4 Platforms to Help Freelancers Track Their Billing

Most freelancers lack in-house accounting departments to manage accounts receivables, prepare and send invoices, collect outstanding debts, and manage other financial matters. However, freelancers must keep accurate records just like larger businesses, and the following billing software tools make it much easier to keep track of what you are owed.

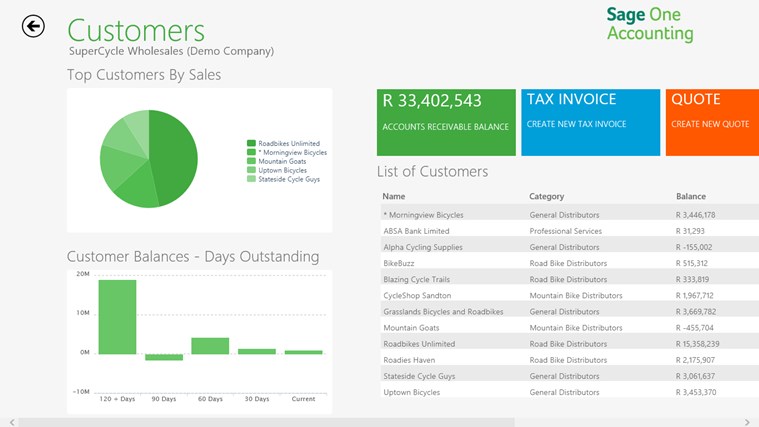

1. SageOne

Although SageOne offers a premium accounting software solution, they also provide a free alternative. Create an account to send and track invoices, keep track of billable hours, wrangle tax documents, and generate financial reports. SageOne is web-based, which allows you to access your financial data from any Internet-enabled device. If you need to send a last-minute invoice from your smartphone while you’re away from home, SageOne helps you get it done.

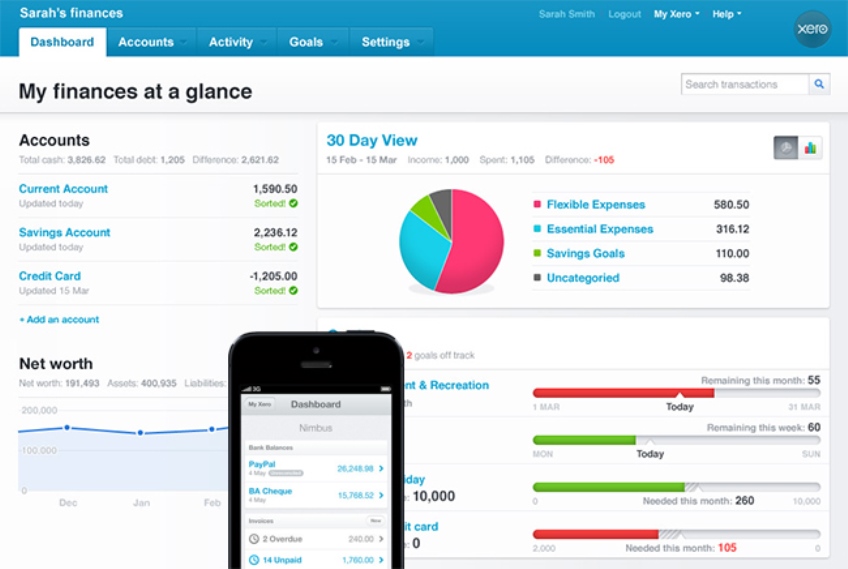

2. Xero

Freelancers who require more robust tools to manage their online businesses might want to consider Xero. It allows users to integrate hundreds of third party apps so they can view all their financial and related data in one place. Xero is also unique because you can pay bills through its interface.

Unlike the previous suggestions, Xero costs money to use. Plans range from $9 to $70 per month depending on the features you need. If you’re not sure whether it will work for you, sign up for the 30-day free trial.

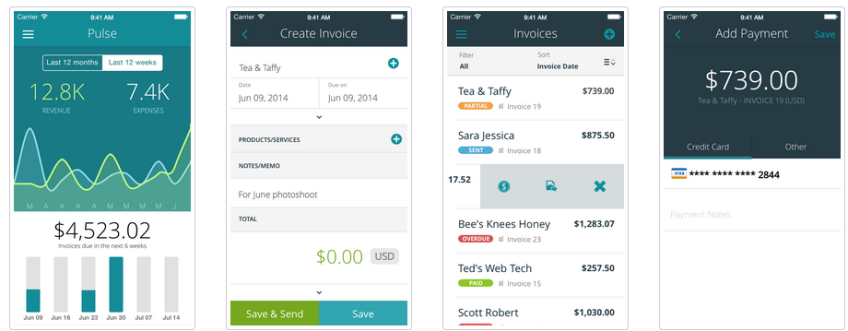

3. Invoice By Wave

Are you always on the go? Invoice By Wave allows you to send as many invoices as you want via your smartphone. This app also incorporates other data about your customers, such as their phone numbers, email addresses, and previous payments. You can also use a cloud accounting software program with Wave and track overdue payments. The app alerts you when your customer has viewed your invoice so you know that he or she has received it successfully.

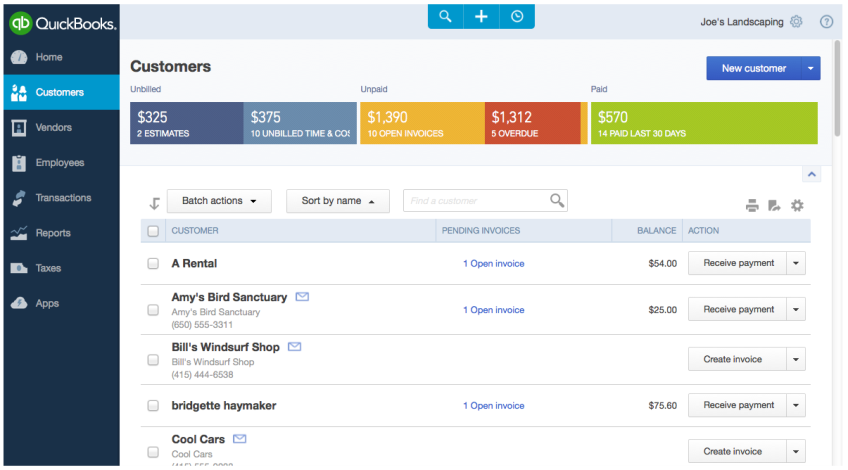

4. Intuit QuickBooks

One of the most well-known accounting programs, QuickBooks continues to change with the times. It now features integration potential with your mobile devices, such as your smartphone or tablet. It is also compatible with both Macs and PCs.

Although QuickBooks markets itself as a small business solution, the company offers a cheaper accounting solution for freelancers. Self-employed (or independent contractor) professionals pay just $7.99 per month. The high level of security and encryption makes this a safe choice for your accounting needs.

After going thoroughly through these tools, it’s difficult to choose an overall winner. They’ve all got their unique features which make them stand out. In the end it all depends on what you prefer. Just make sure to try them out first. Let us know what you think of these tools or if you have additional suggestions!