SWIFT money transfer and fees guide

SWIFT money transfers explained

SWIFT (Society for Worldwide Interbank Financial Telecommunication) was established in Belgium in 1973.

SWIFT is a cooperative society that operates a financial messaging network to facilitate the exchange of telex messages between financial institutions, but it has since evolved to include various other forms of electronic communications, such as secure file transfers and emails.

One of the key features of SWIFT is its network availability, which hovers around 99.999%.

Additionally, SWIFT uses the ISO 20022 standard for payments, which helps to ensure a smooth and efficient funds transfer process.

SWIFT charges a small fee for each message sent through its network. These fees vary depending on the type of message being sent and the destination country.

For example, a SWIFT message sent from the United States to Europe will likely have a lower fee than a message sent from the United States to Asia. Additionally, some banks may charge additional fees for using SWIFT, so it is important to double-check with your bank for more information on specific fees.

In terms of facilitating international money transfers, SWIFT allows banks to communicate with one another in a standardized format, which helps to ensure that the transfer is processed relatively quickly and accurately. This is particularly beneficial for large sums of money or for businesses that need to make regular payments. SWIFT is a reliable and efficient way to transfer money internationally, but it is important to be aware of the costly fees.

Information Required for Global Funds Transfer Using SWIFT:

- The sender/recipient’s bank account number and bank’s SWIFT code.

- The sender/recipient’s name and address.

- The currency and amount being transferred.

- The reason for the transfer (such as payment for goods or services).

- Any additional info that may be required by the sender/recipient’s bank (such as a reference number or invoice number).

- The bank’s charge for the transaction

- The sender’s personal identification

- The recipient’s personal identification

- The sender’s authorization to process the transaction

- The recipient’s authorization to receive the transaction

- Intermediary bank information if applicable.

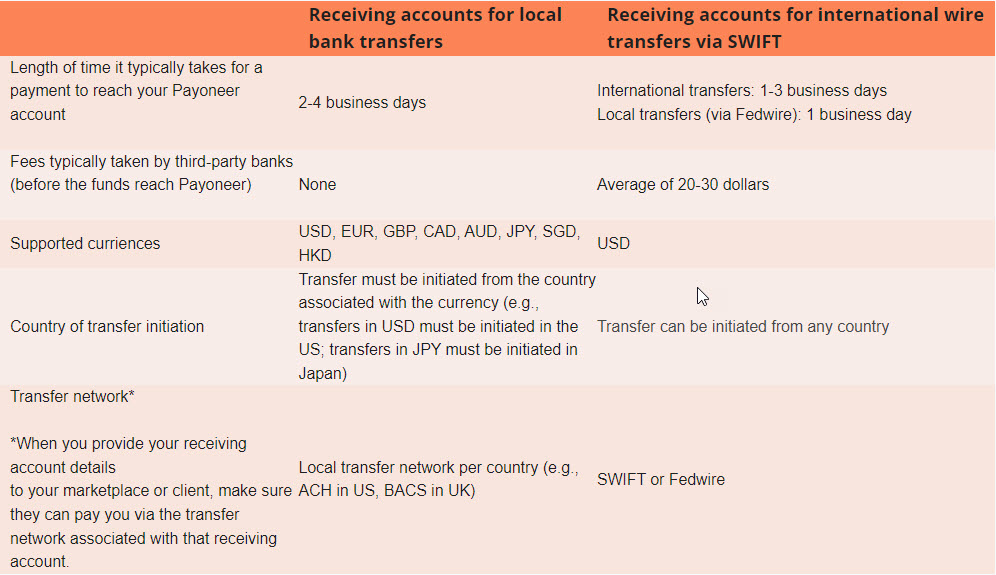

Payoneer offers a SWIFT free alternative for money transfers?

Source: Payoneer Receiving Accounts for SWIFT (Wire) Transfers FAQ

The SWIFT system routinely faces criticism for needing to be updated and faster compared to newer options like cryptocurrencies and digital payment services. Transactions through SWIFT can take several days to complete, and while accelerated options are available, they come at an additional cost.

This lack of efficiency and transparency may not be equitable, especially as more financial institutions and individuals join the network and demand for faster, more efficient options increases.

Payoneer helps freelancers and consultants understand the ins and outs of SWIFT money transfer options by facilitating alternatives to avoid SWIFT fees. Since Payoneer accounts are free of SWIFT, it’s possible to save money and optimize your ROI, through substantially-reduced fees.

What are SWIFT Money Transfer Fees?

When it comes to SWIFT money transfer fees, there are several costs that you may have to pay depending on the type of transfer and the bank you are using.

These include:

- An outgoing wire transfer fee for sending your SWIFT payment. The sender’s bank typically charges this fee for initiating the transfer and can vary depending on the amount being sent and the destination country.

- An incoming payment fee to receive money in your account through SWIFT. The recipient’s bank typically charges this fee for processing the incoming transfer and can also vary depending on the amount being received and the country of origin.

- A foreign exchange fee to convert your payment into another currency. If the currency of the sender and recipient’s currencies differ, a foreign exchange fee may be charged to convert the funds. This fee can vary depending on the exchange rate and the bank’s policy.

- A SWIFT tracing fee to check on the progress of your payment. In some cases, a fee may be charged for checking on the status of a transfer, particularly if the bank needs to investigate a delayed or missing payment.

It’s worth noting that not all banks charge all of these fees, and some banks may have different fee structures and policies.

Therefore, asking for a fee breakdown before you confirm your SWIFT payment is important.

Additionally, SWIFT fees can change over time, so it’s always good to check with your bank for the most up-to-date information.

Freelancers and consultants are encouraged to consider a Payoneer account – free of SWIFT, as a cost-efficient alternative to high SWIFT fees. With Payoneer’s all-in-one platform, it’s possible to avoid the SWIFT money transfer costs and put more of your own money back into your business. The savings rapidly add up over time, particularly with businesses conducting regular large-scale, international money transfers.

Who is responsible for paying SWIFT fees?

Regarding SWIFT fees, it can be confusing to understand who is responsible for paying them. The main point is that SWIFT charges banks and other financial institutions a one-off fee to use its services, plus yearly fees depending on how many messages they send, what types of messages they send, and how long the messages are.

However, these fees are often passed on to customers by the bank. Therefore, the person sending or receiving the money may be responsible for paying the SWIFT fees. The sender of the money can choose to have the recipient pay all the fees or to divide the fees between the sender and the receiver. Banks use codes to track who is paying the fees. These codes include:

- “OUR” stands for “ours” and indicates that the sender of the money is responsible for paying all of the fees associated with the transfer.

- “BEN” stands for “beneficiary” and indicates that the receiver of the money is responsible for paying all of the fees associated with the transfer.

- “SHA” stands for “shared” and indicates that the sender and receiver of the money will divide the fees associated with the transfer.

It’s worth pointing out that these codes are not unique to SWIFT but are used by banks and financial institutions to indicate who is responsible for paying the fees. Therefore, it is essential to check with your bank for their specific policy on SWIFT fees and who is responsible for paying them.

Regarding alternative options, Payoneer is a popular e-commerce business that offers a range of services for online payments, including global bank transfers, mass payouts, and more. In addition, Payoneer is known for its competitive pricing, with transparent and lower fees compared to SWIFT.

Plus, Payoneer offers an account free of SWIFT. This allows for faster transaction times, more payment options, and enhanced security features. As an all-in-one solution, Payoneer is the preferred payment solution for businesses and individuals looking for a more efficient and cost-effective alternative for international money transfers.

See an example of how a SWIFT payment works between a bank in Milan, Italy, and a freelancer’s bank account in Bangkok, Thailand.

SWIFT payment costs

Regarding SWIFT payments, several costs may be associated with the transfer, including fees charged by both the sender’s and recipient’s banks, foreign exchange fees, and trace fees. Your costs largely depend on the originating country and receiving country banks, the number of redirects and intermediaries, individual bank processing fees, and the attendant forex fees.

One of the main costs associated with SWIFT payments is the fee charged by the sender’s bank for initiating the transfer.

This fee can vary depending on the amount being sent and the destination country and can range from a few dollars to several hundred dollars. In addition, the recipient’s bank may also charge a fee for processing the incoming transfer.

Besides bank fees, there may also be a foreign exchange fee associated with the transfer. This fee is charged when the currency of the sender and the recipient is different, and the funds need to be converted. The foreign exchange fee can vary depending on the exchange rate and the bank’s policy and can range from a few cents to several percentage points of the total amount transferred.

Yet another potential cost associated with SWIFT payments is a tracing fee. This fee may be charged if a transfer is delayed or if there is a problem with the payment, and the bank charges a tracing fee to investigate the issue.

It’s worth noting that not all banks charge all of these fees and some banks may have different fee structures and policies.

Therefore, asking for a fee breakdown before you confirm your SWIFT payment is important. Additionally, SWIFT fees can change over time, so it’s always good to check with your bank for the most up-to-date information.

Must I Pay Forex Fees for SWIFT Payments?

Source: Payoneer Full Transparency Fee Schedule

SWIFT payments typically incur a foreign exchange (Forex) fee when the currency of the sender and recipient’s currencies differ.

This fee is charged to convert the funds from one currency to another and can vary depending on the exchange rate and the bank’s policy. The forex fee can range from a few cents to several percentage points (between 3% and 5%) of the total amount transferred.

Banks have a poor reputation for charging high foreign exchange (forex) fees on SWIFT payments because they can leverage their market position and pricing power to charge higher fees. Banks act as intermediaries in the foreign exchange market and can buy and sell currencies at interbank rates, which are more favorable than the rates offered to retail customers.

This difference in rates, known as the bid-ask spread, allows banks to profit when they buy and sell currencies. Plus, banks may charge additional fees to cover the costs of hedging currency risk and operational costs.

Yet another reason why banks charge high forex fees is that the market for foreign exchange is opaque. This means that prices and fees can vary significantly between institutions and different branches of the same bank. This lack of transparency makes it difficult for customers to compare prices and fees and negotiate better rates.

With SWIFT being a global system, many banks charge extra fees to cover the costs of complying with local regulations, taxes, and compliance.

It’s important to check with your bank for their specific policy and fee structure for foreign exchange. For example, some banks may include the forex fee in their outgoing wire transfer fee, while others may charge it separately. Additionally, check with your bank for their most up-to-date information on forex fees and ask for a fee breakdown before you confirm your SWIFT payment.

SWIFT late payments and fees

The sending of a SWIFT payment can take up to four working days to be completed and even longer for the receiving bank to clear the funds into the recipient’s account. Therefore, if you need to make a payment before a certain date, you should allow plenty of time for the SWIFT transfer to go through and the funds to clear. If you don’t, you may end up paying fines for late payment, even though you started the transaction before the deadline.

Despite the name, SWIFT payments are slower than one might expect. It can take several days for the money to reach the recipient, and there is also a possibility of delays due to public holidays in the countries the payment passes through.

Therefore, if you need to make a payment on a specific date, you should plan and allow enough time to go through to avoid any late payment fines.

With Payoneer, these issues are a non-starter since this complete payment solution eliminates the need for using SWIFT money transfers. Moreover, with the GPS (Global Payment Solution) from Payoneer, sending money across borders is easier and more affordable than ever. Best of all, this payment solution is free with money transfers from other Payoneer accounts.

At Payoneer, we understand the importance of reliable and cost-effective international money transfers. That’s why we offer a unique solution that allows you to easily complete global transactions without the added cost of SWIFT fees.

Our service includes a SWIFT code for seamless transactions, and we do not charge any fees for incoming payments.

This means you can save money on your global transactions and have peace of mind knowing that your payments will be received on time.