Get Your Invoices Paid Faster: 5 Research-Backed Hacks You Should Use

Editor’s note: This is a guest post by Bamidele Onibalusi, freelance writer and Founder at Writers in Charge.

Late invoice payments are no fun. They force freelancers and small business owners to get creative with their bills, instead of their work. Yet, severe cash shortfalls are a sad reality for lots of entrepreneurs. A recent survey of UK SMEs revealed that:

- 51% of respondents state that late payments became a bigger problem than it was 3 years ago

- 58% state that late payments put their business on the verge of failure

- 51% of small business owners are also forced to dip into their personal savings to cover deficiencies

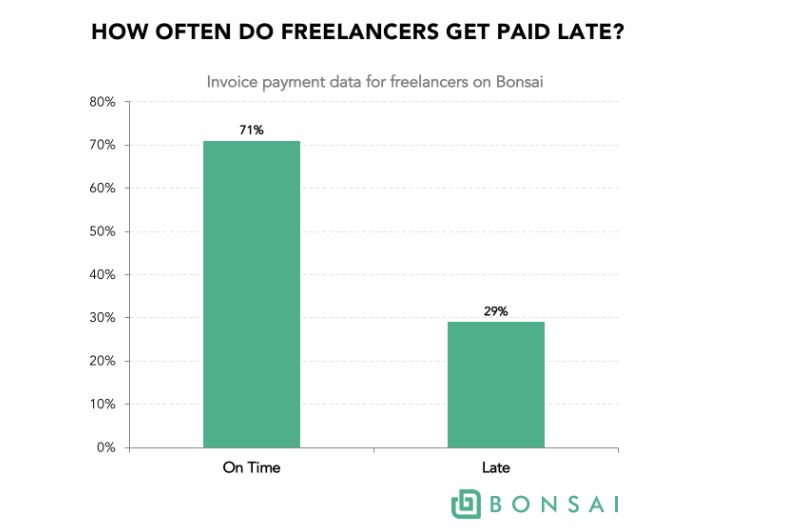

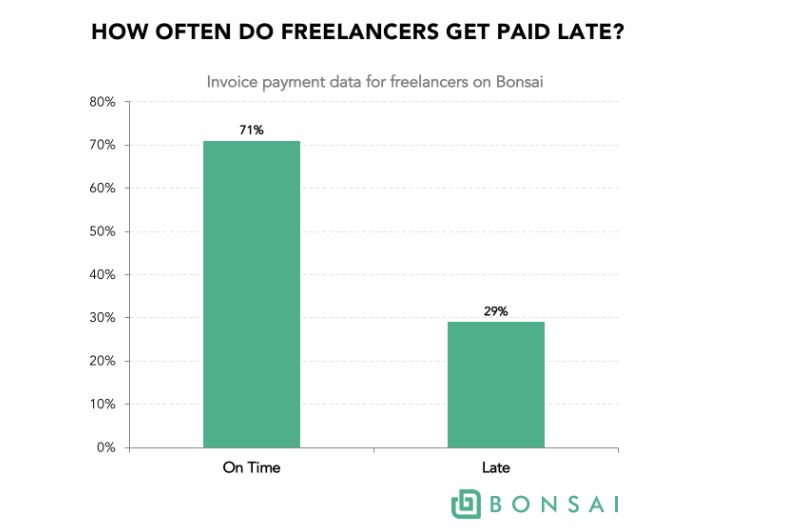

In the freelance economy, late invoice payments are also rampant. Bonsai estimated that 29% of freelance invoices are paid after the due date. The bigger problem, however, is that late payments often evolve into non-payments – another issue plaguing the freelance space. A PayPal study indicates that half of US freelancers have experienced not being paid at least once.

Source: Bonsai

While new legal mechanisms emerged to protect freelancers against non-payment, chasing up a single paycheck still takes a lot of productive time. That is unless you approach your invoicing process the smart way.

Below are several data-backed strategies that will help you get your invoices paid faster.

1. Adjust Your Invoice Payment Terms

What’s the most important number in your invoice? Nope, it’s not the grand total. It’s the due date!

A due date stipulates when your client is contractually obliged to settle your invoice. Forgetting to set a date in stone can result in misunderstandings. For instance, your client may assume that it’s alright to pay you in two months when you hoped to get that paycheck in two weeks.

Here are some ways to avoid such scenarios:

- Communicate your standard payment terms to every client before you begin work

- List the due date and the payment terms on your invoice

Which payment term should you use? Let’s take a look at your options:

Due Upon Receipt

Such invoices should be paid by the end of the business day. Failure to do so will count as a contract breach and enable you to pursue further action (e.g. charge late fees).

While this payment term is advantageous for freelancers as they recuperate their cash faster, it’s somewhat problematic for their B2B clients. Larger companies often have complex billing cycles and your invoice needs to pass several approval stages before it can be settled. Thus, in most cases, it cannot be paid the same day. This may create unwanted tension between you and your client.

Also, ‘due upon receipt’ is not the best option for large projects (e.g. website development, marketing strategy consulting or video production) where the client will need time to review all the deliverables, and double-check those. This payment term works best for small scale, one-off jobs such as photo retouching, social media copy creation or 2-page translation work.

Net D Payment Term

D stands for the number of days you give the client to settle your invoice. The most common time frames are as follows:

- Net 7 – payment due within seven days

- Net 14 – payment due within two weeks

- Net 30 – payment due within a month

- Net monthly – payment should be made at the end of the month following invoice due date. For example, if you send your invoice on October 21st, your client will have to pay it by November 30th at the latest.

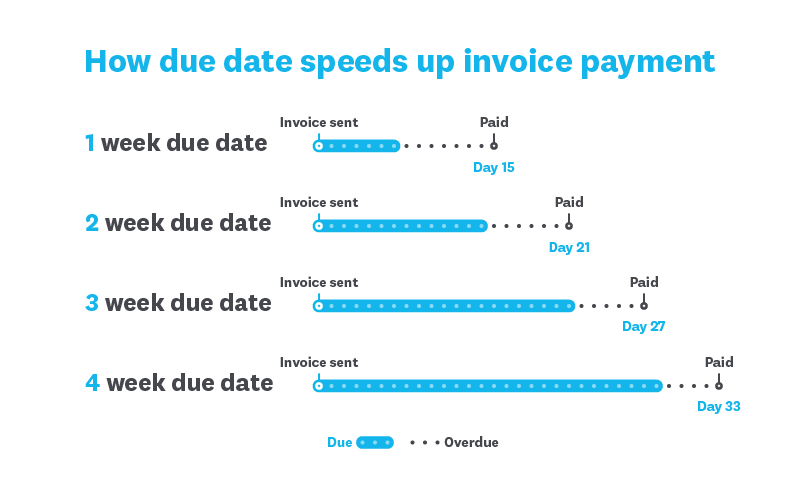

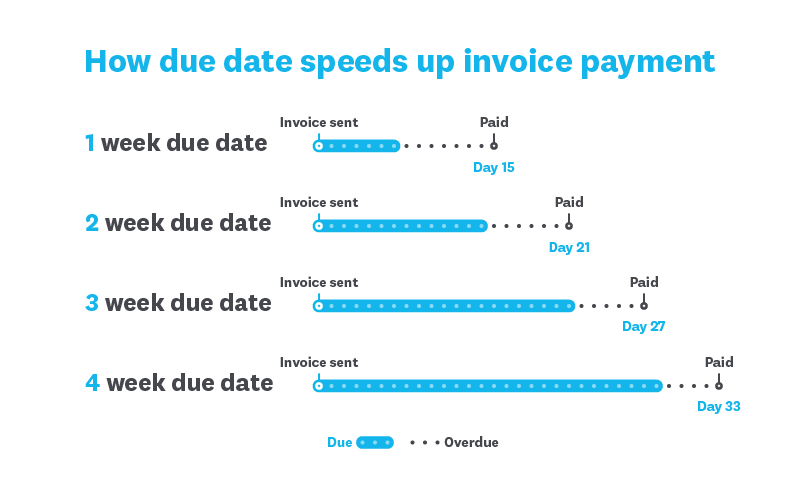

So how long should you give your client to pay? Xero’s study suggests that invoices with shorter payment terms are paid faster. So, opt for NET 7 or NET 14 if you want to receive your payment the same month:

Source: Xero

2. Add a Late Fee Clause to Your Work Contract

As Xero’s graph illustrates, clients will often miss due dates and ignore the payment terms. Collecting those overdue payments can turn into a months’ long struggle, eating up a good chunk of your productive time.

To save yourself the energy, consider adding a late fee clause to your work contract. It could be a simple one-liner stating that:

“Any overdue payments shall require the client to pay a non-compounding X% late fee, accrued monthly on the outstanding amount.”

The standard late fee is 1%-5% max. You can also choose to charge a fixed late fee (e.g. $100 per invoice), though this is less common. In any case, be sure to bring up this clause to your client’s attention as they sign the work contract, and remind them about it when you send over your invoice.

Not everyone would be thrilled with such an arrangement as this letter received by a freelance journalist illustrates:

Late fees can create dissatisfaction among some clients, but they do help you receive your money faster.

3. Bill in Installments

Another proven method for getting your invoices paid faster is breaking down large project payments into more manageable installments.

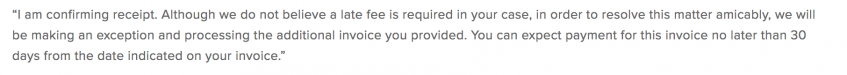

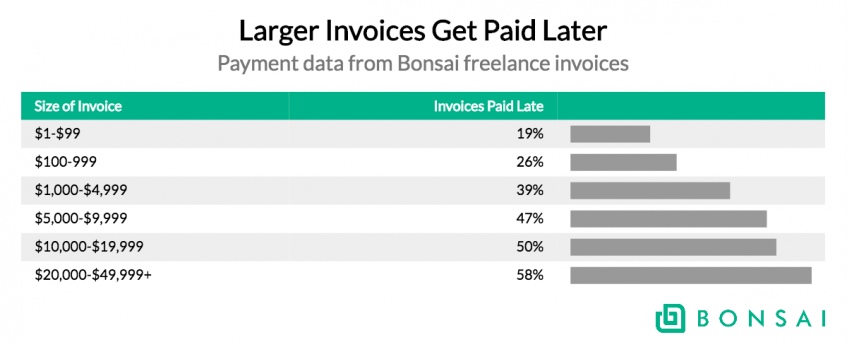

Bonsai research shows that invoices totaling $1,000 or less are settled faster:

Source: Bonsai

That makes sense for several reasons:

- Smaller companies may experience cash flow issues of their own so it may be difficult for them to shell out large sums quickly

- Larger businesses forward the big invoices to their accounting or procurement department that is dealing with hundreds of payments per month which makes the settlement process slower

Want to speed things up? First of all, you approach the client and offer them a custom payment plan – an arrangement that works best for both of you. You can offer to time your invoices to their payroll schedule, for instance. Or, set up a recurring monthly billing plan like a lot of hosting providers do, and collect cash automatically. Perhaps ask your client to speak to their accountant and work things out with them directly.

Bill your clients digitally and offer several payment methods (debit/credit card, bank transfer, etc.). Always re-check your payment details before hitting send.

Lastly, make sure that:

- Your invoice always goes to the right person (e.g. the accountant)

- You have an alternative point of contact in the company and can escalate the late payment issue to someone above your direct manager

If your payment is severely overdue, contacting a senior person may be the best way to draw more attention to the problem and solicit faster resolution.

4. Set Up Automated Payment Reminders

No freelancer likes to appear demanding or impatient when it comes to getting paid. Sometimes firm and polite payment reminders are a necessary evil.

After all, things fall through the cracks all the time, and without a gentle nudge, your invoice can remain buried within a mounting pile of ‘will do late’ chores. So it’s best to remain proactive and create an automated email sequence of payment reminders for clients who tend to miss the due dates.

Your collection should include:

- A payment reminder before the due date – mention that the invoice you’ve sent is approaching its due date and should be settled in X days. Failure to do so can result in late fees.

- First overdue payment reminder – If no action happened on the client-side for 5 business days, dispatch another reminder. Be firmer this time, and state that late fees now apply.

- Second overdue payment reminder – Still crickets? Well, it’s time to be even more direct and state that you plan to escalate the issue to a senior person within the organization or pursue legal action.

Most invoicing software now lets you auto-schedule payment reminders for each overdue invoice. Alternatively, you can use Boomerang for Gmail to do the same.

5. Introduce an Early Payment Discount (with a caveat)

Early payment discounts (also called settlement discounts) are common for five-figure invoices that tend to get stuck in the billing pipeline. It’s a good method for injecting more cash into your business when you have several large invoices due at once and want to avoid cash shortfalls.

Most settlement discounts are as low as 1%-2% of the total invoice and are granted to customers who pay the invoice within 10 or 15 days of receipt. Such terms are added to the invoice as:

- 1/10 – net 30

- 2/10 – net 30

- 1/15 – net 30

We all know that discounts are tricky, and customers may start questioning your pricing and bargain with you the next time around. So here’s one research-backed hack to avoid this – pair your discount with a quick favor request.

A study conducted by The Georgetown University McDonough School of Business showed that favor request majorly increases acceptance of discounted offers. Most people view a discount as a ploy to sell a product. They think that everyone else is receiving the same treatment, thus the offer loses its value (and so do you as a seller).However, when you ask a customer to provide a quick favor in exchange for that discount, they start viewing it as a personalized offer and less of a ploy. The negotiation processes stops being a competition and turns into a reciprocal interaction (i.e. both of us will get something out of this deal).

So if you plan to pitch an early payment discount, pack it along with a quick favor request. For instance, ask the client to provide a referral, leave a review on your LinkedIn/website or write up a testimonial.

Your Business Bottom Line is Important

A business that struggles with cash flow ultimately becomes too expensive to maintain. Stop leaving money on the table and take proactive action when it comes to your invoices!

Bamidele Onibalusi is a successful freelance writer and the founder of Writers in Charge, a leading writing website that helps people get paid to write. You can also follow him on Twitter: @youngprepro.