Best practices for invoicing European or EU clients

Getting paid is a wonderful thing, but sending and managing invoices is less wonderful. Invoice management is a regular challenge for all small business owners, especially when you’re handling your own invoicing and/or bookkeeping tasks. It’s even harder when you have international invoices, and track and record cross-border payments from international clients.

But once you learn invoicing best practices and set up effective invoicing workflows, you’ll find that managing international payments and invoices is easier than you think. When you follow best practices for international invoices, you’ll make it easier for your clients to read your invoices quickly and pay you on time.

Invoicing European or EU clients

Most best practices for invoicing for European clients are common sense ways that make it easy for your client to send payments. For example, always include yours and your client’s details, a description of the goods or services you provided, a breakdown of the total cost, and payment information like your bank details.

But some European countries have specific invoicing requirements. In Italy, e-invoicing is mandatory, so you can’t put a paper invoice in the mail any more. In most EU member states, you’ll need to specify any applicable VAT rates.

It’s also worth it to learn your European clients’ preferences. If you send invoices that are laid out in the style that they are used to, you’ll make it easier for them to understand the invoice, and that means they’ll be more likely to pay you on time.

What’s more, when you send invoices that are laid out in a familiar way you’ll reduce friction for their business workflows, which makes for happy clients who will want to work with you again. But if your invoices are organized in an unexpected way, it makes your business look less professional, even if that’s the way that everyone prepares invoices in your area.

Here’s all you need to know about how to invoice European and EU clients.

1. The details to include when invoicing EU clients

Most of the details in an EU invoice are the same that you’d include on any invoice. To help make sure that you don’t overlook anything when invoicing your EU clients, here’s a checklist to jog your memory.

- Your company’s name and business address

- Your VAT number

- If your business is registered in the EU, include your EU Tax Identification Number (TIN)

- Your client’s business name and address

- Your client’s EU TIN

- Your client’s VAT number

- A unique invoice number

- The date the invoice is issued

- The date that you supplied your products/services

- The location where the product or service was supplied, if it’s different from the client’s business address

- An itemized list of all the products or services you provided, including the:

- Service or item name and short description

- Service or item price, excluding VAT

- The quantity of items or number of hours worked

- The VAT rate for each item or service

- The total cost per item or service

- The total amount due

- Total VAT due

- The total amount eligible for zero rated VAT, if relevant

- Total due for payment, including all taxes

- Payment information for the payment methods you’ll accept, including:

- IBAN and BIC numbers for SWIFT or SEPA wire transfers

- Bank information for BACS local bank transfers

- Your mailing address for checks

- A link to pay online with credit/debit card through your preferred online payments solution

Some countries have extra requirements, like that you attach a copy of the purchase order and include the payment due date, so it’s best to check the requirements for each country individually. Even if it’s not required, it’s a good idea to attach your payment terms and conditions.

Double-check your invoices before you send them. In some European countries, an empty or incorrectly-added field can make your invoice non-compliant. You’d have to redo it and send it again, and that delays your cash flow.

2. Format invoicing for European clients

There aren’t any rules about how to format your European or EU invoice, but it’s best to lay it out in a way that lets your clients read it quickly and easily. Only include the information that your clients need to pay you and complete their accounting records. Anything else makes it harder for the client to find the details they need.

As a general guide, put your logo in the top left-hand corner, and align all the rest of the information against the left margin. Your details and your client’s details should be at the top, and the itemized list of services or invoices organized below, with the payment total and payment methods at the bottom.

Different countries in Europe arrange invoices in slightly different ways, and even the 27 member states of the EU have different preferences. It’s best to follow a template for invoicing in each country, which will guide you to arrange your invoice in a way that is user-friendly for your clients.

3. Offer the best payment methods for EU clients

When you offer a payment method that your clients trust and are familiar with, they’ll be more likely to send payments on time. What’s more, they’ll associate you with that payment method, so some of the trust they feel towards it will rub off onto you.

You might be tempted to offer every payment method you can think of, but don’t get carried away. If you present the client with lots of options, they are more likely to feel paralysed and unable to choose, so they’ll put off making a payment. Just include a few.

Here are some things to consider when deciding which payment methods to include:

- Cost. Your client won’t want to pay extra fees to send payments, and you don’t want to be charged extra to receive your money.

- Security. Assure your client that the money they send will reach the right destination.

- Transparency. You and your client should be able to track the payment’s progress.

- Transfer speed. The faster funds clear, the faster you can use your income to pay your own expenses.

- Flexibility. You want to be able to access your revenue in the way that’s most convenient for you.

Here are some of the preferred payment methods for invoicing European clients.

Credit or debit card payments

It’s convenient for clients to pay online service providers and suppliers with their business credit/debit card, and credit card payments are easy to trace, which helps you both keep your books in order.

But credit card companies can charge high fees for international payments, especially when currency conversion is involved. Business credit cards also come with a cap on payment size, so your client might not be able to pay a large bill in a single payment.

International wire transfers

International wire transfers like SWIFT have a reputation for being secure and trustworthy. But they often come with high fees for both the sender and the recipient, plus the sender has to spend a lot of time filling out forms. SWIFT payments can take days to arrive and they are notoriously hard to trace. If the payment doesn’t arrive or gets delayed, you’ll have no idea what happened.

Most European clients can make payments using SEPA, a Europe-only international transfer scheme that’s faster than SWIFT payments. Regular SEPA payments arrive within 2 days, and SEPA Instant Payments occur almost instantly. Compared with SWIFT, SEPA payments have low fees, because they are processed under the same terms as local bank transfers.

But if you receive a SEPA or SWIFT transfer in EUR to your local bank account outside of the EU, you’ll probably lose money in currency conversion fees and poor exchange rates when you convert it into local currency.

Local bank transfers

Local bank transfers are fast, come with low fees, and clients typically feel that they are secure because they use their trusted bank.

But first, you’ll need to open a local bank account. Most countries have strict rules about who can open a local business account, so you’ll have to find the paperwork, and you’ll probably have to pay an opening fee and commit to keeping a minimum balance in that account. Once you receive payments, you’ll still have to convert it back into your local currency, which can mean losing money on the conversion.

International payments solution

There’s a number of global payments solutions that help contractors and small businesses manage digital payments from their international clients. They offer more favorable exchange rates than banks, together with extra services like payment tracing, automatic payments, and help with invoicing.

For example, Payoneer lets you send an embedded payment link in an email along with your invoice. Clients can use it to pay online using their credit card, local bank transfer, or e-checks, and Payoneer handles currency conversion with its low fees and favorable exchange rates. Payoneer also offers local receiving accounts in 9 currencies, including EUR and GBP, so you can invite European clients to pay you in their local currency.

Once you receive payment, you can keep it in GBP or EUR and use it to pay taxes, buy products online, or pay other Payoneer users in a Payoneer to Payoneer payment. If you prefer, you can convert it into your local currency and withdraw funds to your bank or at an ATM. Online sellers can also connect their Payoneer account to ecommerce marketplaces in Europe to get paid faster and for lower fees.

4. Manage VAT for European invoicing

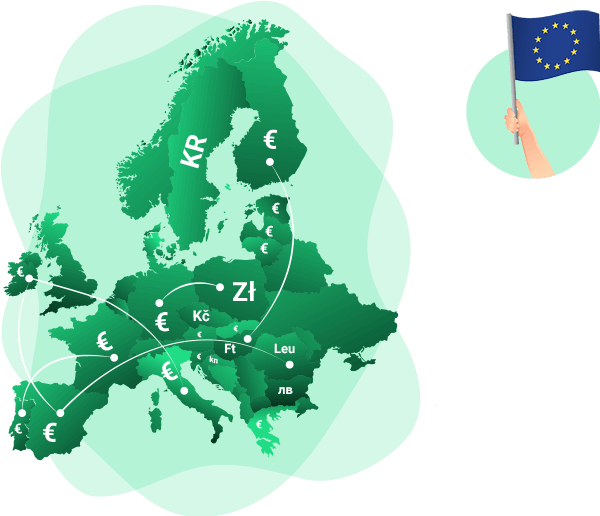

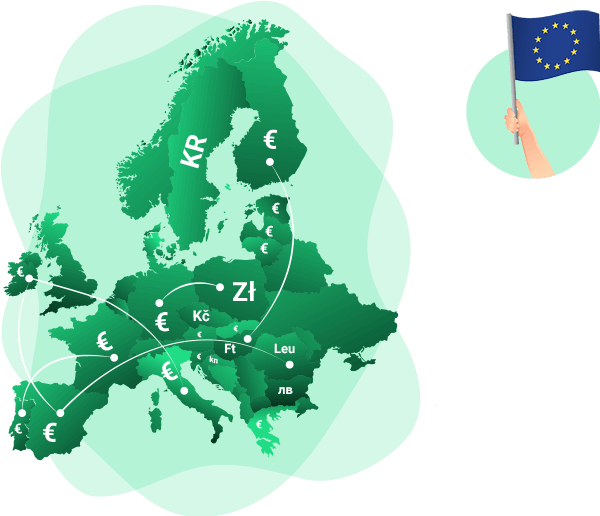

Most online sellers, online service providers, and contractors who work in the EU need to include VAT on their invoices. Most EU countries have three different VAT bands:

- Standard VAT at 19%, which covers most products and services;

- Reduced VAT at 7%, for basic food items, medical equipment, tourism-related goods and services, and some other products and services;

- Zero-rated VAT at 0% for items intended for export outside the EU, and some rail and road transportation services.

You need to register for an EU VAT number if you:

- Buy or sell products in an EU country, including through ecommerce

- Have a warehouse in an EU country

- Hold an event in an EU country

That means that product sellers probably have to register for a VAT number, but online service providers, freelancers, and contractors who work remotely probably won’t.

If your business is registered in an EU country, you’ll have to pay VAT on all VAT-eligible products and services. But small businesses that are registered outside the EU only have to pay VAT if they exceed the “distance-selling threshold.” This is different for different countries; for example, the threshold in France, Ireland, and Italy is €35,000, but in Germany, Luxembourg, and the Netherlands it’s €100,000.

There’s one more thing to bear in mind. If you sell products or services to a VAT-registered business, rather than to consumers, you can usually apply for reverse-charge VAT. This means that your client has to register and track VAT, instead of you. If you are reverse-charging VAT, you need to include “Subject to reverse charge in the country of receipt” on the invoice.

But Europe is a diverse area with many different countries, each with their own VAT rules. There are even variations between different EU member states, although they share a common tax scheme. It’s best to check your VAT obligations for each European country with an expert.

Should I use an online invoice builder for European invoicing?

As you can see, there’s a lot to remember when invoicing European or EU clients. Online invoice builders can help you ease the mental load by making sure that you include all the necessary information and follow a consistent format.

You can build your own EU invoice template, but a free online invoice builder can save you time and effort. Plus you’ll find a bigger range of templates that make your invoice look more professional and attractive. Many integrated online invoice builders offer useful tools like payment tracking so you can see which invoices are paid, cash flow tracking and forecasting, and automated recurring invoices and late payment reminders.

Do EU clients prefer e-invoicing?

E-invoicing is a new approach to invoicing. Instead of sending a paper invoice, or a PDF invoice attached to an email, you can send electronic invoices, or e-invoices, which are digital invoices sent as a data file in XML or EDI format.

Digital invoicing systems can scan and process e-invoices much faster than humans can process traditional invoices. When you send e-invoices, your clients can authorize payments and send information to the right departments with less friction, plus your e-invoicing system can auto-complete invoices quicker than you can.

E-invoicing is catching on in Europe. Italy already made e-invoicing mandatory, and France and Poland are both making e-invoicing obligatory for all businesses from 2024. It’s the right time to learn how to master e-invoicing.

Other tips and best practices for invoicing for EU clients

Here are some more best practices for making invoicing go smoothly for EU clients:

- Use a template or online invoice builder to make your invoices look professional.

- Localize your invoice by translating it into the client’s mother tongue, or by sending it in both English and the local language.

- Agree on terms of payment and deadlines upfront, including the dates for installments, penalties for late payments, and terms and conditions for using an escrow, if relevant.

- Decide which currency you’ll use for payment and specify it on the invoice. You might make a different decision if your client wants to pay in EUR or GBP, rather than a less common currency like CHF or PLN.

- If the invoice total is in a different currency, include the exchange rate used to calculate the amount.

- If items on your invoice are zero-rated for VAT, include that information on the invoice.

- Check that your client’s VAT registration is valid using the European Commissions website.

Let Payoneer help with invoicing for European or EU clients

Don’t let international invoicing put you off from expanding into Europe or the EU. Payoneer can help you prepare professional-looking invoices that meet EU requirements by supporting e-invoicing, offering the right payment methods, and helping you format your invoice correctly, so you can encourage clients to pay on time, and keep growing your business.