants, making good choices, working together as a team, including diverse perspectives, communicating openly, creating its path, launching fast and iterating, and speaking honestly without being rude.

- Adyen is an ethical and sustainable company that prioritizes winning and delivering value to its customers over individual egos.

Adyen is a leading international payment gateway providing businesses worldwide with end-to-end payment capabilities, financial products, and data enhancements.

The platform is built in-house, entirely from the ground up, to meet the demands of ambitious businesses.

Adyen has 3000+ employees from 115+ nationalities in 27 offices worldwide and processed €767.5 BN in volume in 2022.

Adyen is committed to building an ethical business that benefits all customers.

They prioritize making good choices for sustainable growth, work across cultures and time zones, include diverse perspectives, and launch fast and iterate.

Payoneer eCommerce businesses can benefit from Adyen’s all-in-one platform, engineered for ambitious businesses.

The platform offers seamless integration with various eCommerce, accounting, marketing, and operations tools, providing a secure payment experience. Adyen’s customer support team offers straight talk, fast response, and dedicated support.

Best International Payment Gateway: 2checkout

- Trusted by 20,000+ Industry Leaders Worldwide: Malwarebytes, myFICO, Flores a Mexico, Utsav Fashion, MYBOX PRINTER, and Advisera.

- A Platform Built Around Growing Your Business: Modular design, 2Checkout Monetization Platform, and built-in digital goods sales capabilities.

- Take on the World: Go global, maximize customer lifetime value, and fast-track time to market.

- Partner with a Trusted Industry Leader: Honored with many prestigious awards since 2006, 2Checkout eliminates the friction evident in global commerce.

- Everything You Need to Sell Domestically & Internationally: Accept mobile & online payments from buyers worldwide, start selling in 200+ countries and territories, and accept PayPal and major credit cards.

2Checkout is a trusted international payment gateway used by over 20,000 industry leaders worldwide, including Payoneer eCommerce businesses like Advisera, Malwarebytes, and Utsav Fashion.

The company’s all-in-one platform is designed to help businesses grow with modular solutions for global payments, digital commerce, subscription billing, tax and financial services, risk management, and partner sales.

With 2Checkout, eCommerce sellers can access domestic and international markets, accepting major credit cards and PayPal in over 200 countries and territories.

2Checkout offers a seamless, secure, and trusted payment process, with mobile-optimized solutions, localized checkout, and eCommerce support for 29 languages & 100 currencies. They also provide advanced security and fraud protection, as well as world-class support available 24/7.

Whether you’re looking to go global, maximize recurring revenue, or accelerate time to market, 2Checkout has plenty of tools and resources to simplify the eCommerce process and grow your business.

Choose only what you need and add as your business expands, all backed by a trusted industry leader since 2006.

Best International Payment Gateway : G2A PAY

- G2A Pay delivers a variety of pricing options expressly tailored to your business needs, including payment gateway pricing, a business account, and an account for traders’ pricing.

- G2A Pay’s business account is a multicurrency account for your eCommerce operation, with IBAN accounts in 29+ currencies, full currency exchange at the best rates, free multiple top-up methods, and account transfers.

- G2A Pay’s payment gateway includes customized checkout solutions, a variety of different payment processing solutions, instant settlement, and multicurrency account options with dedicated IBAN numbers and affordable currency exchange.

- G2A Pay’s account for traders’ pricing also caters to the crypto market.

G2A Pay is a premier international payment gateway that provides a comprehensive platform for secure payment processing of global payments from your eCommerce store. Transactions are processed quickly and safely, and G2A Pay is highly respected among Payoneer eCommerce sellers for its reliability and flexibility.

With G2A Pay, you can choose from over 20 local and global payment methods, all with the lowest processing fees on the market.

The instant settlement ensures that funds are ready to use as soon as they reach your ZEN account, providing unparalleled convenience for you and your customers.

One of the most valuable features of G2A Pay is its multicurrency account, which allows you to manage 29+ currencies in one account, complete with a dedicated IBAN, currency exchange at the lowest rates, free top-up options, and transfers.

G2A Pay’s Sales team can also offer tailored solutions specifically for your eCommerce needs, providing the flexibility you need to succeed in today’s global marketplace.

Best International Payment Gateway: Skrill Business

- Skrill offers advanced and secure payment solutions for businesses.

- Skrill supports over 100 local payment methods, including cards, digital wallets, and instant bank transfers.

- Skrill’s multicurrency account enables businesses to manage 40+ currencies from a single account for worldwide payments.

Skrill is a trusted global leader in international payment gateway solutions, with advanced payment options that are designed to suit businesses of all sizes.

Skrill solutions are fast, instant, and secure, with over 100 local payment options, including cards, digital wallets, instant bank transfers, and alternative payment methods.

With Skrill’s multicurrency account, you can easily manage over 40 currencies from a single account, which includes a dedicated IBAN, currency exchange at low rates, complimentary top-up options, and transfers.

Skrill offers a range of payment options, including quick checkout, a digital wallet, and Rapid Transfer, which supports 3000+ banks globally.

These options accept local payment methods, including cards and bank transfers.

Using your Skrill wallet online, receiving money from a friend, and uploading funds are all free. Skrill members can also enjoy additional benefits such as a free Skrill Visa Prepaid Card for eligible members and no transfer fees when sending money to an email or Skrill wallet.

Payoneer eCommerce: Receive Global Payments With Payoneer

Payoneer’s multicurrency virtual account is a game-changer for eCommerce sellers.

By using this service, sellers can receive payments from a vast range of reliable payment gateways directly into their Payoneer account.

The funds received can be used with a prepaid Mastercard or e-wallet to pay suppliers and vendors, or they can be withdrawn to a local bank account or via ATMs. With Payoneer, getting paid globally is as simple as getting paid locally.

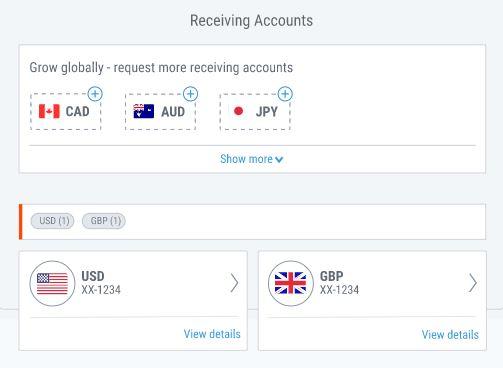

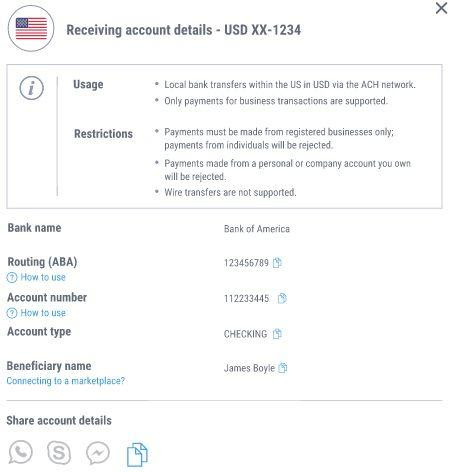

Using Payoneer’s Global Payment Service receiving account information, eCommerce sellers can receive payments in any supported currency.

This means that regardless of the payment gateway used, sellers can easily link it to their Payoneer account to withdraw funds from anywhere in the world.

With Payoneer, eCommerce sellers can enjoy a smooth and hassle-free payment experience while accessing their funds with ease.

What Countries, Currencies, Withdrawal Options, Payment Methods for Payouts are Supported?

Our Global Payment Service supports payments from commercial companies with local bank details in the following regions:

- United States (USD) / Transferred via ACH

- Europe (EUR) / Transferred via SEPA

- United Kingdom: England, Northern Ireland, Scotland, and Wales (GBP) / Transferred via BACS and FPS

- Japan (JPY) / Transferred via Zengin

- Australia (AUD) / Transferred via Direct Entry (BECS)

- Canada (CAD) / Transferred via EFT

Payoneer eCommerce will continue to add additional currencies to the Global Payment Service in the near future.

Check in with our customer support teams at your convenience.

How does receiving payments work with Payoneer eCommerce?

- Register or Sign into your Payoneer account.

- Select Receive from the menu and then Global Payment Service.

- Click the currency you would like to receive.

Don’t have access to one or more of these currencies? Please contact Customer Care.

- Input payment details (each currency has different details).

- Direct transfer from the Payment Platform to Payoneer.

- Withdraw earnings anytime to local bank/ATM.