Bank wire transfers with Payoneer, SWIFT & others

Here at Payoneer, we work hard to ensure you have the best bank transfer options available. That’s why, as a Payoneer client, you have several banking methods available – Local transfers and SWIFT (Wire) transfers. In this article, we will introduce you to both these payment methods and provide a helpful guide on when to use them.

Local bank transfers

Local bank transfers, or ACH transfers, are a popular payment method among Payoneer users. This payment method is ideal for those who want to receive payments quickly and easily from clients or customers in the same country. With local bank transfers, you can receive payments directly to your local bank account without incurring any transfer fees.

Suppose you’re receiving payments in a currency that’s different from your local currency. In that case, Payoneer will automatically convert the payment to your local currency and deposit it into your local bank account. This payment method is ideal for those who want to avoid high transfer fees and currency exchange fees.

Payoneer SWIFT (wire) transfers

On the other hand, SWIFT (wire) transfers are a payment method ideal for those who want to receive larger payments from clients or customers located in different countries. In addition, this payment method is beneficial for international payments requiring high security and reliability.

Payoneer SWIFT transfers are processed through the SWIFT network, a global financial institution network that facilitates international transactions. With Payoneer SWIFT transfers, you can receive payments in multiple currencies and have the option to choose from a range of receiving bank accounts, including USD, EUR, GBP, JPY, AUD, and CAD.

Does Payoneer accept wire transfers?

Absolutely!

Payoneer accepts wire transfers. SWIFT (wire) transfers are one of the payment methods that Payoneer offers clients. With Payoneer SWIFT transfers, you can receive payments via wire transfer from customers anywhere in the world.

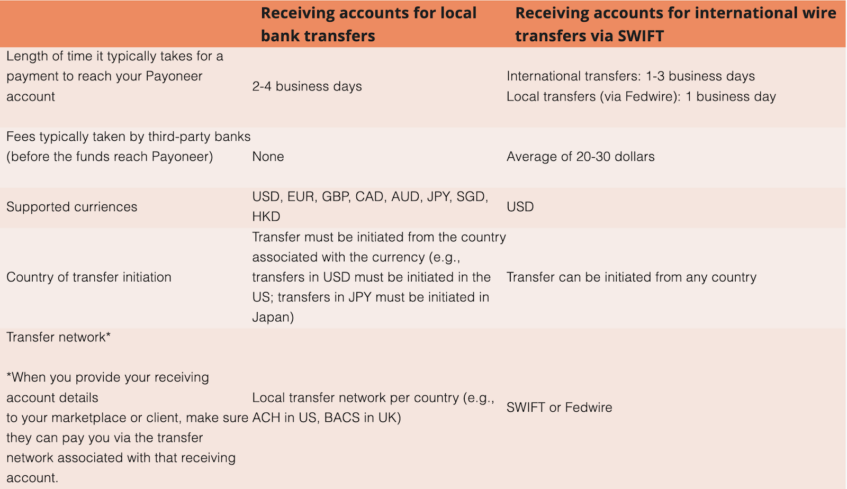

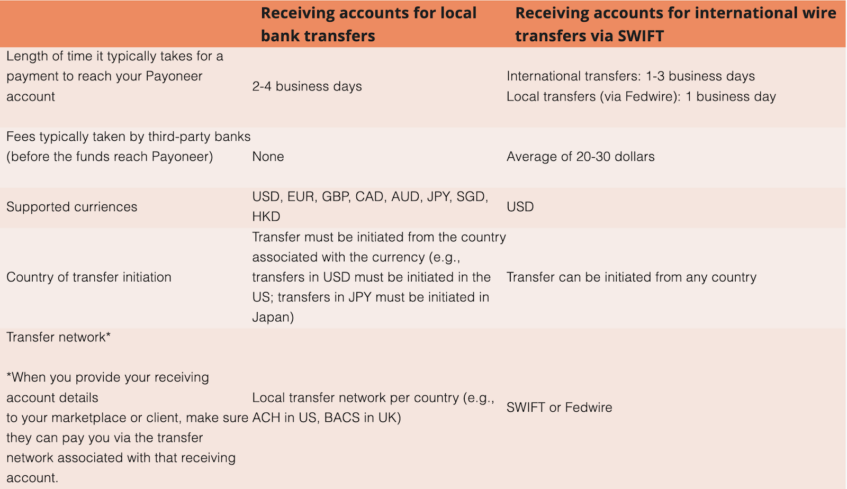

Let’s take a look at the differences between Local Bank Transfers and Payoneer SWIFT Transfers in the table below:

| Receiving accounts for local bank transfers | Receiving accounts for international Global wire transfers via SWIFT | |

| Length of time it typically takes for a payment to reach hit your Payoneer account | 2-3 business days | 1-3 business days |

| Fees | 0%-1% | $20-$40 USD (typically taken by third-party banks (before the funds reach Payoneer) |

| Supported currencies | USD, EUR, GBP, CAD, AUD, JPY, SGD, HKD | USD |

| Country of transfer initiation | Transfer must be initiated from the country associated with the currency (e.g., transfers in USD must be initiated in the US; transfers in JPYEUR must be initiated in Japan/Europe) | Transfer can be initiated from any country |

|

Transfer network* * Check if your client or marketplace can pay through the transfer network associated with your receiving account before sharing the account details.When you provide your receiving account details to your marketplace or client, make sure they can pay you via the transfer network associated with that receiving account. |

Local transfer network per country (e.g., ACH in US, BACS in UK) | SWIFT |

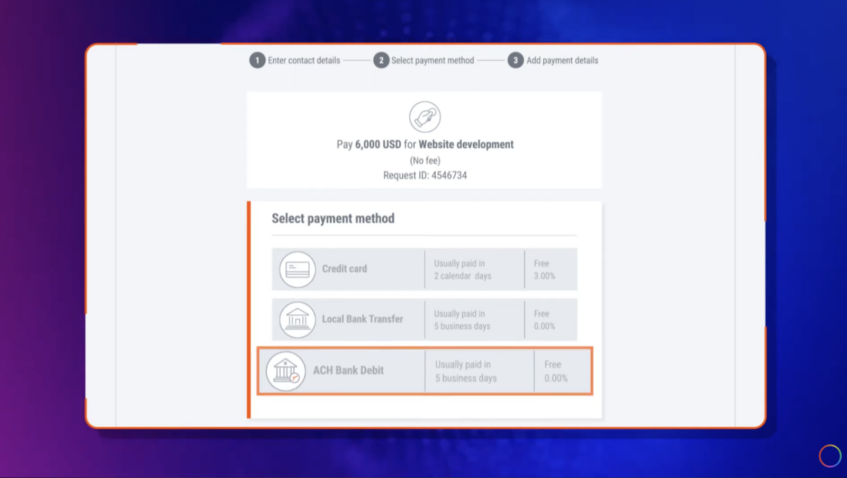

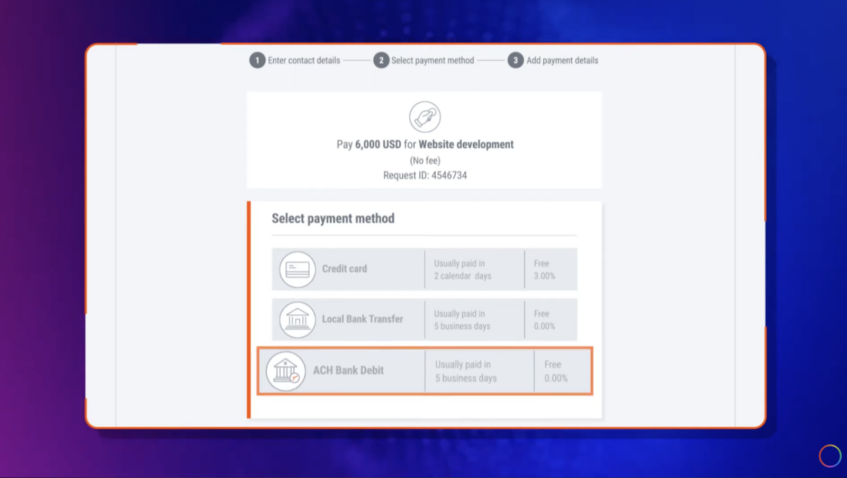

If you want to receive payments from the USA in USD, you can choose between ACH local transfer or SWIFT (wire) transfer. Let’s explore these payment methods in detail.

Request a wire receiving account

What is an ACH transfer?

An ACH transfer is a domestic bank account transfer made within the United States. This payment method utilizes the Automated Clearing House (ACH) network to transfer funds from the payer’s bank account to the recipient’s account.

Payoneer’s local receiving accounts offer ACH transfers to their users, allowing their clients and marketplaces abroad to pay them just as they would with a local US bank account. By utilizing the ACH system, Payoneer allows users to receive payments from the USA in USD seamlessly and efficiently.

Payoneer offers users a receiving account in a designated currency, which they can provide to their clients or marketplaces for payment transfers. Once the company receives these details, it can initiate a bank transfer, and the payment will be credited to the user’s Payoneer account.

It’s essential to note that although receiving accounts share some similarities with bank accounts, they aren’t actual bank accounts. Users can only receive payments via their receiving accounts and cannot make any charges or debits to the account. Therefore, any such attempts will be unsuccessful.

What is a Payoneer SWIFT wire transfer?

Payoneer SWIFT wire transfers are a globally accepted method of international transfer, facilitated through the SWIFT network – one of the most extensive financial messaging systems worldwide.

With SWIFT transfers, payments can be received in real-time, quickly, and conveniently between banks located anywhere in the world. This payment method benefits individuals and businesses needing payments from foreign countries.

On the other hand, Fedwire transfers are solely for domestic payments within the United States. However, both SWIFT and Fedwire transfers enable you to receive payments on the same day they are sent. This means you can receive payments from businesses and individuals worldwide, even in countries where Payoneer’s local receiving accounts aren’t yet supported.

Payoneer SWIFT and Fedwire transfers provide an efficient and reliable way to receive domestic or international payments. Whether you need to receive payments from clients in the United States or worldwide, Payoneer’s diverse payment options have you covered.

Request a wire receiving account

Which payment method is best for you: local bank transfer or Payoneer SWIFT?

Speed of transactions processing

- Local bank transfer

This payment method typically offers fast transaction processing times.

In most cases, payments can be processed and deposited into your bank account within one to two business days.

- Payoneer SWIFT transfer

Transaction processing times may vary depending on the country and financial institution involved. However, on average, SWIFT transfers take 2-5 business days to process.

Fees Charged to Users

- Local bank transfer

This payment method is typically the most cost-effective option. Most local bank transfers are free; some banks charge a nominal fee for processing the transaction.

- Payoneer SWIFT transfer

Additional fees may be involved in SWIFT transfers, such as currency conversion and bank fees. These fees may vary depending on the bank and country involved in the transaction.

Initiating Party Preference

- Local Bank transfer

The initiating party, such as the marketplace or client, often prefers this payment method as it is a more straightforward and familiar process. In addition, this payment method is ideal for receiving payments from clients or marketplaces in the same country as your bank account.

- Payoneer SWIFT transfer

This payment method is often preferred by clients or marketplaces based outside your country. Payoneer SWIFT Transfer is the best option for receiving payments in a foreign currency, making it easier for businesses and individuals to receive payments globally.

If there is no option to get paid by the marketplace or you can’t get paid from the client in the country from which they initiate the payment, several alternatives exist.

One option is to use a third-party payment processor or a payment gateway that supports multiple payment methods. Another option is to consider using a digital wallet, which allows you to receive and store funds in various currencies, making it easier to transact globally.

It’s clear that Local Bank Transfer and Payoneer SWIFT Transfer offer unique advantages depending on the user’s specific needs.

You can choose the payment method that best suits your requirements by considering the processing times, fees involved, and the initiating party’s preference.

In situations where there is no option to receive payments through traditional channels, alternative payment methods can be explored.

*Click here for a list of supported marketplaces in the Payoneer network.

Payoneer offers a range of payment solutions for businesses and individuals across the globe. Local bank transfers and Payoneer SWIFT transfers are two primary payment methods provided by Payoneer, each with its unique advantages.

Local bank transfers are ideal for receiving payments quickly and easily from clients or marketplaces in the same country. In contrast, Payoneer SWIFT transfers are perfect for receiving payments in a foreign currency, making it easier for businesses and individuals to receive payments globally.

When choosing between these payment methods, it’s crucial to consider factors such as processing times, fees, and initiating party preference to ensure you select the best option for your needs.

Regardless of the payment method, Payoneer wire receiving accounts provide secure and reliable options for managing your payments and receiving your funds efficiently.