Manage Your EU and UK VAT Payments Easily with Payoneer’s Providers

Value Added Tax (VAT), is a big concern among foreign sellers selling to the UK and EU markets. With the UK’s recent crack-down on foreign sellers selling on Amazon, Amazon is now responsible to verify that users are registered to pay VAT. Soon enough, non-VAT registered sellers may find themselves unable to sell on Amazon.

Navigating the VAT laws can be confusing and costly if done without guidance. Payoneer is now offering a new service to sellers to help make the VAT registration and payment process as smooth as possible.

What is VAT?

VAT or Value Added Tax is a tax imposed on the sales of some products. VAT is charged based on sales volume thresholds. These thresholds and the actual VAT percentage differ between the European countries you’re selling in; what’s more, you need to be registered with the VAT office in every country you sell to.

VAT is usually around 20% of the value of the product sold, and in GB, for example, is to be paid to the government on a quarterly basis.

Sellers paying VAT directly to the various governments can potentially lose a lot of money in the process.

Say you’re located in the U.S., selling on Amazon.uk to the UK market. If you’re selling to the tune of 600,000 GBP a year, you’ll owe approximately 1/6 of that in VAT to the UK government. To pay your VAT, you would have to go through these stems:

- Withdraw the VAT amount owed (100,000 GBP) to your local bank account in the U.S. in your local currency, USD. That comes out to about $123,000.

This withdrawal would incur 1-2% in fees, or roughly $1,200-$2,500 in fees. - Convert these funds back to GBP at your local bank, a process that would also incur fees of 1-2% (another $1,200-$2,500).

- Wire the VAT funds to the UK government bank account in the UK, an international wire that will cost an additional $35-50 in fees.

In total, you’ll end up paying $2,500-$5,000 in fees (!!!) just to pay your owed VAT.

Save $$$ with Payoneer’s VAT solution

Payoneer can help you save thousands of $$$ annually with a new solution for sellers: Payoneer has partnered with specialized VAT service providers to help sellers navigate the European VAT scene. Payoneer has teamed up with some of the leading, Amazon-recommended firms to help users stay on top of their VAT filings and payments.

Payoneer’s VAT providers work within Payoneer’s network. To transfer funds to the providers, Payoneer users can utilize Payoneer’s Make a Payment service to pay the providers directly. In doing so, users will only pay an 0.7% fee for this service, saving thousands of dollars they would otherwise pay in fees for international bank transfers.

In the example above, you would only pay $875 in fees instead of $2,500-$5,000. That’s a huge difference!

Ease and peace of mind

These providers are world-renowned VAT experts with internationally-recognized brand names. They know the VAT laws and regulations inside and out.

Once you’ve partnered with one of Payoneer’s VAT service providers, they will take care of managing the VAT payments for you. You can remove one more task from your to-do list and rest assured that your money is in good hands.

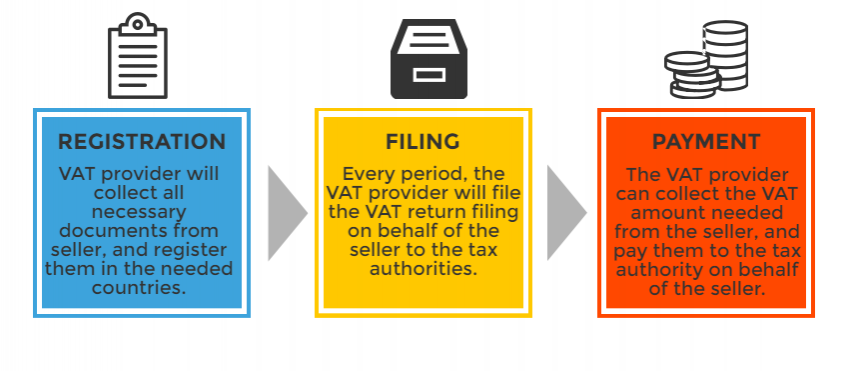

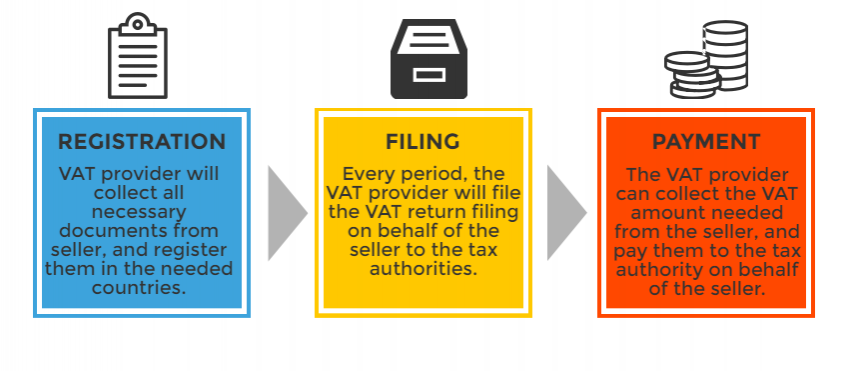

How does a VAT provider handle my VAT needs?

How do I get started?

- Take a look at the info below about each provider. You can go ahead and click on Learn More to read more about each one.

- Choose one or more that match your needs and requirements.

- Contact the relevant provider by clicking on their Contact button, or copy/pasting the relevant email address. Make sure to let them know you are a Payoneer user and will be paying via your Payoneer account balance.

- When contacting a provider, make sure to CC VAT@Payoneer.com, so that we can assure you get quick and relevant support.

- The provider(s) will walk you through the process.

If relevant, your provider will help you register for VAT payments to the relevant country or countries, file all requires papers, pay your VAT and collect returns (when relevant) to your Payoneer account.