How to manage Value Added Tax (VAT)

The quick & easy guide to managing VAT

If you’re an eSeller looking to grow your business globally, it’s essential to understand the effects of Value Added Tax (VAT) on your operations.

In the US, VAT is similar to sales tax, with one key distinction: sales tax is only charged at the point of sale, which means resellers are exempt from paying VAT when they make purchases. In contrast, VAT is collected at every stage of the supply chain outside of the US.

As a result, eSellers need to have a plan in place for effectively managing VAT payments. This plan should factor in many different elements, notably:

- Product Type

- Sales Volume

- Delivery Method

- Customer Location

To stay competitive and avoid any unexpected tax liabilities, it’s essential to have a solid understanding of VAT and how it applies to your business. Our in-house experts created a list of helpful VAT management tips for your business.

When does VAT matter to your business?

If your business is located within the EU, you must follow the VAT registration guidelines of your specific country before registering as a VAT-compliant entity. This process can vary depending on the country, so it’s important to research the VAT requirements and ensure you’re fully compliant with the rules and regulations.

Suppose your business is incorporated and located outside the European Union (EU). In that case, you will need to register as a Non-Established Taxable Person (NEPT) to comply with VAT regulations. NEPT is a term that describes businesses not established in the EU that still need to pay VAT on their regional sales.

By registering as an NEPT, you will be able to properly charge and pay VAT on your sales in the EU. This is an important step for any eSeller looking to do business in the EU, as failure to comply with VAT regulations can result in significant penalties and other consequences.

When selling goods on online marketplaces, eSellers must also include their VAT number on their account. So, for example, you will need to add your VAT number to your Seller Central Account (SCA) on Amazon. Similar rules apply to eCommerce platforms like eBay or Alibaba. This will ensure that you are appropriately charged VAT on your sales and can reclaim VAT on your purchases.

By understanding the requirements and implications of VAT, eSellers can avoid unexpected tax liabilities and remain competitive in the global marketplace. Therefore, it’s essential to have a solid grasp of VAT and how it applies to your business to ensure your success and growth in the international market.

VAT and inventory holdings in the EU

Holding inventory in the European Union (EU) can benefit eSellers, as it can shorten delivery times and improve customer satisfaction. However, VAT laws in the EU require that goods be taxed at every stage of the sales process, including the purchase and storage stages.

If an eSeller looking to hold inventory in the EU, you must be registered as a Non-Established Taxable Person (NEPT) to comply with VAT regulations.

For example:

Suppose you have an Amazon store and use Amazon’s Fulfillment by Amazon (FBA) program.

In that case, you may store your inventory in EU facilities to speed up delivery times. However, doing so will also trigger a VAT event.

Holding inventory in the EU can significantly improve the customer experience and grow your business.

But first, it’s important to understand the VAT implications and ensure you comply with the relevant regulations to avoid potential penalties or other consequences.

The payment of VAT: tips to smooth the process

One of the most challenging aspects of VAT is the fact that it must be paid in local currency. This means that, for example, Austrian VAT must be paid in euros, while in Britain, VAT is paid in sterling.

For eSellers located outside of the European Union (EU), this can pose a problem, as fluctuations in exchange rates and transfer fees can impact profitability. These extra costs can be crippling if you run a low-margin business. But, on the other hand, they can be the difference between breaking even and incurring a loss.

To avoid these complications, it’s important to have a VAT payment solution that sharply reduces exchange rates and currency transfer fees and simplifies multi-currency VAT payment management. Effective payment solutions can do precisely that.

This will help you to expand your operations and sell goods internationally without worrying about the impact of VAT on your profitability. Choosing the right VAT payment solution ensures that your business remains competitive and continues to grow globally.

Introducing Payoneer: a low-cost solution for VAT payments

Payoneer is a company that provides low-cost solutions for VAT payments for international eSellers. With Payoneer, eSellers can manage their VAT payments instantly and with minimal costs. Payoneer does not charge withdrawal or currency conversion fees and instead allows eSellers to pay the VAT directly from their Payoneer balance.

This makes it easier for eSellers to manage multi-currency VAT payments while ensuring that VAT payments are received within one business day. In addition, eSellers eligible for VAT refunds can receive the funds directly into their Payoneer account at no additional cost, making it easier to manage VAT funds.

Find out how Payoneer can help you manage your VAT. Our customer support team is standing by to offer assistance. By choosing Payoneer for your VAT payment needs, you can simplify the process and reduce costs, allowing your business to focus on growth and success in the global marketplace.

Sage advice on managing VAT payments

eSellers operating in international markets through Amazon are governed by marketplace rules and VAT compliance.

Consequently, marketplaces preclude the sale of goods to European customers without a VAT number.

However, it’s important to remember that making VAT payments remains the responsibility of the eSeller. I

t’s not the marketplaces like Amazon, eBay or Alibaba, et al. This is why many eSellers are looking for all-encompassing systems to help them process VAT payments as smoothly and efficiently as possible.

Don’t be discouraged from your global entrepreneurial ideas because of VAT complexities. For additional info about the impact of VAT on your business, expected VAT payments, and how best to manage your VAT payments, click the link below to learn more.

5 tips for managing your VAT & sales tax

- Research and understand the VAT regulations for your specific country before registering as a VAT-compliant entity.

- Include your VAT number on online marketplaces when selling goods to ensure you are appropriately charged and can reclaim any applicable taxes on purchases.

- Understand the impact of VAT on holding inventory in the EU, including registering as a Non-Established Taxable Person (NEPT) if necessary.

- Consider using a payment solution like Payoneer to reduce costs and simplify multi-currency management processes when making payments in local currency.

- Remember that making VAT payments remains the responsibility of the eSeller, not the marketplace they’re selling through, so plan accordingly with an all-encompassing system to process payments efficiently and effectively

FAQs

- What is Value Added Tax (VAT)?

Answer: VAT is a consumption tax imposed at every supply chain stage outside the US. It is similar to sales tax, but unlike sales tax, it applies to all stages of production and distribution.

- How do I register for VAT in the EU?

Answer: You must follow the VAT registration guidelines of your specific country before registering as a VAT-compliant entity. This process can vary depending on the country, so it’s important to research the VAT requirements and ensure you’re fully compliant with the rules and regulations.

- Do I need to include my VAT number when selling goods online?

Answer: Yes, you will need to add your VAT number to your Seller Central Account (SCA) on Amazon or other eCommerce platforms like eBay or Alibaba. This will ensure that you are appropriately charged VAT on your sales and can reclaim any applicable taxes on purchases.

- What are some tips for managing multi-currency payments?

Answer: To avoid complications with currency exchange rates and transfer fees, it’s important to have a payment solution that reduces costs while simplifying multi-currency management processes, such as Payoneer, which provides low-cost solutions for VAT payments.

- What is the responsibility of eSellers when making VAT payments?

Answer: Making VAT payments remain the responsibility of the eSeller and not the marketplaces like Amazon, eBay or Alibaba, et al. Therefore, many eSellers are looking for all-encompassing systems to help them process VAT payments as smoothly and efficiently as possible.

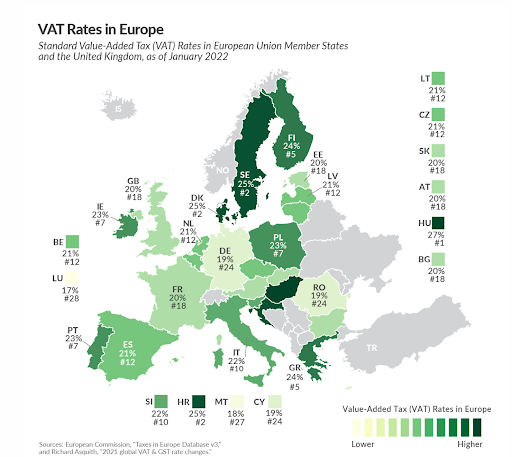

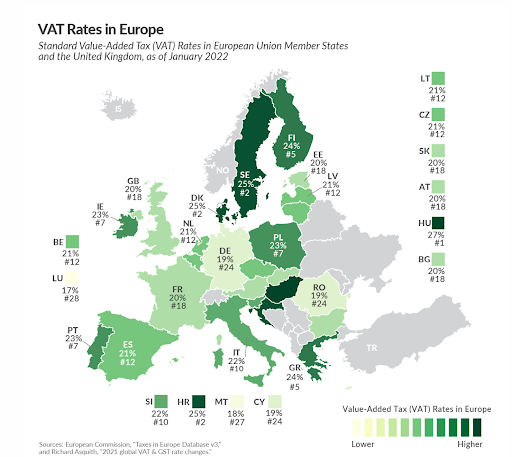

VAT Rates in Europe

Source: Tax Foundation