Table of contents

Whatever business you’re in, whether you’re running a small business or working solo or operating as a contractor for local or international clients, you can’t avoid invoicing. Invoicing and billing are fundamental business tasks — that’s how you get paid, which is always a good thing.

But for many business owners and freelancers, invoicing and associated tasks like bookkeeping and managing accounts is a real headache. You didn’t go into business to manage invoices, but sometimes it can feel like that’s taking up most of your working hours.

The good news is that there are ways to streamline invoicing and record-keeping so that it sucks up less of your time and is much less of a headache. That’s why we’ve prepared this invoicing guide to how to bill your clients.

What is an invoice?

An invoice is a legal document that describes the products and/or services that you’ve delivered to your client, and requests payment for them. Sometimes, people refer to an invoice as a bill, because invoicing and billing are both ways of asking for payment.

Why do you need an invoice?

Here are some of the reasons why you need to invoice clients:

To get paid

Your clients won’t send payments until you request them. If you send an invoice promptly after completing your project or shipping your products, you’re more likely to receive payments in a timely manner. Invoices that include a list of the payment methods you’ll accept and payment information like your local bank details also encourage customers to pay quickly.

To comply with the law

An invoice is a legal accounting document, and you need it to keep track of your income and your tax obligations. An archive of correctly-numbered invoices shows the IRS that you’ve been reporting your income correctly, and helps you file taxes accurately to reduce your risk of being audited.

To manage your business

Invoices help you keep track of how many products you sold or projects you completed in any given period of time. Checking your previous invoices helps you trace your cash flow, so you can make better predictions about the future. This helps you to know how often to restock your inventory, and make better decisions about growing your business.

To remove misunderstandings

Misunderstandings happen, but you want to avoid them as much as possible. Properly filled-out invoices help confirm a sale and clarify what products or services you supplied to a customer. This way, if a customer claims that you failed to deliver, you’ll have your invoice to prove exactly what you agreed to provide. An invoice also helps if a customer refuses to pay and you need to take them to court over the debt.

When do you need to send an invoice?

Here are some situations when you’ll use an invoice.

Your florist’s business received an order to provide and arrange flowers for a wedding. You send an invoice listing how many bouquets you’ll provide, which flowers you’ll use, and the cost of the flowers and the labor to arrange them and decorate the wedding venue, so the client knows exactly what to expect.

Your ecommerce business ships an order of several hundred children’s toys to Australia. You include an international invoice with the shipment so the buyer can check that the inventory is complete.

You’re a freelance web designer, and you’ve just finished designing a new website for your client. You send an invoice as a payment request, including a breakdown of the work you completed so the client can see what was involved.

You’re a contractor building bespoke wooden cabinets, and an eager client just accepted your quote and paid upfront. You send an invoice marked “paid” to record the payment and keep your accounting processes in order.

Why you should invoice electronically?

More companies are embracing electronic invoicing, or e-invoicing, but if you’ve never tried online invoicing before, it might seem challenging to learn a new invoicing system. However, e-invoicing systems are easy to use, and there are so many benefits to making the change.

Technically, there are two kinds of electronic invoicing: digital invoices, and electronic invoices (e-invoices). A digital invoice can be a PDF invoice that’s sent as an email invoice attachment, which could be generated using Word or Excel, or even be a scanned paper invoice (although that ruins the point of digital invoicing).

An e-invoice is a data file, like XML, EDI, or internet-based web forms, which computer programs can scan and process automatically. They aren’t so easy for humans to read, but they suit online invoicing systems.

Here are some of the reasons why your business should join the e-invoicing revolution.

Get paid faster

E-invoicing makes it easier for the client to pay, so you’re a lot more likely to get paid on time and save the hassle of having to chase up late payments. With online invoicing, you can include a “pay online” button so clients can pay immediately through a credit/debit card, or with ACH bank debit if they’re in the US.

Simplify your record keeping

It’s too easy for paper invoices to get lost, mislaid, or misfiled, but that’s not possible with online invoicing. It generates a unique number for each invoice automatically, never loses count or gives two invoices the same number, and stores a copy of every invoice in your online accounting records.

Make life easier for your clients

E-invoicing also helps your clients with their records and financial reporting. Many businesses have automated payment systems which scan electronic invoices, share the information with the right departments, and send payments automatically. They’ll thank you for saving them the hassle of reading and inputting data from a paper invoice.

Same time

E-invoicing programs can prefill invoices, making it faster to get your invoicing done. You won’t have to go searching through your emails for the client’s name or contact details — your e-invoicing software pulls it for you from your database.

Reduce manual errors

Everybody makes mistakes, but an error in your invoice can delay payment and gives a bad impression of your business. E-invoicing saves you with that same ability to prefill invoices and find client details. No more accidental spelling mistakes, no more wrongly-filled fields.

Make a good impression

Streamlined, online invoicing looks so much more professional than paper invoices. Using e-invoicing software helps your business appear organized, up-to-date, and well-managed, which helps impress your clients.

Save money

Digital invoices can help you save money in two ways. Research has found that digital invoices cost up to five times less to process and manage than paper ones, plus an e-invoicing system makes it easier to track late payments and follow them up effectively.

Increase transparency

With an automated electronic invoice system, you’ll lower the chances of fraudulent or duplicate invoices and make the entire process more transparent.

When to send your invoice?

Timing is everything. Sending your invoice at the right time makes it more likely that you’ll get paid quickly. Invoices should be sent after the client placed an order, but before they send payment, but the exact timing varies.

If you sell products, you might send your invoice together with the shipment to be paid when the goods arrive. If it’s a large order, you might send the invoice before the shipment and ask for payment to clear before the goods are shipped.

If you provide services, there are a few different options. For long term projects or clients who are on a retainer, many businesses send invoices monthly. In this case, check which day of the month your client processes batch payments, or their payment cycle. For example, if their payment cycle goes from the 10th of each month, and you send your invoices on the 9th, you’ll get paid the next day. But if you send them on the 11th, you’ll have to wait for the next payment cycle.

That’s particularly important if you’re invoicing international clients. Lots of companies process all their international payments on the same day of the month. International payments take longer to clear than domestic payments, especially if there’s a currency conversion involved. Make sure to send your international invoices a few days before their payment date.

Service providers often request part payment upfront, before they start on the project. If it’s a big project, you might not want to have to wait till it’s all completed before you get paid. If you request a deposit or payment in stages, include it in your terms and conditions when you send your quote, so that clients are prepared.

Types of invoices

Although all invoices ask for payment, there are still lots of types of invoices. Here are some invoice terms that you should be familiar with:

This is an invoice that you send to your clients with a payment request.

Purchase invoice

This is an invoice that you receive from someone else, like a seller or supplier, requesting that you send payment.

VAT invoice

A VAT invoice is a sales invoice with extra information so the recipient can use it to reclaim VAT. A full VAT invoice needs your VAT number, and a breakdown of the VAT for each item. On a simplified VAT invoice, you’ll just need your VAT number and a simplified VAT listing.

You only need to issue a VAT invoice if some of your goods or services incur VAT. If they are all exempt or zero-rated, you don’t need to send one. Usually, you’ll send a VAT invoice within 30 of delivering the goods or services.

Interim or progress invoices

If you’re working on a long project over several months, or even years, it’s common to send interim or progress invoices at regular intervals. These serve as an official report of your progress.

Proforma invoice

This is an invoice that you send before the customer confirms their order, to give an estimate of the final price and help them make a decision. It’s not a legal or accounting document and it isn’t considered a request for payment.

Final invoice

If you’ve been sending interim or progress invoices, the final invoice marks the end of the entire project. It shows the final amount due and the total for the whole project, even if the client has been paying in stages. For most projects or orders, you’ll only send a final invoice.

Recurring invoice

A recurring invoice means you send the same invoice every month, like if you have a retainer client who pays you X amount each month to secure your services, or a customer with a recurring monthly order that doesn’t change. It’s another way that e-invoicing makes life easier, because the software can send recurring invoices automatically on the right date.

Past due invoice

If a client doesn’t pay on the date that payment is due, you might need to send a past due invoice to share your payment methods again and remind them to pay up. If you’re charging interest or a late payment fee, you should include that on a past due invoice.

Commercial invoice

You’ll only need a commercial invoice if you sell products. A commercial invoice is mostly used for international invoices to list the value of goods that are being exported. A commercial invoice includes more detailed information about the products, like total units, total declared value, country of origin, and transportation costs.

Customs invoice

A customs invoice is a type of commercial document for international invoicing, but it includes extra customs terms.

Consular invoice

This is another type of commercial invoice for international sales. With a consular invoice, the consul of the importing country stamps a visa on the goods.

Understanding the online invoicing process

It’s easy to get the hang of online invoicing, because the tools help simplify the whole experience.

The first step for any invoicing is to gather the information you need, like the recipient’s contact details and the goods and services you provided. If you sent an estimate or quote, or received a purchase order, you can use those to help you. An online invoice builder or invoicing software will usually pull the information in for you.

If you don’t have an invoice generator, choose one online. There are plenty of free and low-cost invoice builders that make the whole process easier. An invoice builder offers plenty of templates, so select one that suits your business branding and invoicing needs. If you’re doing this manually, you can find a free invoice template online.

Next, add your branding. That means including your logo and changing the font and/or color choices to match your brand’s color scheme and look. With most invoice builders, you’ll only need to do this once, and then you can save it as a new invoice template.

Fill in all the relevant information — or click to get your software to do it for you — and then read it through to check if you need to add any more details, like VAT information or your preferred currency for payment. Add your terms and conditions before you send it.

If necessary, send the completed invoice to your finance department for approval and recordkeeping purposes. Otherwise, it’s time to send the invoice. If you’re using e-invoicing, sending an invoice requires just one click, but if not you can send it as an attachment to an email, or even print it out and send it in an envelope.

Finally, follow up on invoices. On the payment due date, check your accounts to see if the payment has arrived. If not, you might need to send a reminder, or get in touch to verify if the invoice arrived. Most invoice building software notifies you when the invoice arrives and when the client opens it, which helps with follow-up, and some send automated payment reminders.

Using the correct invoice format

Using the right formatting is almost as important as putting the right information into an invoice. With e-invoicing, you’ll just need to make sure to choose the right template and the formatting will be done for you.

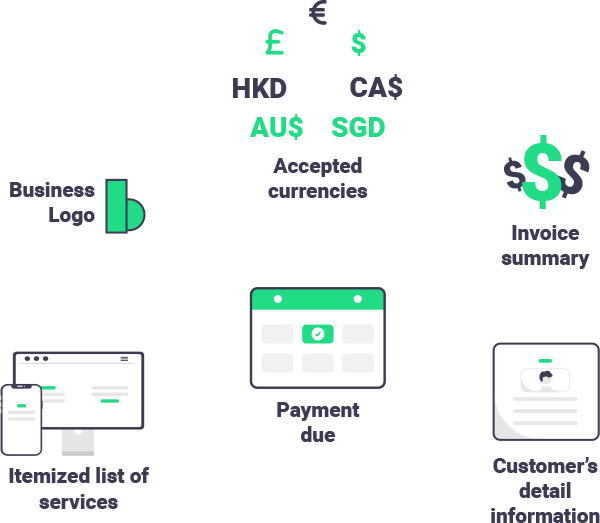

What to include in an invoice?

An invoice is a legal accounting document, so there are some things that you have to make sure to include every time.

Here is a list of the items to include in every invoice you send:

- Your name, company name, registered business address, and contact details.

- The recipient’s name, company name, registered business address, and contact details.

- A unique invoice number (if you use invoicing software, it will create this for you).

- The date you prepared the invoice.

- The date when payment is due.

- A detailed list of all the products you sent or services you provided. This should be itemized, with each type of product or service on its own line.

For products, include the number of units; for services, include the number of hours worked (if relevant) or the number of services provided (like building 3 websites).

- Itemized pricing. If you sell products, give the unit cost of each item together with the quantity ordered. For services, either list the price of each service together with the quantity, or your hourly rate together with the number of hours.

- Payment terms, such as on receipt of the invoice; net 30 days; net 60 days; or net 90 days.

- Your payment methods, like credit/debit card payments, wire transfer, ACH bank debit, mobile wallet payments, cash, checks or e-checks, and online payments.

- For international invoices, include which currencies you’ll accept.

- The total payable.

The items listed above need to be included on every invoice, no matter what type it is. But other things only need to be included on certain types of invoices. For example, a full VAT invoice has to include:

- Your VAT number

- The total excluding VAT

- The total including VAT

- The total amount of VAT due

- The price per item excluding VAT

- The VAT rate for each item, including items that are exempt from VAT or are zero-rated

A simplified VAT invoice only needs your VAT number, the VAT rate for each item, and the total including and excluding VAT.

Invoicing tips and best practices

Be clear

Use a separate line for each type of product or service and itemize the price per unit/service/hour as well as the total price, to avoid misunderstandings. If you have other documentation, like a quote or estimate, a purchase order you received, or a contract, include that along with the invoice.

Send it to the right person

It’s not enough just to send your invoice to the right company — you need the right individual. In big corporations, invoices can bounce around for ages before they reach someone with the authority to make a payment, so check who to send the invoice to and include their name at the top of the invoice.

Make it easy for the client to pay

Include payment details, like your BIC and IBAN numbers for SWIFT transfers or your local bank details for domestic transfers, so the recipient can make the payment straight away without having to look up the details or ask if you accept American Express.

Accept as many payment methods as possible

The more payment methods you include, the easier it is for the client to pay. If you use e-invoicing and accept online payments through a platform like Payoneer, you can include a “pay now” button and the client can click and send payment immediately.

Include your branding

Invoicing is a marketing opportunity, so include your logo and brand colors. It’s a good idea to send a short cover note to say thank you, so keep up your brand tone in the messaging you send.

Invoice on a regular schedule

For example, always send invoices as soon as you complete a project, as soon as the shipment departs, or on the same date every month. This helps you avoid forgetting an invoice, and helps your regular customers to know when to expect it to arrive.

Issue electronic invoices

E-invoicing helps with automating invoice creation and payment follow-ups, saves time on formatting, and speeds up the entire process. Automating invoice generation for recurring invoices means you’ll never forget to send an invoice.

Follow up promptly

Nobody likes to press a client to pay, but when you follow up quickly, it’s less awkward for the client.

Be kind with late payments

Most of the time a late payment is a mistake, not something deliberate, so send a friendly reminder together with another copy of the invoice just in case it got lost on the way. If you have to deal with someone who keeps avoiding having to pay, be polite but firm.

Stay on top of record keeping

Storing a copy of your invoice, marking it as paid, and following up with a receipt of payment is also part of invoicing. Many invoicing tools help automate this too. It’s recommended to keep invoices for at least 3 years for accounting purposes.

Invoicing doesn’t have to be a hassle

When you set up an efficient invoicing system and find the right tools to help you with the process, managing invoices becomes a lot easier. Once you’ve streamlined your invoicing, you’ll see cash-flow management move more smoothly, enjoy fewer headaches over invoice creation and payment follow-up, and have more energy to invest in growing your business.

FAQs

| Is an invoice the same as a receipt? |

| No. Once someone pays your invoice, you need to send a separate receipt. |

| What payment terms should I use? |

Your payment terms are up to you, but common payment terms include:

|

| Is an invoice the same as a bill? |

| Usually an invoice and a bill are the same thing, because they both ask for payment from the customer. |

| What should I do if someone doesn’t pay on time? |

| The first time that someone misses a payment, assume that it’s a mistake. Send the invoice a second time in case it didn’t reach them, along with a friendly reminder. If they repeatedly miss payment requests, or refuse to pay, you might have to take them to court. |