A (very) short guide to understanding currency risk

As a business that operates across borders, you may have experienced the impact of currency fluctuations on your bottom line. This is known as currency risk, and it’s important to understand it in order to minimize its impact.

Let’s start with the basics:

What is currency risk?

Currency risk is the risk that changes in the value of one currency relative to another will affect your business. For example, if your business receives payments in one currency but has expenses in another currency, a fluctuation in exchange rates could affect your profit margins.

These are called currency fluctuations and they can occur for various reasons, including changes in economic conditions, government policies, and international trade.

There are essentially three types of exchange risk:

- Transaction risk

- Translation risk

- Economic risk

Transaction Risk

Transaction risk is the risk that arises from fluctuations in exchange rates between the time when a company enters into a transaction and the time when payment is made or received. For example, if a US-based company agrees to purchase goods from a supplier in Japan and agrees to pay in Japanese yen, there is a transaction risk that the yen will appreciate against the US dollar before payment is made, increasing the cost of the goods.

Translation Risk

Translation risk is the risk that arises from the conversion of foreign currency financial statements into the home currency of a company. For example, if a US-based company has a subsidiary in Europe and the Euro depreciates against the US dollar, the translated financial statements will show a lower value in US dollars, leading to a potential loss.

Economic Risk

Economic risk is the risk that arises from changes in macroeconomic variables such as inflation rates, interest rates, and economic growth rates. For example, if a US-based company invests in a foreign country where the inflation rate is high, the value of the investment in US dollars may decrease due to the depreciation of the foreign currency.

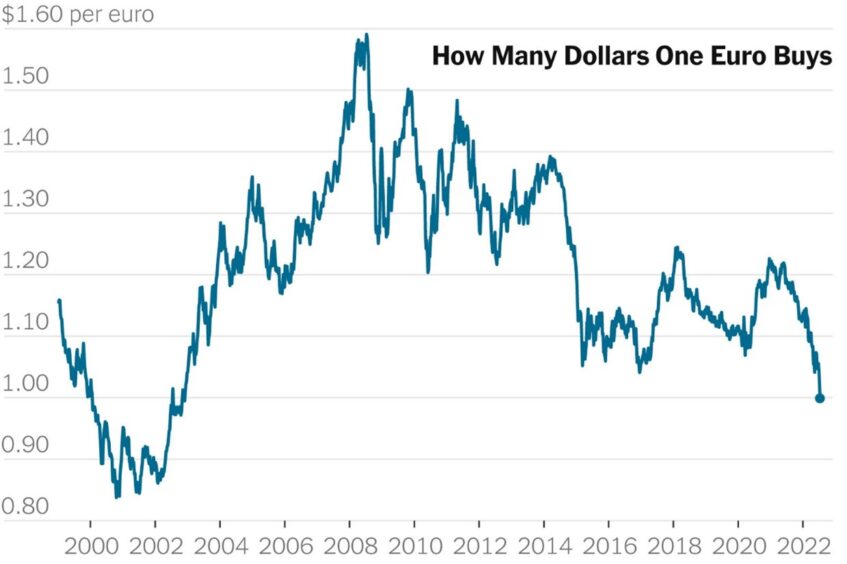

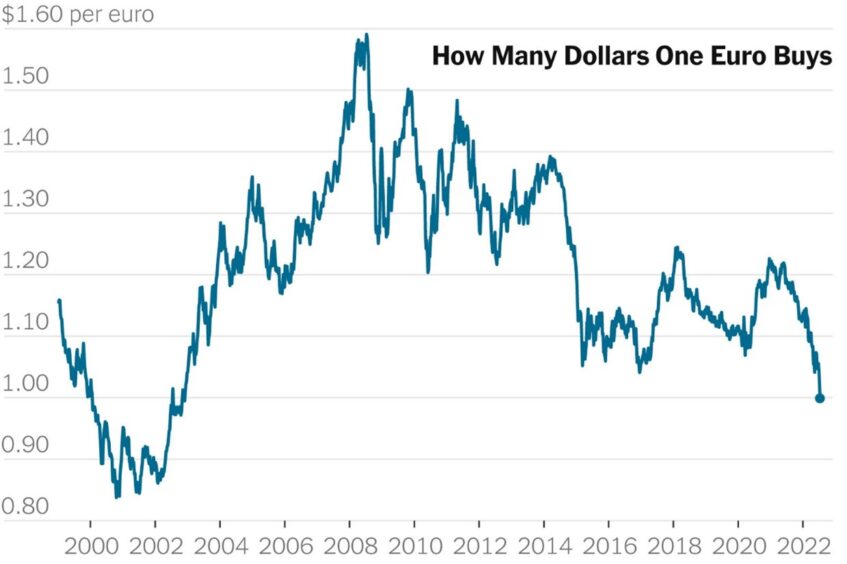

Source: New York Times

How does currency risk impact your business?

Currency fluctuations can be a risk for cross border businesses because they can affect the cost of doing business in different countries.

For example, if a company is based in the United States but does business in Europe, changes in the exchange rate between the US dollar and the Euro can impact the amount of revenue the company generates. If the Euro becomes stronger relative to the US dollar, it will cost the company more to do business in Europe, and their profits may decrease. Similarly, if the US dollar becomes stronger relative to the Euro, it may become more expensive for European customers to purchase products from the US company, which could result in lower sales.

Currency risk can have a significant impact on your business if you’re not prepared for it. For example, if the value of your home currency decreases relative to the currency you receive payments in, your profits will be lower. On the other hand, if the value of your home currency increases, your expenses will be higher.

What can you do to minimize currency risk?

There are several strategies you can implement to minimize the impact of currency risk on your business. One of the most effective is to use currency hedging tools, such as forward contracts or options, which allow you to lock in an exchange rate for a future transaction. Another strategy is to diversify your currency exposure by doing business in multiple currencies.

Understanding currency risk is essential for businesses operating across borders. By taking the necessary steps to minimize its impact, you can protect your business from the adverse effects of currency fluctuations and help ensure long-term success.

How Payoneer can help

Payoneer’s multi-currency receiving accounts can help reduce a business’s exposure to currency fluctuations and currency risk by providing a way to hold multiple currencies and receive payments in the same currency as they pay their suppliers or contractors.

For example, let’s say a US-based business sells products to customers in Europe and pays suppliers in China. In this scenario, the business is exposed to currency risk because they need to convert the Euros they receive from customers into US dollars to pay their suppliers in China. If the exchange rate between the Euro and the US dollar changes, the business may end up losing money.

With Payoneer’s multi-currency receiving accounts, the business can hold Euros in their account and receive payments in Euros from their European customers. They can then use the same Euros to pay their European suppliers, avoiding the need to convert currencies and reducing their exposure to currency fluctuations and risk.

Furthermore, Payoneer’s multi-currency receiving accounts allow businesses to receive payments in over 150 currencies, making it easier to do business globally without having to worry about the complexity of foreign exchange transactions.

I’m ready to reduce my risk to currency fluctuations