ecommerce in Nigeria – tips for success

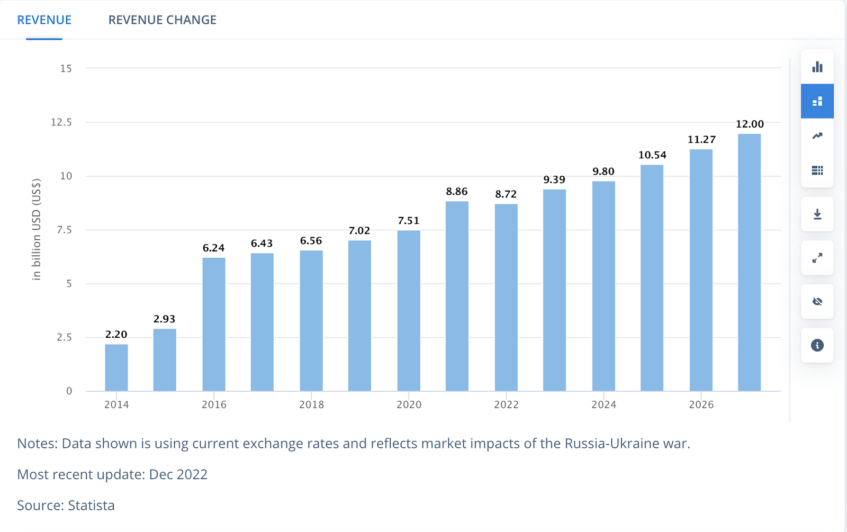

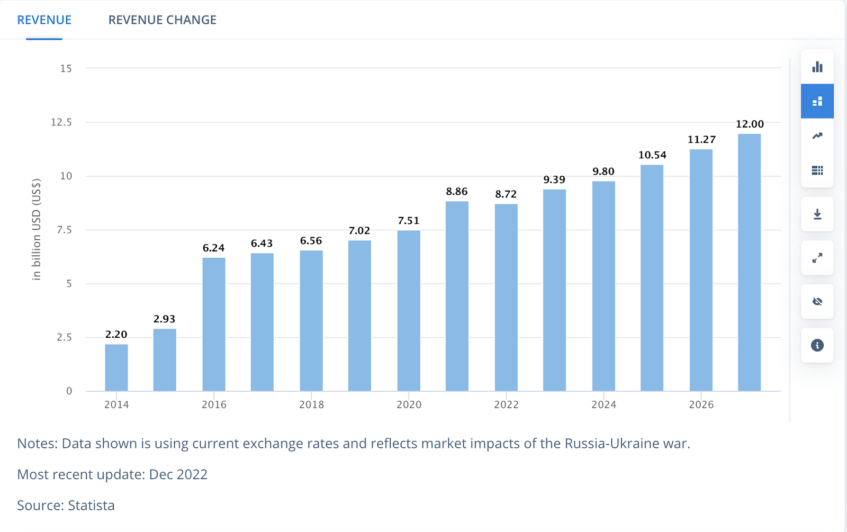

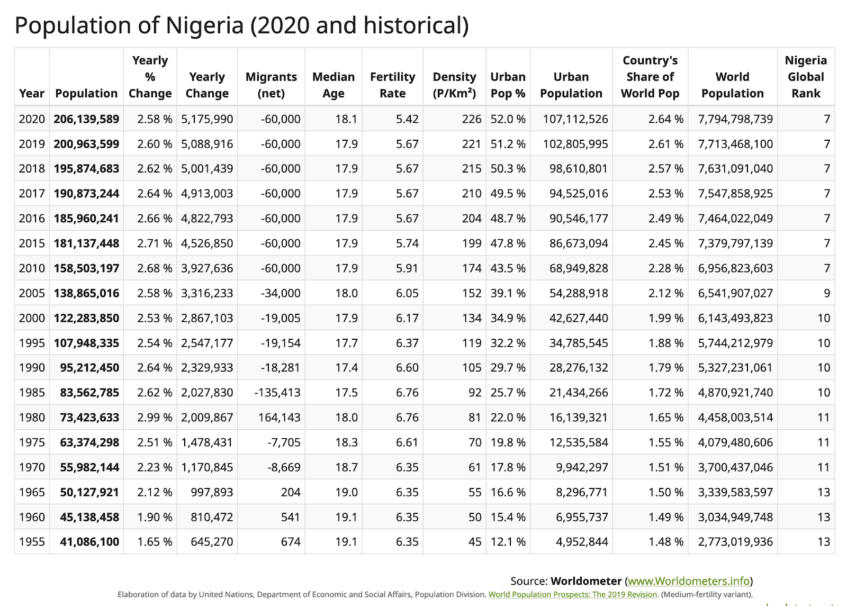

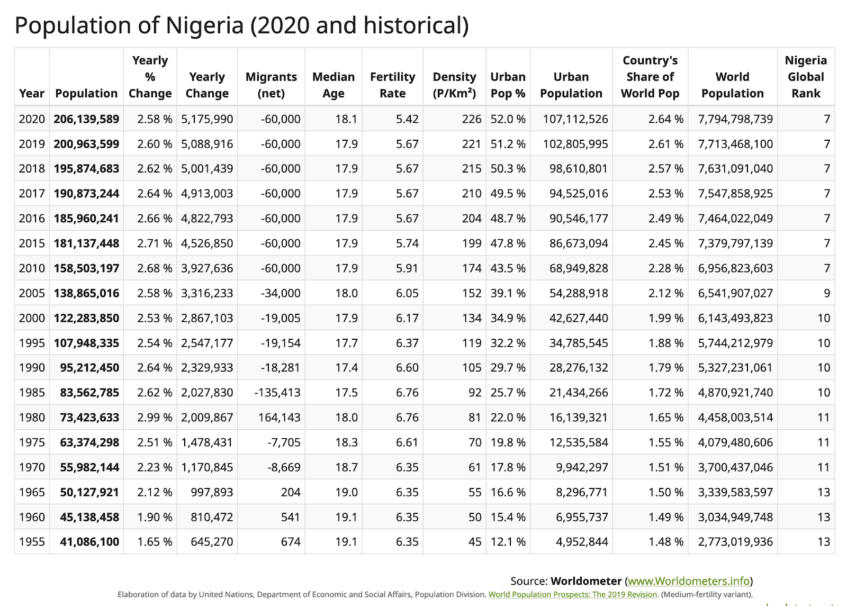

Nigeria’s ecommerce market is rapidly growing and is projected to generate a revenue of US$7,627 million by the end of 2023, making it the 39th largest ecommerce market globally. With a compound annual growth rate of 11.3% (2023-2027), the market is expected to reach a volume of US$11,707 million by 2027.

The Nigerian ecommerce market’s contribution to the global growth rate in 2023 is expected to be over 25%.

- Electronics & Media is the largest market, accounting for 39.3% of Nigerian ecommerce revenue.

- Nigeria’s ecommerce market is predicted to reach US$7.6 billion by 2023, with a compound annual growth rate of 11.3%.

- The market is expected to grow by 25.5% in 2023, contributing to the global growth rate of 17.0%.

- The market is comprised of five major categories: Electronics & Media, Fashion, Furniture & Appliances, Food & Personal Care, and Toys, Hobby & DIY.

The top ranking online stores in Nigeria

- Jumia.com.ng is the leader in the Nigerian eCommerce market, with US$20.7 million in revenue in 2021.

- The top three stores, including Slot.ng and Ajebomarket.com, contribute 52.2% of the revenue for Nigeria’s top 100 online stores.

- The store rankings include all revenue-generating stores in Nigeria.

* Only Revenue Generated in Nigeria was Evaluated

The rapid growth of ecommerce websites in Nigeria

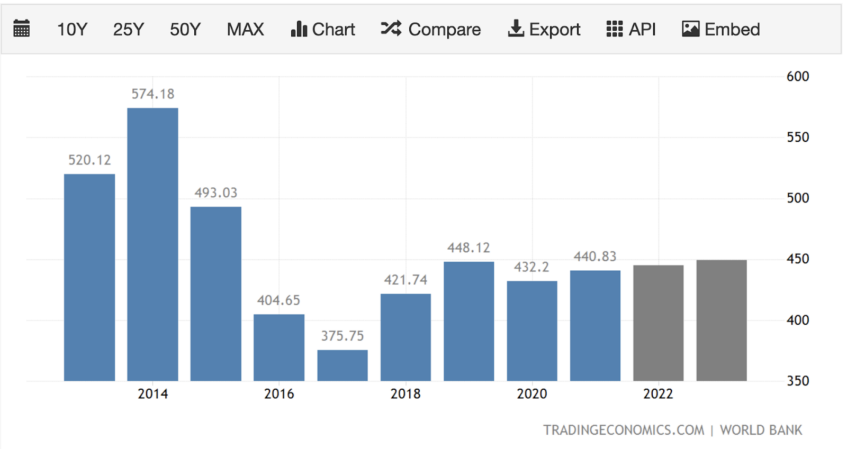

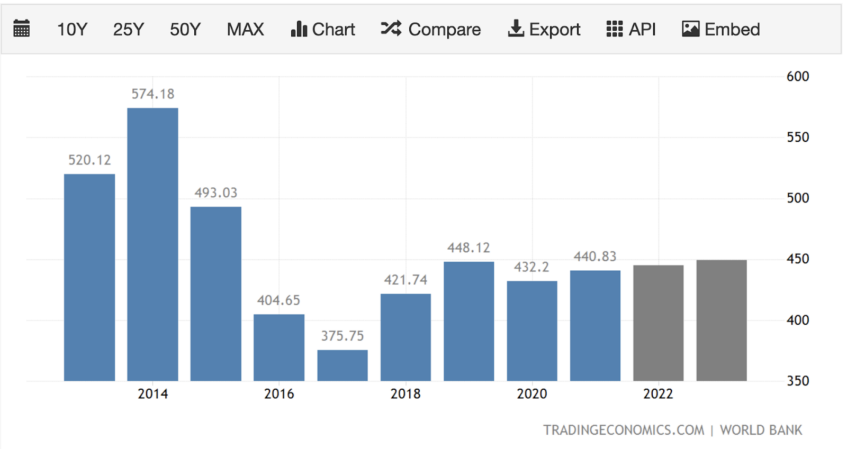

Source: Revenue and projected revenue in billions of USD from 2014 – 2026

In Nigeria, the smartphone segment is expected to generate a revenue of US$9.39 billion in 2023, with a projected annual growth rate of 6.33% (CAGR 2023-2027).

The per-person revenue in this segment is expected to be US$42.25 when compared to the total population figures.

And the average volume per person in the Smartphone segment is expected to be 0.15 pieces in 2023, indicating a potential growth opportunity in the country’s Smartphone market.

Nigeria’s ecommerce economy has grown due to increased internet access and mobile phone ownership. However, despite the coronavirus pandemic’s boost, eCommerce in Nigeria faces several challenges, including inadequate logistics infrastructure, limited payment options, high shipping costs, and low consumer trust.

To overcome these challenges, businesses must prioritize creating reliable delivery networks, secure payment options, and cost-effective shipping methods while establishing customer trust. In addition, successful ecommerce in Nigeria requires navigating Nigeria’s unique market challenges. Indeed, this wealthy African nation is one of the leading countries on the continent.

Let’s now take a closer look at some of the challenges that ecommerce businesses in Nigeria face, and provide solutions to overcome them.

How Payoneer can help with payments to and from Nigeria

Payoneer provides you with the tools and services to effectively manage your incoming and outgoing business payments. Our suite of services, which includes multiple currency accounts with local account details in the US, Europe and Asia, currency conversions and multiple ways to use your funds, ensures you’re able to grow your business in Nigeria and beyond.

Tell me about managing my payments in Nigeria

Characteristics of the Nigerian ecommerce market

According to the latest commercial updates from the International Trade Administration, ecommerce in Nigeria boasts the following features:

Nigeria is also shifting toward cashless payment by implementing digital payment and electronic banking. The adoption of electronic payments has encouraged cross-border and B2B ecommerce and the ecommerce market is estimated to be worth $12 billion, projected to reach $75 billion by 2025.

Payment service providers are investing in Nigerian electronic infrastructure projects, and debit cards from local banks are used by Nigerian travelers abroad.

ecommerce intellectual property rights are protected under the Cybercrimes Act of 2015, but internet fraud remains challenging. Jumia, Konga, and Yakata are among the most popular ecommerce sites in Nigeria.

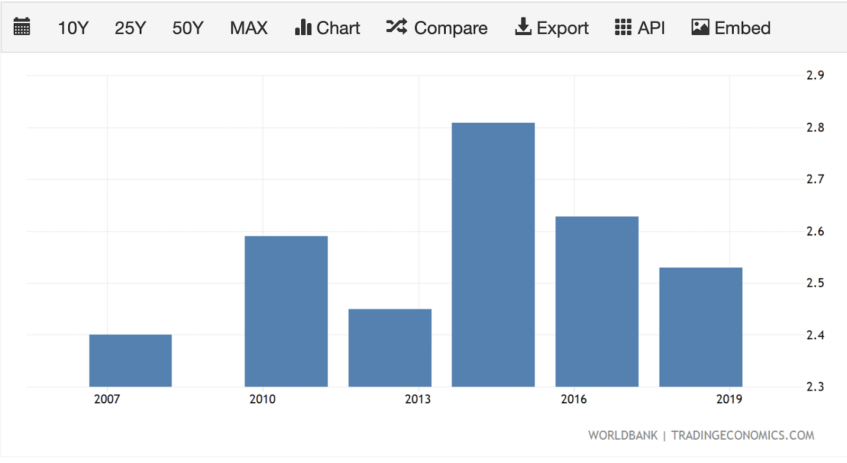

Source: Trading economics Nigeria’s GDP 2014 – 2023

Setbacks for ecommerce in Nigeria

Managing an ecommerce website in Nigeria comes with a multitude of obstacles. The uncertain business environment in Nigeria, combined with various challenges, has impeded the development of ecommerce in Nigeria. Without adequate planning and proactive measures to address these obstacles, ecommerce businesses risk operating at a loss and ultimately failing.

Let’s delve into some of the major challenges Nigeria is currently facing.

Logistical issues when running an online store in Nigeria

The ecommerce sector in Nigeria has faced significant challenges, including the failure of several prominent companies.

However, some businesses have persevered, and their resilience is beginning to pay off as the sector gains increased attention.

TradeDepot’s B2B model has attracted $13 million in investment, and Foodlocker has achieved significant revenue growth.

In other African countries, Sokowatch and Afrikrea have also secured substantial funding.

This delay is largely due to the country’s poor addressing and house numbering system, which poses a significant challenge for logistics companies.

Often, these companies resort to alternative means, such as using major landmarks or seeking help from locals to locate customers.

Bureaucratic policies in government

Governments often impose regulations on businesses, and eCommerce in Nigeria is no exception. However, Nigeria’s lack of a unified system for data archiving and digital identification has impeded the growth of the digital economy and eCommerce sector.

However, more favorable policies could unleash the full growth potential of the industry. Recent policies, such as the ban on cryptocurrency exchanges by banks and the increase in taxation, including VAT, may limit the payment options available to online shoppers and reduce patronage for eCommerce stores.

Nigeria’s poor infrastructure

Nigeria’s digital infrastructure still has a long way to go to support a vibrant digital economy. For instance, credit card availability is minimal, with less than 5% of the population owning one. Additionally, broadband penetration levels in Nigeria are less than 40%, mostly concentrated in urban cities, and the growth in the digital economy is projected to be hindered as a result.

Poor road networks also pose a major challenge, with not all parts of the country accessible by roads. This makes it difficult to deliver goods to remote areas, where people may have to pay more or wait longer for their goods to be delivered, making it difficult for them to patronize ecommerce stores.

According to the World Bank Group, infrastructure has contributed around one percentage point to Nigeria’s per capita growth, despite unreliable power supply, which holds back growth. Improving the infrastructure can boost annual growth by around four percentage points.

While Nigeria has advanced power, road, rail, and ICT networks, challenges persist. Addressing these challenges requires a sustained expenditure of almost $14.2 billion annually through 2021. Nigeria already spent about $5.9 billion through 2011, and it has the potential to raise funds needed for infrastructure, given its strong economy and abundant oil revenues.

Overall, traffic congestion, bad roads, lack of alternate routes, gated roads, and poor networks are major hindrances to the free movement of goods and people, affecting ecommerce growth in Nigeria.

How Payoneer can help with payments to and from Nigeria

Payoneer provides you with the tools and services to effectively manage your incoming and outgoing business payments. Our suite of services, which includes multiple currency accounts with local account details in the US, Europe and Asia, currency conversions and multiple ways to use your funds, ensures you’re able to grow your business in Nigeria and beyond.

Tell me about managing my payments in Nigeria

Nigerian payment gateways

Limited payment gateways are operating in Nigeria due to the absence of international payment platforms such as PayPal in Africa.

This has led to most eCommerce websites in Nigeria relying on the payment-on-delivery (POD) option, which customers can abuse. Even for the existing payment gateways, cost, chargeback frauds, card data security, technical integrations, multi-currency, and recurring payments are still major problems.

Cryptocurrencies have gained relevance in Nigeria due to the country’s economic challenges and the growing demand for alternative means of payment.

With restrictions on foreign currency transactions, many Nigerians have turned to cryptocurrencies such as Bitcoin to bypass currency controls and access international markets.

Additionally, cryptocurrency provides a faster and cheaper way to transfer money internationally than traditional banking methods.

As a result, despite some concerns over regulation and security, cryptocurrency adoption continues to grow in Nigeria.

Security challenges in Nigeria

The eCommerce sector in Nigeria is growing rapidly, but the country’s reputation for internet fraud is a major concern for potential customers, particularly older generations. Nigerians are understandably reluctant to share their debit card information online, fearing they may be scammed or receive something different than what they ordered.

This lack of trust is compounded by the country’s deteriorating security situation, with insurgency, banditry, kidnapping, and armed robbery affecting the movement of people and goods. However, these challenges present unique opportunities for businesses to differentiate themselves by offering secure payment options and reliable delivery services.

By building trust with their customers, brands can overcome these challenges and build a strong ecommerce website in Nigeria.

1. Build trust

ecommerce has become a rapidly growing sector in Nigeria, but it still faces significant security challenges.

These challenges range from the security of personal information to concerns about the delivery of goods and services.

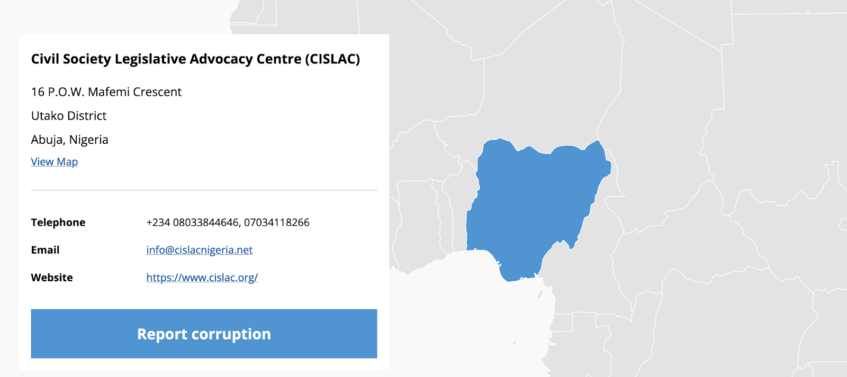

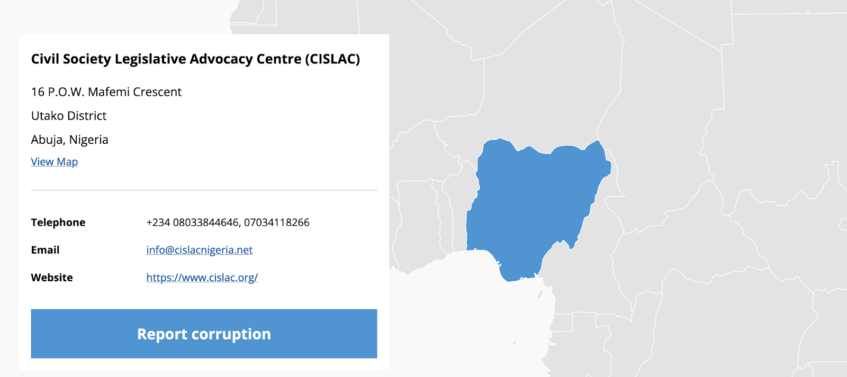

The reputable website, Transparency.org ranked Nigeria as 150/180 in 2022 for Corruption Perceptions Index.

However, Nigeria’s 2022 Corruption Perceptions Index score was 24/100.

However, despite these challenges, there are still ways to build trust and confidence in the Nigerian eCommerce market. In this section, we will explore some ways ecommerce businesses can address these challenges and build a strong reputation for reliability and security.

- Make sure the product delivered is the same as what was displayed and ordered

- Use social proofs such as testimonials, reviews, and badges from previous customers

- Ensure expected delivery times are as accurate as possible

- Operate a flexible return and refund policy

- Ensure the security of customer details and personal information

How Payoneer can help with payments to and from Nigeria

Payoneer provides you with the tools and services to effectively manage your incoming and outgoing business payments. Our suite of services, which includes multiple currency accounts with local account details in the US, Europe and Asia, currency conversions and multiple ways to use your funds, ensures you’re able to grow your business in Nigeria and beyond.

Tell me about managing my payments in Nigeria

2. Offer additional delivery options

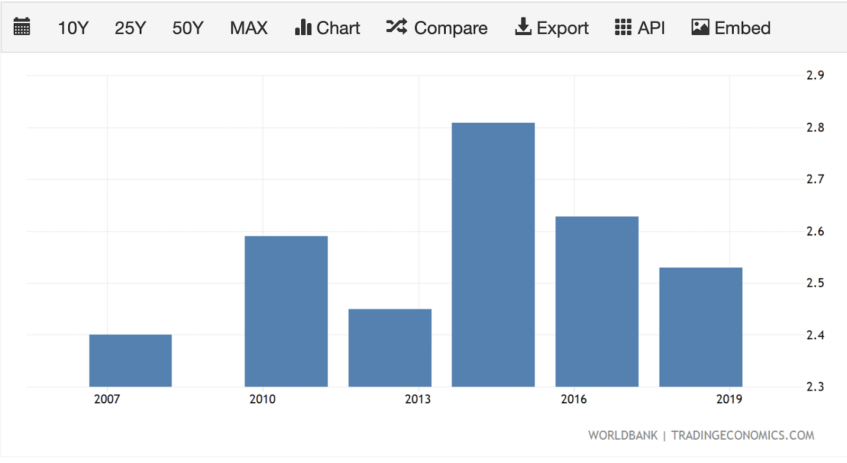

Source: Nigeria Logistics Performance Index

As Nigeria’s eCommerce market grows, logistics remain a major challenge for businesses looking to deliver their goods to customers.

To tackle this problem, businesses must get creative with their delivery options. Here are some ways that ecommerce companies can improve their logistics and increase customer satisfaction:

- Same-day delivery for urgent orders

- Offer drop-off and pick-up options at convenient locations

- Offer free delivery to incentivize customers to make purchases

- Provide express delivery for customers who need their products quickly

- Weekend delivery for customers who may not be available during the week

- Utilize multiple carriers to ensure efficient delivery and reduce the risk of delays

- Additional payment solutions to boost ecommerce in Nigeria

Providing a seamless and efficient customer experience is crucial for any ecommerce business to thrive in Nigeria. To ensure that customers enjoy a hassle-free experience, multiple payment options should be made available to cater to different preferences.

The traditional cash-on-delivery option remains relevant in Nigeria and should not be disregarded. However, it is also important to implement identity verification and routine calls to verify transactions to prevent fraudulent activities and false claims. This will help build customer trust and credibility and ultimately increase customer retention and loyalty.

Top 10 payment solutions for ecommerce websites in Nigeria:

-

Payu

-

GTPay

-

Remita

-

Dusupay

-

Amplify

-

Paystack

-

VoguePay

-

Cashenvoy

-

Interswitch

-

Flutterwave

Plus, businesses can also consider partnering with reliable and secure payment gateways to provide an even more convenient and secure payment process for their customers.

How Payoneer can help with payments to and from Nigeria

Payoneer provides you with the tools and services to effectively manage your incoming and outgoing business payments. Our suite of services, which includes multiple currency accounts with local account details in the US, Europe and Asia, currency conversions and multiple ways to use your funds, ensures you’re able to grow your business in Nigeria and beyond.

Tell me about managing my payments in Nigeria

4. Branding in Nigeria

Branding is a crucial part of any successful ecommerce business in Nigeria. It helps retain customers and improve their loyalty, which is essential to online sales. However, statistics have shown that acquiring new customers is much more expensive than retaining existing ones.

- In Nigeria, branding is particularly important for building customer trust and credibility due to the prevalence of scams and fraudulent activities.

- It’s important to establish a strong visual identity for your brand, including a recognizable logo and color scheme, to make your business easily recognizable and memorable.

- Social media can be a powerful tool for building brand awareness and engaging with customers. Maintaining a consistent brand voice and messaging across all social media channels is important.

- Collaborating with influencers and running targeted ads can also help increase brand visibility and reach a wider audience.

- Partnering with other reputable brands in your industry can help build credibility and customer trust.

- Offering personalized and customized products or services can help differentiate your brand from competitors and increase customer loyalty.

Hence, it is crucial to invest in branding to increase customer loyalty and trust in your business, leading to a significant payoff for your ecommerce activities.

5. Investments in marketing & technology

Marketing and technology are key to the success of any eCommerce business, and this is especially true in Nigeria.

As the country’s online retail industry continues to grow, businesses must invest in digital marketing to stay ahead of the competition. Content marketing, lead generation, and conversion rate optimization are all essential to increase website traffic and sales.

However, businesses must also prioritize technology and security when creating an eCommerce website in Nigeria.

A dedicated server and advanced security measures such as firewalls, 2-factor authentication, and SSL certificates can help prevent cyber-attacks and protect customer data. By investing in both marketing and technology, eCommerce businesses in Nigeria can build a strong foundation for growth and success.

6. Omnichannel is the way forward in Nigeria

Source: ThisDayLive.com from ecommerce to omnichannel

Omnichannel is quickly becoming the way forward for eCommerce businesses in Nigeria.

By utilizing multiple channels to engage customers, businesses can increase their chances of reaching a larger audience and improving their sales.

The ability to shop across various channels has been observed to increase customers’ lifetime value by up to 30%, and Nigerian businesses are starting to realize the benefits of this approach.

With the rise of social media platforms like Facebook, Instagram, and Twitter in Nigeria, businesses can create an omnichannel strategy that leverages these platforms to reach their target audience. In addition, other channels such as retail stores, websites, sales channels, and business forums can all be incorporated into an omnichannel strategy.

One essential component of a successful omnichannel strategy is the availability of a seamless cross-border payment processing solution.

Payoneer, for instance, is an excellent payment solution that enables Nigerian ecommerce businesses to receive payments from global customers in multiple currencies.

With Payoneer, businesses can receive payments from multiple channels, including online marketplaces and individual customers, and withdraw funds to their local bank accounts in Naira.

The ability to process cross-border payments seamlessly is a critical component of any successful omnichannel strategy.

Payoneer is an excellent solution for businesses looking to expand their reach globally.

Boosting ecommerce in Nigeria

The internet has spurred the emergence and growth of electronic commerce in Nigeria, unleashing a wave of opportunities for businesses to tap into. However, the path to success in this promising yet complex domain has hurdles.

Nigeria’s challenging landscape, encompassing physical and digital infrastructures, presents significant obstacles for ecommerce enterprises striving to thrive and prosper.

Yet, a tenacious and enterprising spirit, coupled with a flexible and innovative mindset, can allow businesses to overcome these challenges and leverage the potential of the Nigerian eCommerce market.

With the right mix of creativity, resilience, and adaptability, the rewards of venturing into this dynamic and rapidly-evolving sector can be truly outstanding.

How Payoneer can help with payments to and from Nigeria

Payoneer provides you with the tools and services to effectively manage your incoming and outgoing business payments. Our suite of services, which includes multiple currency accounts with local account details in the US, Europe and Asia, currency conversions and multiple ways to use your funds, ensures you’re able to grow your business in Nigeria and beyond.