How to Use Payoneer in Serbia

Many Serbian businesses get confused about the use of alternative payment institutions such as Payoneer. While it’s not only completely legal and exactly like any other foreign currency account, it’s also often preferable.

Let’s go through some of the basics on how to use Payoneer in Serbia.

It’s just another account

Opening a Payoneer account from within Serbia is exactly like opening a foreign bank account through a traditional Serbian bank. You can register as a legal entity.

Every income must be justified

Whether you’re doing business as an individual, entrepreneur, or company, the same rules apply as for any domestic bank account; every income needs to be justified. i.e. it needs to have a corresponding invoice or contract for that payment.

Even if that money never actually physically enters Serbia, you still need to be able to trace it and have a record of it.

According to the National Bank of Serbia and Tax Government, your listing of transactions through Payoneer may be susceptible to control. This means that when the Tax Government requests that you send them invoices etc. for standard control, your documents must include income from any account that is registered with an alternative payment institution.

Important: As an individual, entrepreneur, company or freelancer, you are responsible for reporting taxes to your local authorities. Payoneer does not report tax information on your behalf.

Invoicing like a pro

An invoice is a bill that is issued to every buyer for a given service or sold product, whether you are providing this personally or as a legal entity. The invoice is created with a corresponding date and price and then sent to the customer that executes the payment.

When providing a service or product to another party, you must issue an invoice on the amount you’ve received in your account. The amount stated on the invoice does not include commission from the bank or payment institution or costs of money transfers from one bank account to another.

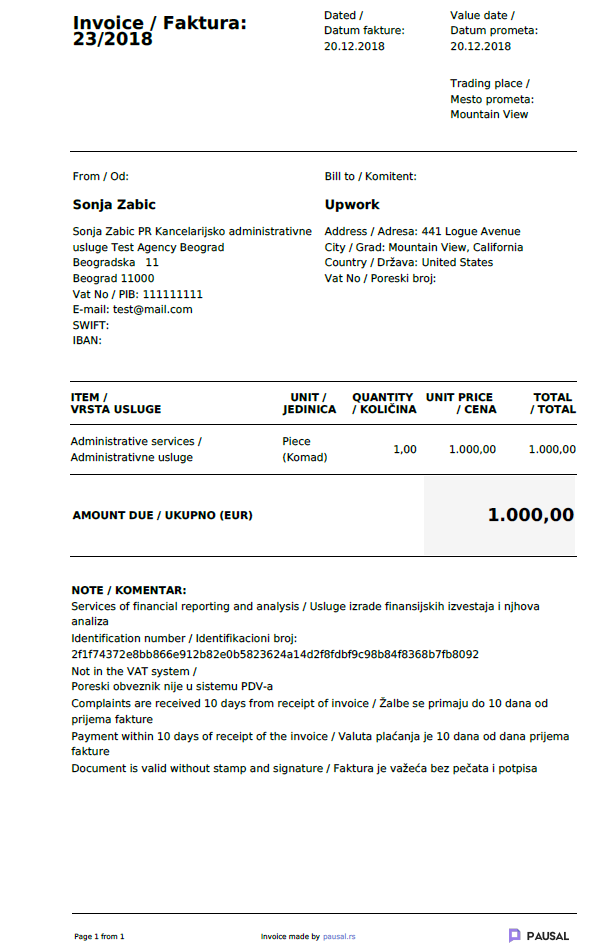

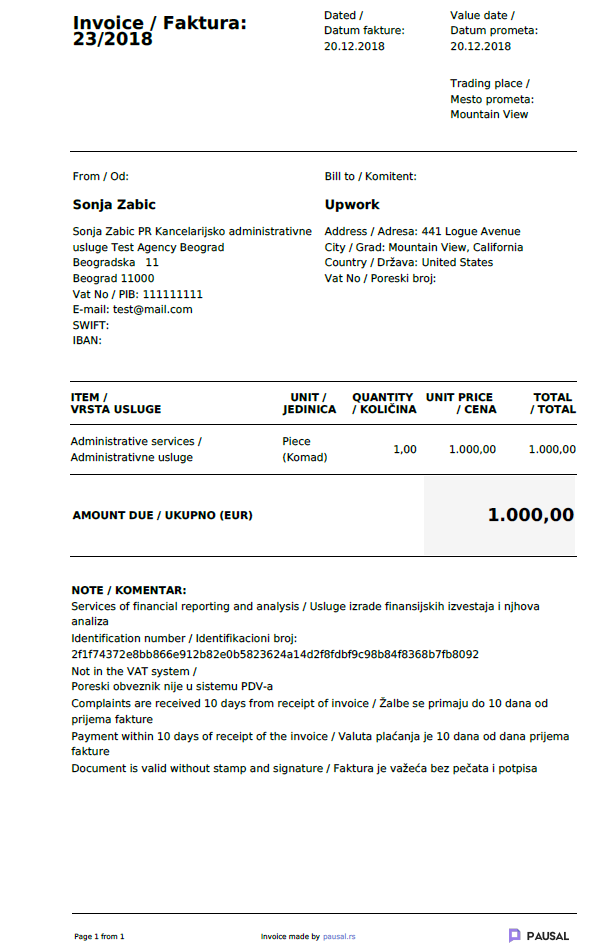

Another issue is the validity of the invoice. Whether you are using a software or creating your own invoices, you must make sure to include two specific elements:

- An identification mark – every electronic invoice needs one of these as proof that you’ve created it.

- Two languages – since legal authorities request that the documentation is in Serbian, or translated to Serbian, it’s preferable that the invoice be created in both Serbian as well as the relevant other language.

Below is an example of such an invoice, which you can create yourself on Pausal’s application.

What to do with the money

Now that you have the money in your Payoneer account in the currency you’ve chosen, you have three options. You can either leave the money in your Payoneer account and use it to make foreign payments, use the Payoneer Mastercard to withdraw your funds in to the local currency, or transfer the funds to your local bank account (no invoice needed for the last option).

Note: When you transfer money from your Payoneer account to your local bank account, the bank will ask you to justify this income. Essentially, this means that you’ll need to fill out a form that testifies on what basis you have received this money and attach the relevant invoice.

The one limit is…

Important! According to Serbian law, transferring money between two residents in a currency other than RSD (Serbian dinar) is not allowed, whether you are both individuals or legal entities. Therefore, if you need to make or receive a payment, make sure you do so in RSD.

Conclusion

While it is absolutely fine to use Payoneer in Serbia (the National Bank of Serbia has even endorsed it), you must make sure to create an invoice for every payment you receive into your account, no matter what you choose to do with the money afterwards.

To aid you in creating invoices and in order to ensure you stay within the Serbian legal framework, register with Pausal.