Brexit’s impact on eSellers in the UK, EU and rest of the world

There’s no getting around it. The UK’s decision to leave the EU will have a big impact on all UK-based eSellers and anyone else who sells into the UK. But to understand how big this decision was, its important to understand essentially what the EU is all about.

The EU is, to use the term loosely, essentially a “club” of 27 European countries (28 countries, with the UK still included) with a variety of social and economic aims. For those living in the member states of the EU, its benefits are intuitive and run deeply through the fabric of daily life. It is more than just a trading bloc with over 400 million consumers. It is a community of nations unlike any other in the world which has as its guiding principles four primary “freedoms”:

- Freedom of goods

- Freedom of capital

- Freedom to establish and provide services

- Freedom of movement of persons

Goods, capital, services and people move freely across the EU because each member country acknowledges and respects a set of common rules which are applied uniformly across all member states. This means that goods and services can move within a member country or EU national borders seamlessly and without the need for clearing customs.

When it comes to eCommerce, even the smallest of sellers will have taken advantage of Amazon services that are made possible by the Four Freedoms of the EU. For example, Pan EU FBA allows sellers to ship stock to a Fulfillment Centre in one European country and have it move seamlessly, without the burden of tariffs or customs declarations, to a customer in any other EU country.

For UK sellers, however, following the UK’s vote to leave all of this will come to a very abrupt end on January 1st, 2021.

What does this mean for your business?

Well, if you supply goods and / or services within the remaining 27 EU countries only, or between some country (other than the UK) and the EU, Brexit probably won’t have a significant impact on your operations.

However, in every other scenario, you’ll need to make changes to your company’s operations to ensure continued profitability. Some of the questions you’ll need to consider are:

- Do you sell only goods, only services or a mixture of both?

- Does your company consume only goods, only services or a mixture of both?

- Do you sell products, services or otherwise have operations based: only in the UK; only in the EU; someplace else; or some combination of all three?

- Where do you employ staff or contractors?

- Do you, or your staff, travel between the UK and EU for business?

- Do you have significant flows of funds between the UK and EU?

- What client, partner and employee data do you hold or otherwise process, and where?

If any aspect of your business is based in the UK, Brexit will affect you.

More questions to consider include:

- Do you have products labelled, manufactured and protected in the EU? You’ll need to check whether your contracts are Brexit-proof.

- Are your products and / or services developed in the UK? If so, you may need to re-certify them for sale in the EU.

- Do you have a .eu domain name? If so, unless you have some legal basis to remain in an EU country, you will not be able to keep the domain.

- Will you recruit EU staff working for you in the UK in 2021? Do you or they travel to the EU for business purposes? If so, you’ll need to check visas, the right to remain in the UK, rights to work and travel in the EU. In many cases, you’ll need to check with each country where you intend to travel for work what the local immigration and employment rules are for those outside of the EU.

Would a trade deal avoid the need to take significant action?

At the time of writing, late October 2020, a deal being made within the next month seems very unlikely. Trade deal or no deal, businesses need to start preparing now and the starting point should be preparing to trade on World Trade Organization terms. This entails understanding relevant customs procedures, tariffs and the need to check local rules whether you are trading in goods or services.

In addition, considering the COVID-19 pandemic and its continued uncertainties in terms of business impact, delays due to social distancing and more, it is imperative that businesses prepare with extreme urgency for a no-deal Brexit.

Businesses need to start preparing now and the starting point should be preparing

to trade on World Trade Organization terms

How are you supposed to prepare?

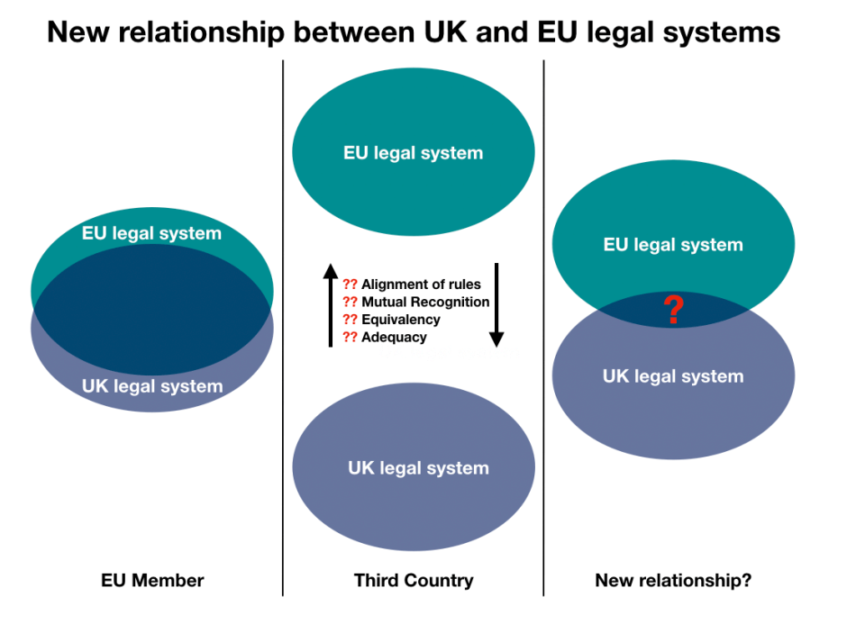

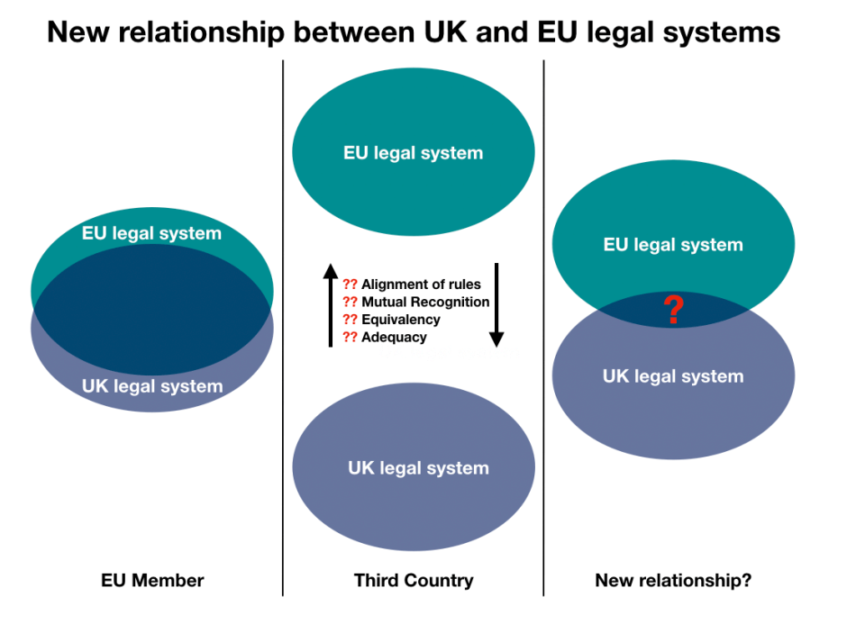

The fundamental issue here is that the UK will have a completely new commercial environment with the EU and, more importantly, separate legal systems.

From the 1st of January 2021, the UK will be a ‘third country’, outside the EU. This means that all rules that regulate business life will need to be negotiated. The EU and the UK can agree to align business rules, mutually recognize them, or the EU can consider UK rules as ‘equivalent’ or ‘adequate’. But this process will not be finalized by the end of the year.

That’s why it’s important you check every regulation around your business and whether you need separate licenses or certificates for the EU market.

If you’re thinking this sounds very complicated, you’d be right. It is.

But that doesn’t mean you can’t begin putting a plan together and be prepared. The best approach is to take what seems like a potentially overwhelming task and break it into smaller components.

5 Steps to prepare for Brexit

You may have been operating in a consistent manner for many years and now need to undergo significant upheaval in your workflows. To be prepared and ready in just four weeks is certainly going to be a challenge.

Below is a 5-step plan to continue selling in the EU having completed the VAT registration necessary for all relevant marketplaces.

Step 1:

Understand how EU Exit will impact you and create a Task Force to collaborate with you to develop a resilience plan. Some things you’ll need to consider are:

- Staff

○ Have you supported your employees and their requirements for any work permits or visas? Be sure to differentiate between those EU nationals already in the UK versus those EU nationals planning to arrive in the UK.

- Supply chain / partners

○ Look at your end-to-end supply chain, consider each of your products (or services) and ask yourself either who handles it, or who adds value to it each step of the way. Visit the websites of marketplace, banks and shipping services you work with, contact your account managers, and watch for any information they send you and follow the guidance they offer.

- Regulations

○ Also review regulations that might affect your company (such as business, consumer, information security and intellectual property rights), sector specific regulations, financial and other regulations.

- Legal / Tax

○ Review your contracts, particularly for INCOTERMS (International Terms and Conditions of Service).

- Licenses and qualifications

○ Consider the import / export flow of your goods. Amongst other requirements, you will require an EORI – Economic Operator Registration and Identification (issued by your tax office), a clear understanding of your HS codes and compliance with EU product rules.

Step 2:

Review your end-to-end supply chain, identifying products and services, who handles them, how value is added, and what geographic journeys are implied. Also, don’t forget to talk to your bank, investors and funding partners not only to ensure that you have access to sufficient funding to take you well into 2021, but also to keep an open dialogue to convey you are putting appropriate business controls in place.

Step 3:

Read relevant supporting government materials for your business and products (a very brief summary is provided below). Build a plan to work your way through the task list this will generate.

Step 4:

Onboard with a customs broker and shipper able to start shipping your goods to the EU; ensure you have both UK and EU EORI numbers as well as a thorough understanding of your HS codes (8-digit commodity codes). There will be an immense rush from tens of thousands of businesses looking for the same (don’t forget Christmas and COVID), so it really is a first-mover advantage here. Also consider what happens to your product returns on the other side of the border? For example, if a German customer returns a product, where will it go if you’re based in the UK?

Step 5:

Obtain the necessary product certifications, licenses and / or permissions from relevant Intellectual Property owners. Ensure you have proof of your official business / seller names, business registration documents, photo identification to hand (this task will also help with your discussion with customs brokers)

Important Amazon dates for your diary:

- 14th November – Inventory removals for cross-border will end.

After this day, where will your product returns go? - 18th December – Pan EU FBA transfers will stop between UK and EU.

Your product will no longer share an inventory pool and you will need to inbound 2 shipments – one to the UK, one to the EU. - 21st December – Cross-Border Fulfillment via EFN and Pan EU FBA will start winding down.

Also ensure your Amazon listings are compliant against commodity codes.

How Payoneer can help

As an online seller looking to expand your business online and increase sales, Payoneer is your go-to partner for managing all your business payments.

From multi-currency receiving accounts that enable you get paid from international marketplaces, to Capital Advance to help you invest in your business and bring it to the next level, to paying your suppliers or VAT requirements directly, Payoneer has a whole suite of tools to help.

Open an account today and see how easy, fast and low-cost managing your business payments can be.

Reading list:

This is the right link: https://ec.europa.eu/info/european-union-and-united-kingdom-forging-new-partnership/future-partnership/getting-ready-end-transition-period_en

Study the EU’s Check. Change. Go. website

Obtain your UK EORI number, or your EU EORI number

Read up on the UK’s Settlement Scheme for EU nationals

Look Up Your Products’ Tariff Codes for the UK, and for the EU

London Business Hub Brexit Help Fact Sheets

Amazon’s Brexit Help Pages (along with Amazon specific screen by screen tutorials)