The Payoneer guide to SWIFT payments – Find your Payoneer SWIFT code

The easy Payoneer guide to SWIFT payments

Greetings, business owners, and welcome to our guide to SWIFT pay at Payoneer. As one of the world’s premier payment platforms, we understand the importance of seamless global transactions for eSellers. That’s why we’ve put together this Payoneer SWIFT code guide – just for you.

We’re here to provide you with a comprehensive guide on SWIFT— The Society for Worldwide Interbank Financial Telecommunications. SWIFT connects over 11,000 institutions worldwide, ensuring secure messaging and facilitating the exchange of valuable information between banks and other financial entities.

Established in 1973, SWIFT was created as a reliable messaging system to transmit transaction information without any room for confusion. It’s important to note that SWIFT doesn’t hold funds, and you don’t need a personal SWIFT account to initiate a transaction.

Rather, SWIFT acts as a secure channel for banks and financial institutions to exchange messages globally. While SWIFT was initially developed by banks, it has evolved to serve a broader range of entities, including foreign exchange services, money brokers, and various financial institutions. The latest stats reveal that SWIFT processes 35 million transactions per day.

With SWIFT, customers can easily and securely pay each other, even if their accounts are held at different banks or in different countries and currencies. This makes SWIFT pay the go-to solution for cross-border transactions, fostering global connectivity and enabling efficient financial operations.

As part of our commitment to empowering eSellers, we leverage SWIFT’s capabilities to facilitate all your international payment needs. Through this comprehensive guide, we aim to equip you with the knowledge and tools necessary to leverage SWIFT’s secure messaging system and unlock the potential of global value movement.

Fast facts about SWIFT

- 8.4+ billion FIN messages annually

- 100% SwiftNet availability

- 200+ countries and territories connected

- 99.999% FIN availability

- 11,000+ institutions connected to SWIFT

*Source: SWIFT.com

Driving innovation with SWIFT

SWIFT is driving innovation to transform the world of payments and securities. With a focus on faster, smarter transactions, SWIFT is committed to enhancing the user experience and unlocking new possibilities for the financial community.

Frictionless instant payments

SWIFT simplifies cross-border payments, aiming for a straightforward, quick, and secure experience. Collaboration, communication, and trust are the foundations of SWIFT’s mission to enable seamless payments across borders.

Continuous innovation

SWIFT gpi, a groundbreaking framework for cross-border payments, increased transparency, and speed, revolutionizing the industry. With thousands of banks adopting SWIFT gpi, billions of payments are processed faster, and transparency has improved substantially.

SWIFT’s framework has revolutionized international money transfers bringing speed, transparency, and traceability to the fore. As SWIFT advances, this payments revolution accelerates, driving transformative advancements in the global financial landscape.

Into the future

SWIFT is transforming its platform to enable instant, frictionless cross-border payments, ensuring efficiency, cost-effectiveness, and security. This includes improved data quality, advanced analytics, and new value-added services to enhance the customer experience.

Future-proof solutions

SWIFT continues to enhance its platform with planned functionalities, including gpi and financial crime compliance. These services serve as building blocks for transaction management capabilities, such as pre-validation and fraud detection, ensuring investments remain future-proof.

Benefitting businesses and beyond

SWIFT’s approach benefits businesses by providing transparent fees, faster transactions, and optional shared services for data and compliance. This expands reach, strengthens operations, and facilitates growth in existing and new areas.

What is a Payoneer SWIFT code used for?

A SWIFT code, also known as a BIC (Bank Identifier Code), is a unique code used to identify the country, bank, and branch associated with a specific account. It is essential when sending money internationally to ensure it reaches the correct destination. SWIFT codes serve as the foundation of the entire SWIFT system, providing a unique identification number for banks, branches, cities, and countries.

To understand Payoneer SWIFT codes better, let’s break them down:

Purpose: A SWIFT code identifies the receiving bank, branch, city, and country for an associated account. It is sometimes referred to as a SWIFT ID, bank identifier code, or ISO 9362 code.

Different from IBAN: It’s important to note that a SWIFT code is distinct from an IBAN code. While a SWIFT code identifies the bank and branch, an IBAN code includes additional information such as the bank account number, bank branch, bank name, country, and city.

Structure: SWIFT codes consist of either 8 or 11 characters. In an 8-character code, the first four characters represent the bank name, the following two indicate the country, and the final two refer to the city. In an 11-character code, the bank utilizes three characters to denote the branch.

Understanding the purpose of a SWIFT code:

When sending a bank transfer to family or friends in another country, a SWIFT code is required. It ensures that the money is directed to the correct country, bank, and branch associated with the recipient’s account. Without a SWIFT code, the bank transfer may not reach the intended destination.

Appearance and how do I find my SWIFT code

A SWIFT code comprises 8 or 11 letters and numbers arranged in the following format: AAAABBCCDDD.

(We have added colors for illustrative purposes only)

- AAAA: 4-character bank code – Red for bank code

- BB: 2-character country code – Black for country code

- CC: 2-character location code – Purple for location code

Let’s consider several prominent multinational banks and their SWIFT codes:

- Bank name: UniCredit Banca

- SWIFT Code/BIC: UNCRITMM

- Bank Name: HSBC Bank PLC

- SWIFT Code/BIC: HBUKGB4B

- Bank Name: Deutsche Bank AG

- SWIFT Code/BIC: DEUTGB2L

- Bank Name: Lloyds Bank PLC

- SWIFT Code/BIC: LOYDGB2L

- Bank Name: Bank of America N.A.

- SWIFT Code/BIC: BOFAUS3N

- Bank Name: Wells Fargo Bank N.A.

- SWIFT Code/BIC: WFBIUS6S

For a comprehensive listing of banks and their designated SWIFT codes, click here.

While a SWIFT code identifies the bank and sometimes the branch, it doesn’t provide specific information about the receiving account. To complete an international payment through SWIFT, you also need to provide the recipient’s name, account number, and the receiving bank’s name and address.

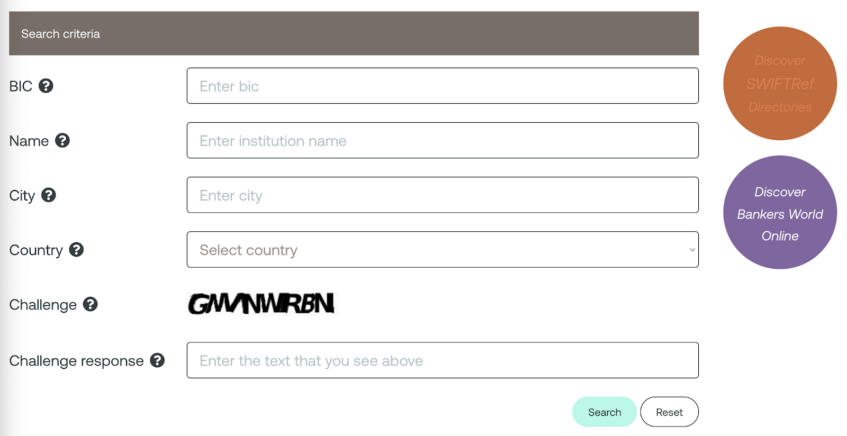

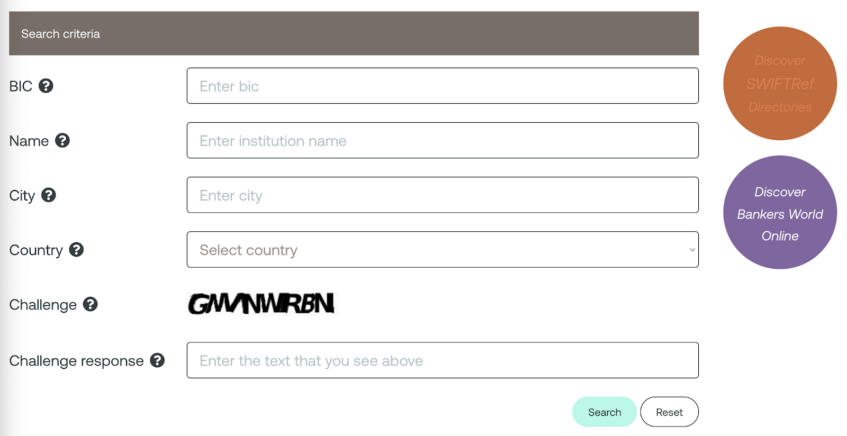

To find a SWIFT code, you have a few options:

So, now you know what these codes look like, but you’re wondering: How do I find my SWIFT code?

- Check your bank statements: SWIFT codes are often listed on paper statements or within online banking platforms.

- Visit the bank’s website: Many banks provide SWIFT codes on their websites, either in FAQs, international payment sections, or through a search feature.

SWIFT codes and BIC codes:

SWIFT codes and BIC codes are part of the ISO 9362 standards used for international money transfers. SWIFT stands for Society for Worldwide Interbank Financial Telecommunication, while BIC represents Bank Identifier Code. Both codes are employed globally to identify bank branches, ensuring the accurate and secure transfer of funds.

Remember, folks, SWIFT codes are essential in ensuring the correct routing of international bank transfers. By understanding their structure and purpose, you can confidently provide the necessary information to facilitate secure and accurate transactions.

How do SWIFT payments work?

When it comes to conducting international transactions in the online marketplace, SWIFT payments play a crucial role in ensuring smooth and secure money transfers. Let’s dive into how SWIFT payments work and how they benefit eSellers navigating the global marketplace.

Nostro and Vostro accounts: connecting banks

To facilitate SWIFT payments, banks utilize Nostro and Vostro accounts. Nostro accounts belong to the bank initiating the payment, while Vostro accounts belong to the bank receiving the funds. This system enables seamless collaboration between banks and ensures the successful completion of transactions.

Streamlined payments with direct relationships

When eSellers and their business partners have established direct relationships with compatible banks, SWIFT payments become swift and efficient.

Here’s an example of how it works:

Imagine you’re an eSeller based in Milan, Italy, selling your products globally. A freelancer you collaborate with has an account at Siam Commercial Bank in Bangkok, Thailand. To make a payment of €500, you provide UniCredit Banca, your bank, with the freelancer’s SWIFT code (SICOTHBK).

If UniCredit Banca and Siam Commercial Bank have commercial accounts with each other, the payment process is seamless. UniCredit Banca debits €500 from your personal account and credits it to their commercial account with Siam Commercial Bank. In turn, Siam Commercial Bank transfers €500 from their commercial account to the freelancer’s personal account.

This direct relationship streamlines the payment, ensuring it reaches the recipient swiftly.

Routing through intermediary banks

In cases where banks do not have direct relationships, they rely on intermediary banks that have established connections with both the sending and receiving banks. For instance, if UniCredit Banca and Siam Commercial Bank do not share commercial accounts, they might route the payment through a bank they both work with, such as Deutsche Bank in Berlin, Germany.

In more complex scenarios where no single bank connects the sender and recipient, the payment may traverse a series of intermediary banks until it reaches its destination. However, this can lead to increased costs and longer processing times.

Empowering eSellers in the global marketplace

For eSellers and online entrepreneurs operating in the global marketplace, understanding SWIFT pay is essential. SWIFT provides a secure, reliable, and widely accepted system that enables smooth cross-border transactions.

By leveraging SWIFT payments, eSellers can expand their reach and seamlessly receive funds from buyers worldwide. Whether it’s selling products internationally or accepting payments from global marketplaces, SWIFT pay ensures efficient and trustworthy transactions.

As an eSeller, it’s crucial to have the necessary information ready, including the recipient’s SWIFT code, account details, and the corresponding bank’s name and address. This ensures a smooth transfer of funds, facilitating your business growth in the global marketplace.

With SWIFT as your trusted partner in the international payments landscape, you can confidently navigate the complexities of cross-border transactions, streamline your operations, and seize new opportunities in the ever-expanding world of ecommerce.

Navigating SWIFT money transfer fees: seamlessly conduct cross-border transactions

When engaging in SWIFT money transfers, understanding the associated fees is crucial for successful cross-border transactions. Let’s explore the fees involved, empowering you to make informed decisions and conduct seamless international transfers.

Outgoing wire transfer fee:

- Charged by your bank, this fee covers the initiation of your SWIFT payment.

- Amount varies based on factors like transfer amount and destination country.

Incoming payment fee:

- Imposed by the recipient’s bank, this fee processes the incoming SWIFT transfer.

- The specific amount varies based on the received amount and country of origin.

Foreign exchange fee:

- This applies when the currencies of the sender and recipient differ.

- Covers currency conversion costs, facilitating seamless cross-currency transactions.

- Amount varies based on exchange rates and bank policies.

SWIFT tracing fee:

- Occasionally charged for checking the progress of your payment.

- Common when investigating delays or missing transfers, ensuring support and investigations.

Navigating fee variations:

- Fee structures differ among banks, necessitating familiarity with your bank’s specific policies.

- Understanding fees empowers you to make cost-effective cross-border transactions.

Streamlining global transactions:

- Despite fees, SWIFT empowers businesses and individuals in the global marketplace.

- Seamlessly connect with partners worldwide, unlocking vast opportunities.

Stay informed and efficient:

- Understand the fees associated with SWIFT transactions.

- Collaborate with your bank to optimize cross-border financial endeavors.

Maximize value with confidence:

- Comprehending costs enhances the value of SWIFT transactions.

- Expand your global footprint with confidence, leveraging the power of SWIFT.

In a nutshell: SWIFT charges member banks a one-time fee and annual fees based on message types used, which are then passed on to customers. Transaction costs depend on the bank’s usage volume and policies, and currency conversion fees apply if required.

How long does a SWIFT payment take to process?

When it comes to SWIFT payments, it’s important to understand the time required for processing as various factors come into play. While ensuring robust security measures against fraud and money laundering, SWIFT’s processing timeframe can be influenced by several practical considerations.

Anti-fraud and anti-money laundering checks:

- SWIFT conducts thorough checks on every payment to ensure enhanced security.

- While these checks contribute to transaction safety, they also add to the overall processing time.

Time zones and public holidays:

- Global transactions involve different time zones and public holidays, impacting processing timelines.

- The availability of banking services during specific hours and non-working days can influence the speed of your SWIFT payment.

Banking procedures and intermediary banks:

- The complexity of your payment journey, including the involvement of intermediary banks, can affect processing time.

- If your transaction requires multiple intermediary banks, the processing duration may extend to ensure smooth routing.

Practical examples:

- Payments between banks with a direct relationship can be processed within a day, thanks to streamlined communication.

- However, if your payment involves several intermediary banks, the process may take up to four working days to navigate the necessary channels.

Please note that these examples provide general timeframes, and actual processing times may vary based on individual circumstances and bank policies. By maintaining open communication with your bank and staying informed, you can better manage your expectations and optimize your financial operations.

Understanding the practical factors influencing SWIFT payment processing time empowers you to plan effectively, ensuring timely and efficient cross-border transactions in the global marketplace.

By prioritizing security and incorporating practical insights, SWIFT facilitates secure and efficient transactions while offering you the peace of mind you deserve.

Payoneer as an alternative to SWIFT pay

Understanding the complexities of international payments is essential for businesses and freelancers navigating the global marketplace. By breaking down the intricacies of SWIFT transactions you now have valuable insights into how these processes work.

While SWIFT transactions offer a secure and established method, the need for faster and cost-effective cross-border payments has become paramount in today’s interconnected world. This is where Payoneer steps in as an alternative solution, empowering you to streamline your payment processes and save money on fees and exchange rates.

With us, you can accept & send payments in local currencies, eliminating foreign exchange fees and ensuring more favorable rates. What’s more, payments between Payoneer accounts are entirely free, allowing you to transact with ease. What a win!

To experience the benefits firsthand and explore Payoneer’s comprehensive platform, we invite you to sign up today. Say goodbye to unnecessary fees and complexities, and embrace a more efficient and cost-effective approach to your international payment needs.

It’s time to embark on a seamless payment journey with Payoneer.

By choosing Payoneer, you’re joining a trusted community of thousands of businesses and freelancers who have harnessed the power of simplified international payments. Start saving money and transforming your cross-border transactions today.