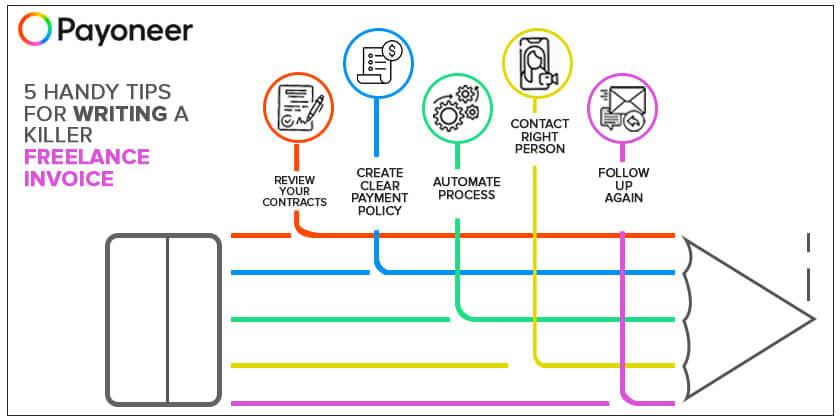

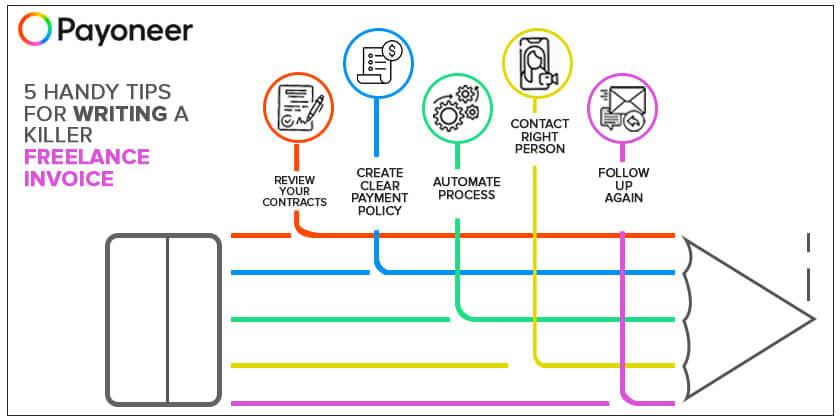

5 Handy Tips for Writing a Killer Freelance Invoice That Gets You Paid…Fast!

If you’re a full-time freelancer, either veteran or rookie, you’ve probably already felt the burden of waiting to get paid from clients. Nobody likes to chase clients and, to be quite honest, you shouldn’t have to!

Frustratingly, over 70% of freelancers have reported that they’ve had difficulty getting paid as a freelancer at least once in their career, according to research from the Freelancer’s Union, a U.S.-based non-profit organization that provides advocacy and insurance benefits to freelancers.

As getting paid on time remains one of the biggest challenges freelancers face, it’s crucial that you set up formal and clear payment policies with your clients before getting paid for a gig. Oftentimes, projects on your plate will pile up and you’ll find it easy to put off administrative tasks, but your clients won’t start the payment process until after you’ve sent them a bill, so the quicker you take care of your invoice, the faster you’ll get paid.

With that said, getting paid for your independent work shouldn’t be such a hassle. Here we’ll break down five effective ways to write an invoice for your freelance work and make sure you get paid…on time!

1. Review Your Contracts

Before you begin preparing an invoice for a client, it’s highly recommended to review the freelancer agreement or contract you created with that client in order to make sure that you’re both aligned on what’s expected. One of the most common delays in freelance payments is due to the fact that an invoice or bill doesn’t match up with the original terms both parties agreed to. When you review your contract with them before creating an invoice, you’ll most likely avoid an awkward situation.

Gather your contracts and check to see if in fact you met the required deadlines for the project and which specific payment methods were agreed on. In addition, to stay organized, if you work with multiple clients, then it’s best to keep your terms with all clients fairly the same, as it can be easy to forget things in different contracts/agreements. You wouldn’t want to put yourself in a situation in which you mix up agreements with clients.

2. Create a Clear Payment Policy

When writing an invoice to send to your client(s), be extremely clear about your payment terms and try to add as much detail as possible. The best way to get paid on time is to let them know what “on time” means and a straightforward payment policy will communicate that.

Always include a due date, your preferred payment method and any charges for potentially late payments. Indicate as much as possible on your invoice template so clients have an understanding of their timeframe to pay. Interestingly, a recent study reported that 29% of freelance invoices are paid after the due date.

To make the process a bit more creative, perhaps you can offer a discount for an early payment (any client would certainly enjoy a small incentive to working with you).

Sending invoices in a consistent manner can also provide a smoother payment process, for example, billing your clients on the 1st or 10th of each month (depending on when you begin and complete the work).

In addition, let your clients know up front when to expect an invoice from you. Many freelancers request a specific percentage of a project fee up front before they begin to work.

3. Automate the Process

Having the ability to notify your client that a payment request is on the way can really help ease the process of getting paid, especially when working with clients overseas.

For example, with Payoneer’s flexible payments solution for freelancers and businesses, you can request a payment from your client abroad easily and securely and have them pay you using their preferred method of choice. Once you’ve sent them a request, you can then track your payment until it arrives in your account.

In addition, you could also break your project down into smaller phases in which you would invoice your client for each stage of the project, ultimately improving your cash flow.

4. Contact the Right Person

So, you’ve cleared your agreement with your client, but sometimes your contact person is not the correct person in charge of the books. This means that invoicing the wrong POC can only delay the process further.

When you first start working for a client, make sure to establish a relationship with the right contact at the business/company, such as the finance manager or accountant. This way you’ll avoid unnecessary communication with those that don’t handle your payments and get paid on time.

5. Follow Up and Follow Up Again

Communication is key! We’re sure you’ve heard this phrase plenty of times, but when it comes to getting paid for your hard work, clear communication is vital in order for your freelance business to thrive. Chances are, you’ll need to follow up with your client multiple times and remind them, but each time, you’ll get better at it.

In fact, delivery of your invoice, along with a friendly email could really help rather than a simple attachment with the words “please pay me”. Remember, it’s always good to keep a good relationship with your client, as you never know when you might night their assistance in the future.

In case your client misses their deadline, try the following:

- Resend the invoice with a gentle reminder

- Pick up the phone and call the client/leave a message

- Although it’s a more expensive option, legal action should only be taken in the case a client has completely ghosted you and should only be considered when all other attempts have failed.

Invoicing with Ease

Being a small business owner can often come with stress, and the last thing you need is to get caught up chasing down clients who haven’t paid you.

We hope our tips will motivate you to enhance your payment process. If you’re looking for additional assistance, Payoneer and Free Invoice Builder have teamed up to make your life even easier.

Payoneer provides freelancers like you with a flexible and simple way to receive international payments and access your funds no matter where in the world you’re located. When you bill your clients via Payoneer, they’ll have the choice to pay you via credit/debit card, ACH bank debit or local bank transfer and they’ll be able to pay you within minutes. It’s that easy!

We make it easier to focus less on how to get paid and more on how to grow your business.

Not already a Payoneer user?